In our previous articles of this series, we have explained how you can install MetaMask and did the entire platform walkthrough (part one) and how you can connect MetaMask with Uniswap and swap tokens (part two). In this article, we will explain how you can use the Pool and Info features of Uniswap.

Table of Contents

What is a liquidity pool

A liquidity pool is a pool of tokens in Uniswap created by liquidity providers. In return, liquidity providers get rewards in the form of trade fees. A trader taps into these pools to trade.

Uniswap supports smart contracts for Ethereum and other ERC20 tokens. Unlike centralized exchanges, which are dependent on the order book, Uniswap is based upon a design called “constant product market maker.” So, when a user trades a token, the token is sent from the pool immediately. Thus you don’t have to wait for a buyer/seller without worrying much about price fluctuations.

You can create a new exchange pair in a new liquidity pool for tokens. Uniswap doesn’t charge any fee (except the Ethereum gas fee) for creating a new pair.

How to add liquidity

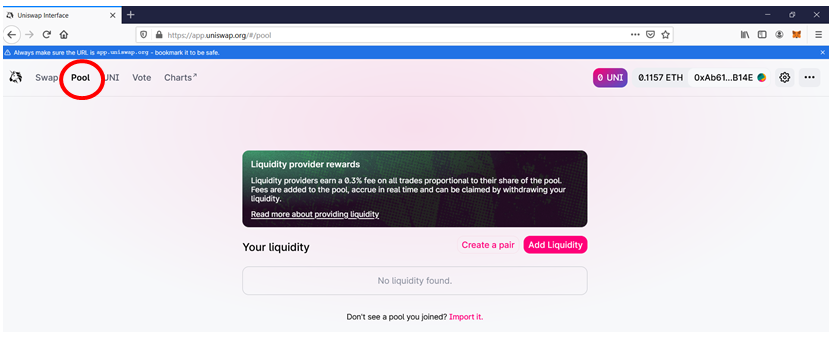

Visit the Uniswap website and connect your MetaMask wallet. Now click on Pool, and a new page will open.

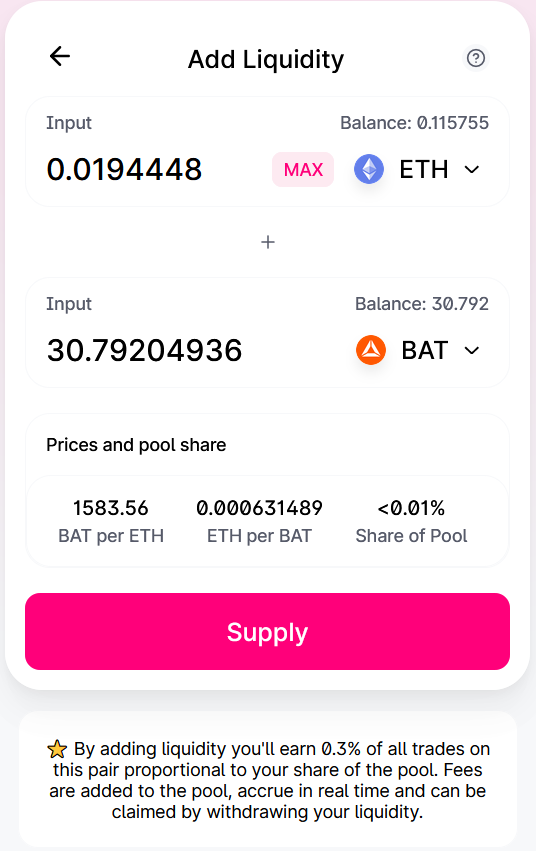

Click on the Add Liquidity button. It will ask you to select the token pair. We have randomly selected the ETH and BAT pair. Users need to pay the equal value of both the tokens that they want to pool.

So just put your desired value against one token and the value of the other token will automatically be displayed.

Important: The two tokens of the Uniswap liquidity pool can be either ETH and ERC20 or both can be ERC20 tokens.

Uniswap will also show you the percentage of your share in the pool. Uniswap will distribute rewards in that proportion.

Important: In case the price of the pair changes during the operation, Uniswap will show you a highlight with the new rate.

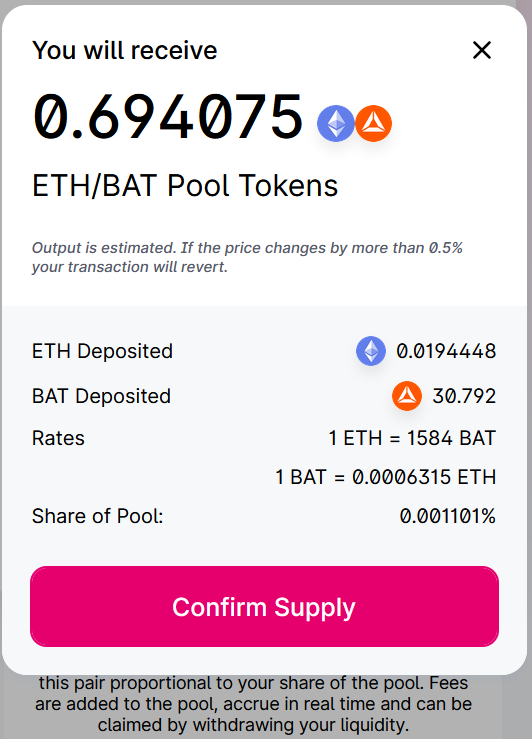

If you click on Supply, the next page will display your pool token share and will ask you to Confirm Supply.

Important: You will receive a pool token proportional to the pool share. And you will also earn a fee in the proportion of your share. Also, you are allowed to remove your liquidity at any time.

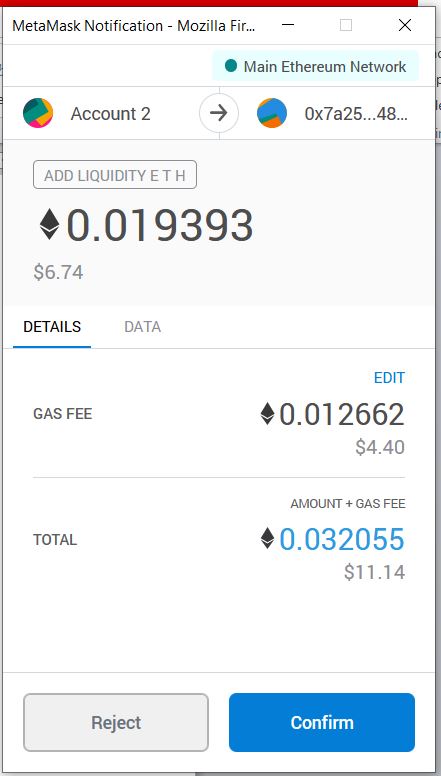

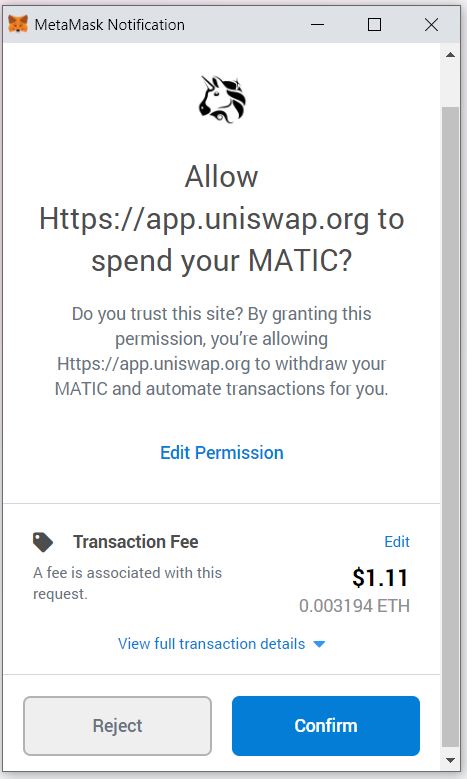

Once confirmed, the MetaMask app will open, mentioning your transaction and required gas fee.

If you are satisfied with the gas fee, then click on Confirm. Your transaction will be submitted and you can check the status on etherscan.

Once your transaction is successful, you will be a liquidity provider and will earn a liquidity fee for every transaction in that liquidity pool.

Uniswap charges a fee of 0.3% from traders. The protocol distributes a portion of this to the liquidity providers.

Create a pair

You can create your pair if it is not present in the existing Uniswap pool list. Users will receive a pool token (ERC20 token) whenever they create a new pool pair and contribute to a Uniswap liquidity pool.

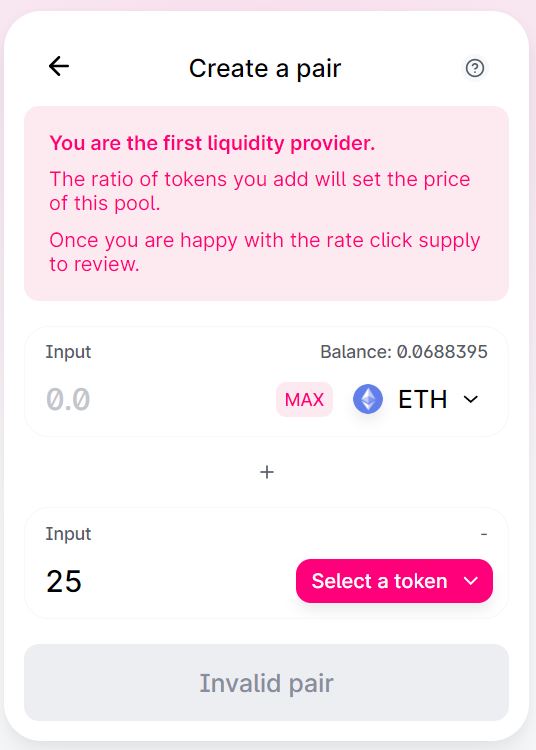

Click on the Create a Pair button.

It will ask you to select the token pair.

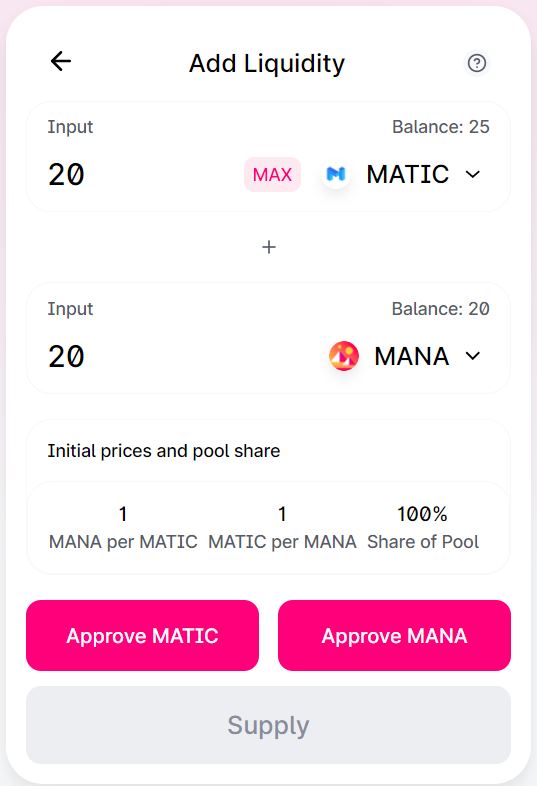

You have to approve both MANA and MATIC transactions. Approve the transaction in MetaMask to give final confirmation.

Important: Select the ratio of the pair carefully to balance the market price.

Removing liquidity

At any time, you can remove your liquidity (partially or completely) and free your tokens. Users will receive a fee along with their tokens that they have earned for the period.

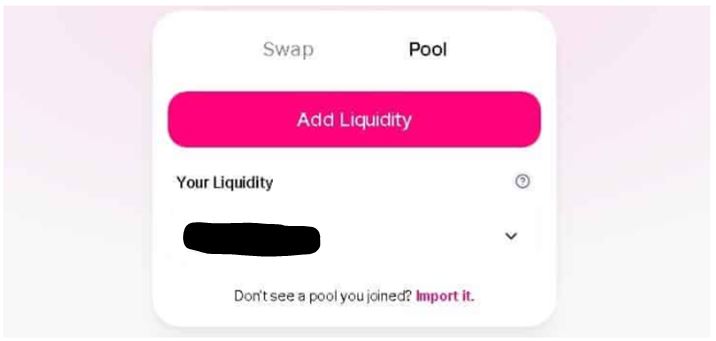

To remove your existing liquidity, go to the Pool tab and go to Your Liquidity. Select the liquidity you want to remove.

Click on Remove Liquidity. Then confirm the removal and transaction.

Important: You will not get the same amount of tokens you initially deposited. The system balances the tokens based on the ratio of deposit.

UNI token

The UNI token is Uniswap’s native governance token for the Uniswap protocol. It launched in September 2020. Uniswap has airdropped 400 UNI tokens to any user who has used the Uniswap protocol before September 1.

UNI holders can participate in the governance of the Uniswap protocol, i.e., any changes, upgrades, and improvements.

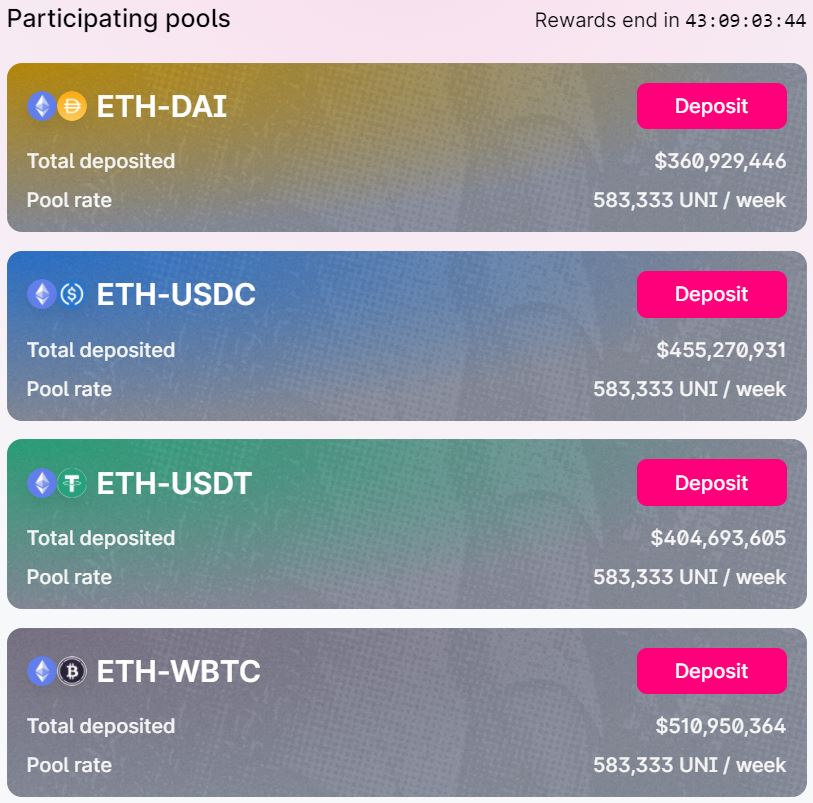

Users can also receive UNI from Uniswap liquidity mining. Uniswap currently supports four liquidity mining pools where you can participate, and instead of receiving fees in the underlying token pair, you will receive the fee in UNI tokens.

- ETH-DAI

- ETH-USDC

- ETH-USDT

- ETH-WBTC

For now, there is no proper utility for the UNI token, but with the release of Uniswap v3, we can expect some additional liquidity mining pool and token utility in near future.

Uniswap features:

Conclusion

Uniswap is a powerful exchange. We have seen a trend of people moving from centralized exchanges to Uniswap. It provides benefits like trading on any ERC20 pairs and also allows users to create pools. Pools have already started replacing ICOs. The only big problem Uniswap has currently is the variable gas fees. Also, Ethereum network fees remain a concern.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Ruma, i found your hard work and resurch educational, thank you

Thanks