Built on the Binance Smart Chain, Multi-Chain Lend (MCL) is an algorithmic money market system that offers lending and borrowing features like flash loans to its users at a very low cost. It is a fork of AAVE. Multi-Chain Lend (MCL) has been audited by Certik. bMXX, a BEP-20 token, is the governance token of the Multi-Chain Lend (MCL) platform.

In our previous articles, we have explained Multiplier Finance in detail, and how you can use their TakoSwap AMM DEX. In this article, we will explain how you can use the recently launched lending and borrowing application by Multiplier Finance, i.e., Multi-Chain Lend (MCL)

Table of Contents

Supported Cryptocurrencies

MCL supports the following cryptocurrencies:

Currently, the LTC and DOT token listing proposal passed in the MCL platform.

Usage Guide

To use the Multi-Chain Lend (MCL) application, go to the Multiplier webpage.

Click on Launch App, and it will redirect you to this page.

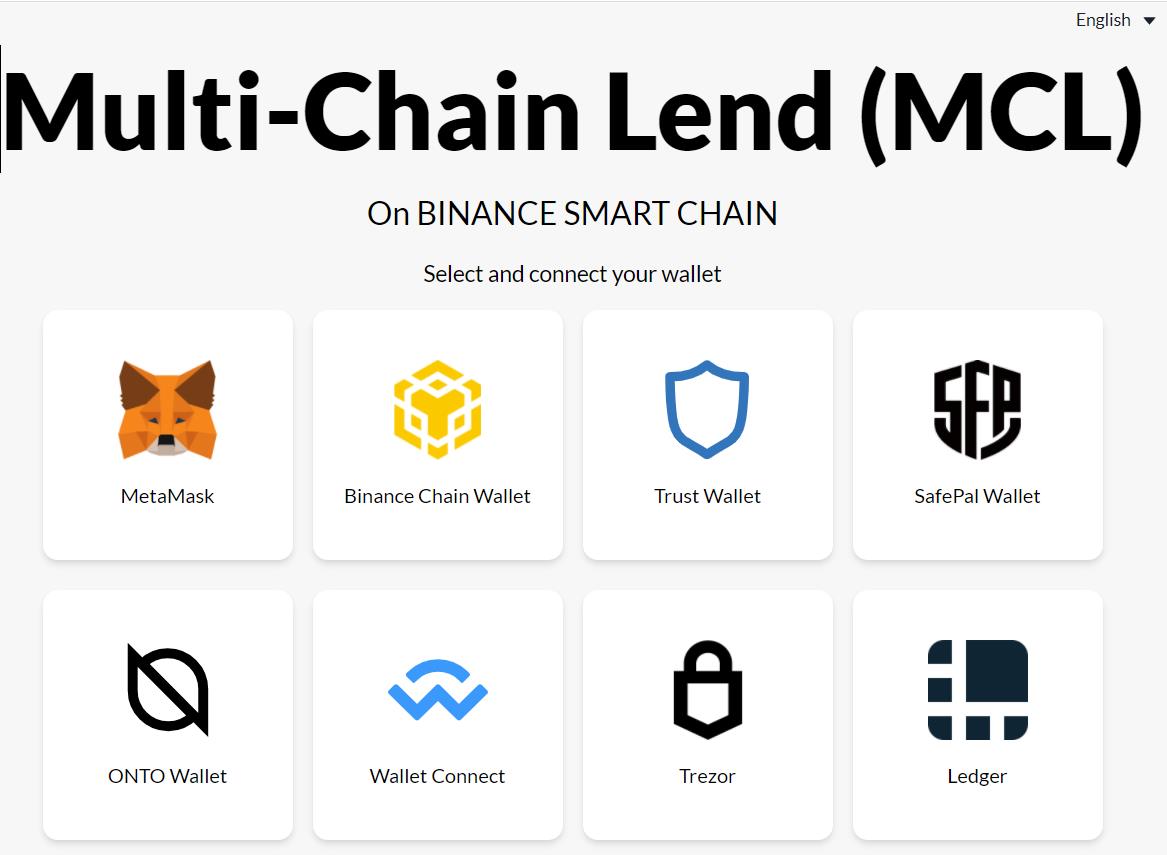

Connect Wallet

The platform supports multiple wallets by which you can connect and access the platform and its features.

- MetaMask

- Binance Smart Chain

- Trust Wallet

- SafePal Wallet

- ONTO Wallet

- WalletConnect

- Ledger (hardware wallet)

- Trezor (hardware wallet)

Connect with your desired wallet.

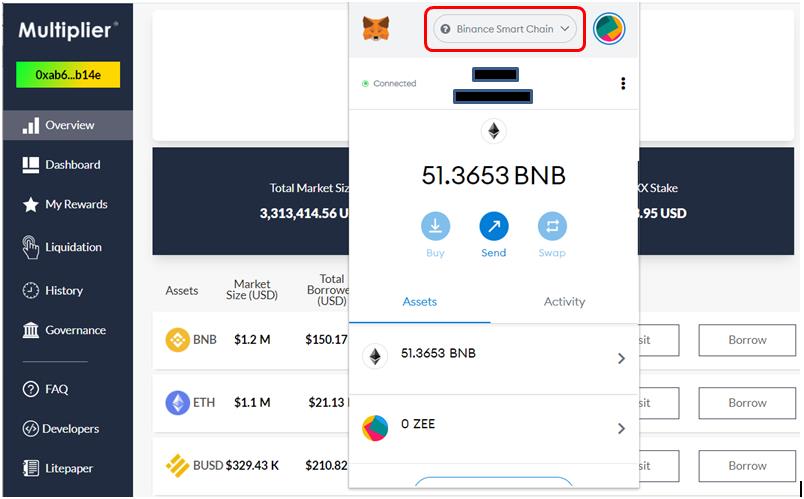

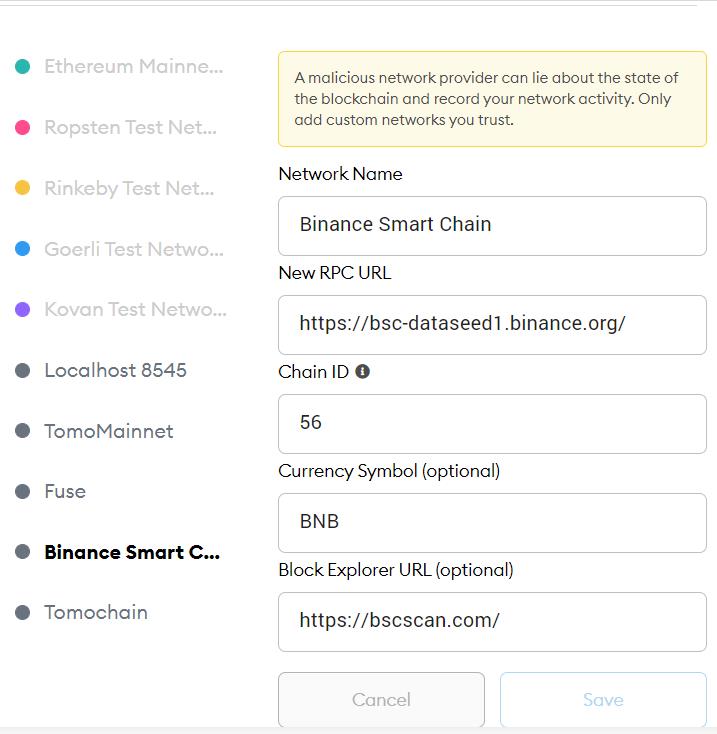

We have chosen MetaMask wallet. Also, set the network as Binance Smart Chain.

In case you do not have the Binance Smart Chain network connection details in your MetaMask wallet, you can add the following connection details for BSC by going to the network setup tab.

Binance Smart Chain Connection Details:

- Network Name: Binance Smart Chain

- New RPC URL: https://bsc-dataseed1.binance.org/

- ChainID: 56

- Symbol: BNB

- Block Explorer URL: https://bscscan.com

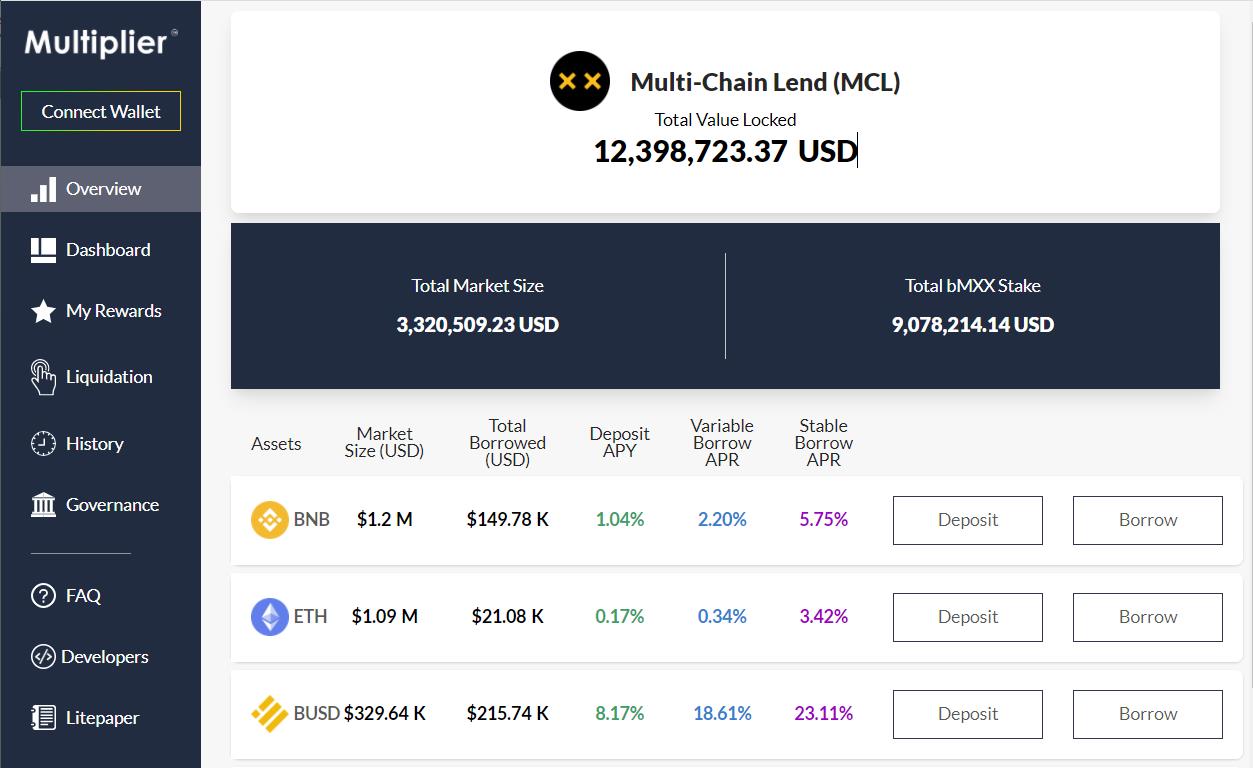

Overview

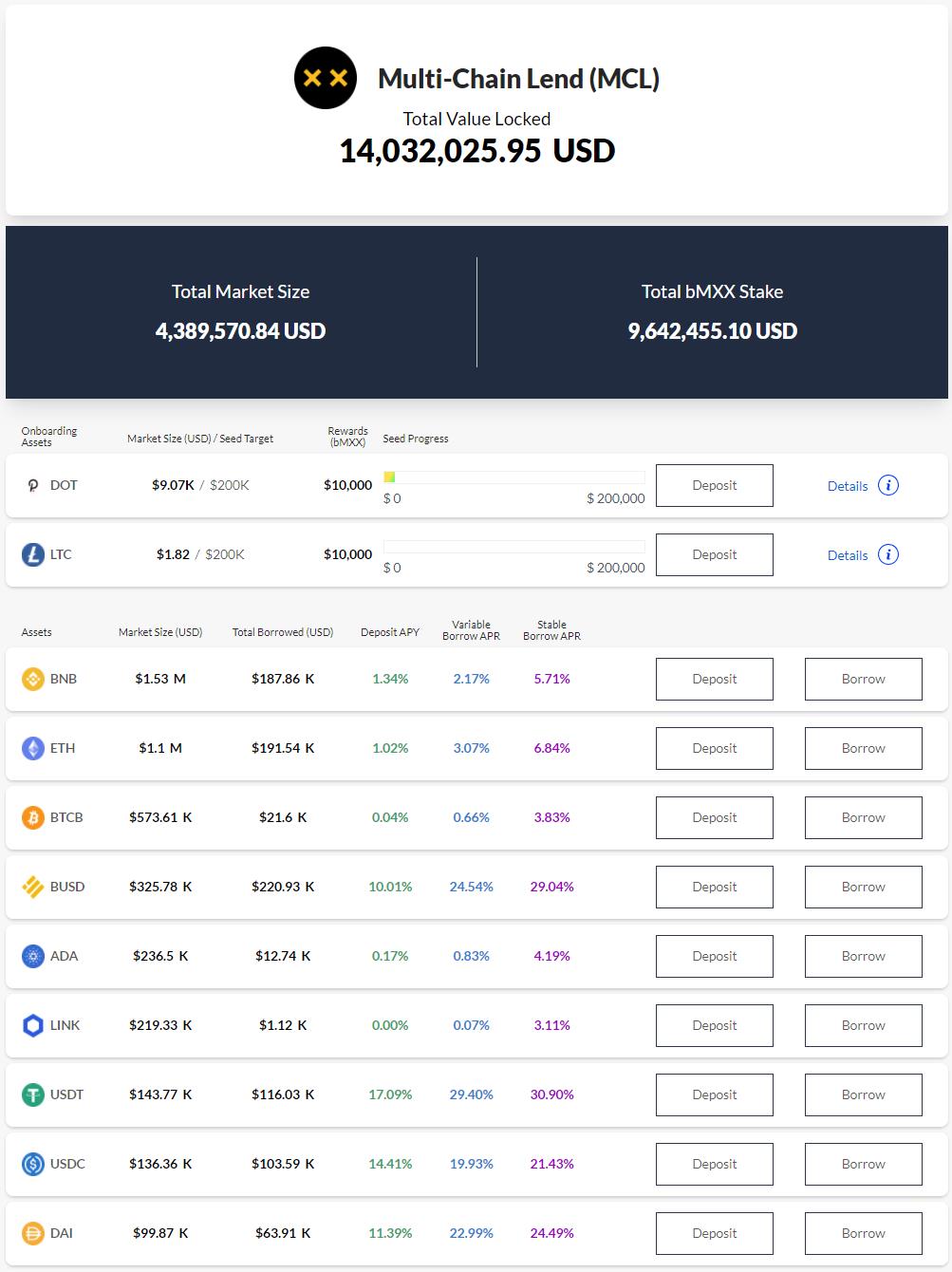

From the Overview tab, you can get the total valued locked in the Multi-Chain Lend platform that comprises the total deposits and borrows of all the supported assets, and the total bMXX locked in staking.

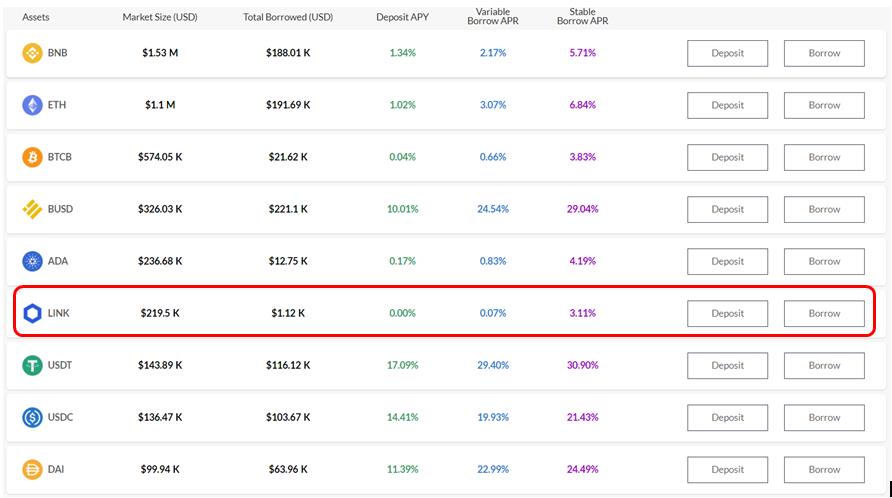

Along with this, you can check the following details about the individual assets supported by the platform:

- Tokens that a user can Deposit or Borrow

- Individual Token Market Size (USD)

- Total Borrowed amount (USD)

- Deposit APY

- Variable Borrow APY

- Stable Borrow APY

Deposit

Users who wish to provide loans can deposit any asset supported by the platform as collateral. These persons are formally termed as lenders. Assets deposited by all lenders are pooled into a smart contract. The lender earns an interest rate depending on the market utilization. Besides, lenders earn from the loan origination and flash loan fees.

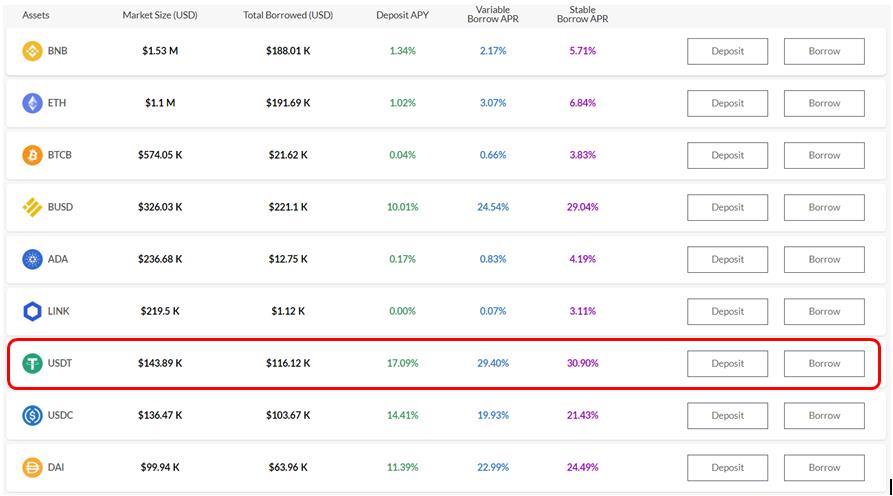

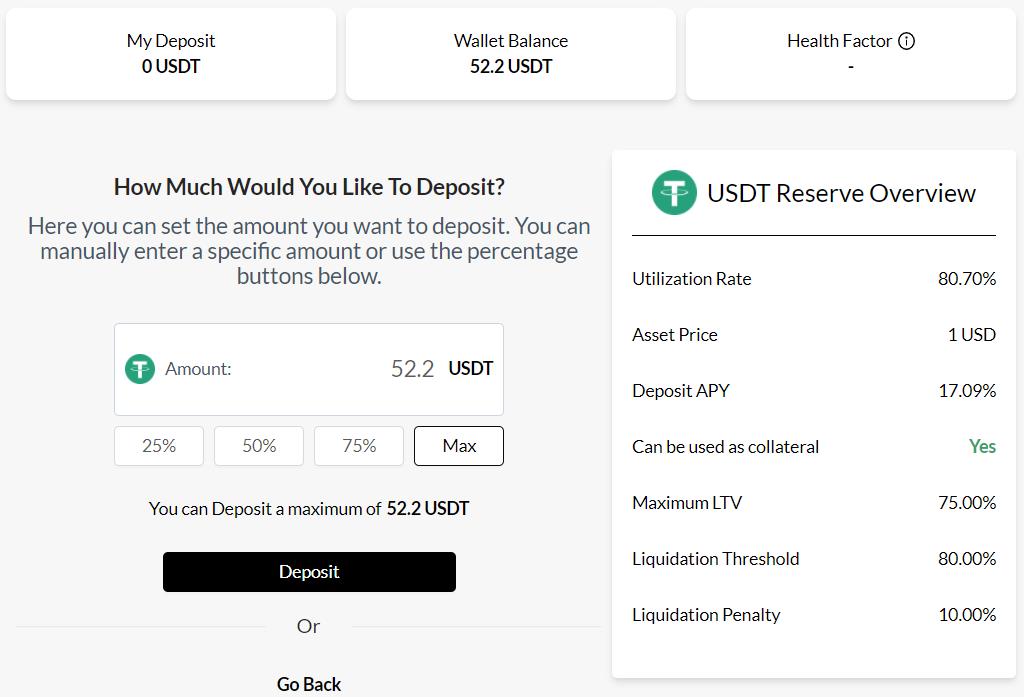

So, we have some USDT in our wallet that we will use to deposit as collateral.

To deposit, click on the Deposit button appearing against the token.

The application will ask you to enter the amount of USDT that you wish to deposit.

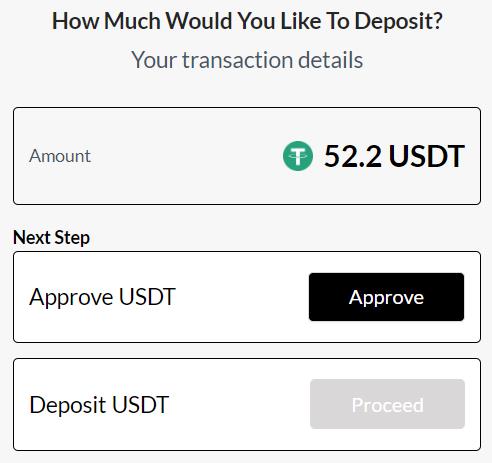

Fill in the amount and click the Deposit button. It will then ask you for approval before actually depositing the asset.

Each of these steps will trigger a MetaMask transaction. Confirm both the transactions.

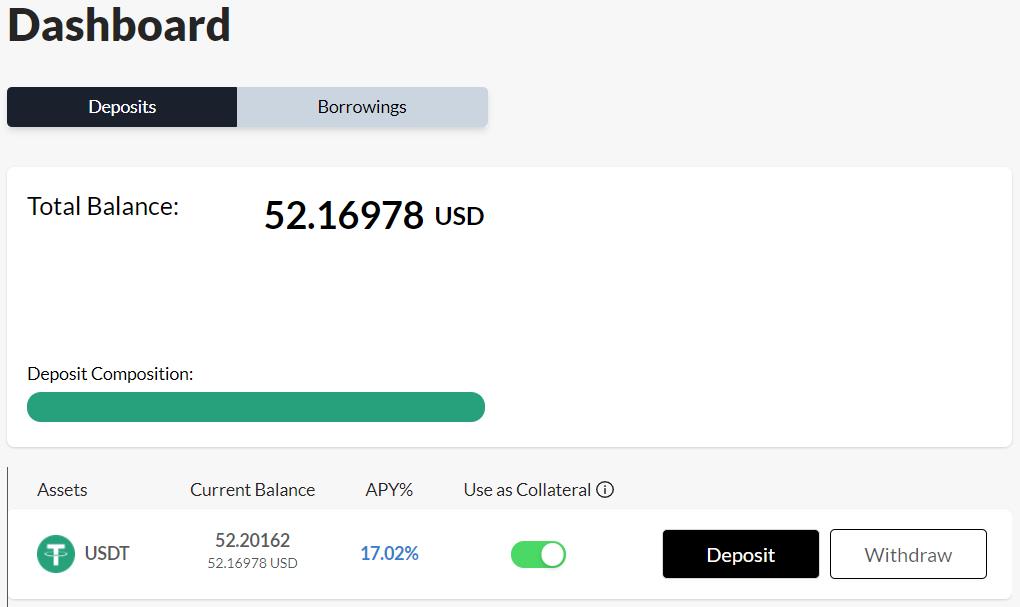

You can now check your deposit from the Dashboard.

One important thing to note here is that the deposited asset can be used as collateral. That means you can use this asset as a safeguard to borrow another asset against it.

Borrow

Users who wish to borrow any asset supported by the Multi-Chain Lend (MCL) platform are required to lock some assets on the protocol as collateral. The locked assets must have a higher value than the borrowed asset. In other words, you can say that you will not be able to borrow the 100% equal value of the deposited asset. Users must need to maintain a health factor>1 to avoid liquidation.

Liquidation

When the collateral value of the user falls to such an extent that it becomes insufficient to cover the loan, then liquidation happens. Two scenarios give rise to liquidation:

- Decrease in the value of the collateral

- Increase in the value of the borrowed amount

This collateral vs. loan value ratio is termed as a health factor in MCL. These collateral ratios are determined by the protocol and are controlled and maintained through the MCL governance process.

To borrow any asset supported by the MCL platform, just click on the Borrow button against the desired asset.

Let us suppose we want to borrow a LINK token.

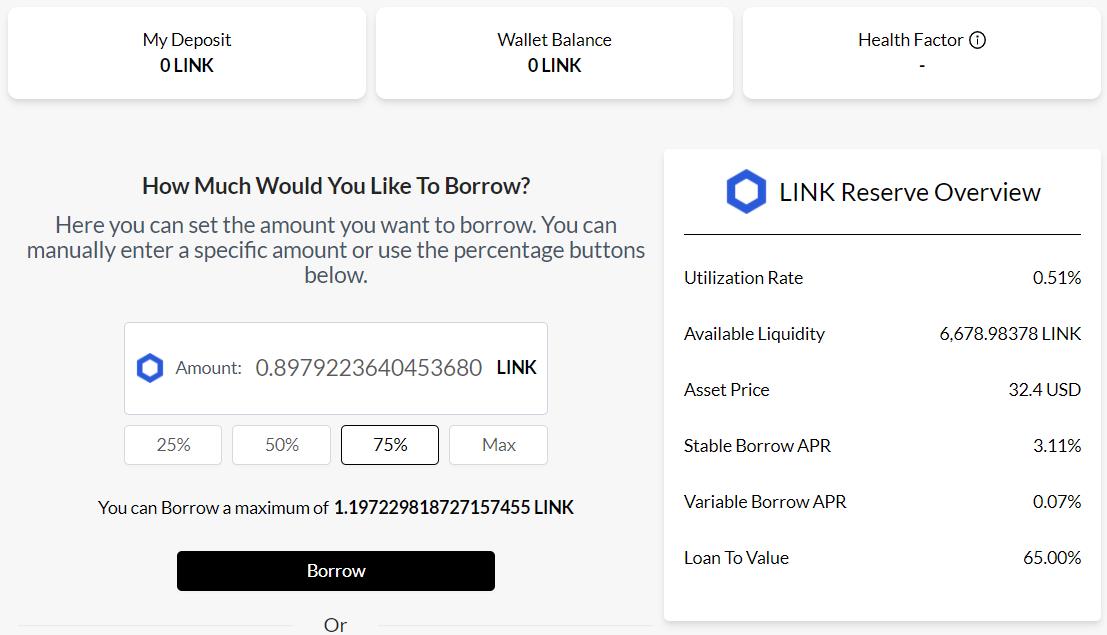

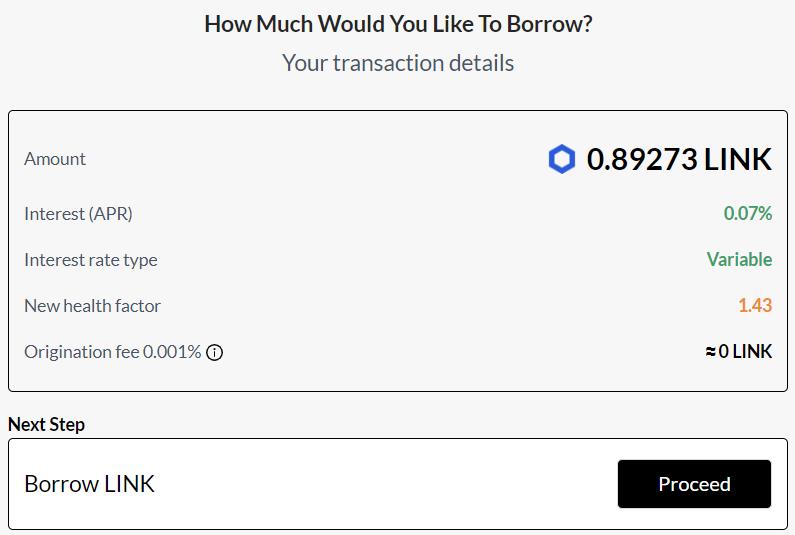

Enter the amount of LINK tokens that you wish to borrow. The application will show you the max LINK tokens you are eligible to borrow. However, it is always recommended not to borrow the maximum token value to avoid liquidation.

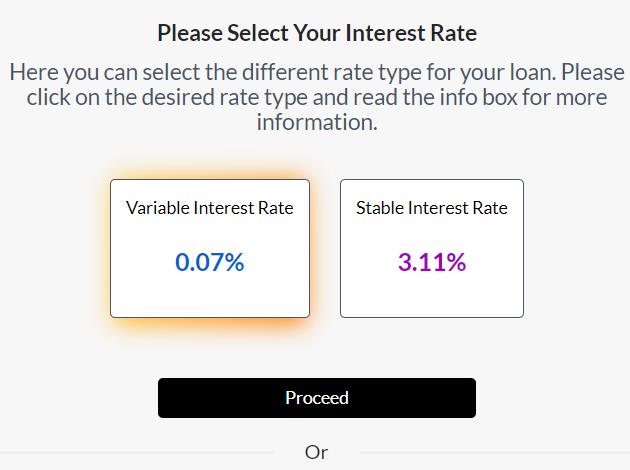

Thus, to maintain a good health factor, we are borrowing only 75% of the token amount. Next, the application will ask you to set the borrowed interest rate. There are two types of interest rates:

- Variable Interest Rate – Recommended for short-term loans. Rates are impacted by market fluctuations.

- Stable Interest rate – Fixed rate throughout your loan duration. Recommended for long-term loan periods.

Depending upon your loan period, you can decide and choose your interest rate. Confirm the borrowing process by clicking on the Proceed button.

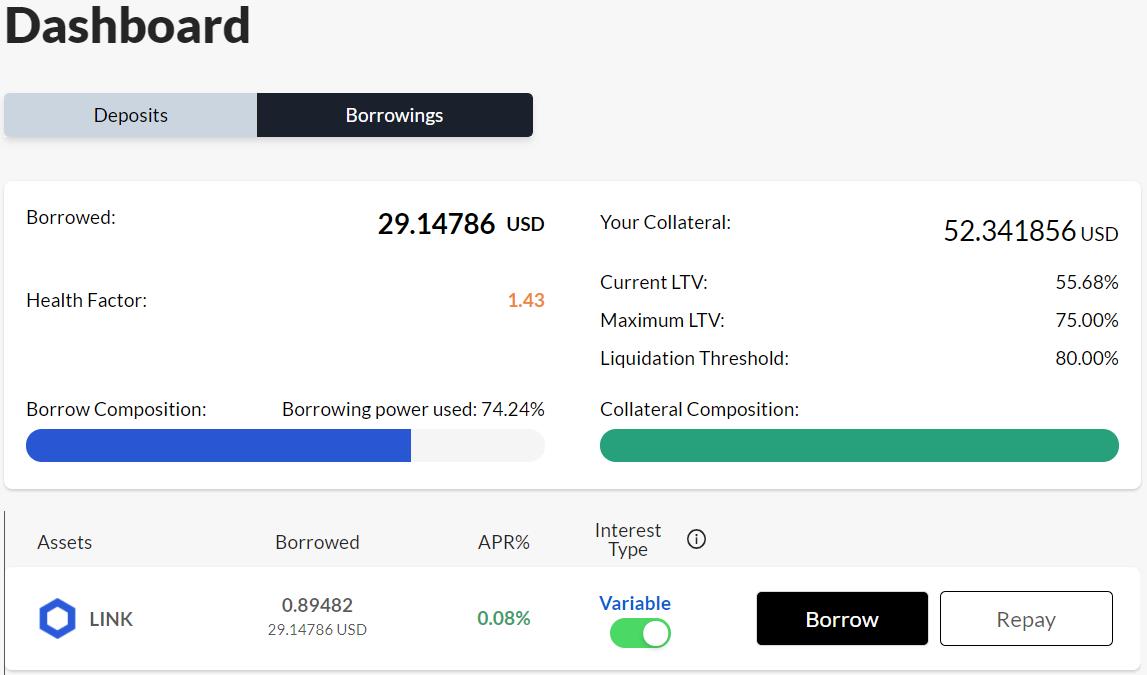

A MetaMask transaction is generated, and once the transaction is successful, you can check your borrowing details from the dashboard.

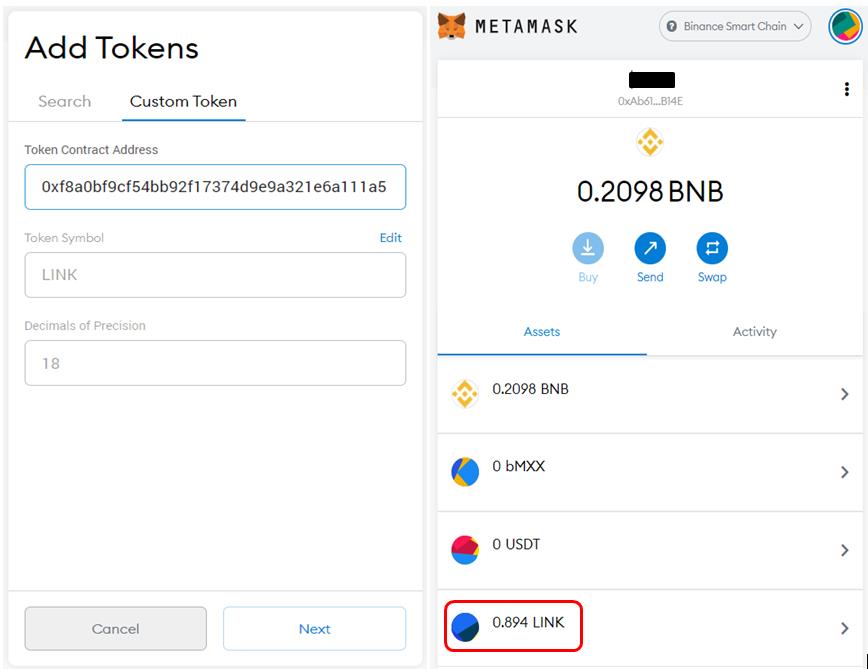

The borrowed LINK tokens will also reflect in your MetaMask wallet.

Borrow Token in MetaMask

If you are using the LINK token for the first time, you won’t be able to see the token directly in your MetaMask wallet. You have to add the token contract address by going to the Custom Token field.

Also, the token contract address in BSC will be different from the ERC-20 contract address.

Follow the below steps to get the BSC contract address of the LINK token.

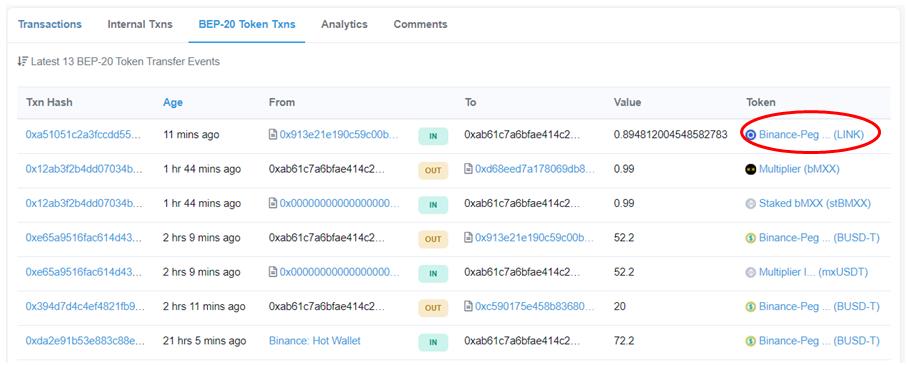

Go to your MetaMask wallet and click on View Explorer. It will open the BSC block explorer of your wallet address.

Now click on BEP-2- Token Txn, search for your token, and click on it.

Copy the contract address from the profile summary. You can now add this contract address to your MetaMask wallet to get the desired token.

Repay

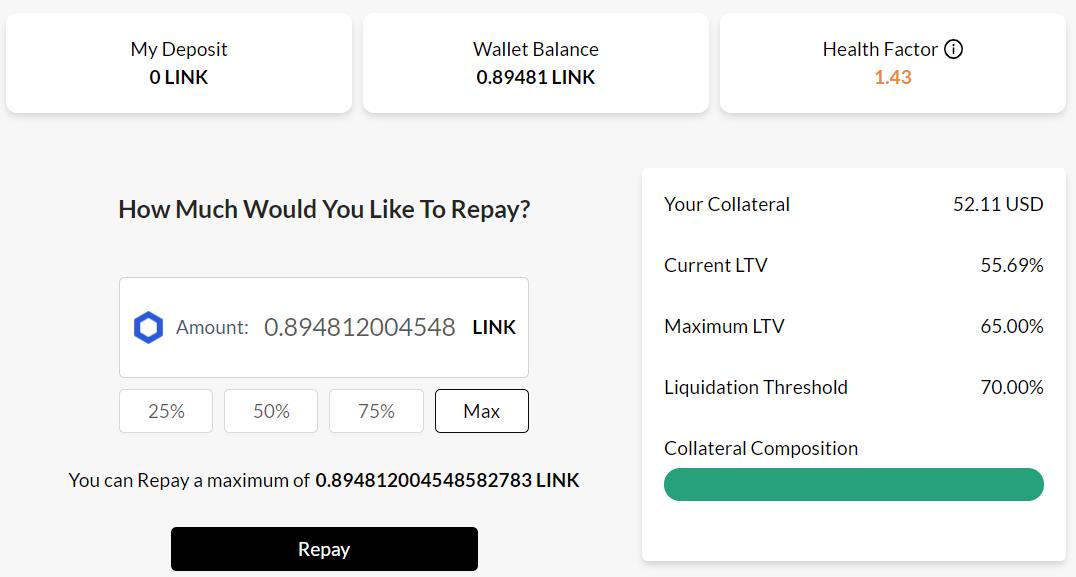

At any time, borrowers can partially or completely repay their loan amount. The loan amount will be comprised of the original loan value along with interest accrued till that time.

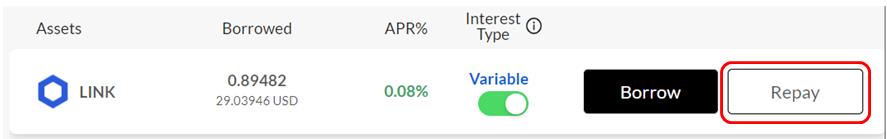

To repay your loan, go to your Borrow Dashboard and click on the Repay button against the asset.

Next, the application will ask you about the percentage of the loan you wish to repay. You can choose either partial or complete repayment.

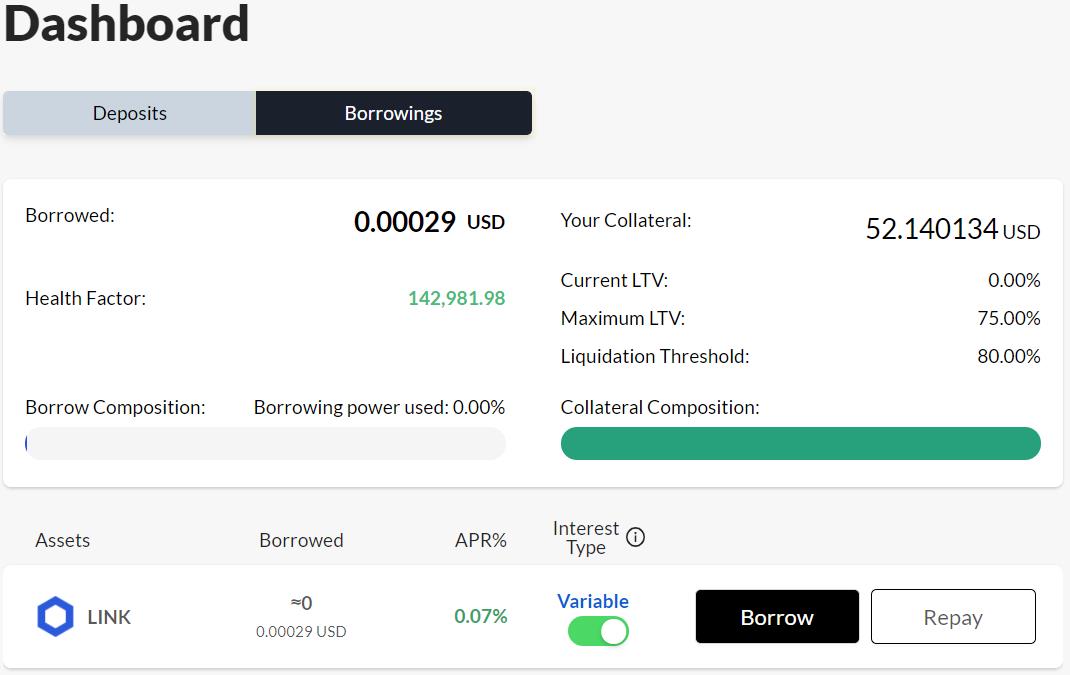

Approve the process and MetaMask transaction. Once the transactions are done, you can see the borrowed amount becomes almost zero in the dashboard.

Withdraw

Users can withdraw their deposit assets at any time from the MCL platform. The withdrawn amount will be comprised of the original asset plus interest earned over the period. But before withdrawing, the users need to repay the loan taken against the withdrawn asset.

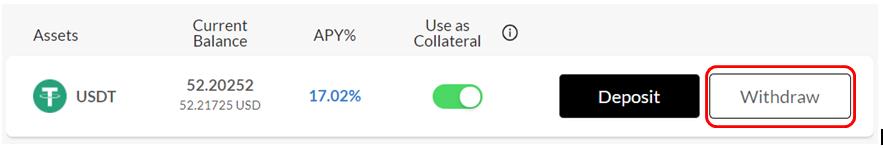

To withdraw, go to your deposit dashboard and click on the Withdraw button appearing against the deposited asset.

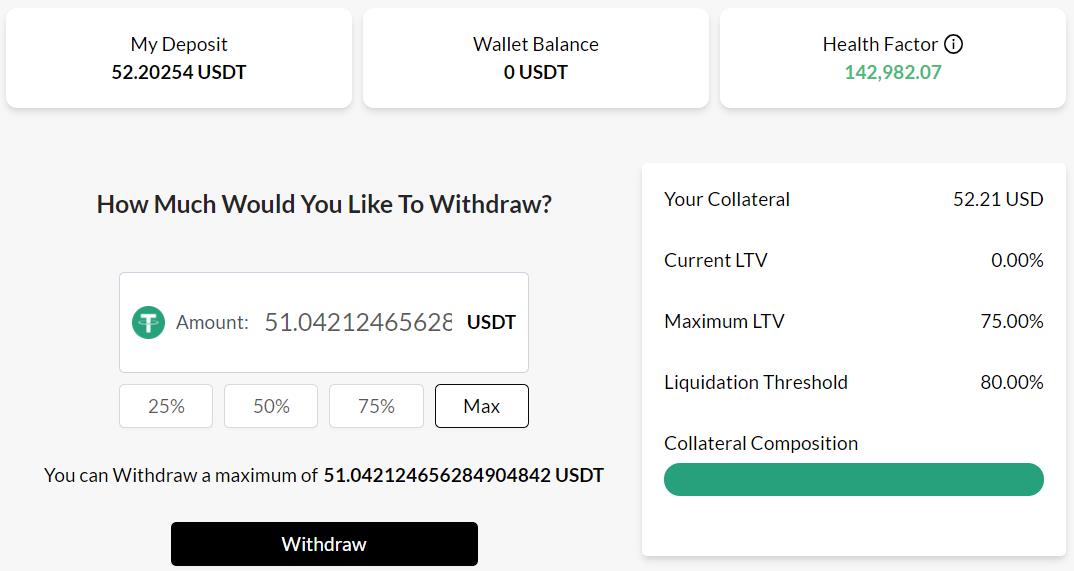

Next, enter the amount of assets that you wish to withdraw and confirm the process.

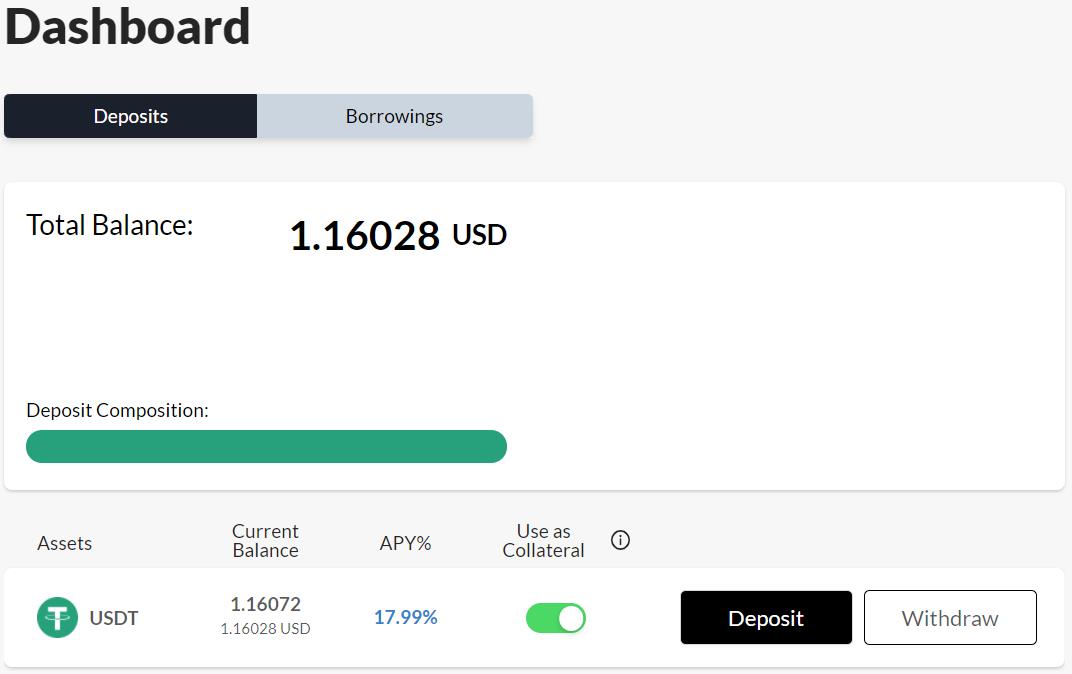

Confirm the MetaMask transaction, and you can now check your deposited asset in the dashboard becomes almost negligible.

Finally, the platform will transfer the withdrawn assets to your connected MetaMask wallet.

In the next article, we will explain how you can convert the MXX token into bMXX, and stake your bMXX token to take part in MCL governance activities.

Resources: Multiplier Finance

Read More: How to Use The SandBox Game