The Bancor Network is based on the Bancor Protocol that consists of a network of smart contracts, also known as “liquidity pools” in general, to perform algorithmic token trades and pooling of on-chain liquidity to perform peer-to-contract trades in a single transaction with no counterparty.

The platform launched its version 2 protocol upgrade in late July, and it is now proposing v2.1 to focus on improvements and protection measures.

The platform’s native token, BNT, is the first smart token that allows the users to exchange any token in its network.

The Bancor Network currently supports operations on the Ethereum and EOS blockchains.

Users can add liquidity on Bancor and earn a trading fee. Users don’t need to have BNT to trade on Bancor. However, for creating a liquidity pool, a user must mandatorily hold BNT on Bancor. Liquidity providers receive pool tokens in proportion to their share. The platform’s native token, BNT, acts as a center and is connected to all other tokens supported by the Bancor network.

Users can also stake BNT and earn rewards and use it as voting rights in the Bancor governance system.

The platform currently supports the following activities:

- Trade tokens on Ethereum or EOS

- Deploy a BNT-token liquidity pool

- Deploy a custom liquidity pool

- Contribute liquidity to a deployed pool

- Integrate Bancor liquidity and trading into my smart contract

- Earn affiliate fees by integrating Bancor into my smart contract or dApp

Table of Contents

Working Guide

Go to the Bancor Network’s page.

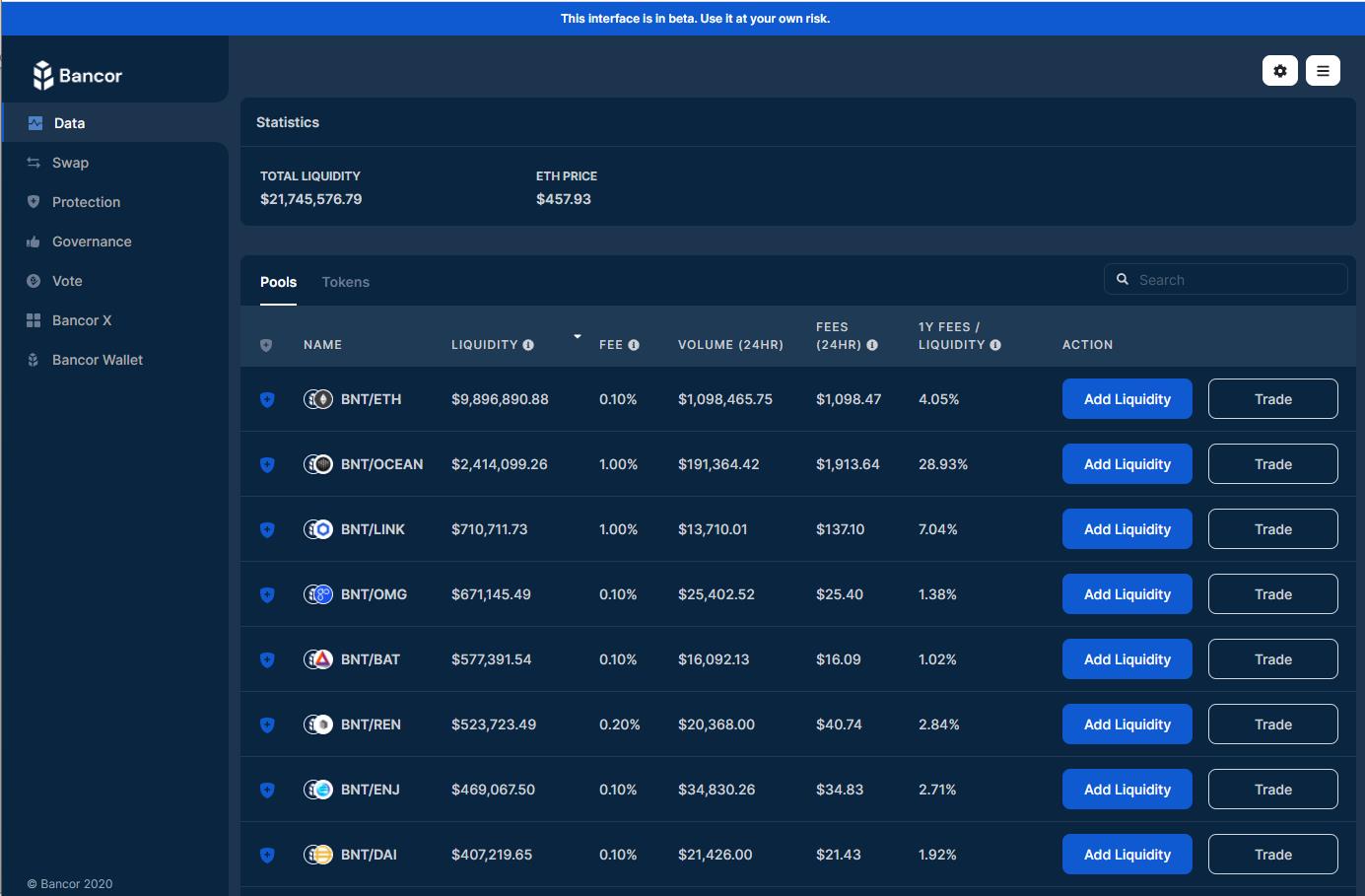

By default, you are on the data page. You can see the protection symbol against each pool.

Important: Kindly note that the platform is in the Beta phase. Take utmost care while connecting your wallet.

Connect Wallet

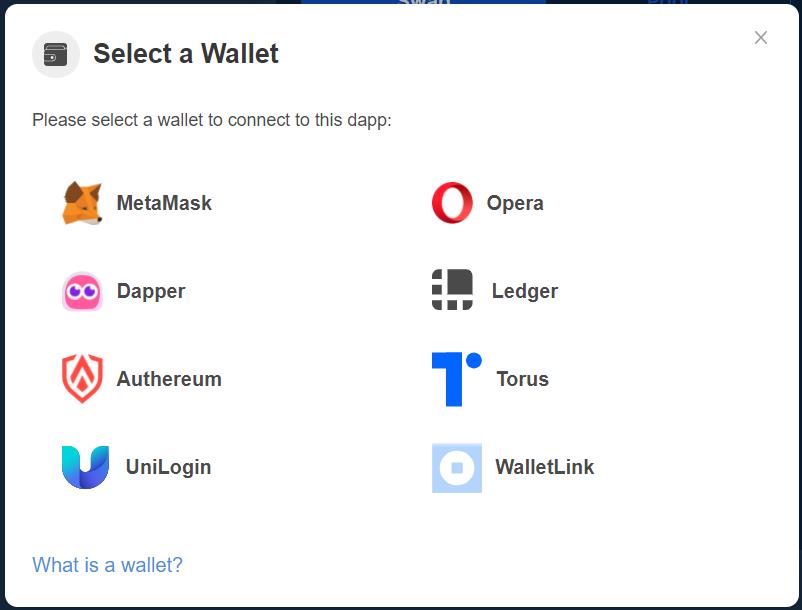

The platform allows you to connect to the various wallets.

Connect your MetaMask wallet to access the network.

Swap

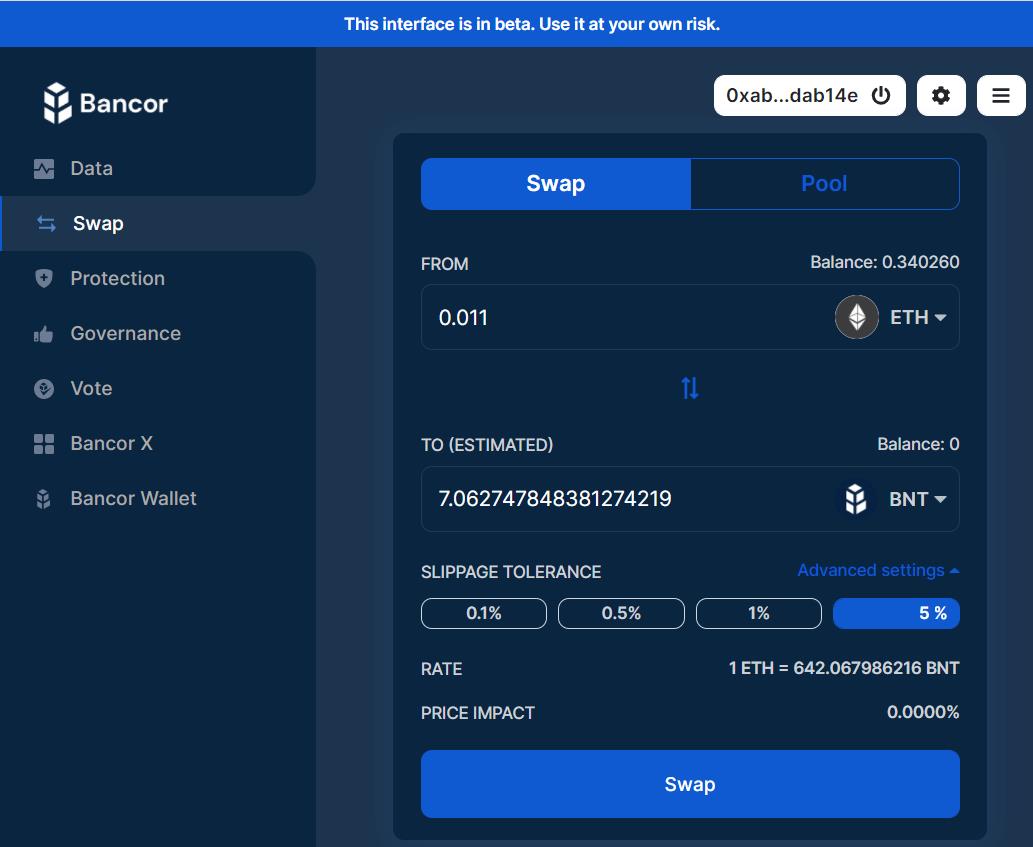

Using the swap feature, you can swap any tokens supported by the platform. It also allows users to adjust the slippage tolerance percentage. Users just need to fill in the number of input tokens and the output token will automatically be calculated by the application.

Once you have filled in the token details and are satisfied with the rate and other parameters, you can proceed by clicking the Swap button.

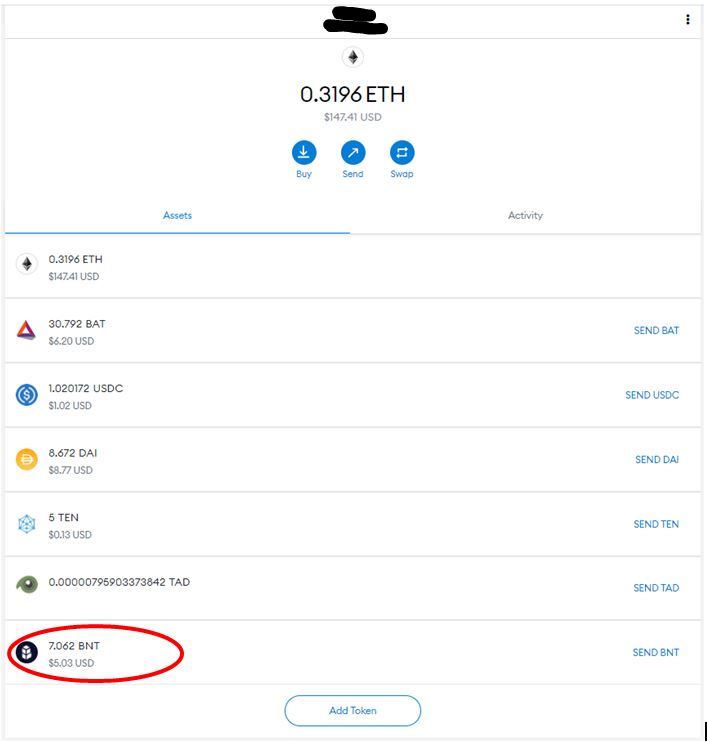

Confirm the MetaMask transaction. Once the transaction is successful, you can see the BNT tokens in your wallet.

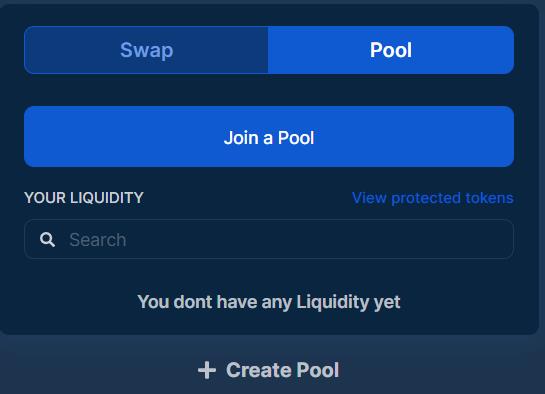

Pool

Users can join an existing pool or create a new pool if it doesn’t exist.

Join a Pool

Click on Join a Pool and then select the pool in which you would like to add the liquidity.

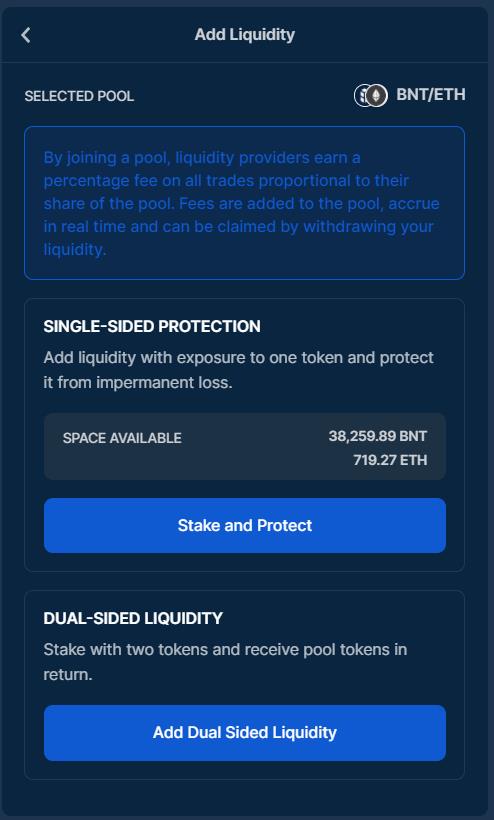

Now you can select these two methods to protect your assets:

- Single-sided protection

- Dual-sided liquidity

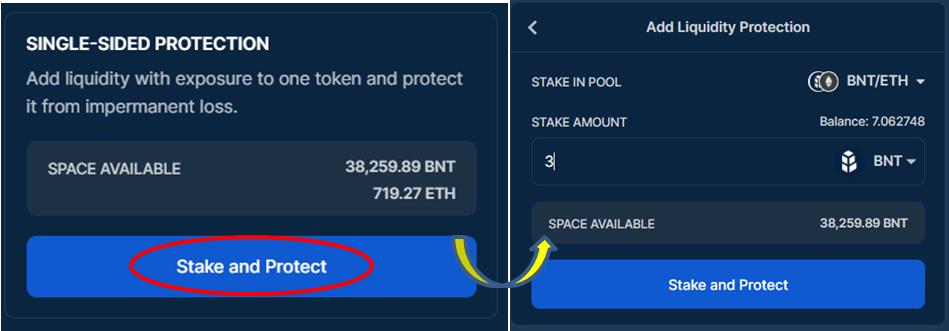

Single-Sided Protection

With single-sided protection, you can add liquidity in a pool but with exposure to only one token, protecting it from impermanent loss.

Select your desired pool and then select the token you want to protect (out of the two tokens in the pool). Enter the number of tokens you would like to supply to the pool.

Click on Stake and Protect and then confirm the MetaMask transaction.

Once the transaction confirms, you can see the token is in protected mode from the Protection tab.

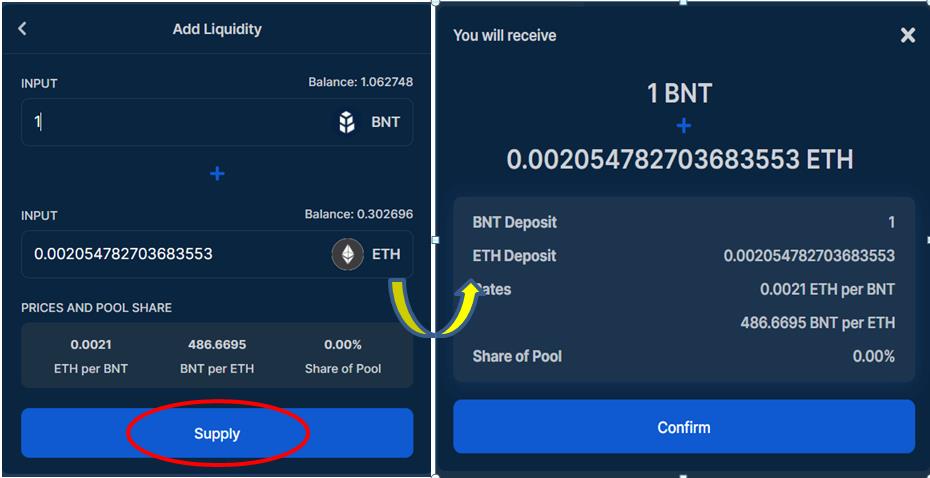

Dual-Sided Liquidity

With dual-sided liquidity, users can stake two tokens in a pool and receive pool tokens in return.

Select your desired pool and click on Dual Sided Protection.

Enter the amount of one token and the application will automatically calculate the amount of the other token.

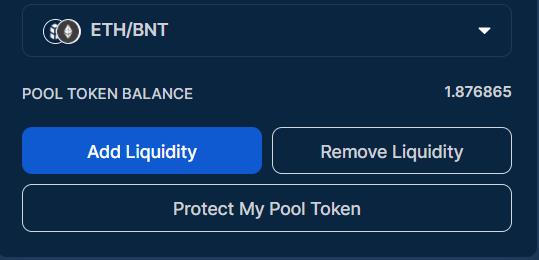

Confirm the MetaMask transaction. You can now see your pool tokens.

Unlike single-sided protection, your tokens will not be protected. If you want, you can further protect your pool token by clicking on Protect My Pool Token.

Protection

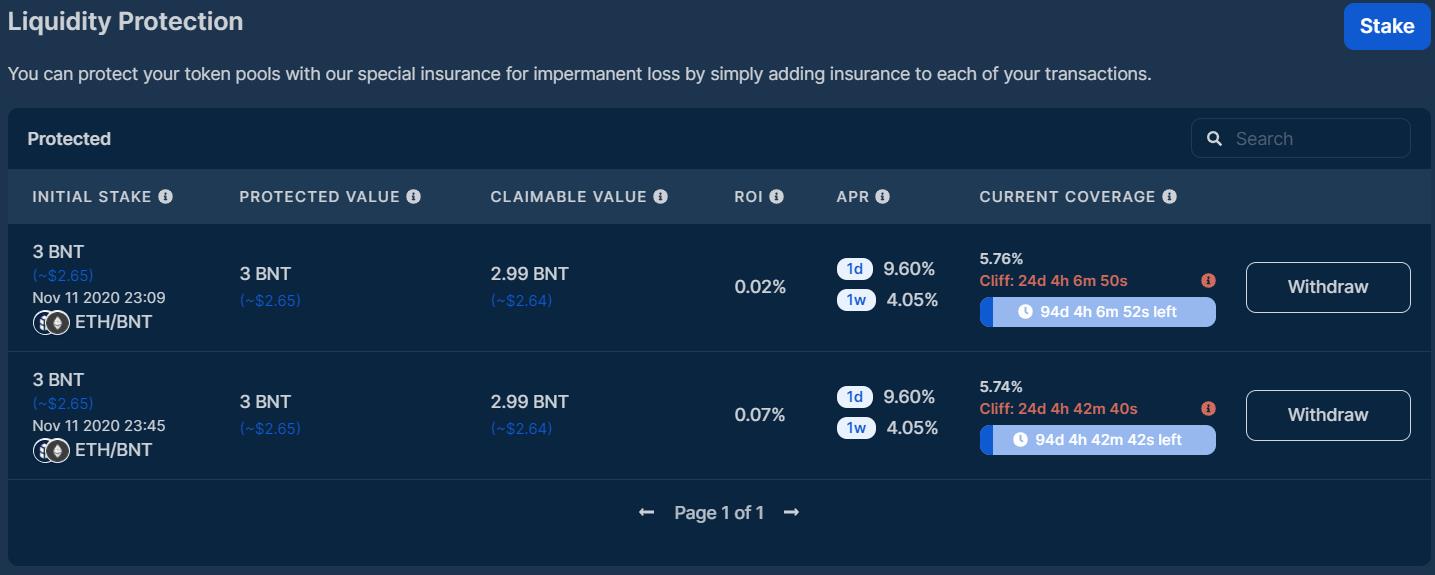

You can see below the list of details of your protected staked token from the Protection tab.

- Staked Amount

- Protected Value (Amount of token you can withdraw with 100% protection.)

- Claimable Value (Amount of token you can withdraw.)

- ROI (Individual returns)

- APR (Overall pool returns for all LPs based on 1 day and 7 days of activity.)

- Current Coverage (Shows your coverage status from impermanent loss. Impermanent loss protection starts vesting immediately when you deposit. But you must be in the pool until the cliff is reached before the protection can be utilized.)

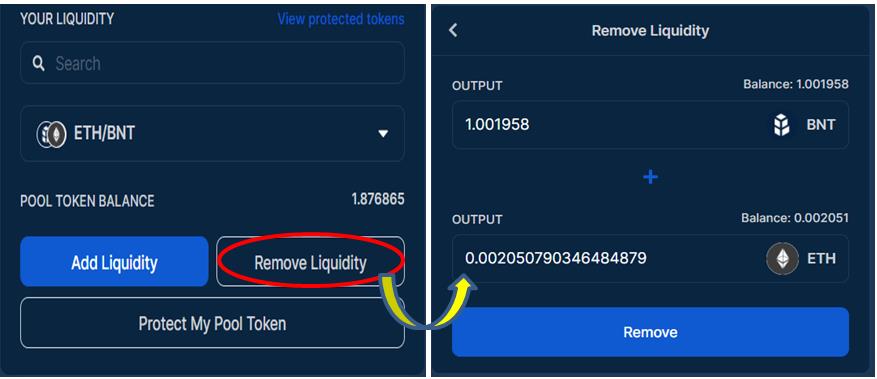

Remove Liquidity

Users can remove their liquidity from the pool by clicking the Remove liquidity button.

You just need to enter the number of tokens you want to remove.

Confirm the MetaMask transaction. Once confirmed, you can see your pool liquidity removed.

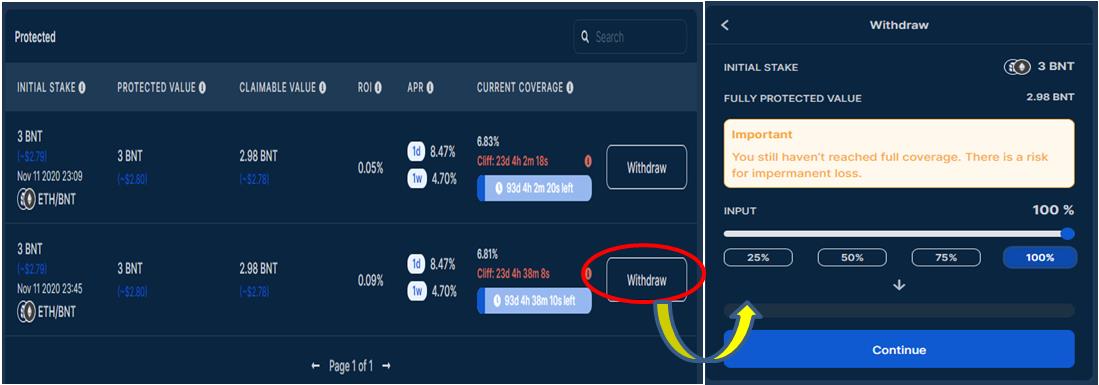

Withdraw

Users can withdraw the staked token from Bancor. To withdraw, just click on Withdraw.

You will receive a pop-up message about your token protection status. In case you have not achieved 100% protection against impermanent loss, then withdrawing the token will lead to a loss in value.

Vote

When a user provides a BNT liquidity to a protected pool, they receive vBNT in return. It represents your protected pool stake as well as your voting power in Bancor governance.

Users can stake the vBNT tokens into the voting contract and use it with the governance interface.

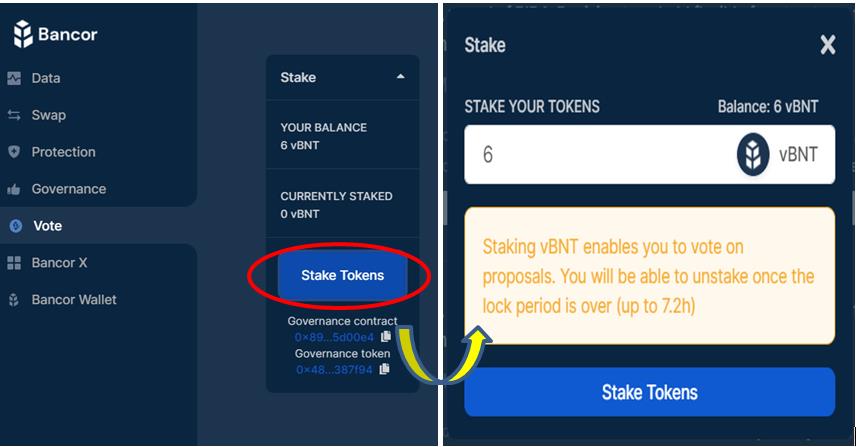

To stake vBNT, click on the Stake Tokens button and enter the amount of tokens you would like to stake.

Your tokens will be staked in the governance contract once the transaction is successful. You can also see a counter displaying the time required to hold until you can unstake your vBNT.

If you have staked vBNT into the governance contract, you can do the two following activities:

-

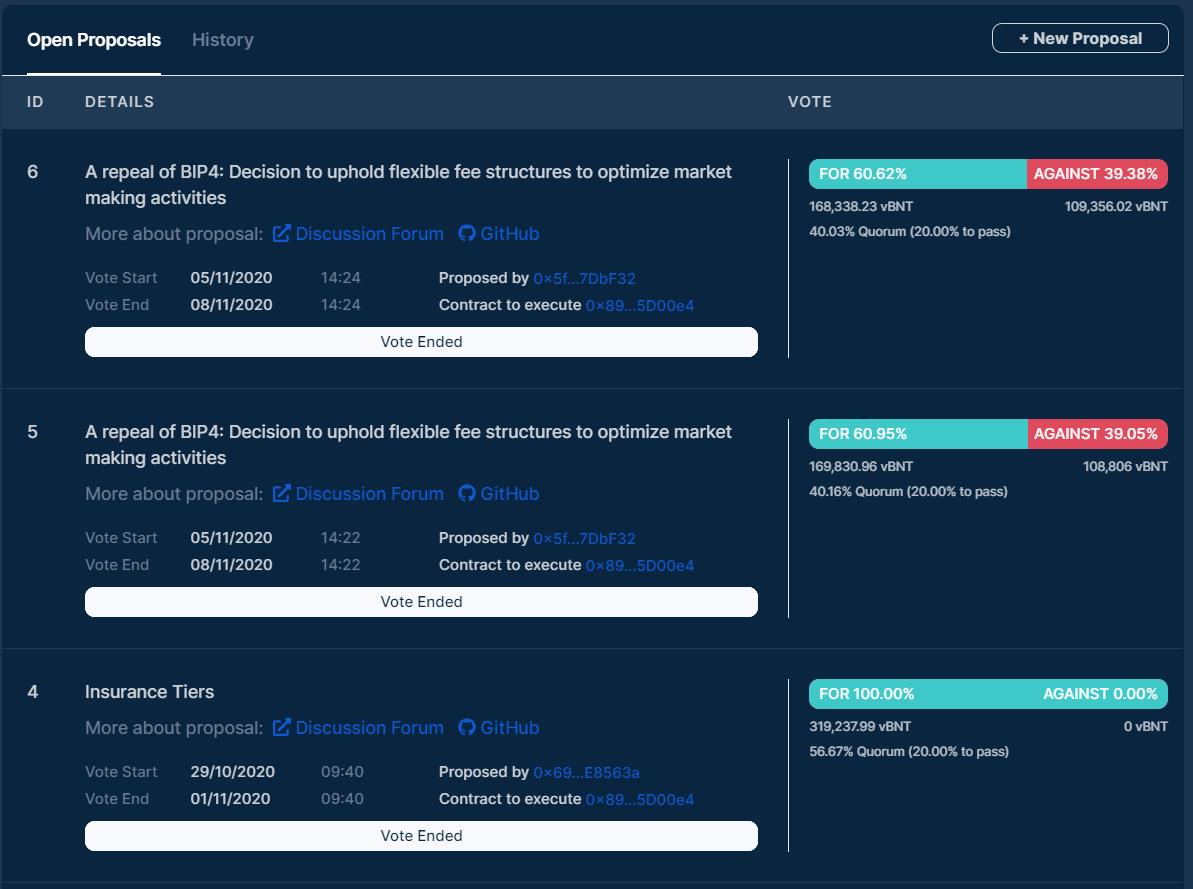

Voting on existing proposals

To vote on an existing proposal, just select the proposal you would like to vote on and provide your vote with the desired option (for/against).

Confirm the MetaMask transaction.

You can also see the status of each vote (percentage of favor/against vote).

You can unstake your vBNT at the end of the voting period.

-

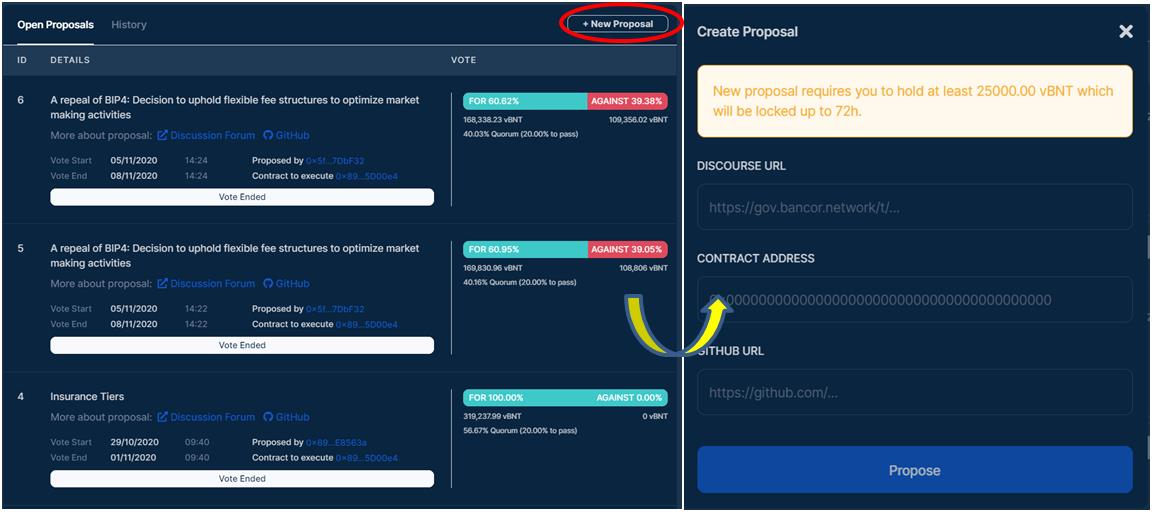

Creating a new proposal

You can create a new on-chain proposal by using the New Proposal tab on the top right corner of the page. The proposal code should be ready and deployed on the blockchain. But for creating a new proposal, you need the following things:

- Discourse URL (URL linking to the proposal discussion on gov.bancor.network.)

- Github URL (URL that contains the code behind the contract.)

- Contract address of the new code that includes the proposal.

Important: For creating a new proposal, users need to have a minimum of 25,000 vBNT locked for 72 hours.

Bancor X

BancorX is the first cross-blockchain, decentralized liquidity network.

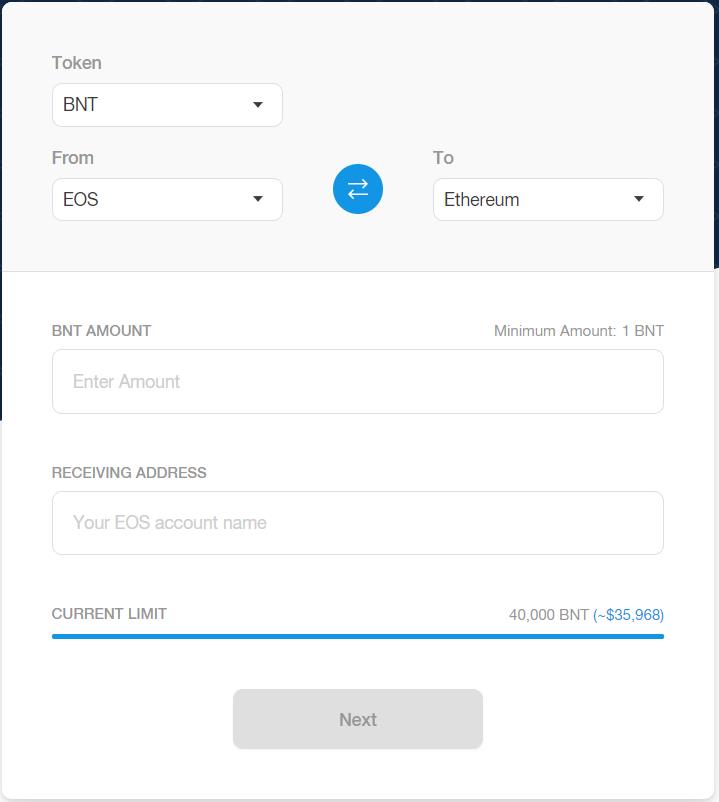

It allows the users to convert tokens across blockchains. The Bancor Protocol that was initially built on the Ethereum blockchain has now extended its support for EOS.

In BancorX, the conversions between Ethereum and EOS are done via BNT, which is a Bancor Network token that operates on both chains.

Click on BancorX, and it will redirect you to a page.

Users just need to fill in the BNT amount and the receiving address.

Governance

Through this forum, the Bancor community and core development team stay in sync as new BIPs are launched. The community members start a discussion on a proposal and create an initial draft of the BIP on the gov.bancor.network by collecting the feedback from members.

When the community members conclude, and if it requires any changes to be implemented, then a proposal is created for voting by providing the final BIP draft.

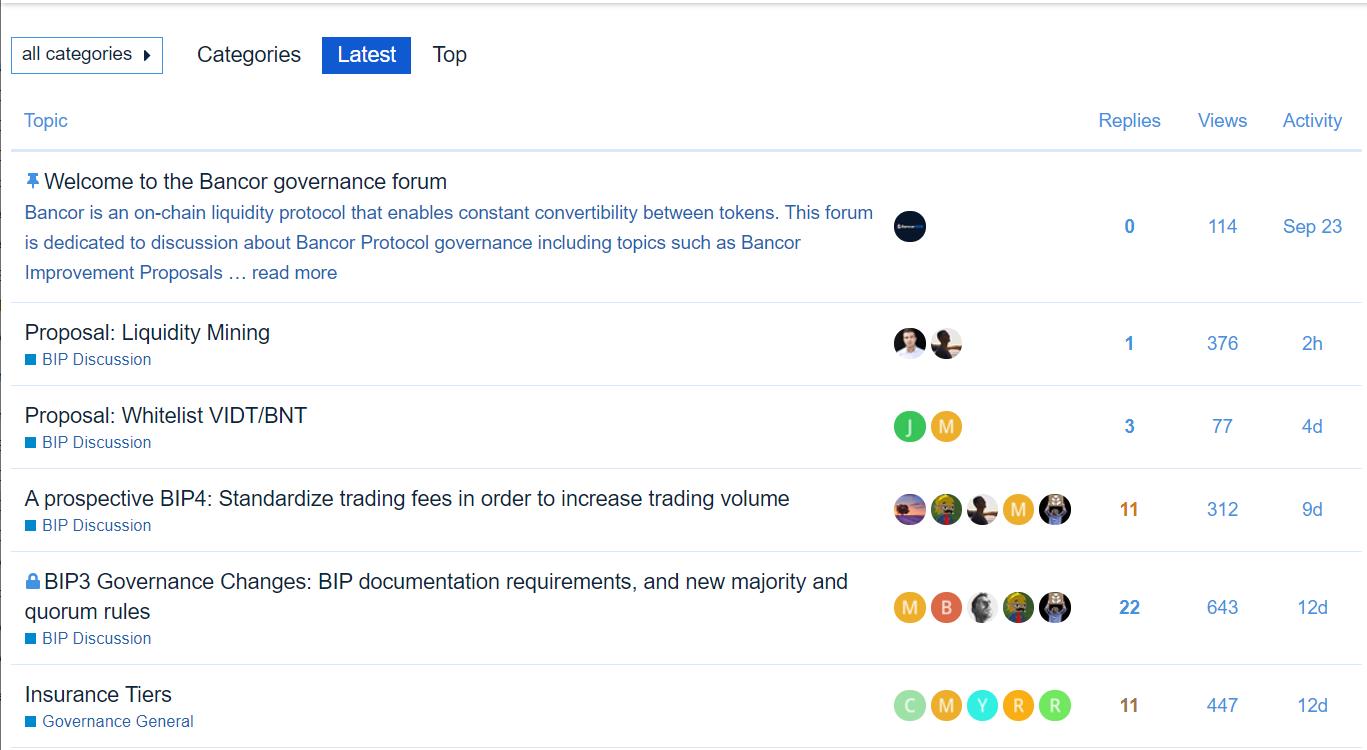

Once you click on the Governance tab, it will redirect you to a page.

You can see the list of the proposals with BIP discussions from this tab.

Conclusion

Bancor has been in the DeFi ecosystem for a quite long time. It is slowly becoming a strong contender in the AMM space. However, Bancor gives priority to its own BNT native token, and as a result, all its AMM pairs are BNT pairs. Bancor started this by airdropping its ETH-BNT tokens in early 2020. It is also trying to give more priority to BNT by introducing staking and insurance to counter impermanent loss. If version 2 is a hit, the demand for BNT will increase drastically.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.