MakerDAO is a decentralized organization based upon Ethereum that allows the users to lend and borrow cryptocurrencies without any involvement of a third party.

The MakerDAO platform supports two native currencies:

- DAI – Stablecoin, soft-pegged to the U.S. dollar.

- MKR – Governance token.

The MakerDAO community manages the Maker protocol. The protocol consists of a set of smart contracts that allow the users to generate DAI by using collateral assets. This protocol is managed by the users who hold the MKR platform governance token. The community also monitors the different risk parameters of DAI to ensure its stability and transparency.

Users can generate DAI by depositing collateral in Maker Vaults. The generated DAI can be used in other crypto transactions.

Table of Contents

OASIS App

The MakerDao borrow and lend features are supported by the Oasis interface. The Oasis application allows the users to interact with Maker protocol. The application offers three major features:

- Trade – Supports trading of DAI generated or purchased through the exchange.

- Borrow – Allows the users to generate DAI by depositing collateral in a Maker Vault.

- Save – Helps the users to earn savings on locked Dai into the DSR

Borrow

In this article, we will mainly focus on the MakerDAO borrow feature supported by the Oasis application.

Go to the Oasis page.

Click on Borrow, and it will redirect you to the MakerDAO borrow page in the Oasis interface.

Oasis supports multiple wallets, including hardware wallets like Ledger and Trezor. Choose as per your requirement.

Connect your MetaMask Wallet.

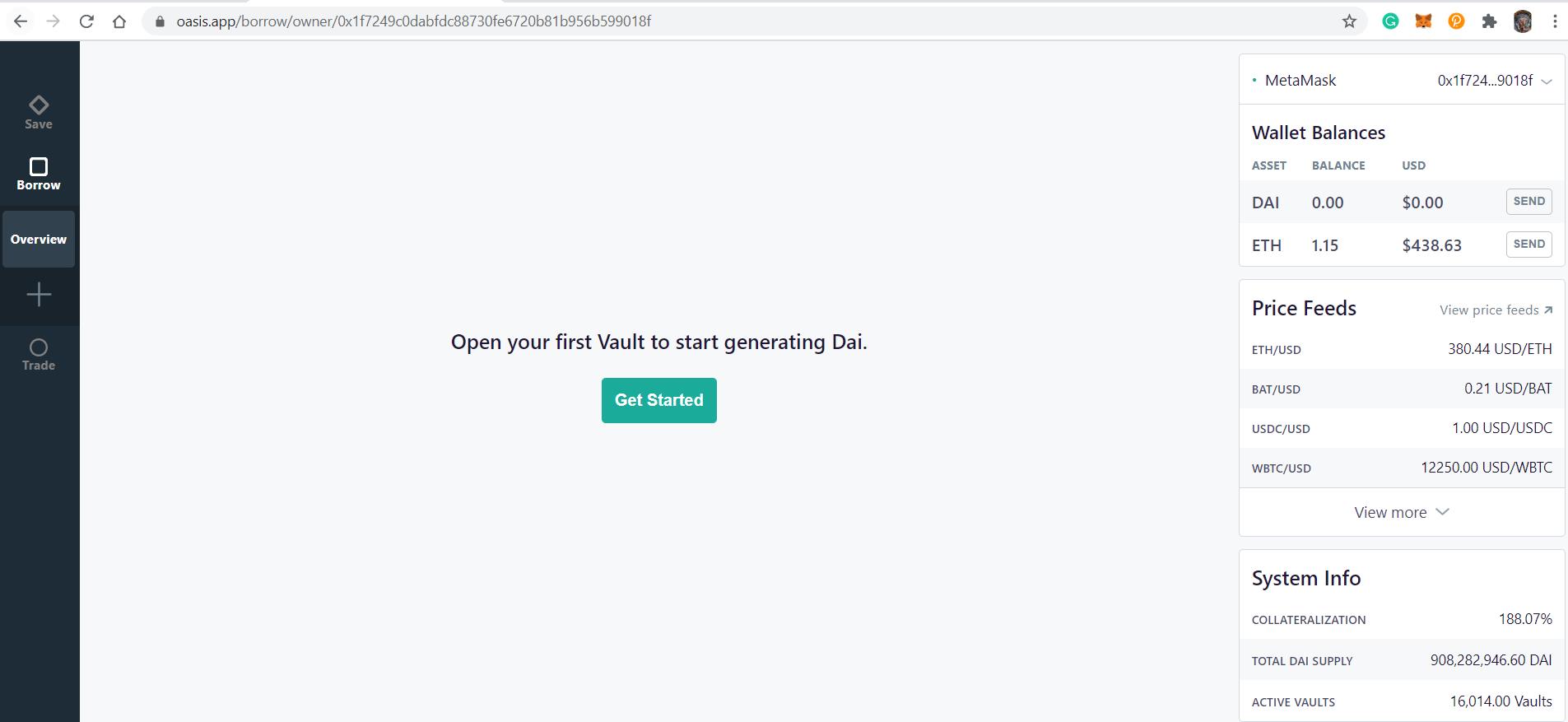

You Oasis landing page looks like this.

Open Vault

To start with, users will open a vault. It involves a few steps.

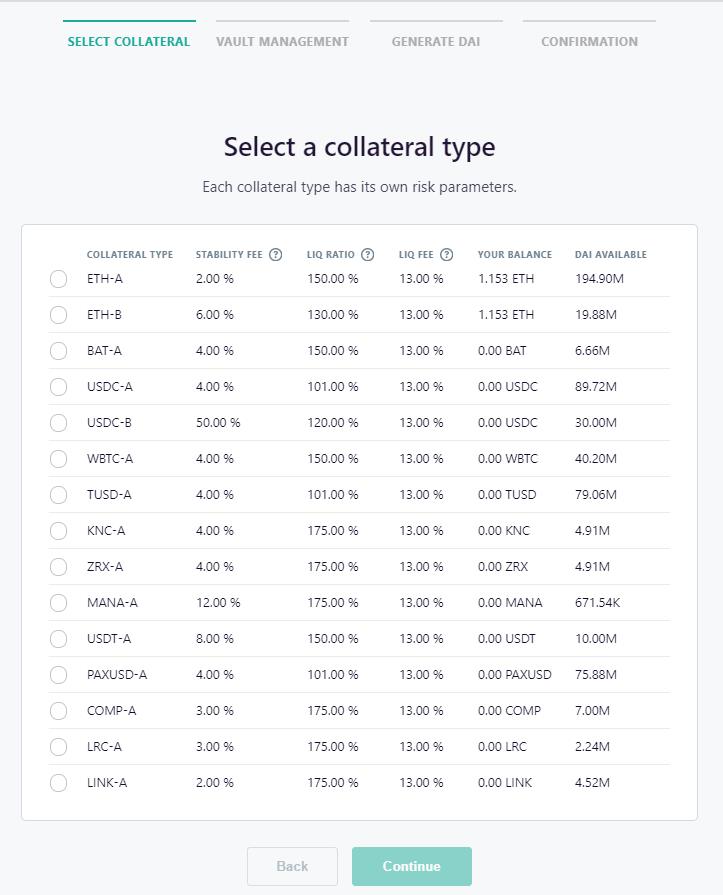

Select Collateral

Once you click on Get Started, it will display a list of collateral types along with various parameters like stability fee, liquidity ratio, liquidity fee, your available balance, and DAI balance available to that particular collateral type.

We have selected ETH-A.

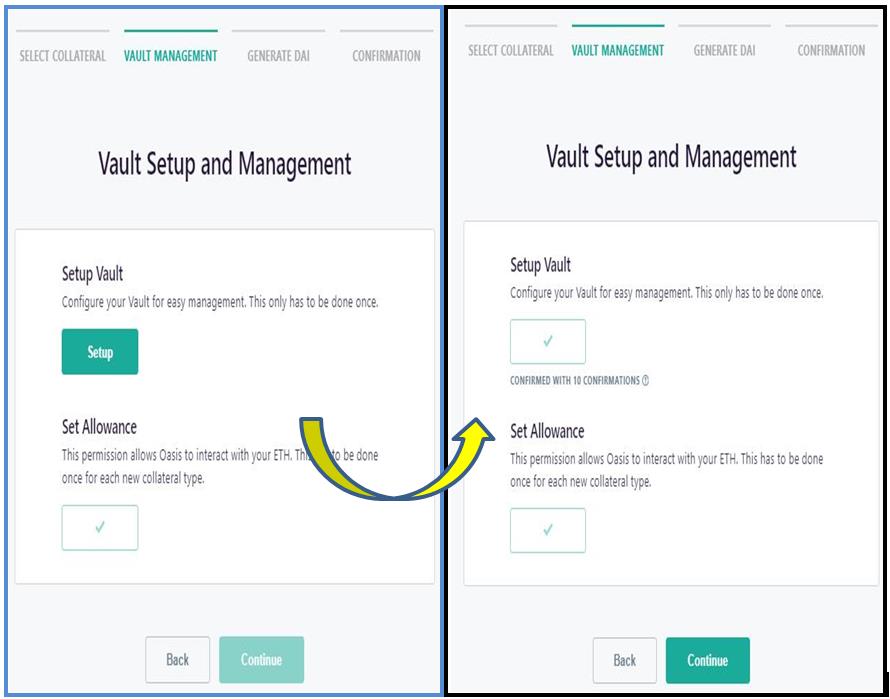

Vault Management

Click on Setup and confirm the transaction of vault creation in MetaMask.

Generate DAI

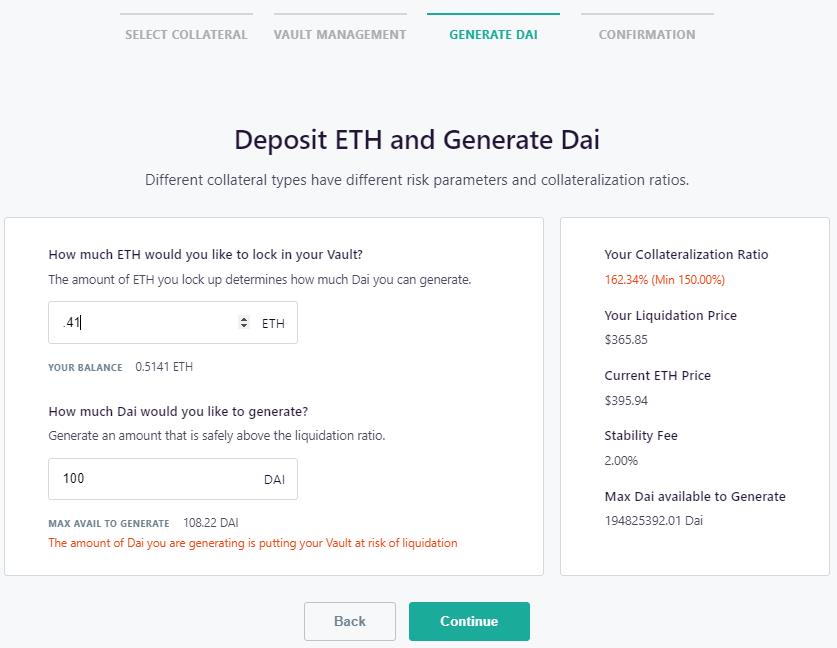

Once vault creation approval is done, you can now select how much collateral (ETH in our case) you want to give to generate DAI.

Important: MakerDao allows us to generate a minimum of 100 DAI.

The application shows you the max amount of DAI you can generate with the given ETH. You can also check your collateralization ratio. (Always try to maintain your collateralization ratio above threshold, i.e., in case of MakerDAO above 150%.) It is suggested not to generate the max amount of DAI which is showing by the application, otherwise your vault will be at the risk of liquidation.

Important: The Liquidation Ratio is the collateralization ratio of DAI to ETH for each vault that a user needs to maintain in order to prevent liquidation. Maker protocol’s Oracle keeps track of the collateral price and notifies the system once the ratio crosses the threshold value and makes the vault available for liquidation.

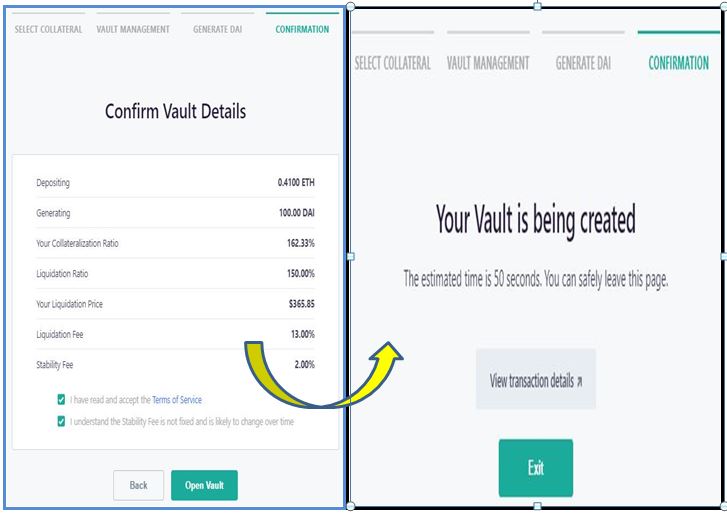

Confirmation

After providing all the necessary details for vault creation, click on the Open Vault button.

You will now receive a confirmation message like this.

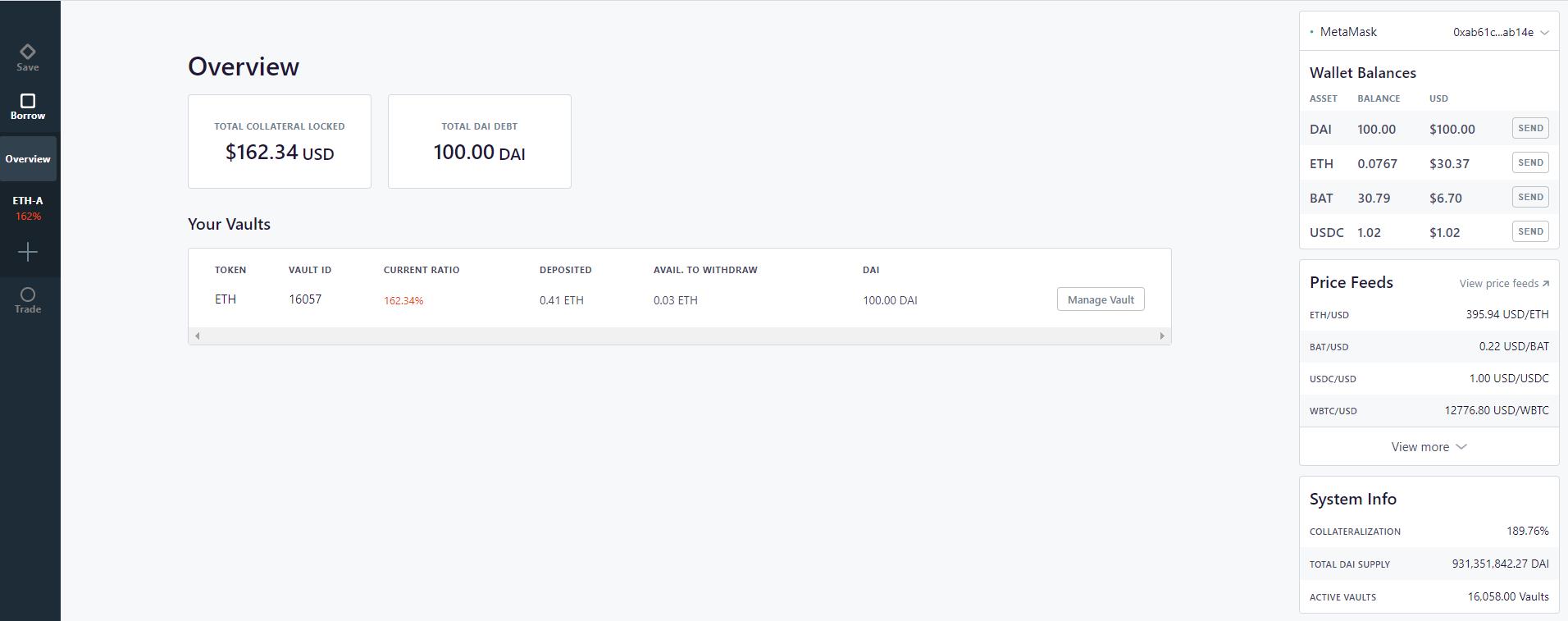

User Vault

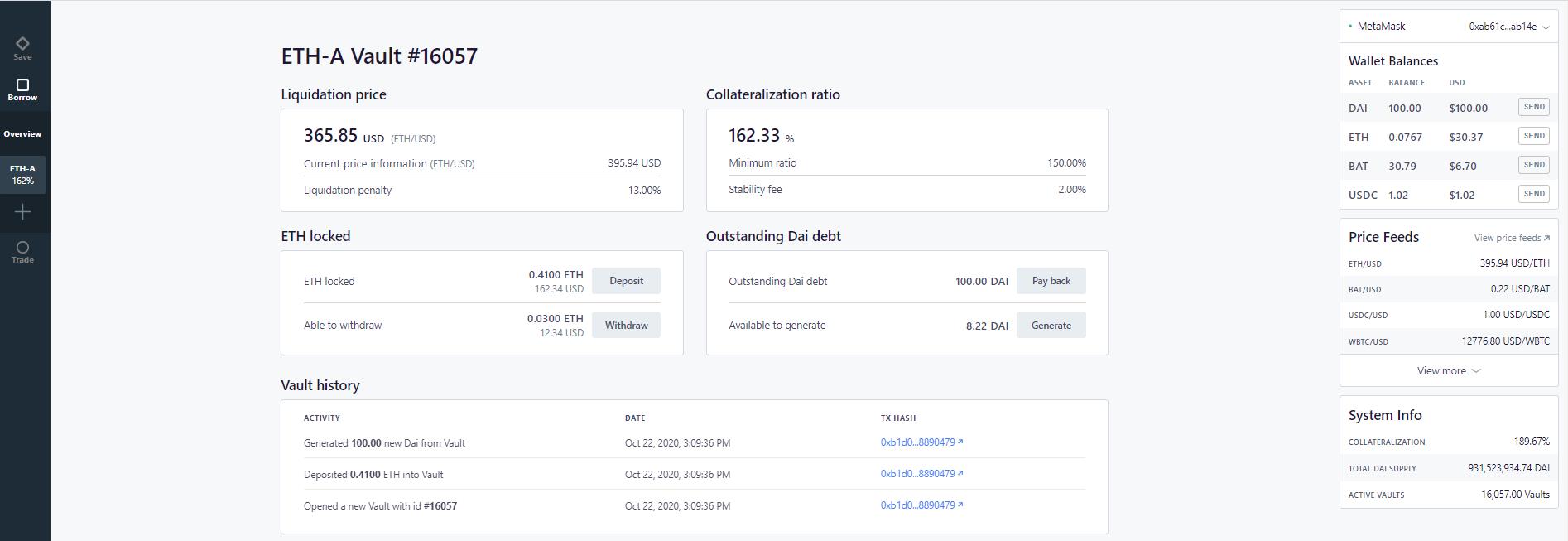

Your vault is created. You can see the vault details like vault ID, your collateralization ration, DAI balance, deposited ETH, etc.) from the Overview tab.

A more detailed view of the vault properties can be seen from the ETH-A tab.

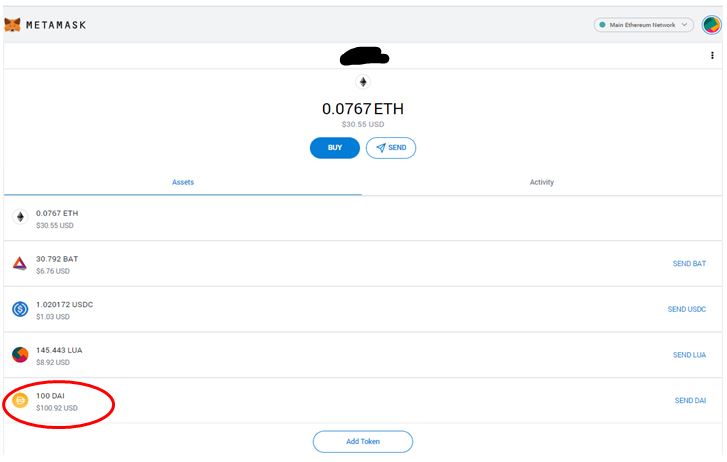

Check DAI in MetaMask Wallet

You will receive the generated DAI in your MetaMask wallet.

Trade

The Oasis trade option provides flexibility to the users to trade tokens ranging from simple swap to market trade. Users need to unlock these tokens before starting any transaction activity.

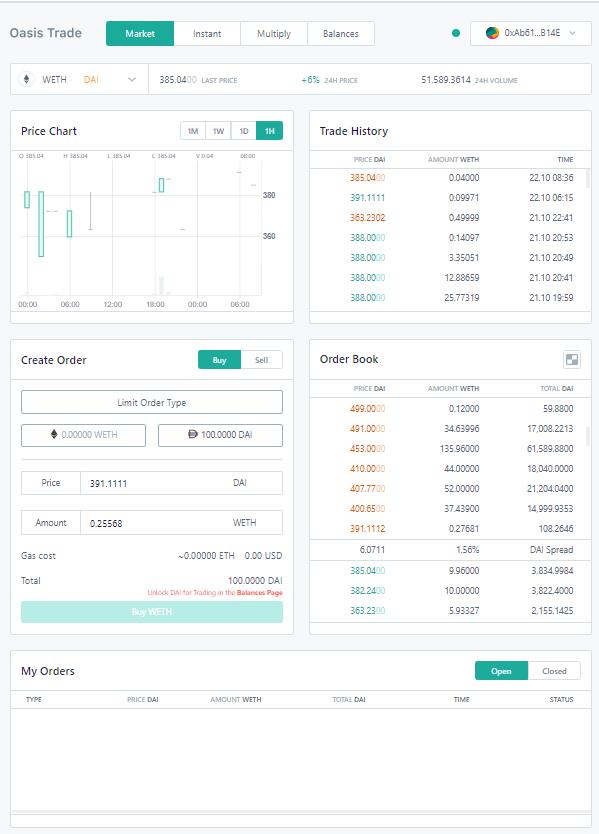

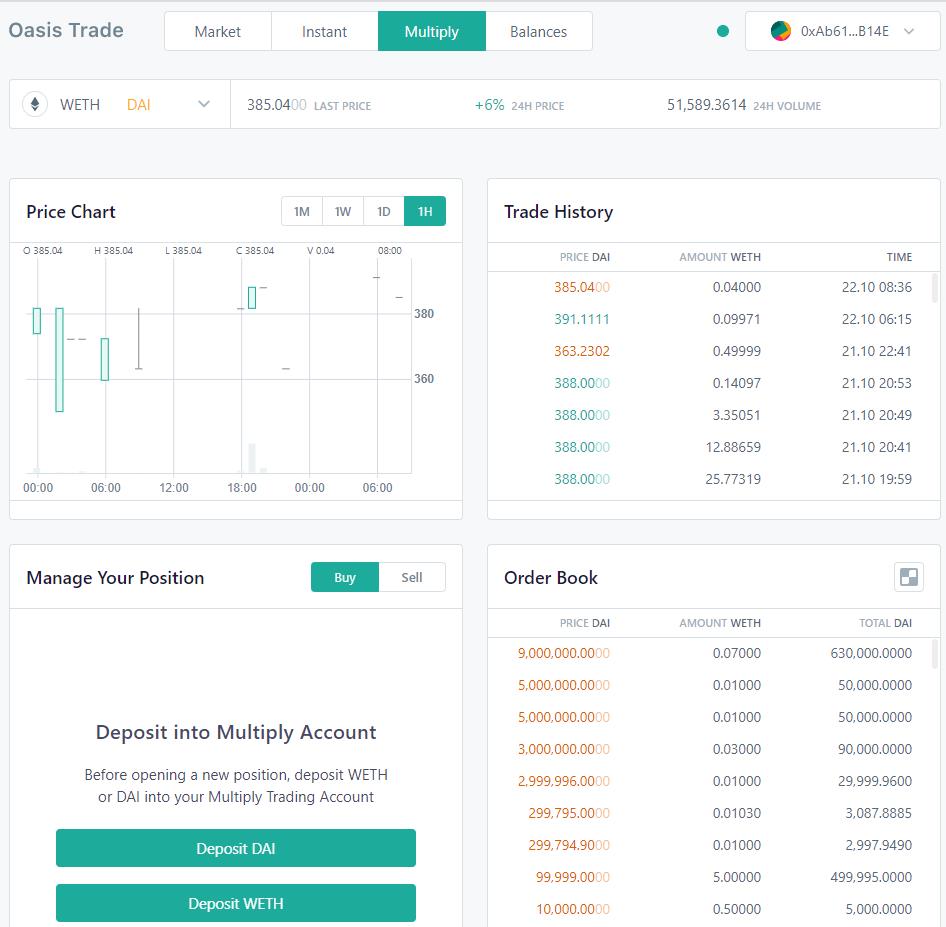

Market

The Oasis Market tab contains various trading related details like order book, price chart, trade history, etc. You can create a buy/sell limit order here.

Users need to select the type of trading, i.e., buy or sell, and a token which they want to trade. Submit the order request. See the order history from the bottom of the page.

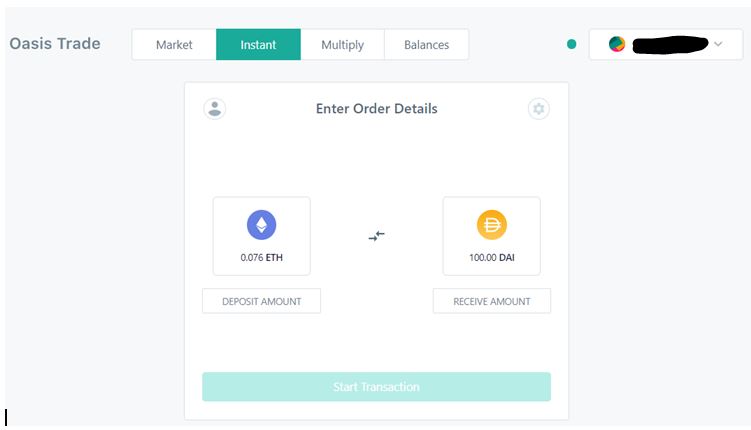

Instant

Through this option, you can easily buy/sell tokens without providing much detail. You just need to fill in the input token type, input token value, and the output token, and the application then automatically calculates the values of the output token.

Click on Start transaction and confirm the transaction in MetaMask. Once the transaction is successful, you will see the token in your wallet.

Multiply

With Multiply, use ETH as a collateral to borrow DAI. Use the generated DAI to buy more ETH, and so on, creating multiples of up to 2x. This way, it allows the users to create long multiplied positions without the need to borrow funds from a counter-party.

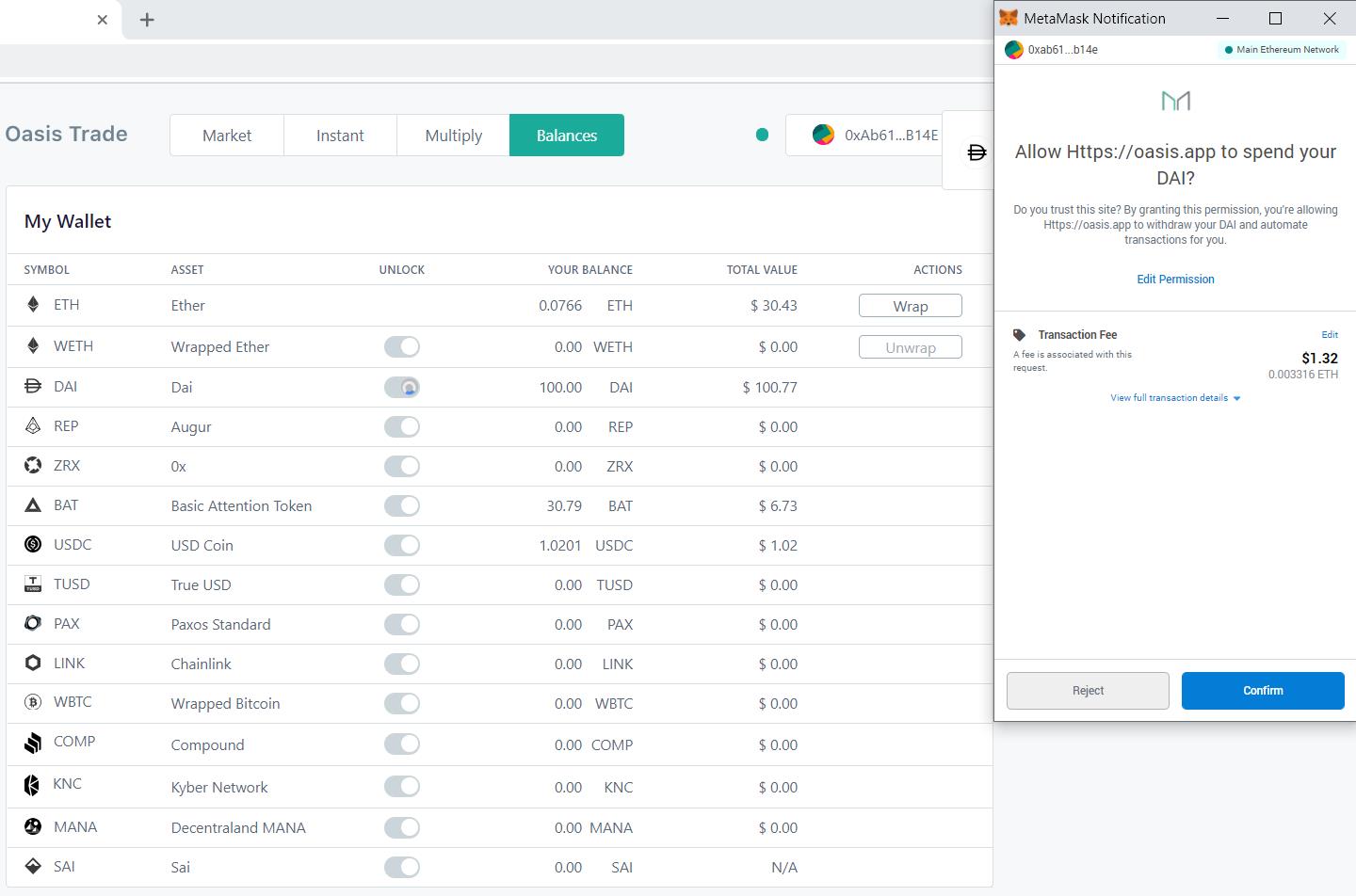

Balances

Users can unlock tokens through the Balance tab. Before using any tokens, each token needs to be unlocked. The unlocking process will trigger a transaction in MetaMask and after confirmation, you will be able to use the token.

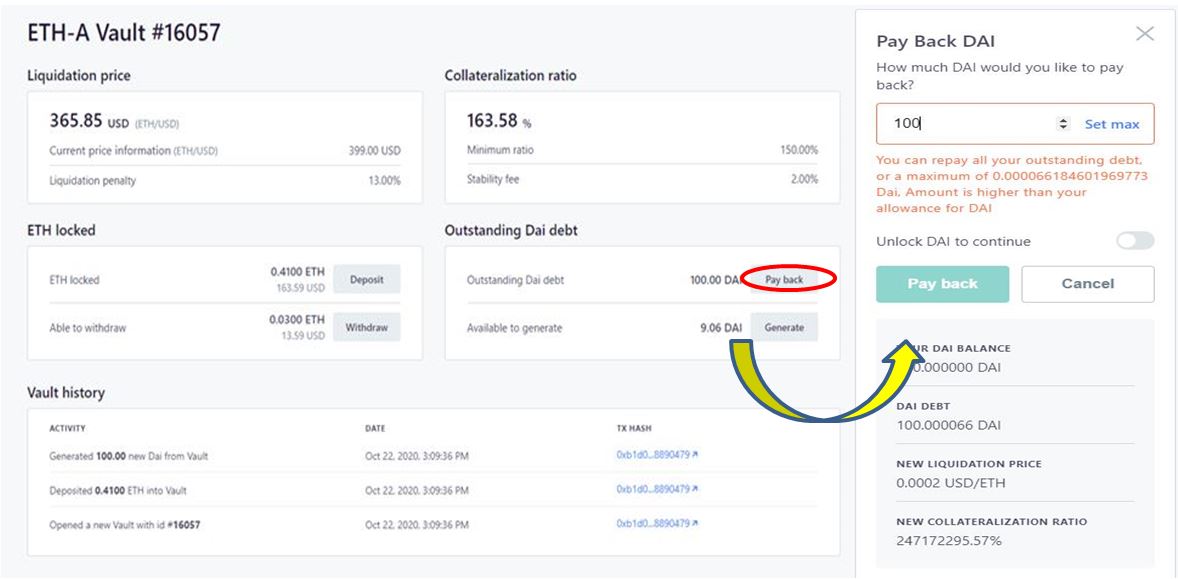

Pay Debt

Users can check their outstanding debt and pay it back easily.

Note that your DAI debt will always be greater than the outstanding debt.

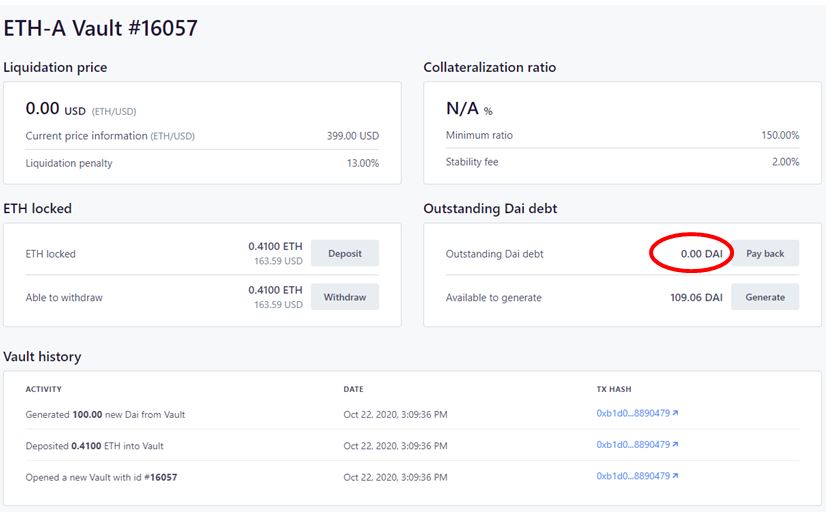

Approve transactions in MetaMask. Now you can check zero outstanding debt in your vault.

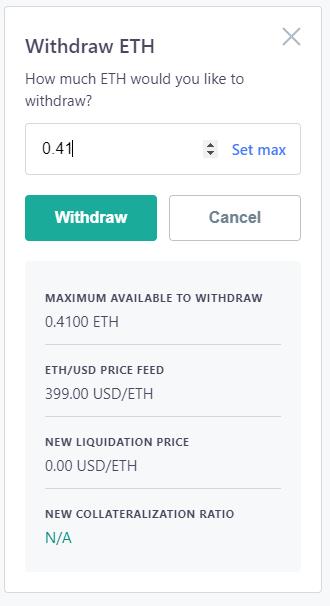

Withdraw ETH

Withdraw the locked ETH after paying the debt.

Just click on the Withdraw button and fill in the amount you would like to withdraw and confirm your transaction.

Your MetaMask wallet will now have the ETH amount.

Conclusion

Maker is one of the first decentralized finance (DeFi) applications that have earned significant adoption. DAI is the most popular decentralized stablecoin. The project has gained trust over the years and has significant TVL. However, with the introduction of competitors like Synthetix and Linear Finance, MakerDAO has a task in hand to keep up with the lot in the coming days.

Resouces: MakerDAO Official Website

Read More: Exploring Linear Testnet For Buildr