We see that governance protocols in AMMs have become popular. You can vote on the liquidity pools these AMMs invest in. However, the issue is that you need to lock up your tokens for up to four years, and the yield on these tokens is small. So, not a great incentive if you’re not a whale. That’s where Sphere Finance gives a helping hand.

So, let’s take a closer look at what Sphere Finance is and does. The video in the next chapter is a good introduction.

What Is Sphere Finance?

You can compare Sphere Finance with a meta-governance center. It built a complete ecosystem on Polygon to benefit liquidity providers. The SPHERE token is their native and governance token. This is a deflationary token. For example, there’s a burn mechanism in place. To date, this mechanism burned up to 1.292 billion tokens. Another great feature is that the protocol doesn’t mint any new tokens.

So, as a holder of the SPHERE token, you’re exposed to a variety of crypto projects. That’s why the protocol also refers to itself as the S&P 500 of crypto.

The protocol also works with real yield. This means that the protocol bases the rewards on funds it generates in real life. There are no gimmicks involved. It’s a high yield as well. If you buy SPHERE, it’s automatically staked. It offers a 1.91% daily reward. The protocol adds this daily reward to your wallet. It also rebases every 30 minutes. Rebasing means adjusting the supply, so you maintain price stability.

This yield comes from various sources. A part comes from the various ecosystem projects. Another part comes from taxes on buying and selling the SPHERE token. These taxes range between 13% and 20% and are set in stone. More on both features later.

These taxes may seem steep to an average investor. On the other hand, whales may not blink an eyelash at these percentages. So, to deal with this, the protocol handles a Dynamic Tax. The higher your share in the Sphere ecosystem is, the more tax you pay. In turn, all these taxes go to the SPHERE token holders and rewards. Furthermore, this is also how the team can fund the protocol.

How Does Sphere Finance Work?

As already mentioned, Sphere Finance works with real yield. This is up to 13% or 20% when you sell or buy the SPHERE token. So, let’s see where these taxes go to. This should clarify partly where their real yield comes from. We have three parts here, for instance,

- Investment Treasury – This receives 3% – 5%. It’s where Sphere sets up its crypto basket. This funds the protocol.

- Liquidity Pool – It receives 5%. This allows for seamless buying and selling in the LP.

- Risk-Free Value – This receives 5%-10% and works as a hedge against market volatility. It also keeps the SPHERE price stable.

Source: Twitter

The other part of their real yield comes from their ecosystem. So, let’s take a look at what’s cooking there. For example:

- Dyson – This is multichain and maximizes your yield. It gives anyone access to perpetual yield farming. Dyson has a Sphere Earnings Pool. You lock your SPHERE here and get governance rights in return. For more information, see their docs.

- SphereLend – This is the protocol’s lending market. You deposit stablecoins. In return, you receive yield from ETH or MATIC. More info is in their docs.

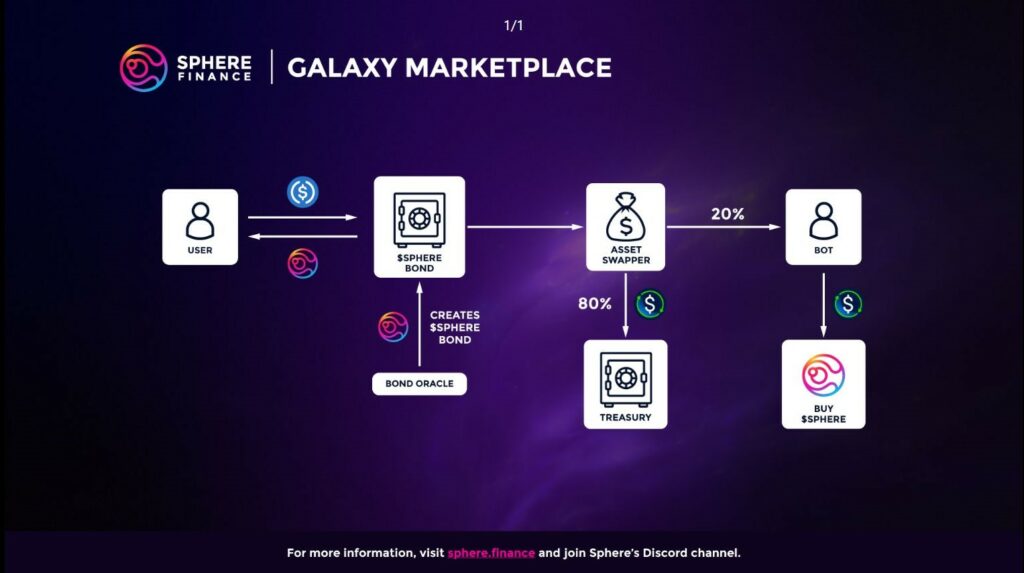

- Galaxy Marketplace – Here you can buy SPHERE directly from the treasury. However, with a discount. See how this works in their docs.

- Penrose & Unknown – These are yield aggregators & liquid wrapper solutions. See their docs for more info.

- Preon – A zero-interest lending protocol. More on this in their docs.

- Covenant – The bribing marketplace. See their docs for an explanation.

The picture below shows the flowchart for the Galaxy Marketplace.

Where and How to Buy the SPHERE token?

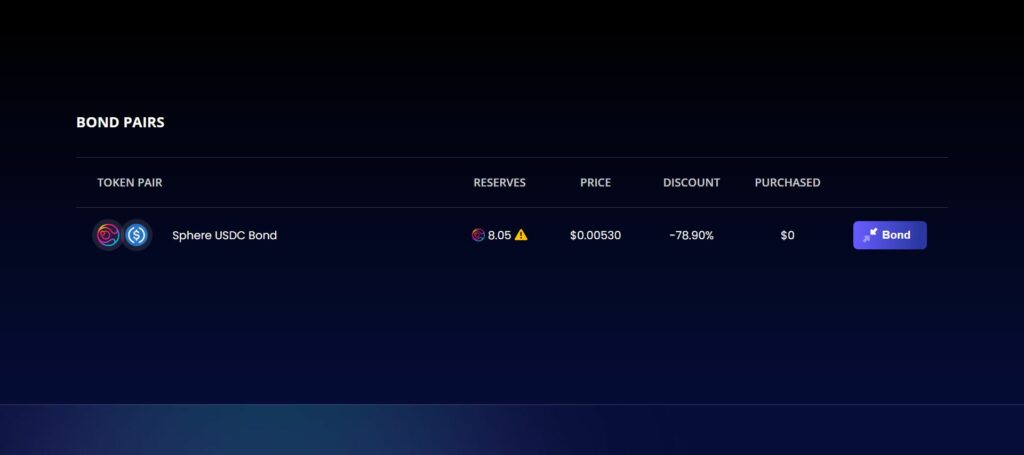

Currently, there are three places where you can buy the SPHERE token. First, that’s directly in their treasury. That’s in the Galaxy Marketplace. This also comes with a discount. It’s a SPHERE-USDC bond, the current discount is -81.2081%. The original price is $0.01 and the bond price is $0.0053. Visit the app and bond USDC. See the picture below.

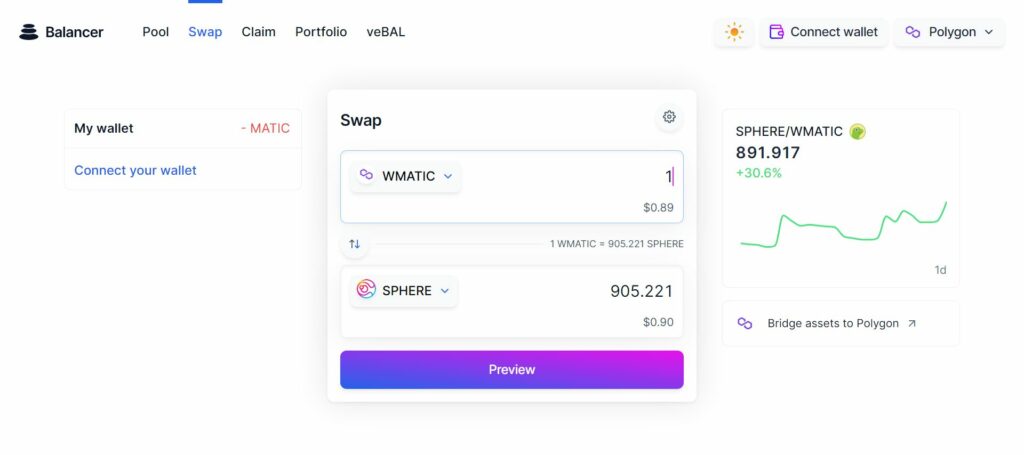

You can also buy SPHERE at the Polygon Balancer V2 pool. You can swap wMATIC for SPHERE. Currently, 1 wMATIC ($0.89) gets you 905.221 SPHERE ($0.90). Connect your wallet to the Polygon network and visit the app. See more details in the picture below.

Source: Balancer V2 Polygon

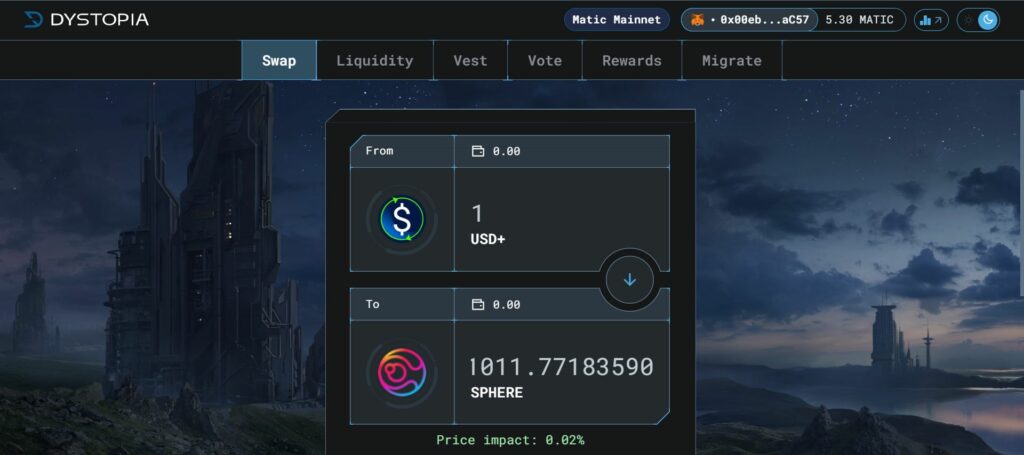

Your third option is to buy SPHERE at the Dystopia DEX on Polygon. Currently, 1 USD gets you, 1011.77183590 SPHERE. Connect your wallet to the Polygon network and visit the app. See the picture below.

Source: Dystopia DEX

To sum up, the current SPHERE price is $0.000976. It has a $7.43 million market cap. The total supply is 8.964 billion tokens. There are currently 7.67 billion SPHERE tokens in circulation. The difference is the burned tokens, remember?

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.