In the young history of crypto, recently we saw a slew of unprecedented CeFi actions. Various CeFi platforms suspended or reduced withdrawals. The list grew way too long by now. Celsius started this new trend. This was soon followed by the likes of Voyager, BlockFi, Babel, and Vauld.

This raises many questions about custodial wallets. That’s why we look at why noncustodial wallets are important. We also look a bit closer at Voyager and its user’s legal position. So, without further ado, let’s dig in.

Voyagers, today we made the difficult decision to temporarily suspend trading, deposits, withdrawals, and loyalty rewards. Read more at: https://t.co/bpGFqQtjAs

— Stephen Ehrlich (@Ehrls15) July 1, 2022

What Happened to Voyager?

Voyager is a crypto broker that connects to a variety of crypto exchanges. They are publicly traded on the Toronto Stock Exchange. On July 1, 2022, they suspended trading and withdrawals from their platform. However, just a few days later, they filed for Chapter 11 bankruptcy protection. One of their liquidity issues was the result of 3 Arrows Capital filing for Chapter 15 bankruptcy. 3AC owed them $650 million from unsecured loans. This splits up between 15,250 BTC and $350 million USDC. As a result, Voyager took legal action to retrieve as much from 3AC as they legally can. There are more debtors, but 3AC seems to be the biggest one for them. The video below talks about this filing.

On a side note; Didn’t Satoshi create Bitcoin, in part, as an answer to unsecured lending? See the previous link.

But where does this leave Voyager’s users? They drew the short straw for the time being. On a positive note, Chapter 11 is not a straight bankruptcy. With Chapter 11, a company tries to restructure and pay back its debts. As we wrote in a recent article. To what degree they can pay back, is a different story. In Voyager’s case, it means that they try to pay back their platform users.

We bet you didn’t think an account holder was a debtor. Are they?

Voyagers, today we began a voluntary financial restructuring process to protect assets on the platform, maximize value for all stakeholders, especially customers, and emerge as a stronger company. Voyager will continue operating throughout.https://t.co/TxlO4eua8E

— Stephen Ehrlich (@Ehrls15) July 6, 2022

And didn’t the users digitally sign an agreement? Yes, they did! So, we are going to have a look at this agreement and see what it says. We will also look into what this means. However, we need to point out that we are not lawyers, and approach this in a non-legal way. However, here is a link to the differences in bankruptcies.

The Voyager Agreement

This agreement is a long read. We took some of the most important parts out of it, that we deem important in this case. We start with point # 5 in the agreement. This talks about cash.

5. Account Funding; Regulatory Treatment

-

Part A Is About Customer Cash.

Here it clearly states that; “any services pertaining to the movement of, and holding of, USD are not provided by Voyager or its Affiliates. Cash in the Account is insured up to $250,000 per depositor by the FDIC in the event the Bank fails if specific insurance deposit requirements are met.” However, that insurance doesn’t protect you if Voyager fails.

Voyager is not a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) or the Securities Investor Protection Corporation (“SIPC”). This means that cash is not SIPC-protected.

In other words, Voyagers shifts any responsibility for cash holdings to their banking partner. This is the Metropolitan Commercial Bank. They carry the SIPC insurance, not Voyager. But the users signed up with Voyager, not with the bank. So, it appears that users don’t have any luck with having their cash insured.

-

Part C Is About Customer Cryptocurrency.

Here, Voyager clarifies that they hold the customers’ crypto in omnibus accounts or wallets. In other words, they control the keys of the wallets.

They also state that they can delegate some or all custody functions to third parties or affiliates. This can also be in a foreign jurisdiction.

So, now they just told you that they can give the keys to ‘your’ wallet to another entity. This means that Voyager can lend out your money to get yield or lend it out for any reason. They can even lend without collateral, as we saw in the 3AC case. Not exactly sound risk management.

This part also shows this; “In the event that Customer, Voyager, or a Custodian become subject to an insolvency proceeding, it is unclear how Customer Cryptocurrency would be treated and what rights Customer would have to such Cryptocurrency.”

They do point out that in the US, there is not really any case law for this. In other words, if Voyager becomes insolvent, you may lose all your crypto assets. That’s literally what it says.

-

Part D Is About Consent to Rehypothecate

This part states that they can use your deposit to; “pledge, repledge, hypothecate, rehypothecate, sell, lend, stake, or arrange for staking.” Furthermore, they say that they can do this at your sole risk.

To clarify, if Voyager lends or stakes your assets, they have full control over them. They can play around with your money, but don’t bear any responsibility for it. Let’s move on to point # 11 in their agreement.

11. Account Termination

Here they say that they can; “terminate, suspend, restrict, limit or shut down all or part of the Services, the Account, as well as Customer’s access to the Platform.”

There doesn’t have to be any cause, and it can be at any time. Voyager is also not liable for any claims related to such termination or suspension.

A pretty clear case in which they covered their responsibilities in case they shut down.

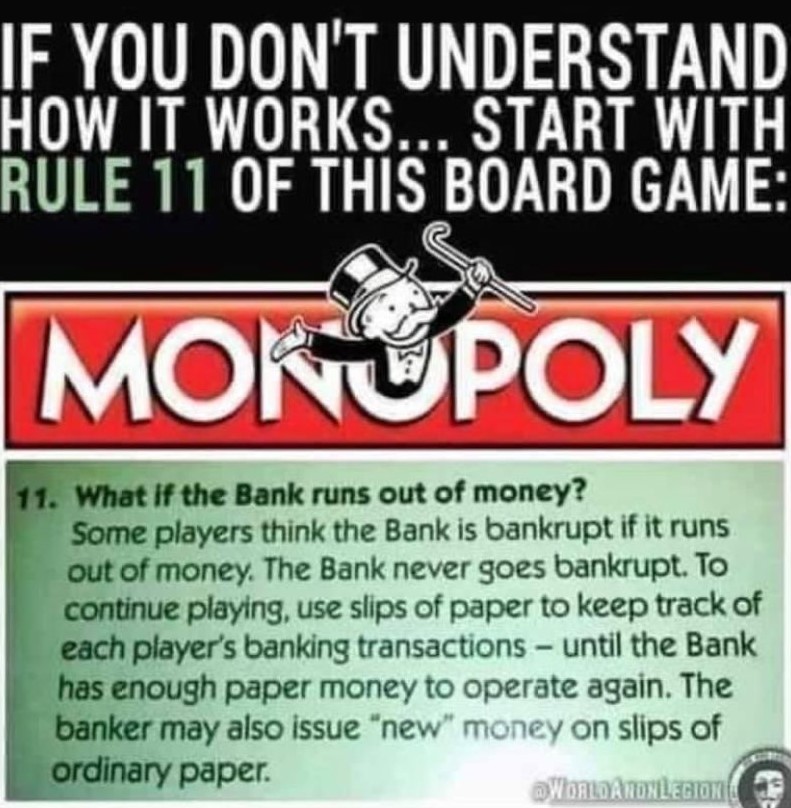

Doesn’t this remind you of the Monopoly game, where rule # 11 is same, same, but different? This is a popular meme in Thailand.

Source: Twitter

Noncustodial Wallets

All the above makes a pretty strong case for keeping your crypto stored in non-custodial wallets. You have a few options here.

- Platforms like THORWallet, work with non-custodial wallets.

- Online wallets like MetaMask. But also a WalletConnect compatible wallet can work out fine.

- Hardware wallets like the Ledger or Trezor series.

We see too many times that as a customer, we draw the short straw. Once a CeFi platform suspends withdrawals, all hell breaks loose. You’re in for an emotional rollercoaster. Especially as a small retail investor, there’s not much you can do, and you’re at their mercy. It is important to take matters into your own hands and control your wallet’s custody. Remember this one? Not your keys, not your crypto.

Conclusion

Recently, many CeFi protocols suspended platform withdrawals. As a result, their customers face some serious issues. You may have locked up your life savings and don’t know if you will ever see them again.

We looked at Voyager’s case, to show you what the rights of a customer are. Unfortunately, it doesn’t look good. This brings the case of noncustodial wallets to the forefront. Take back control of your hard-earned crypto assets.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.