In part 1, and part 2 of this series, we have explained how you can swap, add/remove liquidity, use bridge service, stake Volt, and yield farm via the Voltage Finance platform. In this part, we will explain the lending/borrowing feature of the platform that ola.finance handles for Voltage.

Table of Contents

Fuse Lending

Voltage Finance also allows the users to lend/borrow assets. The lending facility works in collaboration with ola.finance.

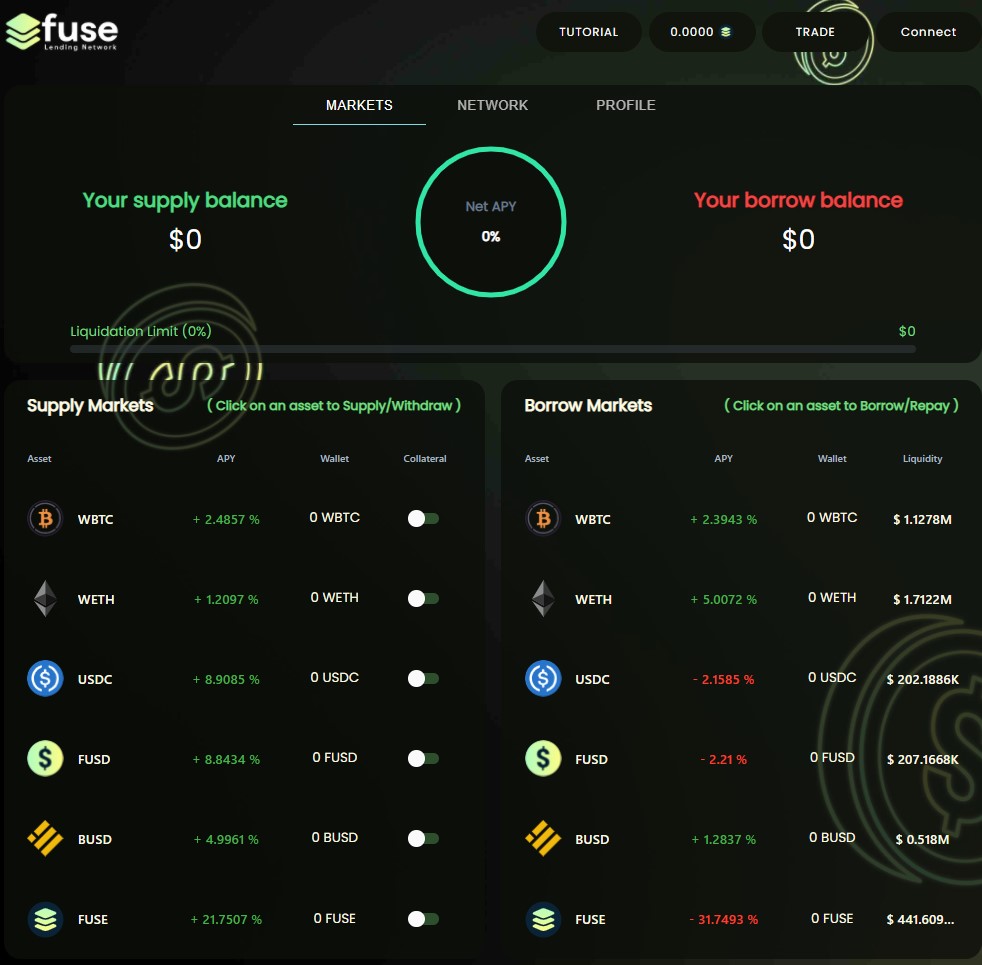

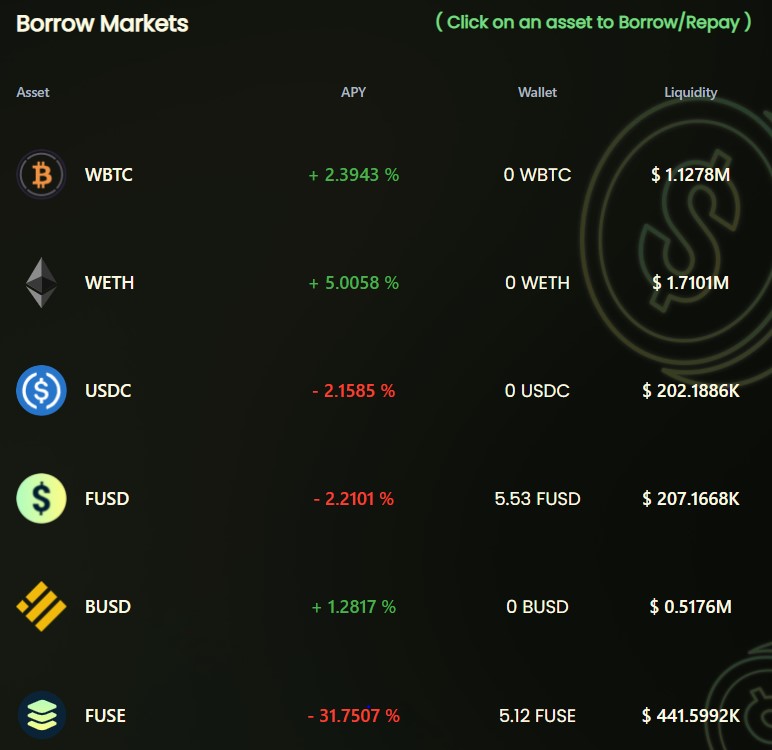

Below are the tokens/coins that are available currently (at the time of writing the article) for lending/borrowing.

Note that to borrow assets users need to first deposit some tokens as collateral. They can later use that collateral to borrow assets against it. The lending platform shows you the threshold value of the asset that you can borrow. It is best to borrow assets below that threshold value to avoid liquidation.

We have a FUSE coin in our wallet that we will deposit. Click on the Deposit button against it, and it will redirect you to the ola.finance platform

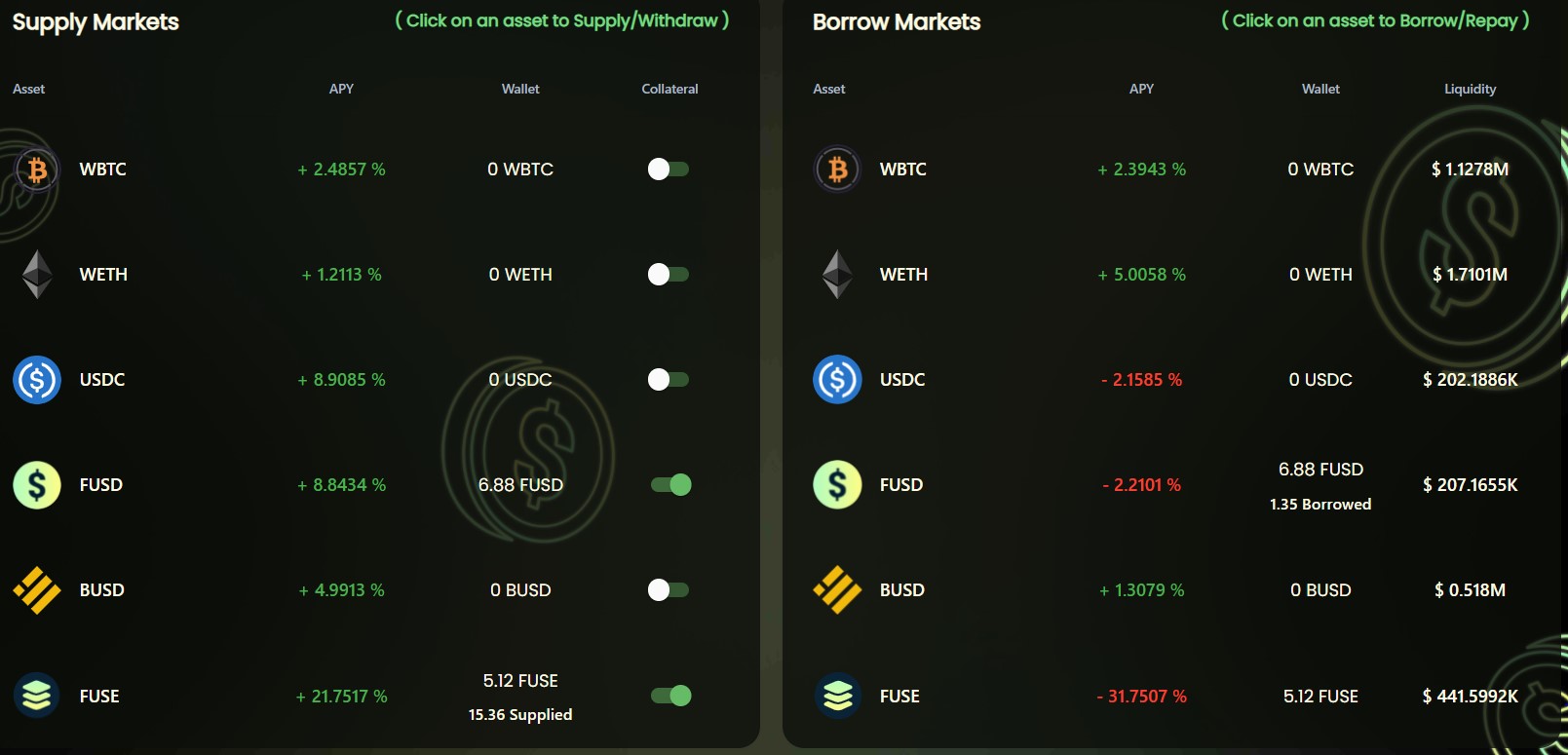

Here you can easily check the different supply and borrow markets. This is nothing but the list of tokens that you can supply and borrow. We will explain it now in detail.

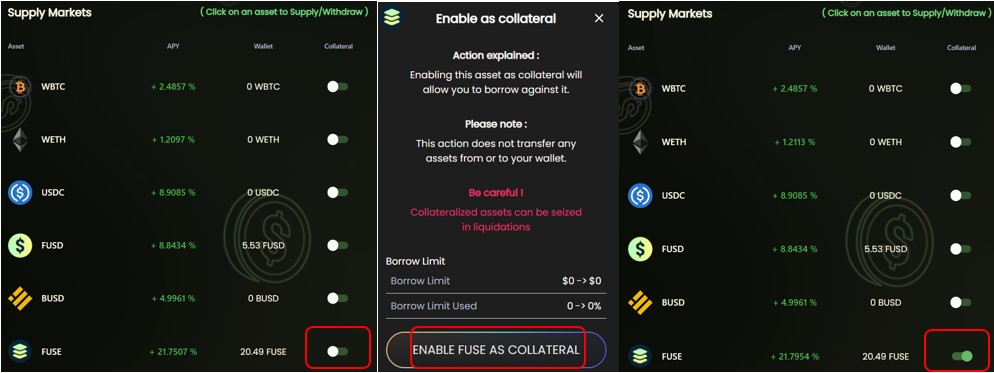

Enable Collateral

The first step of lending is to enable any supporting assets as collateral. As said earlier, we have some FUSE coins that we will deposit as collateral.

To enable FUSE coin as collateral, click on the toggle button. Now follow the entire process shown in the below screenshot. Your Fuse coin is now ready to deposit as collateral. You can follow the same steps to enable any asset as collateral.

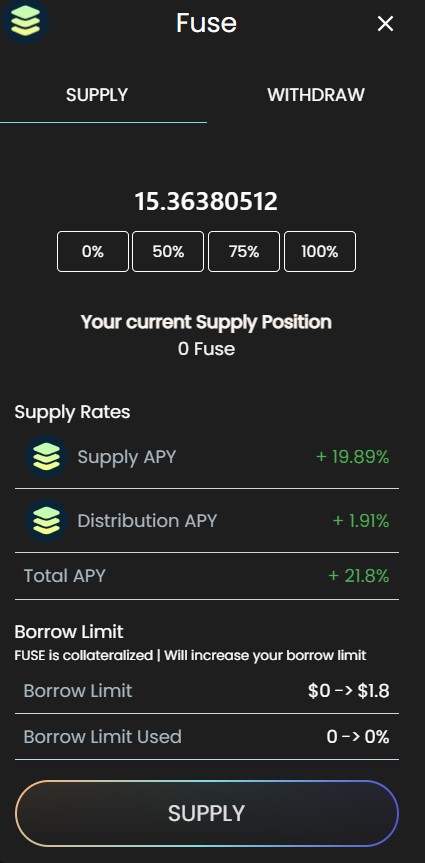

Supply deposit

Once the token/coin is enabled for collateral, you can go ahead and deposit it into the protocol.

To deposit, click on the coin again. A supply window will appear where you can enter the amount of coin that you wish to deposit.

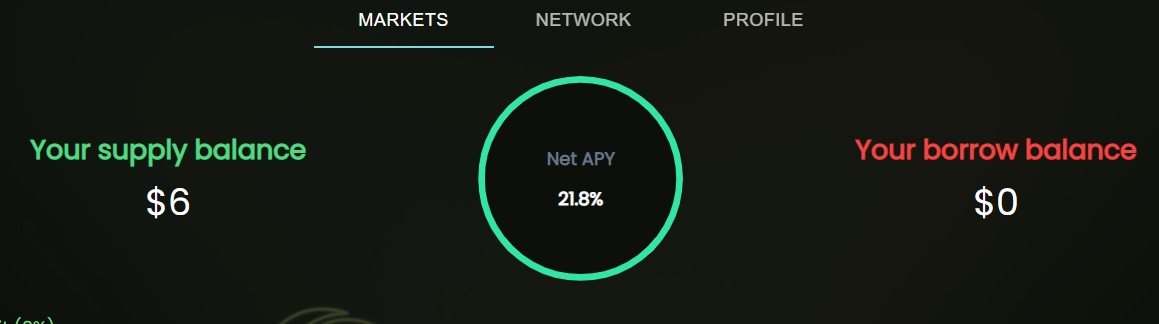

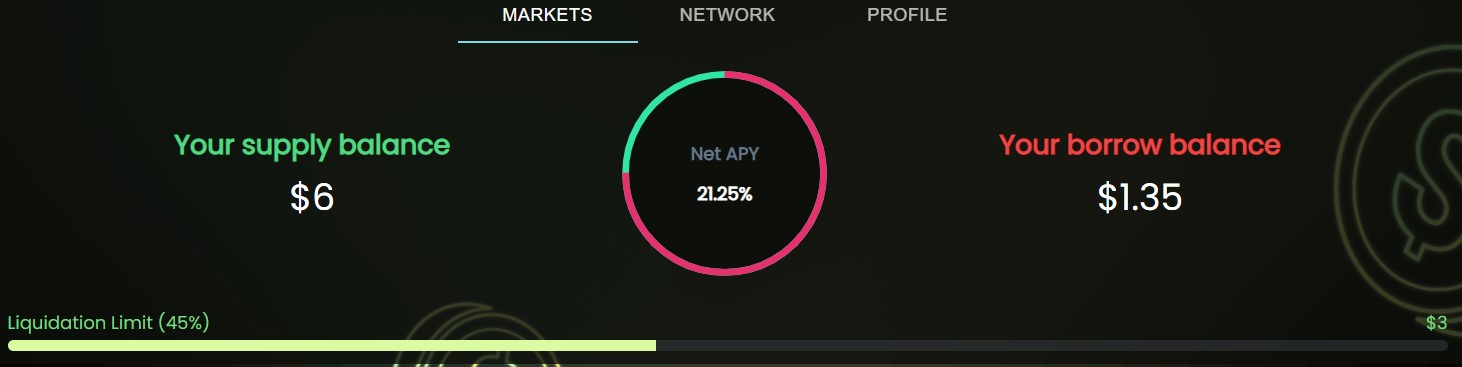

Confirm the process by clicking on the Supply button. Once the transaction is successful, you can check your supply/deposit from the dashboard.

Borrow

To borrow any assets, move to the borrow markets. You can see the list of tokens currently available to borrow.

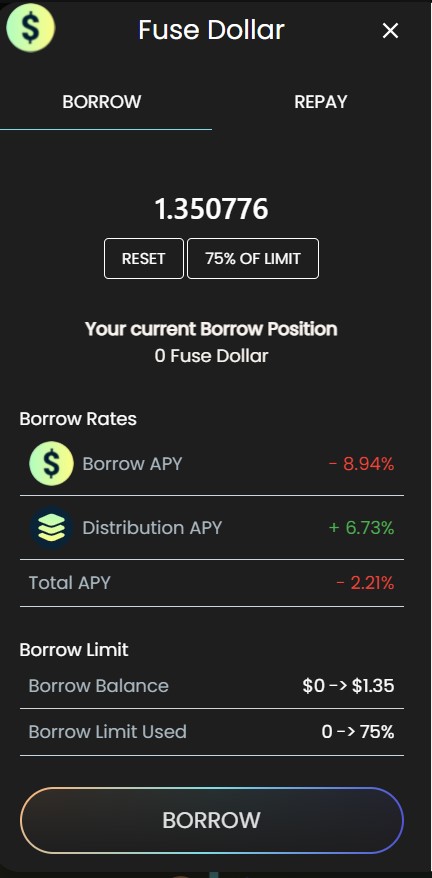

We want to borrow fUSD. Click on it. A window will appear where you can enter the amount of token you wish to borrow. We are borrowing only 75% of the collateral to avoid liquidation.

Confirm the process by clicking on the Borrow button. You can check that your borrowed balance is updated in the dashboard as well as in the supply/ borrow markets section corresponding to the assets (see the below screenshot).

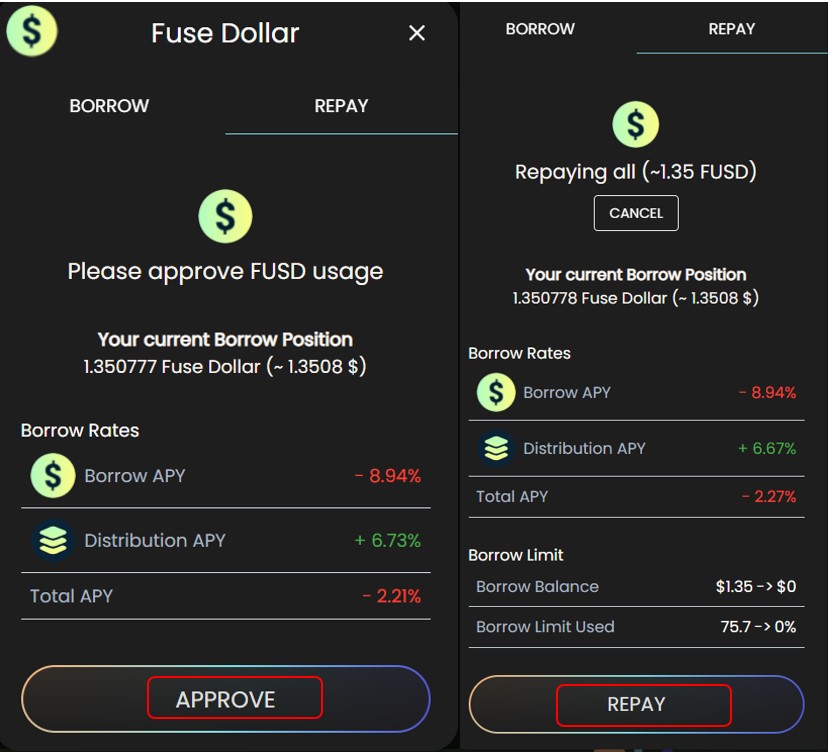

Repay

Users can repay the loan taken against the collateral and free it up for other uses.

To repay, click on the borrowed asset, and go to the Repay tab. Enter the percentage of assets (partial/complete) that you wish to repay. Approve the repay process first, and then finally click on the Repay button to submit the transaction.

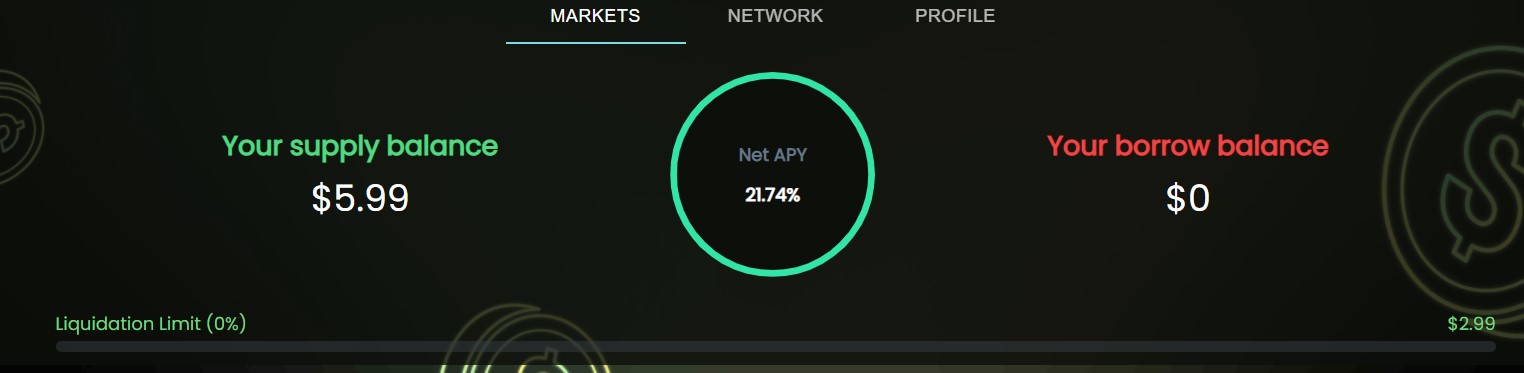

Once the transaction is successful, you will find that the borrowed balance in the dashboard becomes zero.

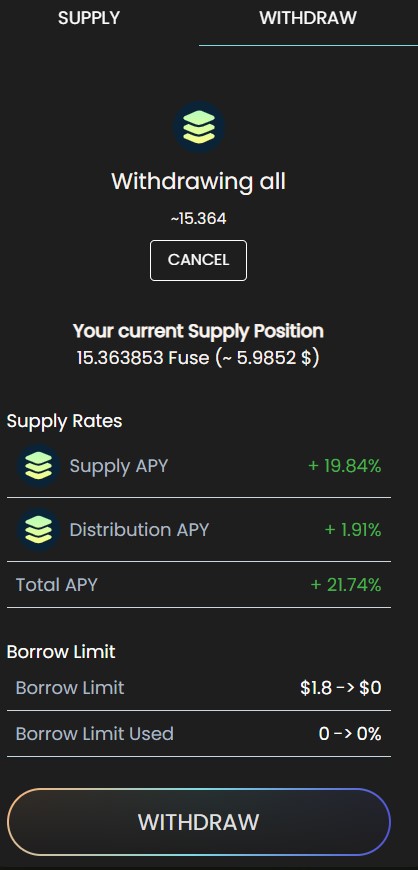

Withdraw Collateral

Once the user has paid all the loans taken against the collateral, they can proceed with withdrawing their deposited collateral.

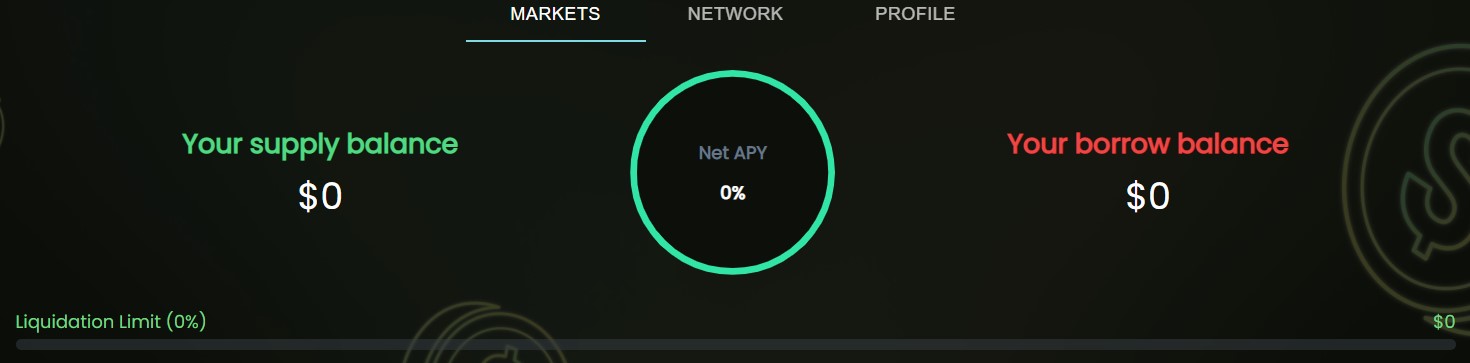

To withdraw, go to the supply market section, and click on the desired asset. Now, go to the Withdraw tab. Then you fill in the amount of collateral that you wish to withdraw, and confirm the process.

Your supply balance will update once the transaction is done. And that’s how you borrow or lend on Voltage Finance.

Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join now starting from $99 per month