Alpaca Finance is one of the largest lending protocols that offer leveraged yield farming on the BNB Chain and Fantom network. Lenders can deposit assets into the protocol and borrowers can take undercollateralized loans to open leverage farming positions to maximize their profits. The platform has a native token named, Alpaca that has multiple utilities in the ecosystem.

Alpaca has undergone 20 security audits by famous auditing firms including CertiK, PeckShield, Block Sec, and many more. The platform holds 3rd position in terms of security on the BNB chain as assessed by CertiK. It has partnered with some major blockchain companies like Binance, KuCoin, Gate.io, MEXC, CoinDCX, Pancakeswap, SpookySwap, etc.

So, in this article, we will explain how you can use the various features offered by the Alpaca Finance platform.

Table of Contents

Access the Alpaca Finance

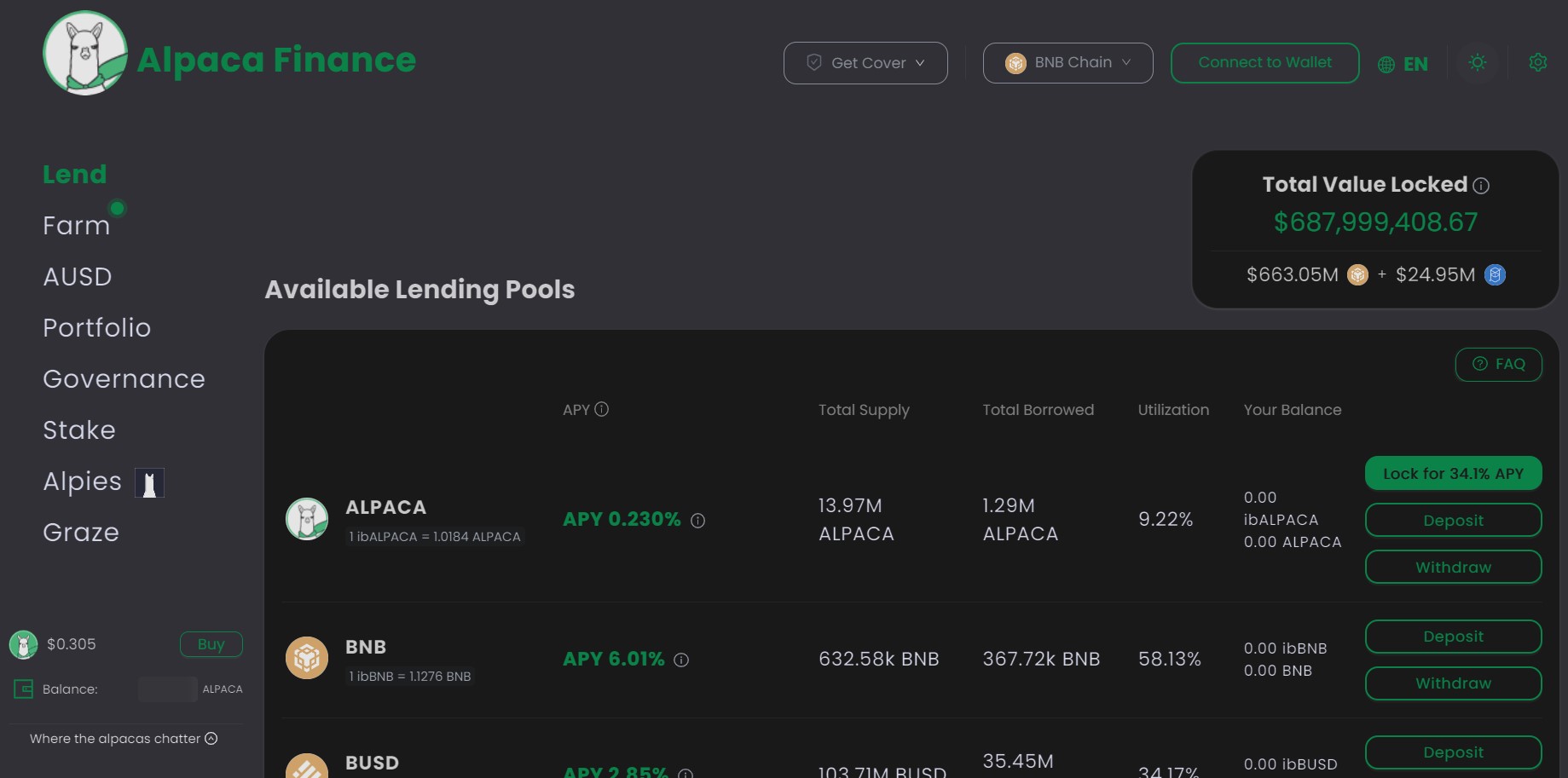

To Access the Alpaca Finance platform, visit the link. At the top right corner, you will find the Launch App button. Click on it and you will be re-directed to the platform’s lend page.

Users need to first connect their wallets to access the platform.

Supported Network

The platform currently runs on BNB Chain and Fantom. Users can switch and work with either of these two networks.

Connect Wallet

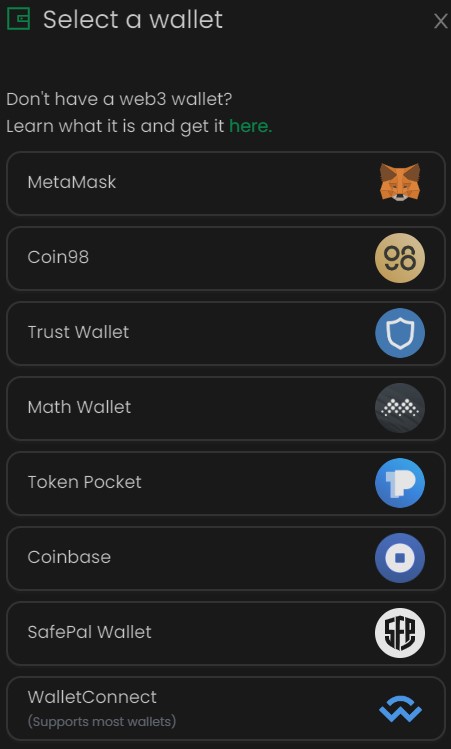

Alpaca Finance allows the users to use any of the below wallet types to connect with the platform:

- Metamask

- Coin98

- Trust Wallet

- Math Wallet

- Token Pocket

- Coinbase

- SafePal Wallet

- WalletConnect

We have connected our Metamask wallet with the network selected as BNB Chain.

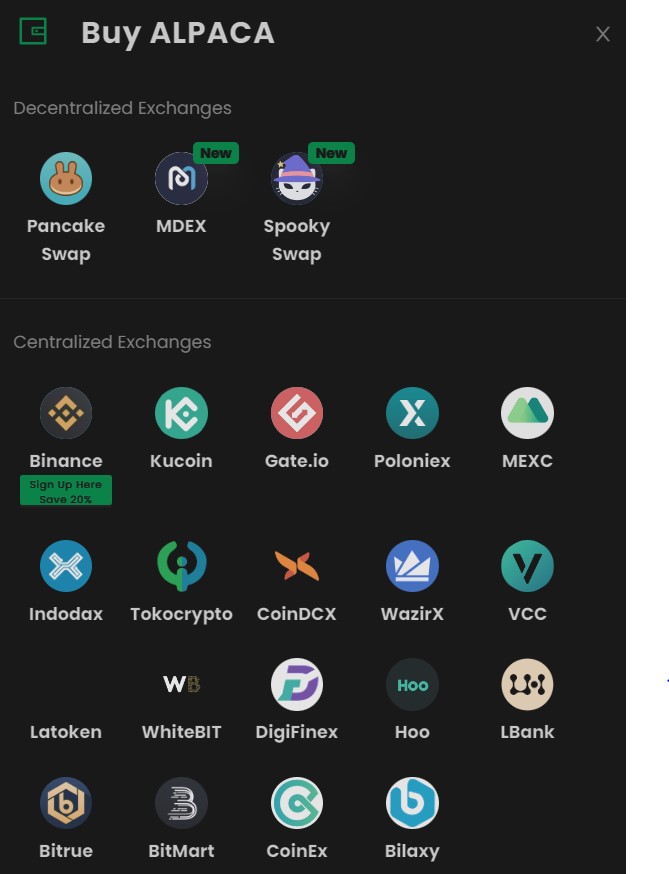

Get The Alpaca Coin

The platform has a native coin named Alpaca. Users can get the Alpaca coin from any supporting decentralized (Pancakeswap, MDEX, SpookySwap) or Centralized exchanges (Binance, KuCoin, Gate.io, etc).

Note that, you do not need to hold the Alpaca token to lend or stake. The platform supports several other major coins or tokens like BNB, BUSD, CAKE, etc that you can lend.

Users need to hold a sufficient amount of BNB coins (if they wish to work on BNB Chain) or FTM coins (if they wish to work on Fantom Chain) in their wallet account to work with the platform. That’s for transaction fees.

However, if you wish to participate in the platform’s governance activities then you must need to have the Alpaca token.

Platform Features

Users can use the Alpaca Finance platform to lend, farm, and staking into the protocol. We will discuss all these features in detail.

Lend

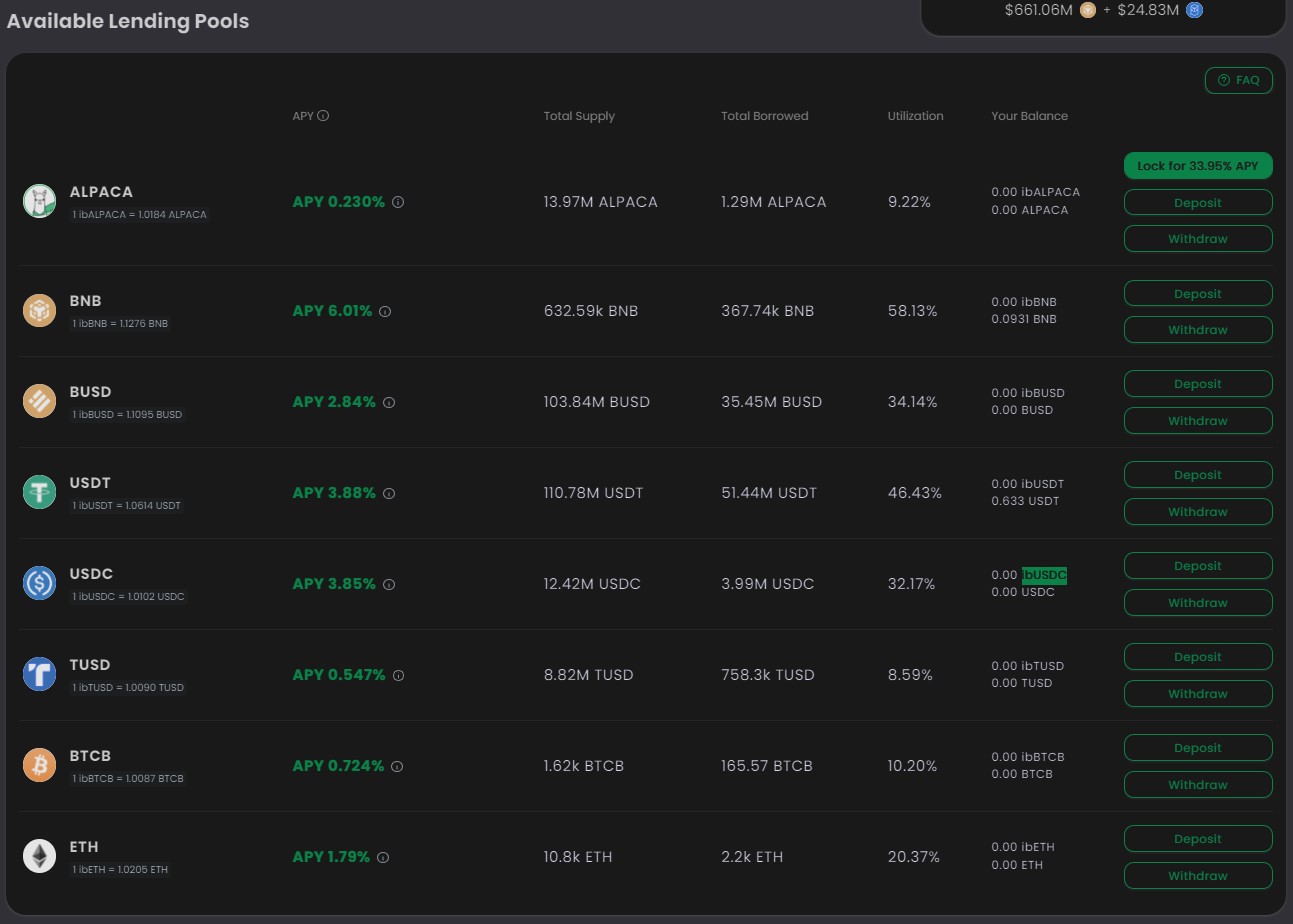

Lending refers to the process of depositing assets into a blockchain protocol. The Alpaca Finance platform also allows users to deposit supporting assets and earn yearly rewards.

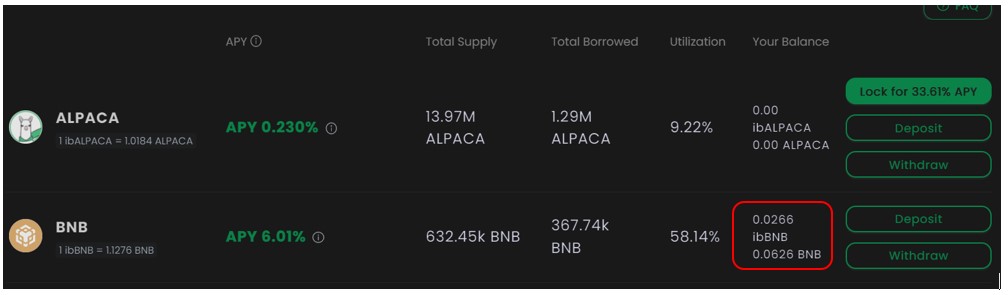

You can go to the Lend tab and check the list of various lending pools where you can deposit the assets. Check the total supply, total borrowed, and APY offered by the pool.

How To Deposit Into Lending Pool

We have some BNB coins in our Metamask wallet that we will lend to the protocol.

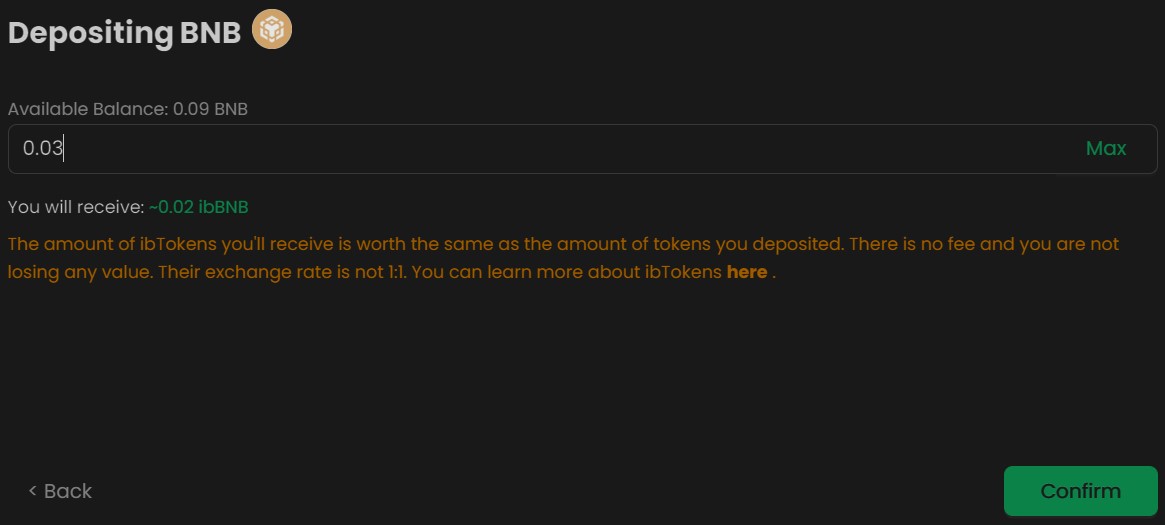

To deposit, click on the Deposit tab against BNB. Now, enter the amount of BNB that you wish to deposit into the lending pool. Approve the deposit process by clicking on the Confirm tab.

Users will receive a transaction approval pop-up request in your Metamask wallet. Confirm the process.

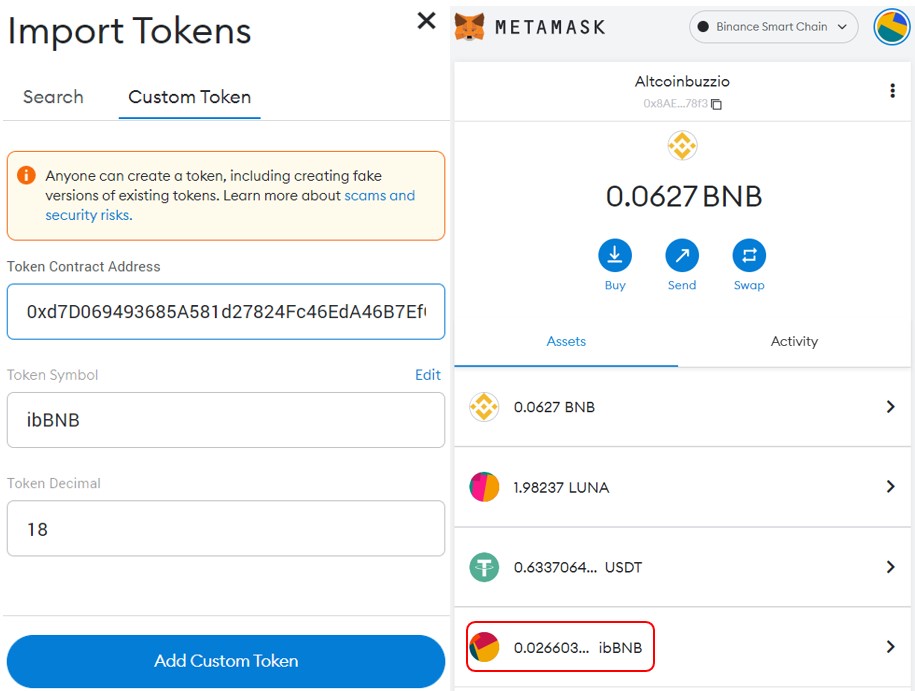

Once the transaction is done, you can check for the desired ibBNB balance in your wallet. It is quite possible that users using these tokens for the first time will not be able to see the token balance in their Metamask wallet directly. They have to manually add the token contract address in their Metamask wallet to see the token balance.

You can get the token contract address from the transaction details (block explorer).

Important: Users depositing any assets will receive iTokens in return. For example, if you deposit a BNB coin, you will receive ibBNB. You will get the same worth (token value not amount) of resultant tokens in your account.

You can also check your lending details from the dashboard.

Withdrawal From Lending Pool

Users who have deposited assets into any lending pool, and withdraw their assets anytime. There is no locking period.

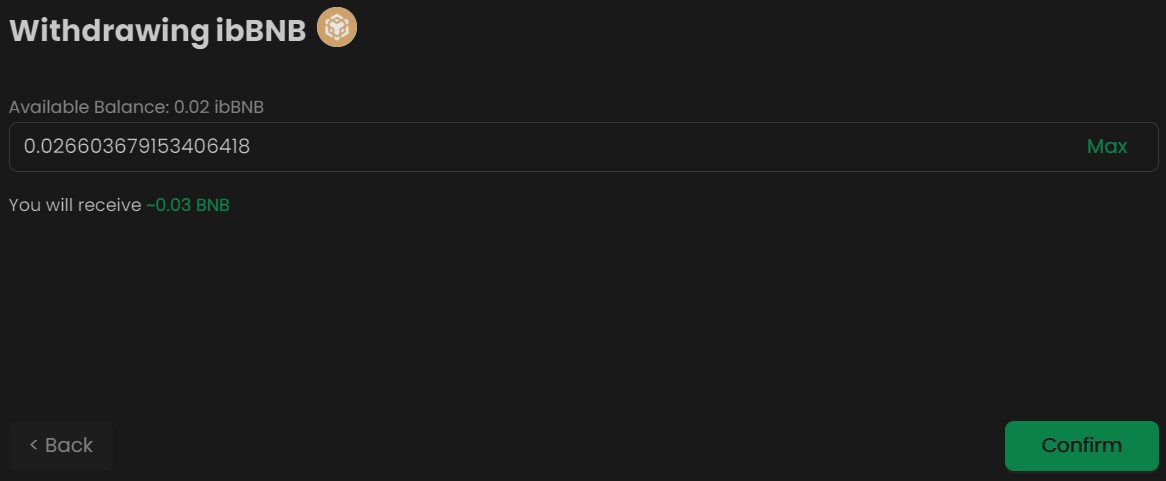

To withdraw, just click on the Withdraw button against your deposited tokens (BNB in this case).

Now, enter the amount of ibBNB that you wish to withdraw, and confirm the process.

The equal value of the BNB coin will be reverted to your Metamask wallet.

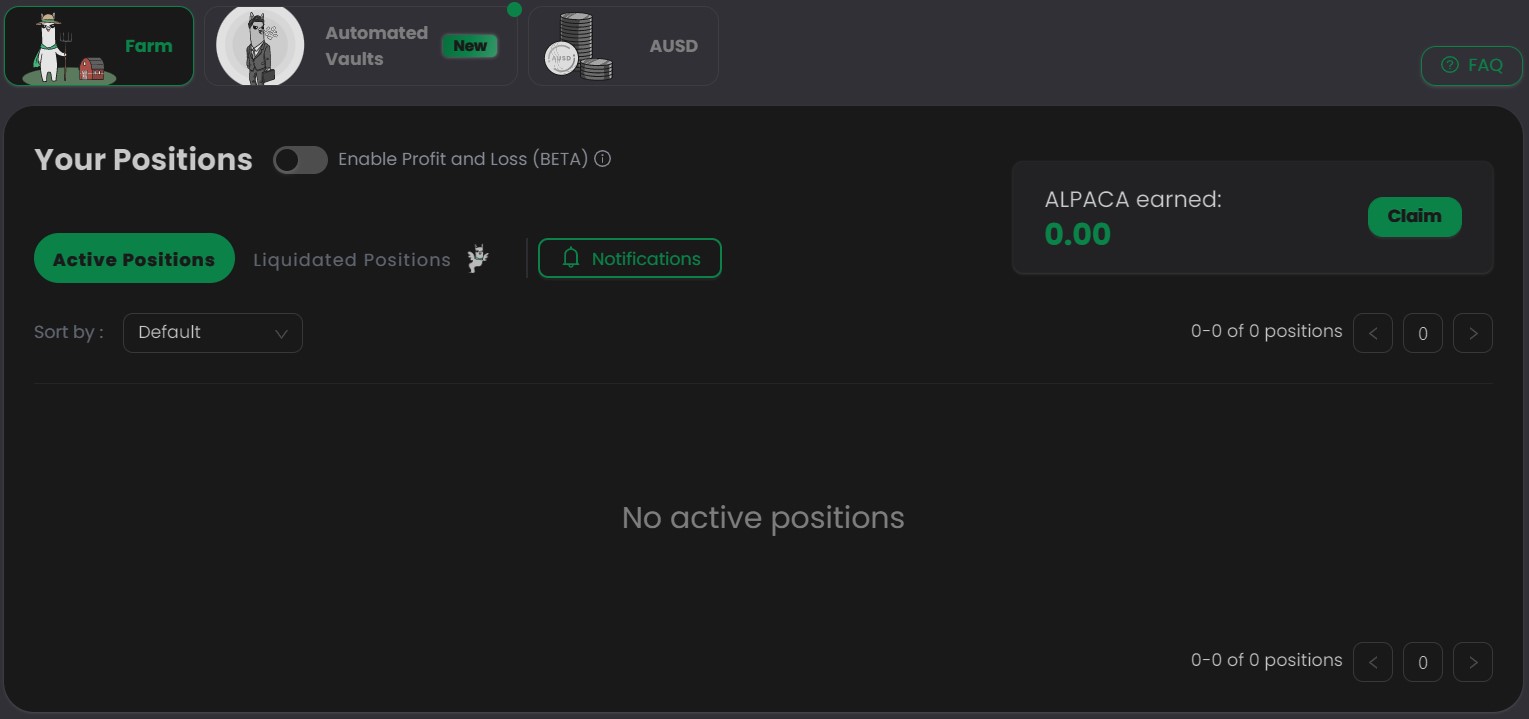

Farm

One of the main features of the Alpaca Finance platform is that it offers leveraged farming. Users can borrow funds to open leveraged positions. Thus, using leverage, you can multiply your yield and profits, as the platforms allow you to borrow assets greater than your collateral value. However, users need to pay interest on their borrowing.

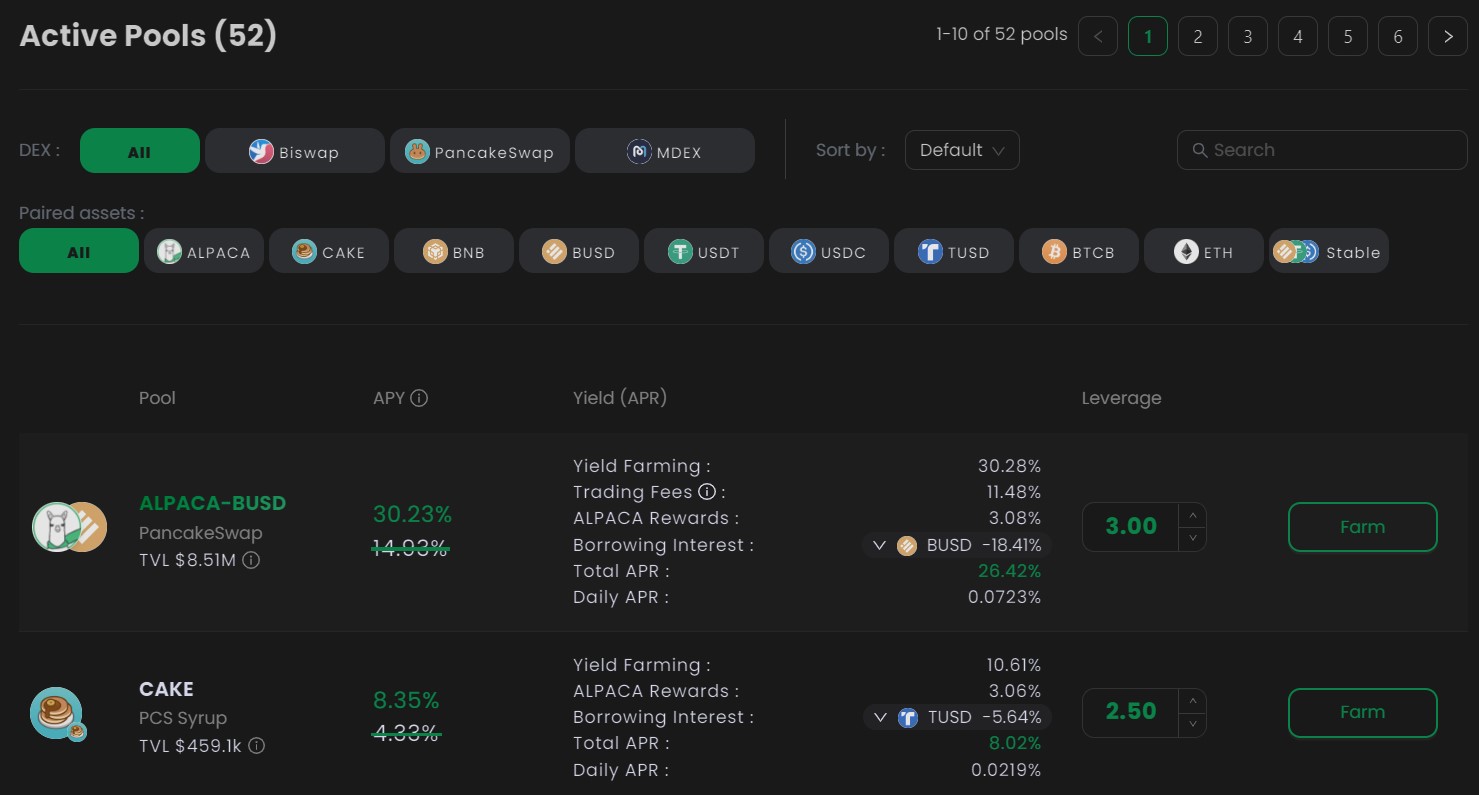

Currently, there is 52 active farms available in the protocol. You can filter the pools by DEX or asset-wise.

We have some BNB and USDT in our wallet that we will deposit into the farm pool.

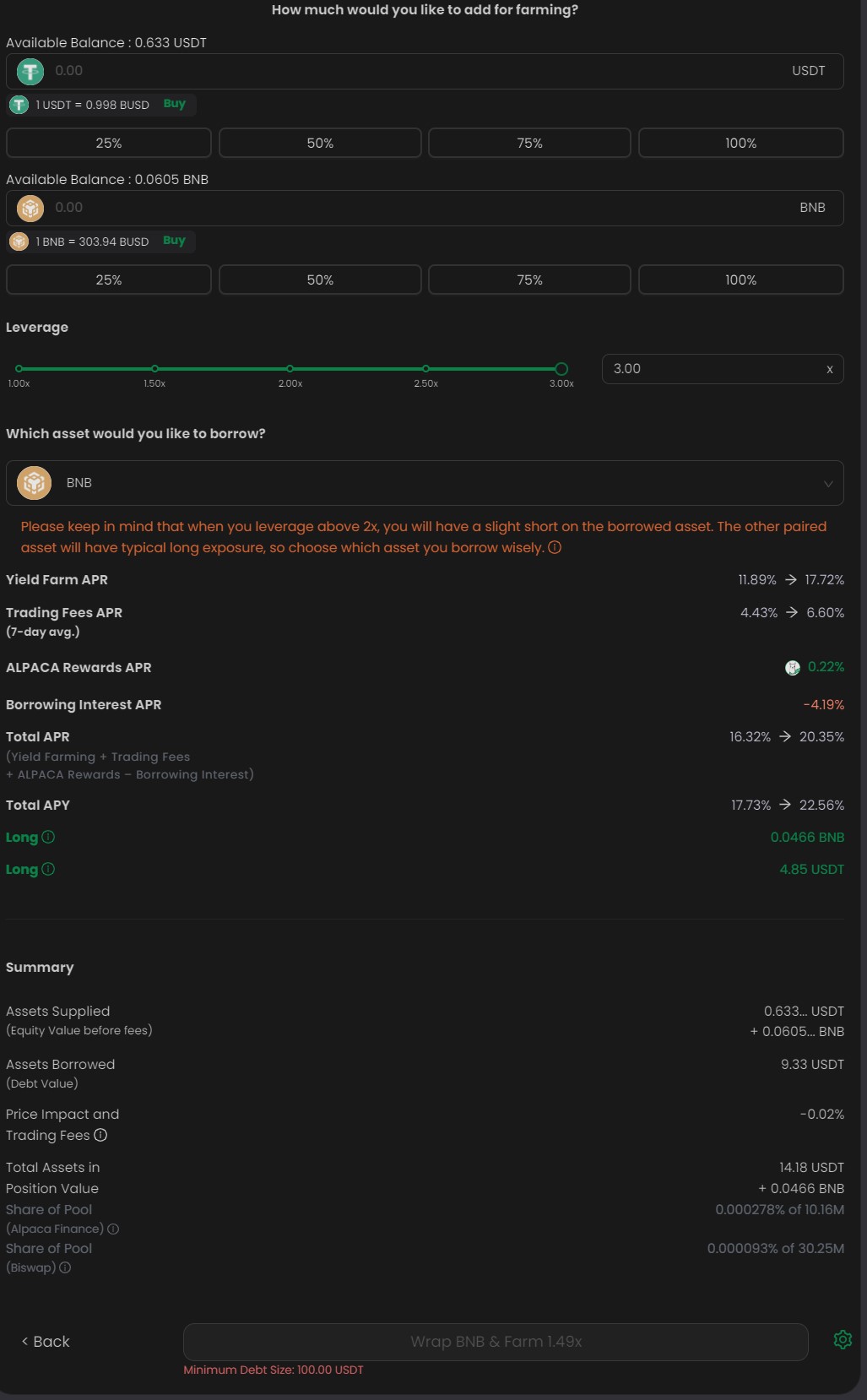

Select the farm pool. Now, enter the amount of both the constituent assets (BNB and USDT in this case). You may enter any combination (in percentage) of values as the underlying smart contract will optimize your deposit and borrowed assets to get an equal value split to the farming pool.

Select the leverage (max 3x in this case). The leverage factor differs for each pool. You can check the Leverage field before selecting any pool for farming.

Now, select the asset that you wish to borrow. You can select any asset to borrow out of the two deposited assets.

Note that the minimum debt amount is $100.

Once you satisfy the minimum criteria, the Farm button will be enabled. You can confirm the process by hitting it. And once the transaction is successful, you can check your position in the Portfolio section.

AUSD

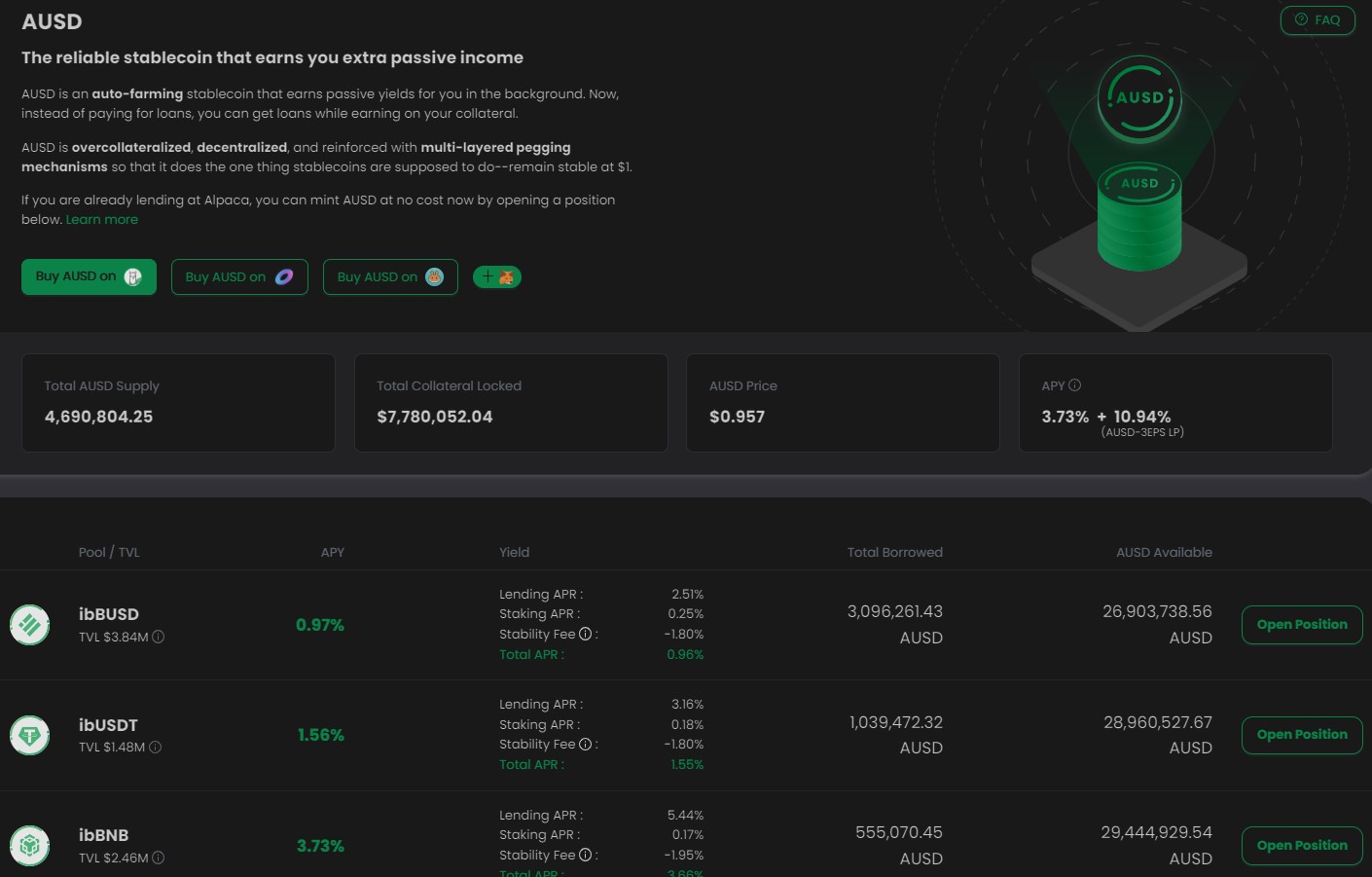

AUSD is an overcollateralized stablecoin that follows a multi-layer pegging mechanism to hold its value at $1.

Users can get the AUSD tokens in two ways:

- From DEX like Pancakeswap, ellipsis finance

- Users who have deposited tokens into the lending pool and have received iTokens in return, can again deposit the iTokens here and mint AUSD at the end without any cost

From the dashboard, you can easily check the total AUSD supply and the total collateral locked against it.

Currently, you will find three ibToken pools (see the below screenshot) where you can deposit the ibTokens and mint AUSD.

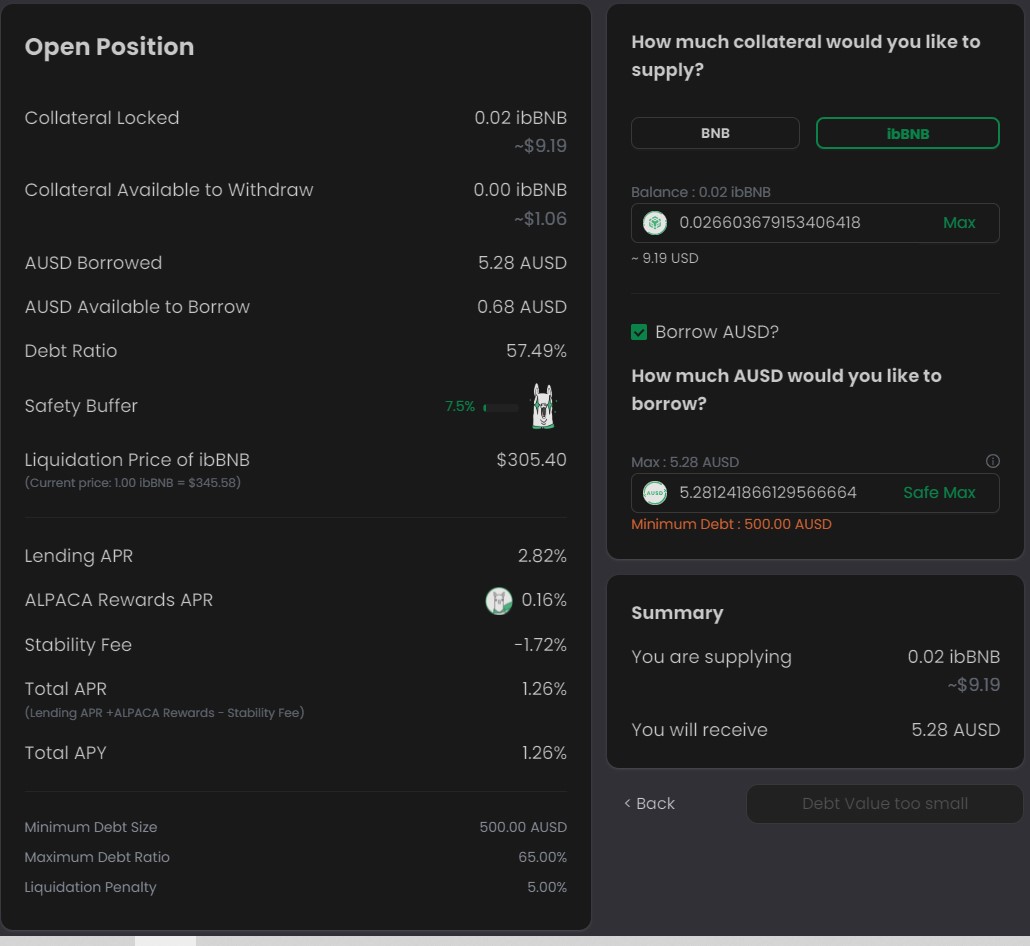

To open a position, users need to take a minimum debt of 500 AUSD. Before opening a position, they need to provide collateral either in iTokens or in their corresponding network tokens. For example, in the case of the ibBNB pool, you can either deposit BNB or ibBNB tokens as collateral to mint AUSD.

Users who have opened a position can go to the Portfolio section to see AUSD position details, once the transaction is successful.

Portfolio

From the Portfolio section, users can check their overall account status in the various products offered by the protocol. You may find the details of your position on Farm, Vault, or in AUSD.

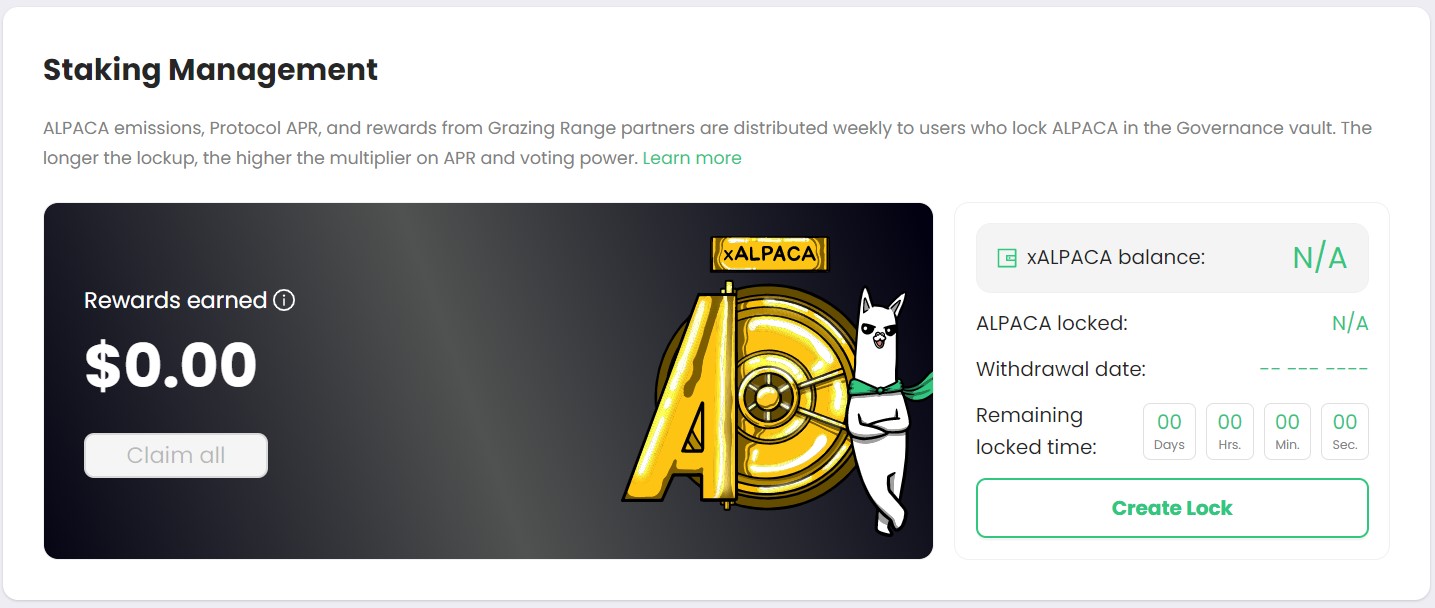

Governance

The governance vault of Alpaca is a fork of Curve DAO. Users can stake their Alpaca tokens into the protocol and in return, they receive a proportional amount of xALPACA tokens. They can lock the tokens from a minimum of 1 week to a maximum of 1 year.

Users locking more Alpaca tokens for a longer duration will receive more benefits in terms of APY and voting power.

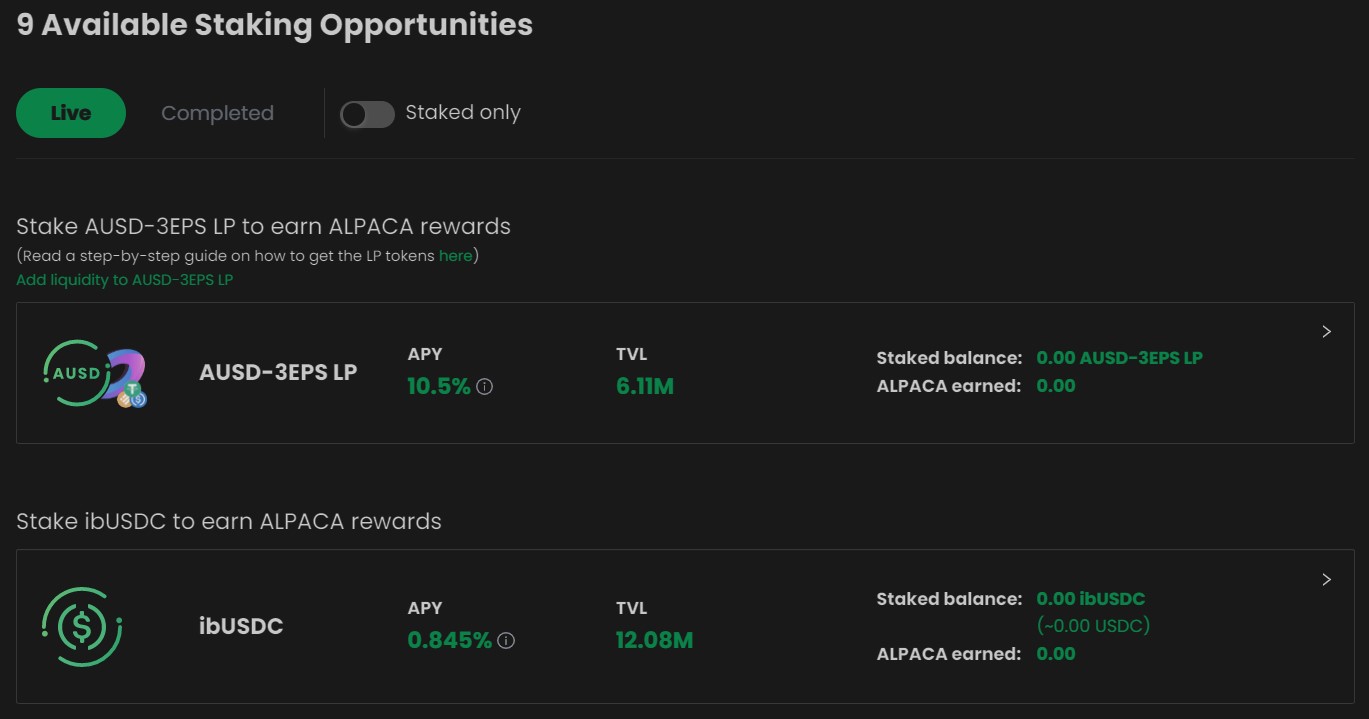

Stake

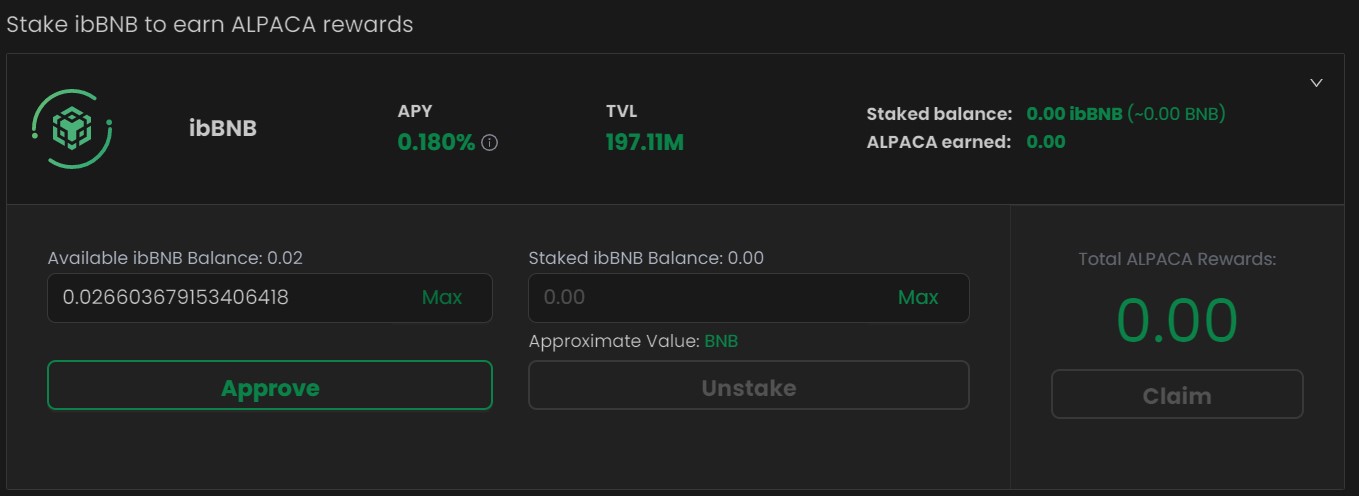

Alpaca Finance also allows you to stake different iTokens. Currently, there are 9 staking pools i.e ibBNB, ibUSDC, ibUSDT, ibBUSD, ibTUSD, ibBTCB, ibETH, ibCAKE, and AUSD-3EPS LP where users can deposit the desired tokens and earn rewards in ALPACA tokens.

Stake iTokens

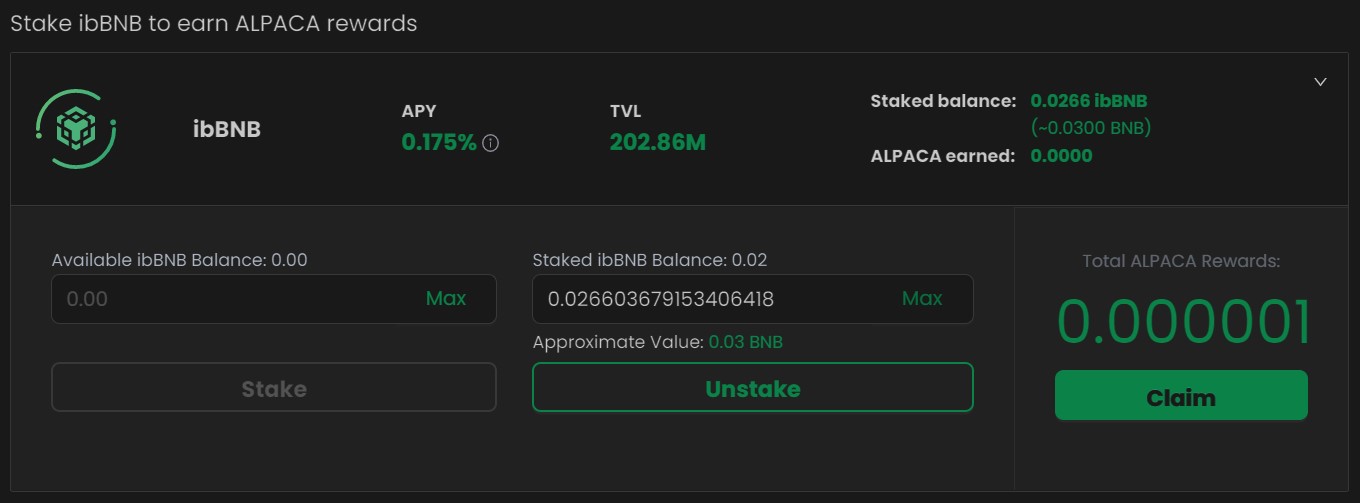

We have some ibBNB tokens in our Metamask wallet that we will use for staking.

Expand the desired pool. You will now find the option to deposit the ibBNB token.

Enter the amount of token that you wish to deposit and confirm the process by clicking on the Approve button.

This will trigger a Metamask transaction, confirm the transaction and you can see the staked ibBNB details from the staking dashboard (see the below screenshot). You can see the accumulated rewards in the ALPACA-earned field.

If you wish, you can stake more iTokens later (into this pool or any other pool) by following the same process.

Unstake iTokens

Users can unstake their staked iTokens at any time. To unstake, just expand the pool where you have deposited your iTokens.

Now, enter the amount of iToken that you wish to unstake, and confirm the process.

Note that, once you opt for unstake, the rewards earned will also get automatically withdrawn to your wallet account.

Alpies

Alpies are the limited edition of the 10,000-piece NFT collection. These hand-drawn NFTs are categorized into two collections:

- The Dauntless – A collection of 5,000 dark-themed Alpies, to be sold in the BNB chain

- The Dreamers – Collection of 5,000 light-themed Alpies, to be sold on Ethereum

Users will be able to buy 30 Alpies in one transaction, and each wallet user can buy a max of 90 Alpies.

Both these collections are interoperable, so users can easily trade them on Opensea, NFTTrade, Rarible, PancakeSwap, TreasureLand, etc.

Read this link here if you want to know more about Alpies.

Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Above all, find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.