Bondly is a portable swap protocol that aims to revolutionize the traditional escrow method and enables users to make their own digital marketplace. The platform aims to create a set of decentralized financial (DeFi) applications that will support cross-chain swap architecture and a novel token-powered escrow platform.

The platform is transparent, trusted, and interoperable between parties in any marketplace and will help users in everyday buying and selling activities.

Table of Contents

BONDLY And Bondchain

The Bondly token (BONDLY) is the native token of the Bondly Finance platform and it follows the ERC-20 standard. BONDLY will be supported natively within the Polkadot ecosystem, and Bondchain will be listed as a candidate for a parachain slot within Polkadot. The total supply of BONDLY will remain the same across all infrastructures.

Market Cap – $8,334,698

Circulating Supply – 57,164,873

Max Supply – 983,620,758

Features

The platform has the following features:

- Versatile – Users can use any chat app or email service to make escrow for crypto assets.

- Innovative – Supports trustless swapping and recurring payments.

- Interoperable – Works with multiple chains.

- Transparent – All activity happens on-chain.

Currently, the platform offers only BONDLY staking and liquidity pool token staking. So, In this article, we will explore how you can stake your BONDLY tokens and from where you can purchase them.

Usage Guide

How To Get the BONDLY Token

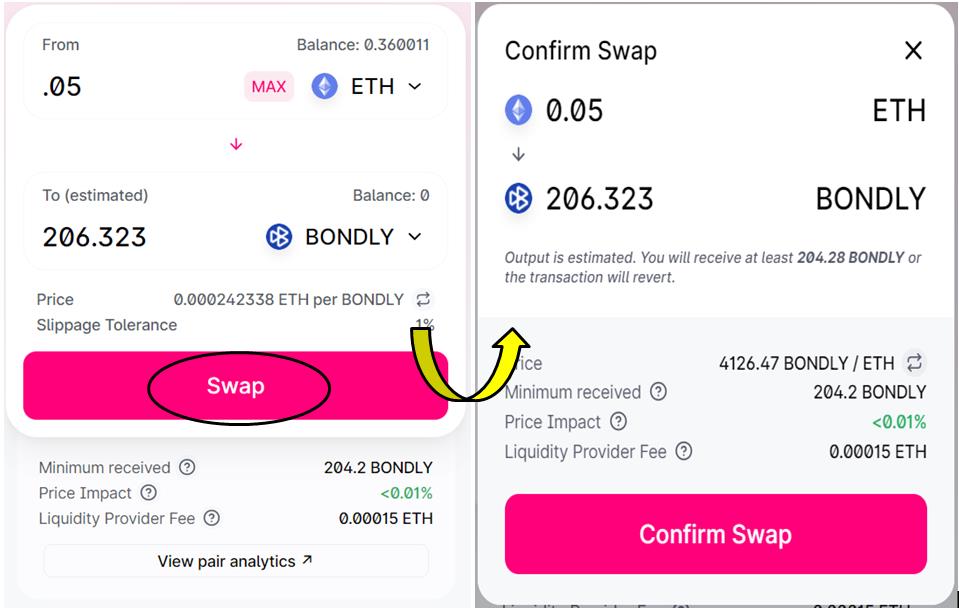

You can get the BONDLY token from Uniswap.

Login to Uniswap. And connect your MetaMask wallet.

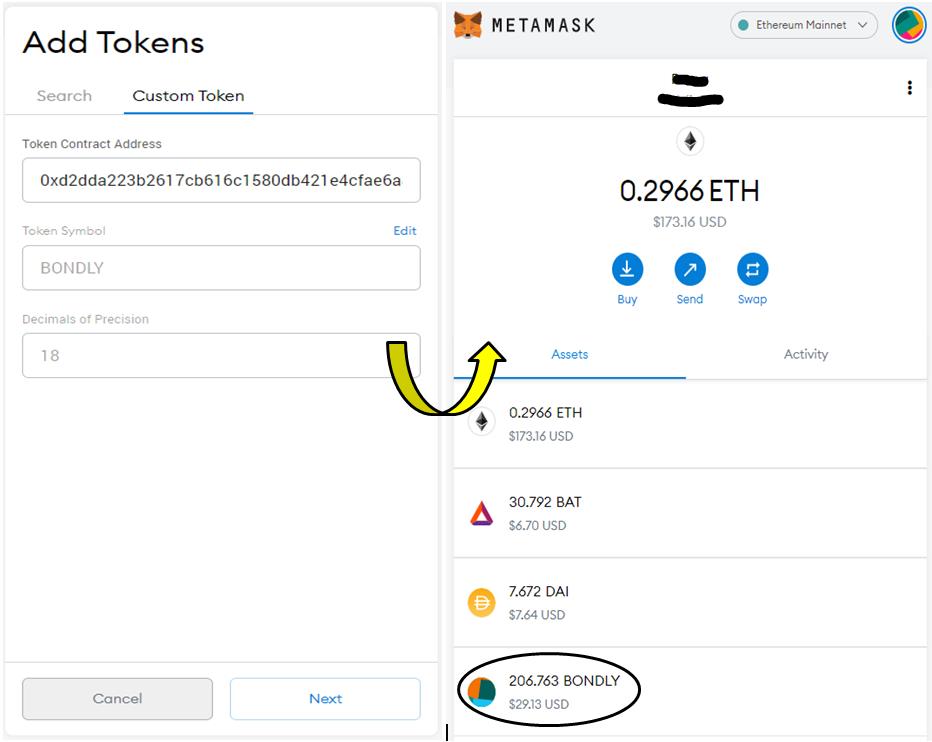

If you are unable to get the token, then you can search by giving the contract address of the token.

Token Contract Address: 0xd2dda223b2617cb616c1580db421e4cfae6a8a85

Enter the amount of BONDLY tokens you wish to buy and then confirm the Swap activity.

This will trigger a MetaMask transaction, and once the transaction is successful, you can see the BONDLY token in your MetaMask wallet.

If the token is not appearing in your wallet, then you can add the token by going to the Custom Token tab and adding the token contract address.

Staking

To provide unique staking features, Bondly has partnered with Ferrum Network and launched an ultra-customized version of Ferrum’s staking.

Users can stake their BONDLY tokens in the staking pools and earn rewards.

To stake your tokens, go to this page.

The platform landing page looks like this.

Click on Bondly Staking and it will redirect you to this page.

Staking Pool

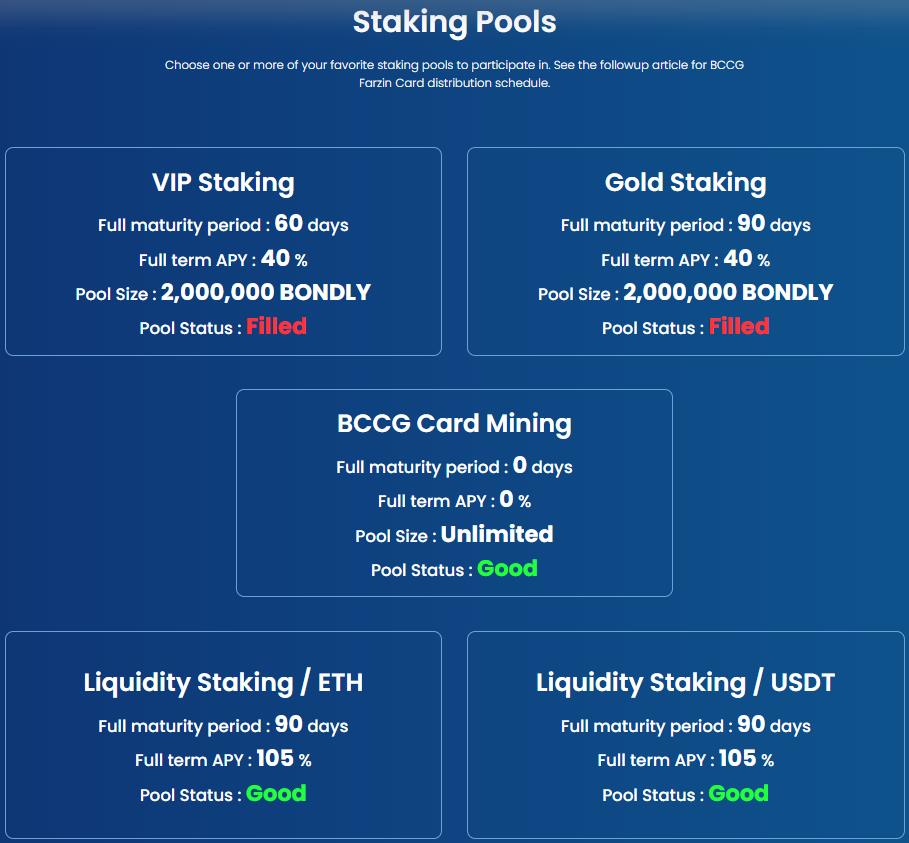

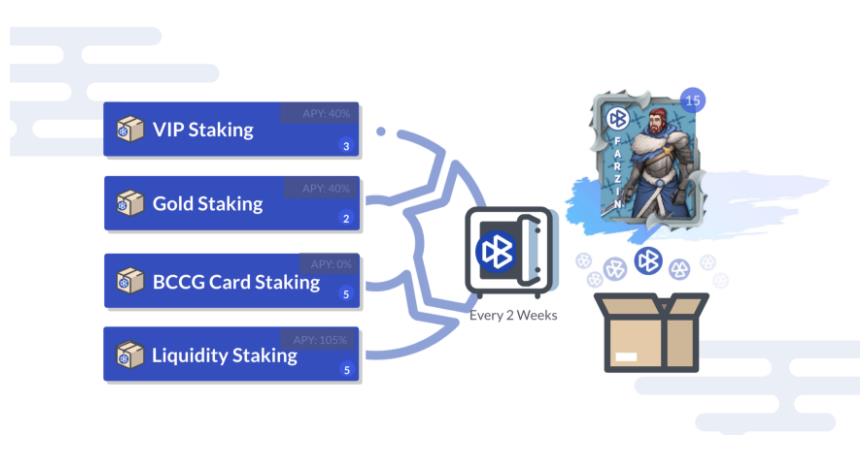

On the staking page, you can see four different staking pools.

- VIP staking

- GOLD staking

- BCCG card mining

- Liquidity staking/ETH and liquidity staking/USDT

The VIP staking and GOLD staking are already filled.

The liquidity pool allows the users to stake their liquidity pool token. Users can get the liquidity pool token from Uniswap by providing liquidity into the ETH/BONDLY or USDT/BONDLY pool.

You can stake your BONDLY token in any of the available pools and earn rewards. Each staking pool in Bondly has its unique characteristics.

If the user stakes 3k $BONDLY tokens in any staking or a liquidity pool for the whole two weeks, they will be eligible to win one of the 15 Farzin card drops.

The Farzin card is a rare, exclusive, and the first edition of a BCCG card from the Isekai series. It is a Hero card and has its utility within the BCCG game and the Bondly product ecosystem. This card will never be sold by the project, and users can earn this RARE NFT only through the BONDLY staking program.

Staking Terms and Benefits

The various staking pools provide the following benefits:

| VIP Staking | Gold Staking | BCCG Card Reward Staking | Liquidity Staking 1.0 | |

| Full Maturity | 60 days | 90 days | 30 days | 90 days |

| Full-term APY | 40% | 40% | 0% | 105% |

| Early withdrawal | 30 days | 45 days | 1 day | 45 days |

| Early withdrawal APY | 0% | 0% | 0% | 40% |

| Farzin NFT Distribution | 3 every 2 weeks | 2 every 2 weeks | 5 every 2 weeks | 5 every 2 weeks |

| Size | 2 million BONDLY | 2 million BONDLY | Unlimited | Unlimited |

| Contribution Period | 5 days /until filled | 5 days or until filled | 7 days | |

| NOTE | Only for existing BCCG cardholders | The rewards will be split into 2 different pairs: BONDLY/ETH and BONDLY/USDT |

Liquidity Staking

Get Liquidity Pool Token From Uniswap

Bondly Finance offers liquidity staking. Users can add liquidity to the Bondly Uniswap pools (either the ETH pool or USDT pool) and then stake the LP token in the stake pools and earn BONDLY rewards in return.

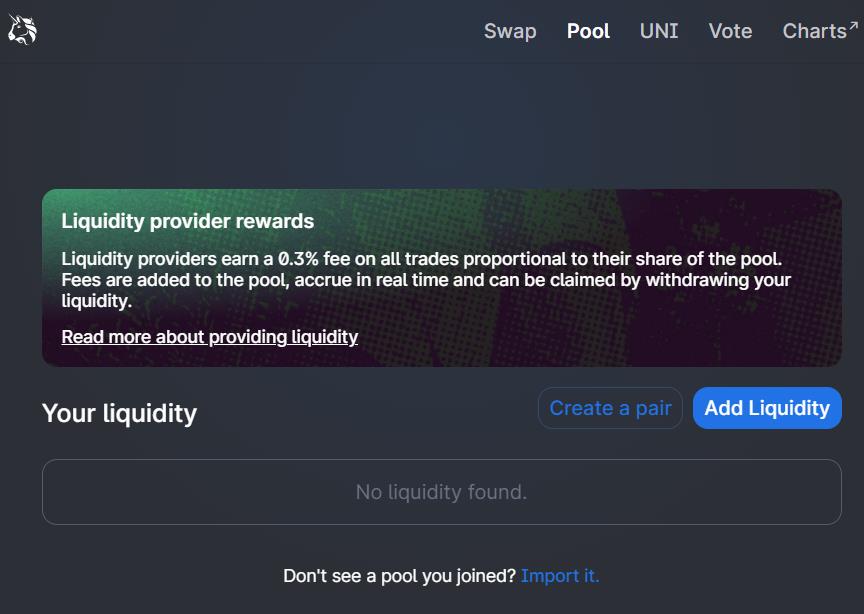

To add liquidity to a Uniswap pool, go to the Uniswap platform.

Now connect your wallet and go to Pool.

Click on Add Liquidity.

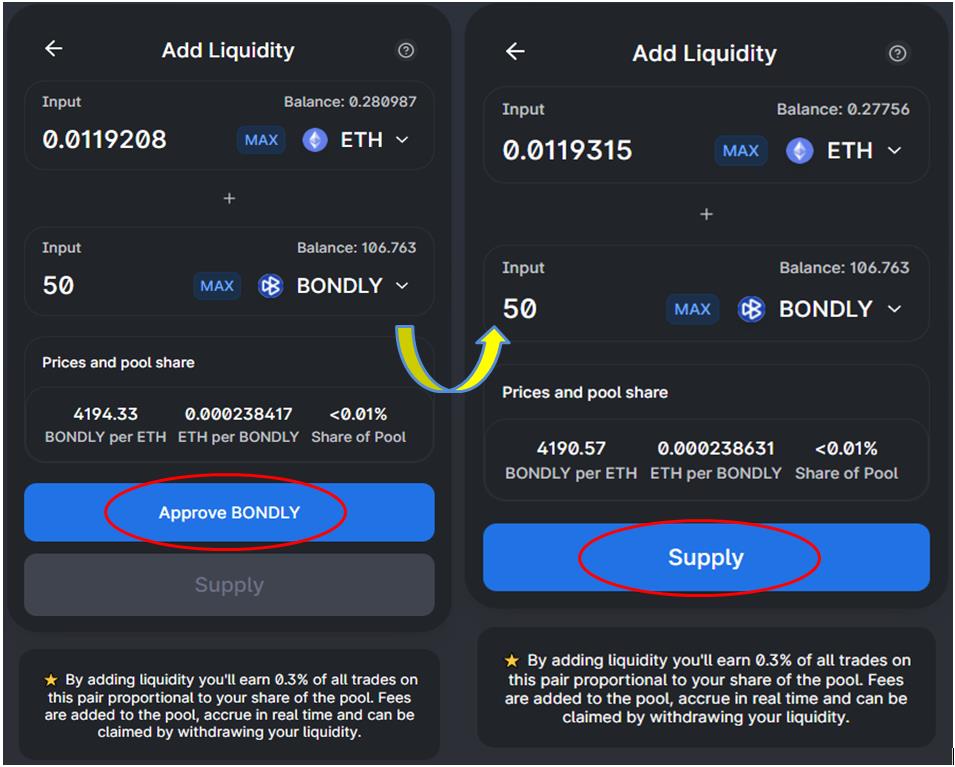

Select the token pair (ETH-BONDLY in this case) and enter the amount of one token you want to provide and the other token amount will automatically get displayed.

If you are using this pair for the first time, you need to approve the pair. Then you can supply it to the liquidity pool.

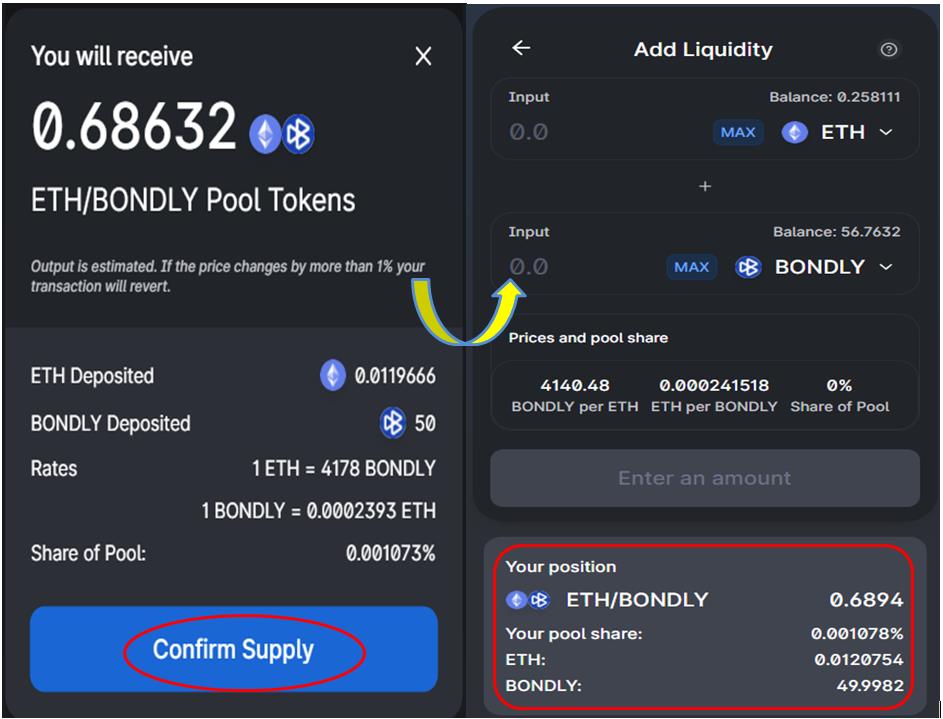

Click on Supply, and the application will show you the amount of LP tokens you will receive.

Confirm the transaction. You can now see your liquidity details from the bottom of the tab.

You can stake these LP tokens into BONDLY liquidity pools.

Stake Pool Token

Again, go to the staking page.

Bondly offers two liquidity staking pools.

Choose the liquidity pool depending upon your pool token.

We have chosen Liquidity Staking/ETH as we have ETH/BONDLY pool token.

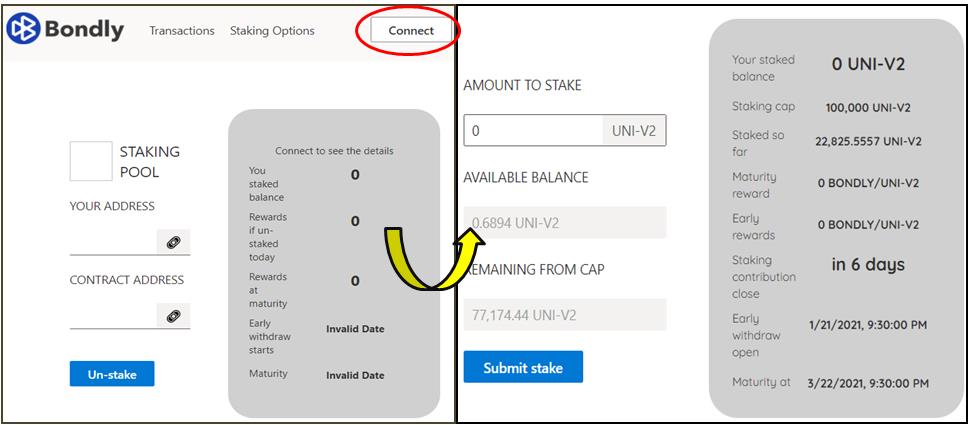

Click on it and you will be redirected to this page.

Connect Wallet

The platform supports two wallets:

- MetaMask

- Wallet Connect

Connect your MetaMask wallet.

Once the wallet is connected, you can see the available LP tokens in your wallet that you can stake.

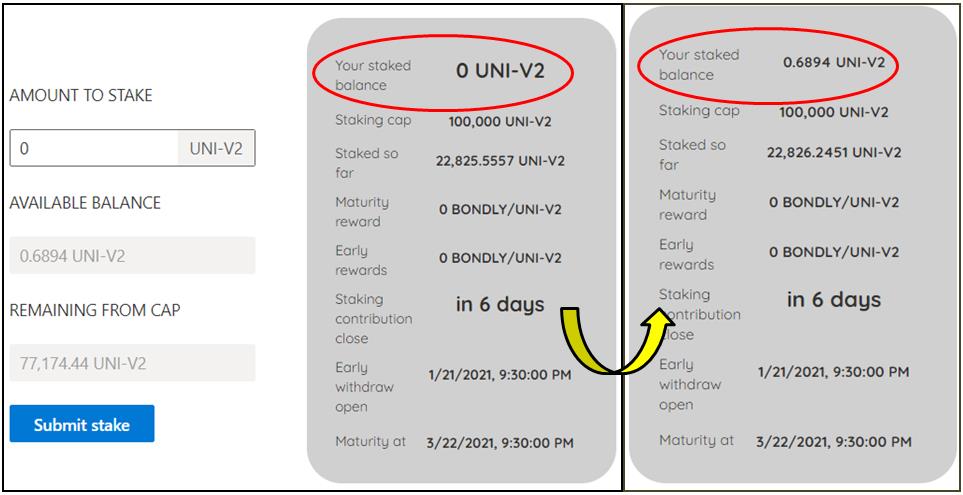

Enter the amount of token you wish to stake and click on Confirm.

Once the transaction is successful, you can see your staked balance in the liquidity pool.

You can check the benefits from the staking terms and benefits table.

Social Presence

Conclusion

Bondly Finance is an innovative project. It aims to bring its own set of decentralized finance applications/products that will help in reducing the complexity and costs associated with the DeFi application. The protocol works with multiple chains and allows the users to trade and escrow crypto assets using any chat application. The platform currently offers a staking facility, and we hope that it will come up with the latest and advanced solution as new products and applications will be launched.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.