Chainalysis is a global firm that creates a transparent integral data platform that shows businesses and governments how people use cryptocurrencies. This company launched a 2021 report of how crypto adoption is doing worldwide.

Did you know that in Latin America, the number of domestic transactions represents 11% of the world? Therefore, in this article, we will talk about Crypto Adoption in Latin America in 2021.

How is Latin America adopting Cryptocurrencies?

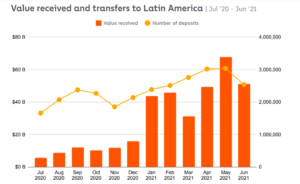

According to the Chainalysis 2021 report, Latin America is in 6th place of the eight regions included in this research. With $352.8 billion in value, this continent registered 9% of the world’s transaction activity. In the chart below, you will see more details about the details of the transactions during 2020-2021.

Source: Chainalysis

Despite that this continent is one of the smallest markets nowadays, Latin America shows a huge potential in adoption. This is caused by leading countries like Venezuela (Rank 7th), Argentina (Rank 10th), and Brasil (Rank 14th). However, the crypto adoption in these 3 countries doesn’t reflect the crypto adoption of the other countries of the continent. But, how does Latin America make crypto transactions?

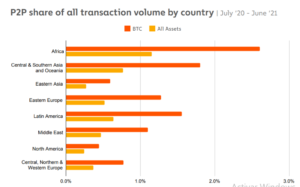

This continent has one of the higher P2P activities, which is similar to other emerging regions of the world. According to the following chart, Latin America is the 3rd region, after Africa and Asia, with the highest P2P activity.

Source: Chainalysis

Venezuela and Argentina Leads the Region in Crypto Adoption

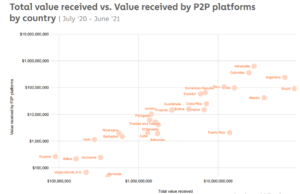

However, if you take a look at stats inside the continent, Venezuela is ranked in the 7th position. This ranking is according to the Global Adoption Index in P2P activity which represents $629 million of received cryptos. Therefore, in the following chart, you can see that Venezuela, Argentina, and Brasil have the highest numbers in value received in P2P platforms.

On the other hand, Guyana, Belize, and the Virgin Islands are the countries with the lowest P2P transaction volumes.

Source: Chainalysis

Moreover, it’s important to mention that Brasil ($90.9 billion) has a larger crypto market than Venezuela ($28.3 billion). However, Brasil only received $90 million in P2P transactions, putting Colombia, Argentina, Perú, and Chile ahead in this sector.

So, why have these countries adopted P2P transactions more than others in the region? Let’s take a look at each of them.

1. Venezuela likes Cryptos and Cryptos like Venezuela

We all know how bad is the economic situation in Venezuela, where their governments have made everything to make this country in the 1st place in the world’s inflation rate. According to Reuters, in 2021, Venezuela achieved 686% in inflation which won, by far, first place.

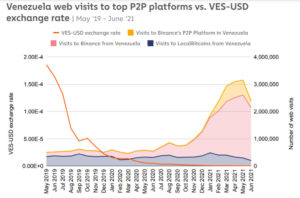

Therefore, since 2019, Venezuelans have been adopting the US dollar. In November of that year, 53% of transactions in the first 15 days of October were made in USD dollars. However, people are still looking for decentralized ways to hold their savings without sacrificing their value. In the following chart, you will see the exchange rate between the US dollar and the Venezuelan bolivar versus the bolivar’s trade volume in a crypto exchange called LocalBitcoins.

Source: Chainalysis

As you can see in the chart, the LocalBitcoins trading volumes are growing steadily. A possible interpretation of this behavior is that Venezuelans are moving their wealth into crypto. In the following chart, we can confirm that Venezuelan crypto trading is rising as the bolivar loses value.

Therefore, you will see a comparison of the bolivar’s exchange rate with the number of exchange webs like LocalBitcoin and Binance.

Source: Chainalysis

As you can see, the traffic of these crypto exchange platforms increases as the Bolivar’s value decrease.

2. Argentina is Also Leading the Crypto Adoption

Argentina is another country that has a special relationship with the crypto ecosystem. Like Venezuela, this country is also adopting cryptos for necessity. According to INDEC, the inflation rate of Argentina in 2021 was 50%.

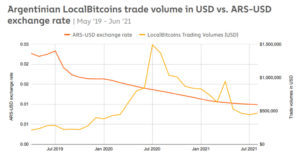

But crypto adoption measure needs to be also made in countries with the less extreme economic situation. Argentina is a very good example. You can see this analysis in the following chart:

Source: Chainalysis

In this chart, you can see that since July 2019, the tendency of the volume trades ingrown and the ARS-USD exchange rate is decreasing.

Remittances are Going Crypto in Latin America

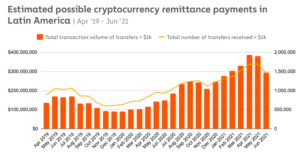

On the other hand, remittances are one of the main use cases of how people in Latin America are interacting with cryptocurrencies. According to the World Bank, in 2020, incoming remittances represented 2.4% of GDP for the whole continent.

Also, specialists mention that remittances are a very important part of the economy of countries like El Salvador and Honduras. It represents 20% of their national GDP. Moreover, in Venezuela, it represents 35%.

Therefore, in the following chart, you will discover how crypto remittances and the number of transfers below $1k are evolving:

Source: Chainalysis

Brasil vs Venezuela: A Market Maturity Comparison

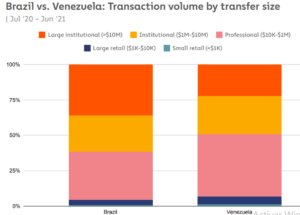

Between June 2020 and July 2021, we mentioned before that Brasil is the largest crypto market by transaction volume in the continent. With $91 billion, Brasil is over three times bigger than Venezuela in this indicator which received $28 billion.

Also, it’s important to mention that Brasil has a stronger economy than Venezuela with a PPP per capita of $15,643 vs $5,178. This means that Venezuelan people use cryptos basically for remittances and savings and Brazilian holders normally use them for speculation and wealth growth.

In this chart, you’ll have a better view of how different kinds of users adopt cryptos.

Source: Chainalysis

As you can see, Brazil moves a bigger share of its total transaction volume in large transactions above $10 million representing 36% in Brasil. In Venezuela, it’s 22%. Also, in Venezuela, 6.7% of crypto transaction volume is made for retail, and in Brasil is 4.7%.

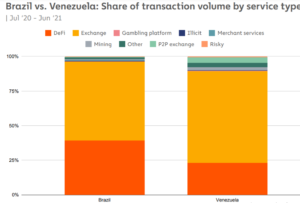

On the other hand, these two countries use cryptos to make transactions in DeFi, P2P Exchange operations, Mining, Gambling, among other use cases. Let’s take a look at this chart to see them closely:

Source: Chainalysis

In this chart, you can see that Brazilian holders use DeFi more than Venezuelans with 39% over 23%. This is a natural reaction of a more robust economy like Brasil. On the other hand, P2P activity is stronger in Venezuela that representing only 3% of their overall transactions volume, whereas Brasil is at 0.2%.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.