Every day we wake up to see our portfolio sliding further; 10%: 20% and more. You thought you bought the dip, but it dipped further. You felt that a token made lots of progress and has some significant milestones in the coming days, but still, the price does not correlate. What do you do?

You wanted to find some comfort in crypto Twitter about the Volatile Crypto Market, but nobody is making sense. The few respected OGs in the ecosystem are only talking about Tech. You are haunted by graphs, predictions, negative news articles, creating fear and fud inside your mind.

Essentially, this is a discussion on understanding your position in the long-term market lifecycle with a consolidated psychological strategy. Therefore, in this article, you will learn how to prepare during the Bear Market to put yourself in the best possible position. We will tell you how you can identify a bear market first.

What Happens in the Bear Market?

Crypto professionals know that there is always a correction for every increase period. Therefore, the high volatility is the nature of the crypto market. Here are a few tips for doing it:

-

The Right Mindset

Do not become emotionally attached to your portfolio. You need to ensure that you have invested in solid projects and don’t bother with the few obstacles that the market put in our road.

-

Understanding and Analyzing Risk

Analyzing your risks is more important in a Bear Market than a Bull Market. You need to understand that there will be many projects which will not survive this bear market. You need to identify them and rebalance your portfolio:

-

- Company / Team

- Project/ Product

- Traction and Marketing

- Tokenomics

- Community (based on company maturity)

- Regulation

- Competitor Analysis

Also, if a project shows positive signals in all these areas, it should be considered a low-risk project. Moreover, try to understand if there are any Red Flags regarding the project like for example:

-

- Coins that need referrals to gain value

- Anonymous ownership

- Invest first to know more

- Closed Source Code

- Unaudited Codes, etc.

In addition, remember that Any Red Flag is a High Risk.

-

Understanding Returns

A fully-diluted marketcap is an excellent measure to understand the probability of the reward of a project. These are some standards to let you have a better idea:

-

- <30 M – Very High Rewards

- 30 M -100 M – High Rewards

- 100 – 500 M – Average Rewards

- >500 M – Low Rewards

You can make an investment decision considering the risks and rewards scenarios simultaneously.

-

Learn Project Evaluation

Bear Markets are also when you understand the good from the bad. The Projects with the proper fundamentals survive through the bear market. Take the example of Binance in 2018 and 2019. When everyone was funding, Binance took it as an opportunity to build. Simultaneously many other projects disappeared.

-

Make Intelligent Investment Decisions

Bear Market is an opportunity to make guaranteed profits. If you can invest in a bear market, you are investing in the bottom, and hence the probability of you making a profit is very high. You need to understand what to purchase and when to buy in a Bear market. For example, in the 2020 Black Swan Event, $ADA was down to 4 cents. In a year, its price has moved to more than a dollar.

-

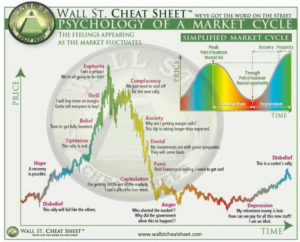

Understand the Market Cycle

Here is the psychology of a market cycle that you need to understand to survive:

Finally, apart from learning every feature of this market, you should know the limits.

What Not to Do in a Bear Market?

Here are some questions that we think you might have right now in your head about this topic:

- Can I hedge with NFTs, how does the NFT economy work in a bearish market, and can we cross-trade between Coins and NFTs?

Since NFT inherently is non-fungible, you can’t hedge them as there is no specific order book or AMM for it. It’s mostly based on auctions.

2. What are my options for moving from manual trading to algorithmic trading, and what type of algorithms?

There are many bots available for algorithmic trading that have different strategies embedded in them with other indicators. You can set which indicator you want to use and customize it too. But bots work well when the market is unidirectional (bullish or bearish). If the market does not have a fixed direction, bots can generate a lot of loss.

Some good platforms for this are Mudrex, Zignaly, Prime XBT Covesting.

3. Can I move to synths in such a case, like a move to Tesla from DOT?

Minimal options here. The synth market is in a very nascent stage.

4. Can I purchase IDO tokens to get into IDOs in a bear market?

That could backfire. It would help if you had expert guidance here. In a bearish market, many IDO tokens are underperforming. Many are trading below their private sale price, and tokens are vested over a broad period, so you cant even sell them.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.