Synthetix Exchange is a decentralized trading platform that allows you to trade your synths for any other synthetic assets. The exchange supports a variety of fiat currencies (e.g., sUSD, sEUR, etc.), cryptocurrencies (e.g., sBTC, sETH, etc.), indexes (sDEFI and sCEX), commodities (gold and silver), and inverse (iBTC).

Trading on Synthetix Exchange is executed against the contract, known as P2C (peer-to-contract) trading. The system exchanges the debt from one synth to another, resulting in infinite liquidity between synths. The asset exchange rate is fed by the supporting oracle.

To start trading, users need to select the target synth that they want to convert with their source synth. These conversions are on-chain and charge a fee of 0.30% that is distributed among the SNX holders who are providing collateral.

The exchange currently supports five categories of synths:

- Fiat currencies – sUSD, sEUR, sKRW, sAUD, etc.

- Commodities – Synthetic gold and synthetic silver, measured per ounce.

- Cryptocurrencies – sBTC, sETH, sBNB, etc.

- Inverse Cryptocurrencies – iBTC, iETH, iBNB, iXMR , iLTC, iLINK, iDASH, iADA,iXRP, iXTZ

- Cryptocurrency Indexes – sDEFI and sCEX

Table of Contents

Working Guide

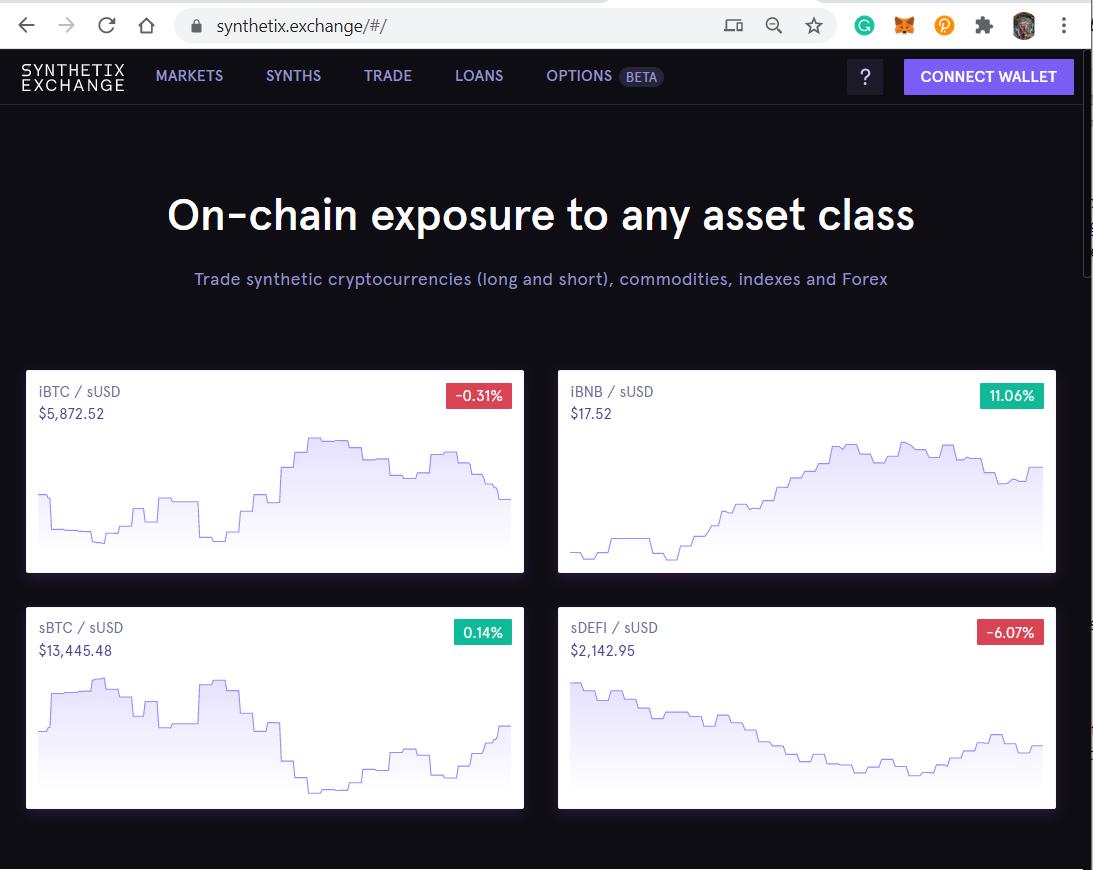

Go to the Synthetix Exchange page.

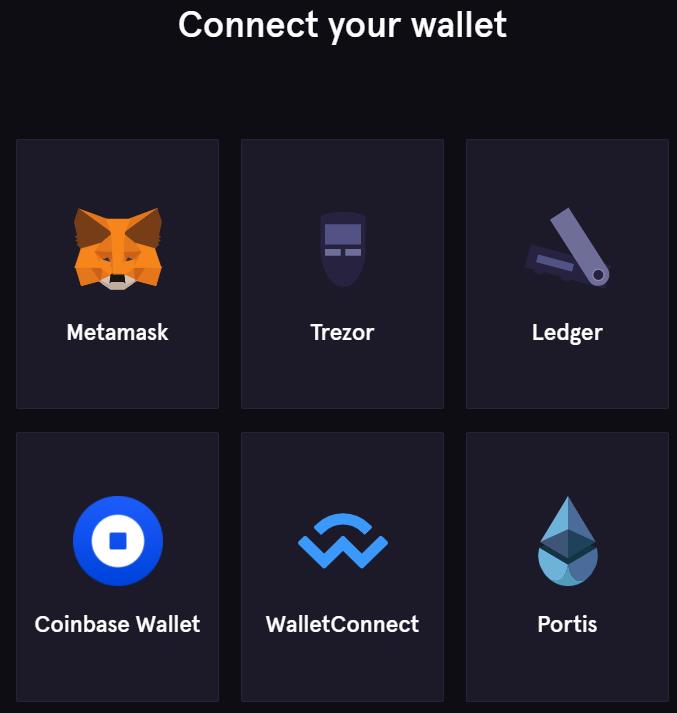

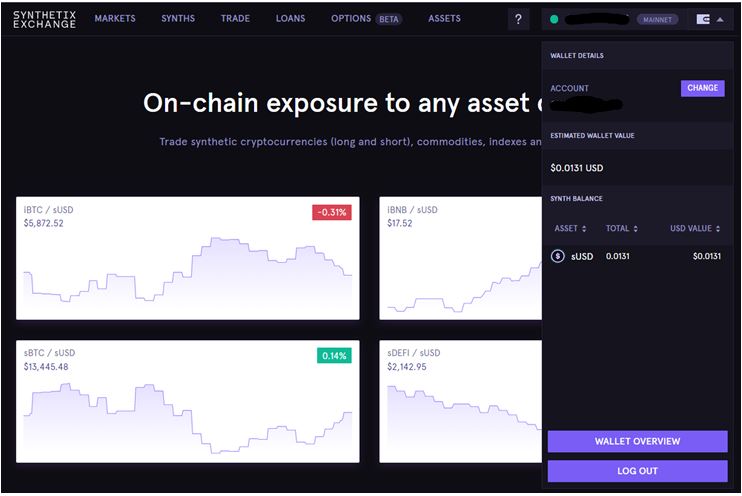

Connect Wallet

The application will give you various options to connect the wallet.

Connect your MetaMask wallet.

The exchange landing page looks like this.

You can see different tabs that allow the user to do various activities with the Synthetix Exchange portal.

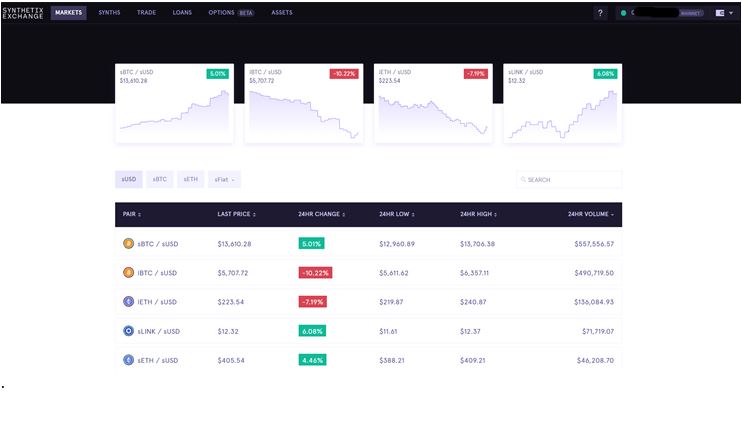

Market

Users can see the different trading pairs available on the Synthetix Exchange from the Market tab. You can easily see the basic trading details of any Synthetix pair like last traded price, 24-hour low, 24-hour high, 24-hour volume, etc.

There are four base synths available from which users can select the desired one.

Synths

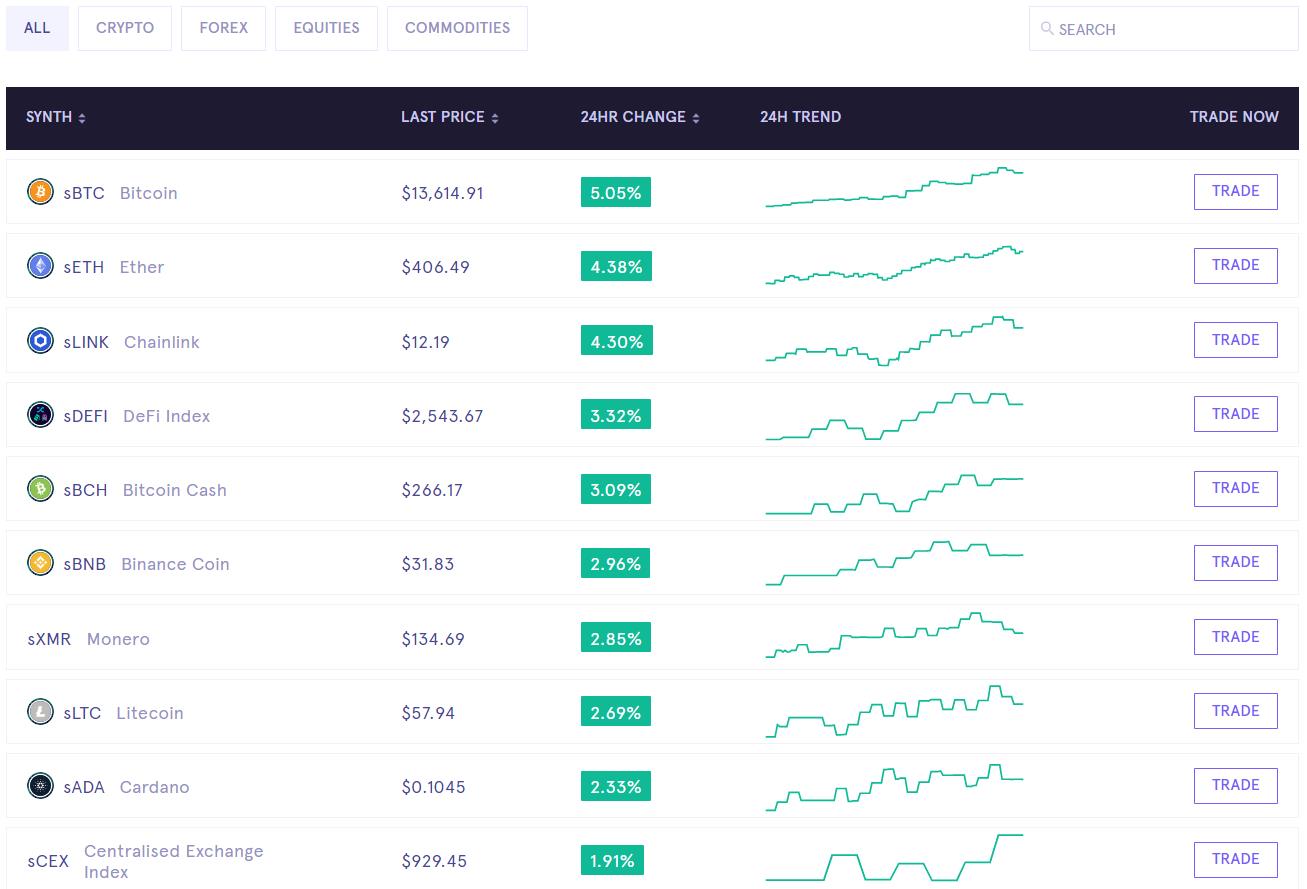

You can see the list of all available synths and their trading details here. Synths are categorized into various sections that give a clear understanding of every asset and its market trend.

Trade

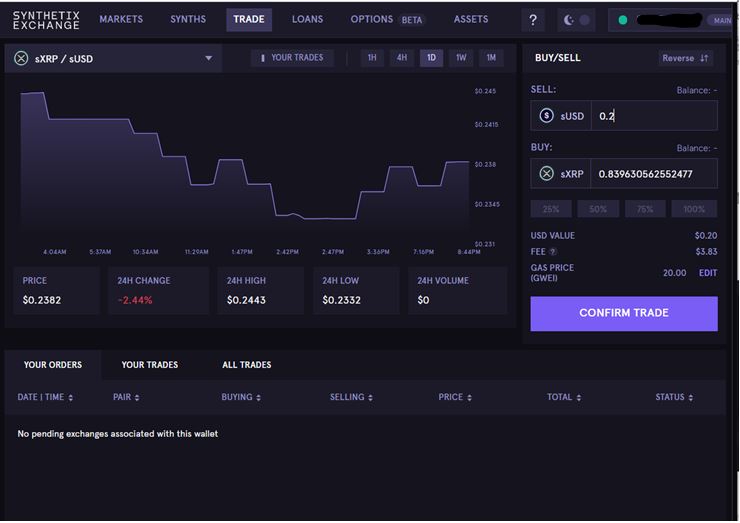

Users can do synths trading here and can place a buy/sell order. Select the source and the target synth and enter the value of the source synth which you want to convert, and it will automatically calculate the amount of target synth.

The application displays the market trend of the selected synth pair. You can select the time frame and evaluate the trend chart by seeing the 24-hour % loss or % profit and its volume.

You can see your order and trade-related details from the bottom of the page.

Click on the Confirm Trade button if you are satisfied with the trade details, and after transaction completion, you will be able to see the target synths in your wallet.

Important: The minimum requirement to do trading is to have synthetic assets and ETH to pay for gas charges. In case you do not have synths, you can check out our previous article about how to mint synths.

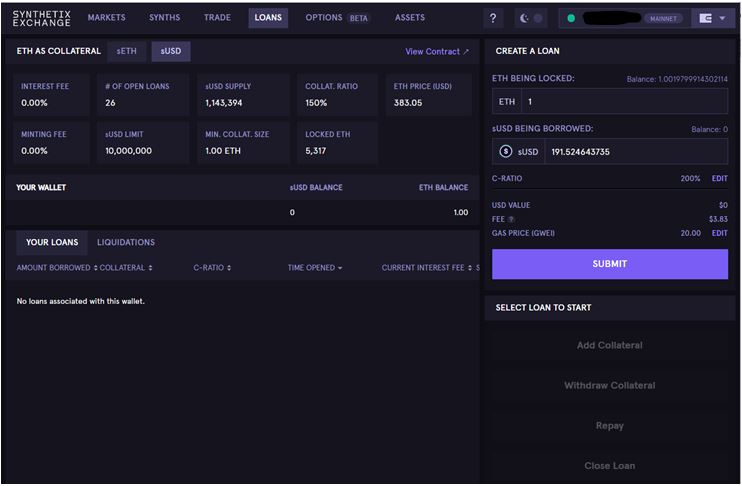

Loans

Users can take out a loan against the ETH that they are holding and can generate either sUSD or sETH. The ETH collateral is currently under a trial period of three months. Users are advised to follow Synthetix Twitter and their Discord channel for further information.

One important point to note here is that sETH minters are not stakers. Hence, they have no obligation towards the debt pool. They just need to pay the sETH that they have generated, and they neither receive any exchange rewards nor inflationary SNX rewards.

You can check the loan stats of the selected pair from the right-hand side of the panel like:

- Minimum collateral size

- Total locked ETH

- Current ETH price

- Number of open loans

- Minting fee

- Interest fee, etc.

The default liquidation ratio for ETH collateral is 200%, i.e., if the collateral ratio falls below this liquidation ratio, the loan will be liquidated. The platform also gives you the flexibility to adjust the C-Ratio (Safe-200%, Safe Max-165%, and High Risk-155%).

Also, users need to pay a liquidation penalty to the liquidators.

Important: Users need to have a minimum of 1 ETH to take out a loan.

Options

A binary option is a contract that allows users to make a trade based on a binary outcome (true/false) in the future.

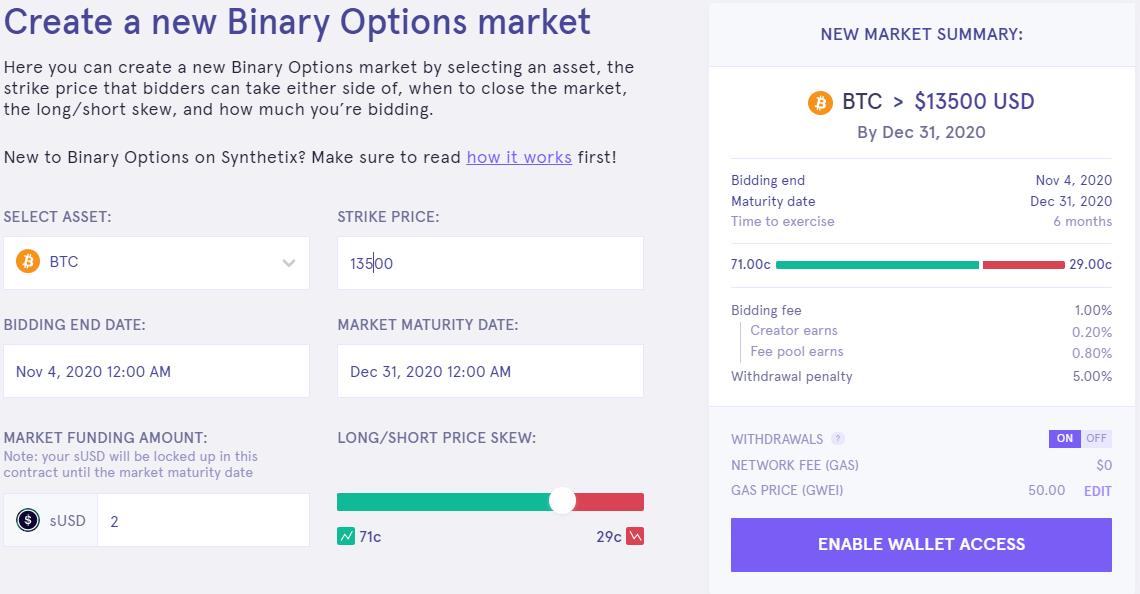

- Create Binary Options Market

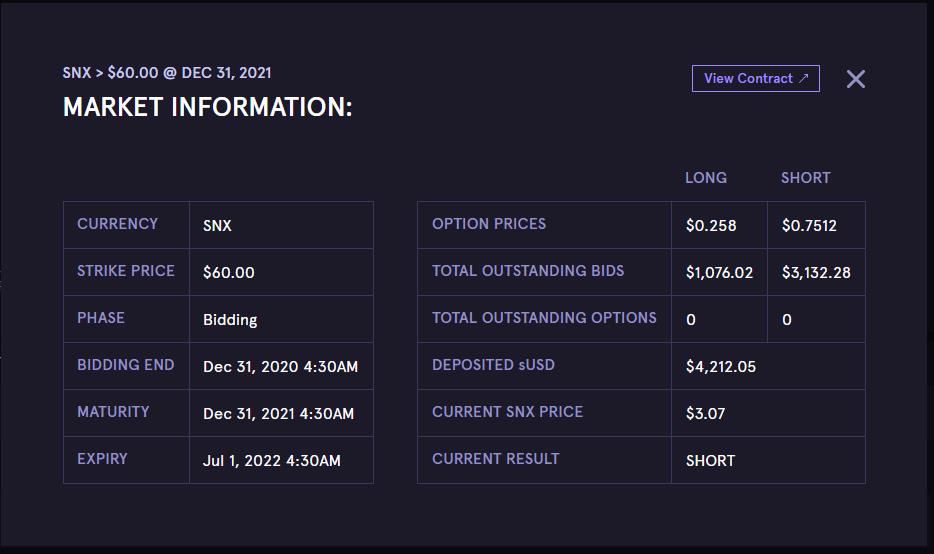

Users can create a binary options market by locking up their sUSD. They need to provide other mandatory details like strike price, bidding end date, market maturity date, and long/short price.

The market creator initially puts the long/short price skew based upon his insight, but this will shift to either side once people start purchasing on that market option.

2. Join Available Option Market

You can also join any available option market by checking the remaining time left for that option. You can then place a long or short bid.

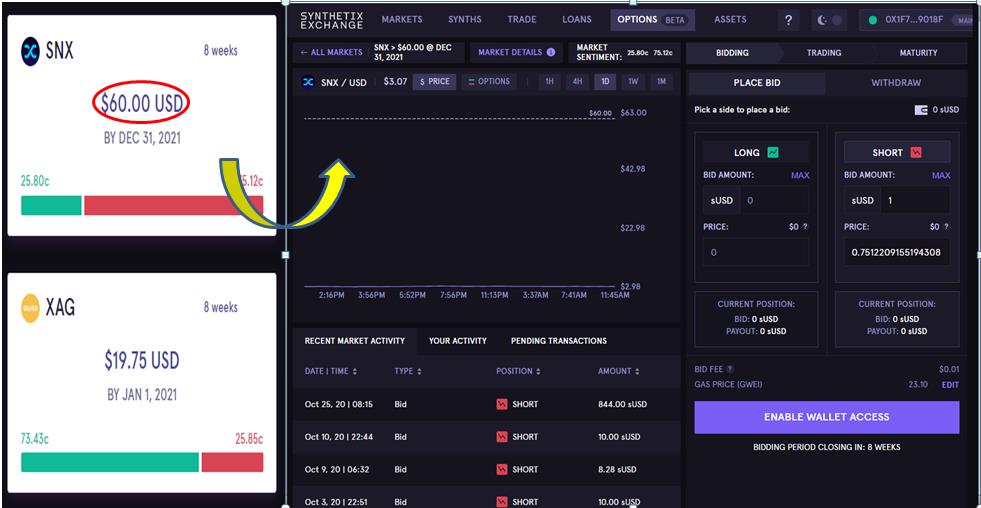

Now let us take the example of the below available option market.

The bid is for SNX> $60.00 @Dec 31, 2021.

This statement will be either true or false. Long option means in favor of the bid and short means false.

In this current example, we can see that 25% of bidders are in long, and the rest (75%) are on the short side.

Now if the market raises a fund of $10,000 sUSD for this bid, and the short side is correct, then the short side will distribute the $2,500 sUSD from the long side.

Check more details about the bid by going to the Market Details tab.

Important: In the binary option market, it is difficult for users to predict what will be the market trend upon maturity. Hence, the users are advised to continuously monitor the bidding trend throughout the bidding phase so that they can ensure that it will behave as expected.

The below list of assets is available in the binary options market.

The options market has three different phases:

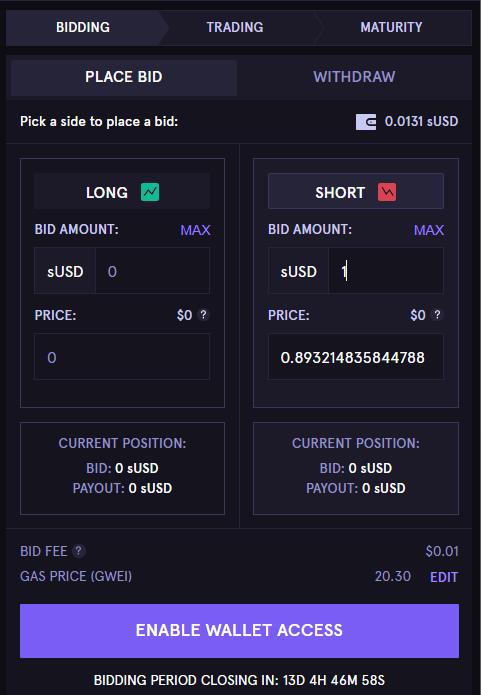

- Bidding

- Place a bid in a floating auction.

- Withdraw a bid by giving a 5% fee.

- Users can make as many bids on either side from the same wallet as you like.

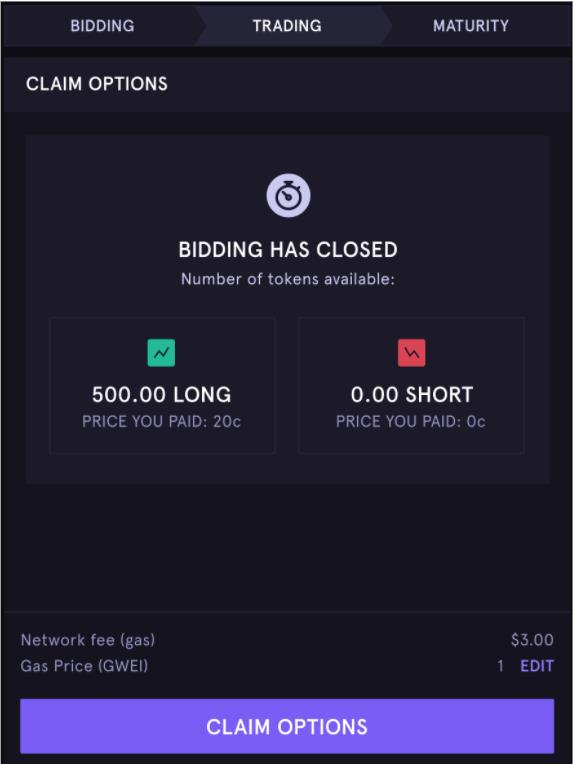

2. Trading

- The bidding is closed.

- Bidders on either side are issued ERC20 tokens representing their options.

- Bidders can claim tokens that can be traded on OTC or via AMM markets.

- Users can leave these token unclaimed if they do not wish to trade it.

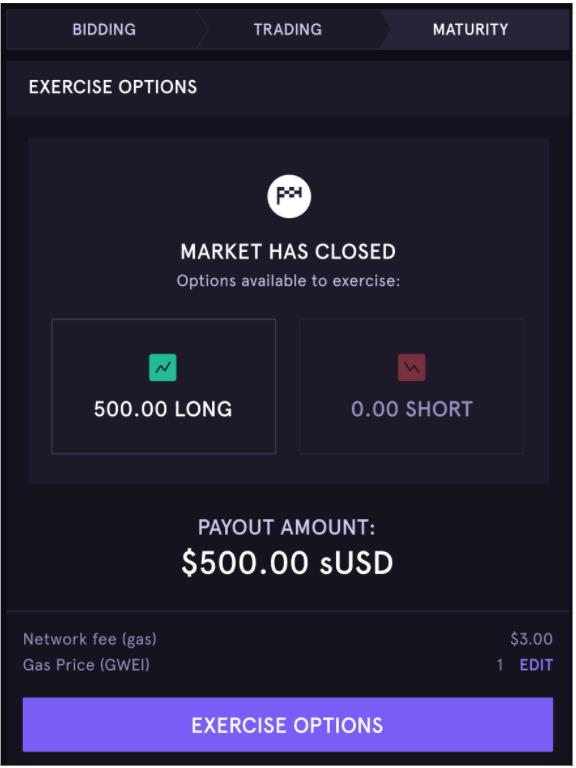

- Maturity

- It is the time frame after the options market maturity date.

- Users can exercise if they have an option available.

- The Maturity phase lasts for six months. Therefore, options must be exercised before the expiry date, otherwise it will be lost.

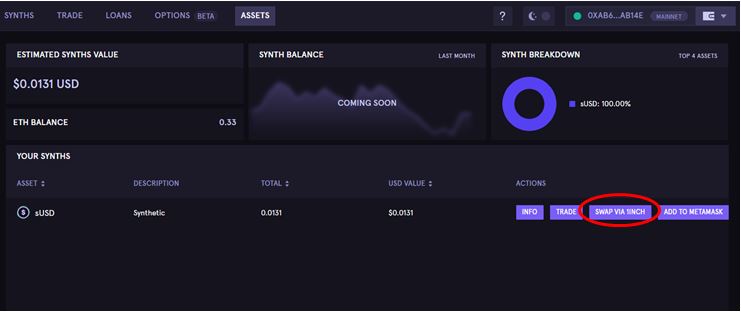

Assets

Check the details of your assets from the Assets tab.

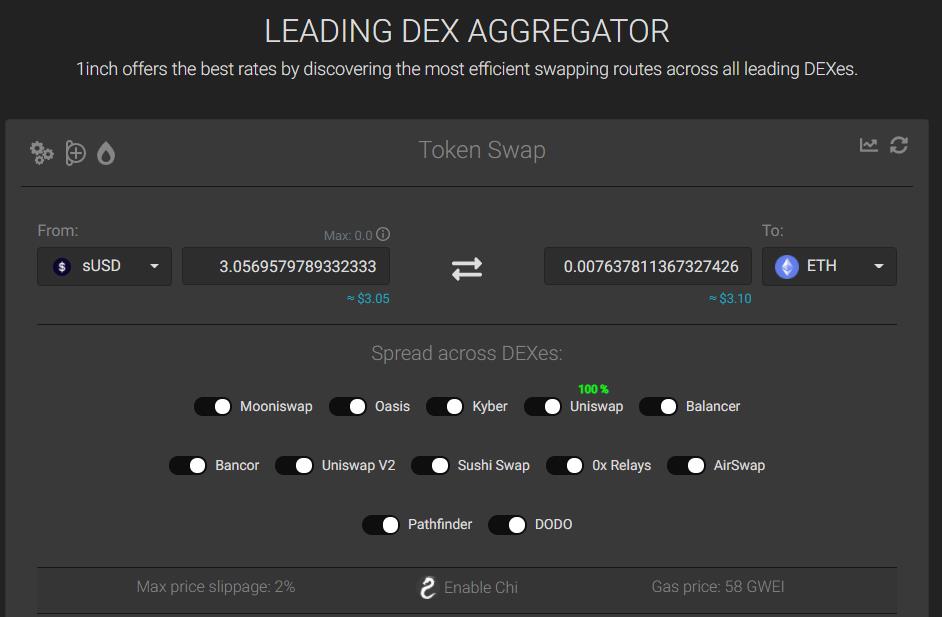

From the assets tab, you can also swap your synths via 1inch aggregator.

Conclusion

Synthetix Exchange is a DeFi platform that allows the users to trade their synths with other available synths without slippage issues. The underlying protocol is based on a collateral debt pool from synths stakers. Thus, it overcomes the issues that exist in centralized exchanges and order books. The platform is already the third-largest DeFi platform, and we hope that once the trial period of the ETH collateral is over, it will attract more users to the platform.

Resources: Synthetix Exchange, Synthetix Exchange blog: How Binary Options Work

Read More: Exploring the Borrow Feature of MakerDAO