This article provides you with a simple, yet comprehensive, guide on a) Why Bitcoin needs to be mined? b) What are Bitcoin mining rewards? c) Is it profitable to mine Bitcoin? d) What are your options to mine Bitcoin?

The Concept Behind Bitcoin Mining

The Bitcoin network has been cleverly (using cryptography) designed in a certain way to remove some of the major problems with existing Fiat Currencies.

The major design points related to our topic today include:

- Finite Supply (21 Million) of Bitcoin enables the creation of value.

- Removes problem of Double Spending and hence fraudulent transactions

- Introduction of Global Distributed Ledger to create transparency.

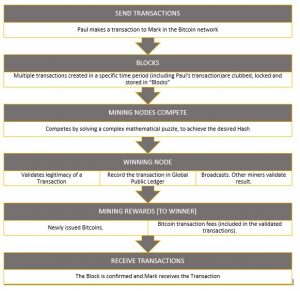

Let’s see how the network works

So we need miners to run the network. What do the miners get in return?

- Newly mined Blocks issue a certain amount of Bitcoin as a reward to the winner.

- The winner also gets the transaction fees included in the validated transactions.

Let us see what amount of Bitcoin does a Block winner receive?

We will check a recently mined block. Source: Blockchain.com

The Block Height 565898 was mined on 6th March 2019. The Block Reward received was 12.5 Bitcoin.

Bitcoin Price in Coingecko at the same time was ~ $3856.76. Simple mathematics tells me that the reward amount in USD was ~ $48209.5. Wow!

Well, hold on!

There’s something strange! The winner of the Block is ‘Antpool’. Upon further investigation below are the results of the winners of 10 transactions between Block 565894 (Date: 2019-03-06 Time: 11:11:05) –Block 565903 (Date: 2019-03-06 Time: 12:47:21):

Keeping aside the winner named ‘Unknown’, all the other winners are ‘Pools’. So in this scenario, 90% of the Bitcoin mined has been won by Pools.

What is a Pool? Pools are mining groups where the miners club their Hash power to mine and share block rewards in return.

So as an individual, what are your chances to mine Bitcoin?

Let’s Deep dive further:

Hash rate: The job of a miner is to find the key to open a Block. This requires the miner to make random guesses. Hash Rate, to put into simple terms, is the number of guesses made per second. The more the number of guesses per second, the more is your probability to win.

So, if you are using your CPU at home (which has low hash power), and competing with Pools having huge Hash Powers, well, the chances of you winning is pretty low, also you have to bear in mind the electricity cost of mining. So, what are my options?

Before we move on to find the answer, here’s an interesting read for you.

How do I mine Bitcoin?

Let’s check all your options, and you decide which path you want to take. There are 3 broad methods:

1. Invest in your own Hardware

2.Join a Mining Pool

3. Invest through a Cloud Mining Contract

Before deep diving into each of the above options, lets quickly set up a Bitcoin Wallet:

- Bitcoin Wallet Software: A list of Bitcoin Wallet Software is available on Bitcoin.org.

- Bitcoin Mining Software: bfgminer, cgminer are some notable examples. Bitcoinmining.com gives a very detailed look into different options.

You can learn more about how to set up a wallet by clicking here.

1. Invest in your own Hardware

Types of Bitcoin Mining Hardware:

CPU: CPU has the lowest mining power (Hash rate). A CPU gives a Hash rate of less than 10 MH/ Sec. Source: Coindesk, Cointelegraph. Such a low speed has now made CPU mining obsolete.

GPU: CPU mining Hash rate can be upgraded using a cutting edge graphics card. The best GPUs are provided by AMD and Nvidia. With the introduction of the ASIC Miners, the GPU Miners are unable to compete and hence just like the CPU Miners, the GPU miners are considered obsolete.

Refer to this article for some GPU Models.

FPGA (Field Programmable Gate Array): FPGA is an integrated circuit built using a number of chips and configured for a specific purpose, thereby setting it up for Bitcoin mining. An FGPA drastically reduced the power consumption of the hardware, thereby increasing the Return on Investment (ROI).

ASIC (Application Specific Integrated Circuits): ASIC Miners are designed specifically for Bitcoin mining and gives a very high Hash rate keeping the power consumption low. They are more advanced compared to CPU, GPU, and FPGA. However, as they are designed just for a specific purpose, the cost of ASIC Miners are high.

Here is a list of available ASIC Hardware miners.

2. Join a Mining Pool

As individual mining became difficult and with declining ROI, Bitcoin miners collaborated to form Pools. The pools collectively work with a combined Hash Power. The Block Reward is distributed as a ratio of the computing power contributed.

There are various Pools available. Here is a Comparison of the Mining Pools

We urge you to investigate in details and select your pool with care. Following criteria needs to be taken into account:

- Pool Fee

- Payment system

- Currency

- Location

- Vardiff

Cryptocompare deep dives into these aspects.

Note: Many pools reward the contributors with the Block Reward only and keep the Transaction Fee just for themselves.

ROI Calculation for Personal Hardware (+/- Pool)

Before you choose the hardware, you need to do an ROI Calculation. Below are some broad steps:

Step 1: Calculate the below important factors of a Hardware

- Hardware Cost

- Hashrate/ Hashing Power (GH/s)

- Hardware Power consumption (W)

- Costs (Shipping, Fans, Cables etc)

- Local Electricity Cost per kWh

- Pool Fee (In case you are using a pool)

Step 2: Use an ROI Calculator to calculate profitability.

Example: Check out this link in Tradeblock.com

Step 3: Compare the profitability of different hardware options using the ROI Calculator

3. Invest through a Cloud Mining Contract

Cloud mining is run through Bitcoin mining hardware located in remote data centers. A user can purchase hardware mining capacity for the data centers through these cloud mining providers. Below are the benefits of the model:

- No prior technical knowledge of Bitcoin Mining needed.

- Remove the hassle of setting up own Bitcoin Mining Hardware

- Remove electricity, bandwidth, maintenance and other related issues.

Before moving further, let me warn you, that the majority of Cloud Mining Contract providers are fraud! So please do your own due diligence. Below are some tips.

Check out these players: Genesis Mining, Hashing 24, Hashnest. Select a plan as per your need.

Consider the below points before selecting a Cloud Mining Contract

- Beware of Fraud

- Is the provider backed by a stable and big organization?

- Are the data centers verified?

- What are the security features provided by the website?

- ROI Calculation

- Existing Bitcoin Price vs your estimated future Bitcoin Price.

- Are there any Hidden Fees (including Subscription and Maintenance Fees)?

- Tenure of Contract vs Time by when will you break even?

- Technical Aspects

- How transparent is the Website’s dashboard?

- Are there additional Features, e.g, demo mining.

- Is the Contract available (In Stock)?

- Is there any problem with withdrawing Bitcoin to your wallet?

It is seen nowadays that Cloud Mining Contracts are not very profitable and people can make more money just by purchasing and HODLing. Refer my other article on how to purchase Bitcoin.

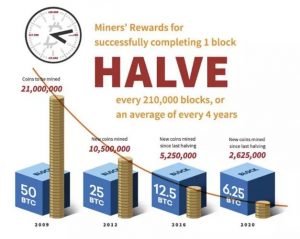

An important note: By 2020 the current Block Reward of Bitcoin will be halved. All calculations demonstrated in this article needs to be adjusted by the changing Block Reward.

Source: Investopedia

Conclusion:

Multiple parameters must be taken into consideration before opting for Mining. Few of those include Buying vs Mining, ROI Calculation, Time and Effort, Mining frauds and shutdowns, Environment: Energy Consumption, Market Volatility etc.

If you are further interested, I have listed down some good reads from our archives:

Technical:

CPU Mining using Honeyminer Software

Maybe You should stop mining and wait

Asus Crypto Mining Motherboard Offers Support for 20 graphics processors

Intel’s new processor Patent

Politics, Industry and Environment:

Missoula County Postpones Decision on Cryptocurrency Mining Ban

Google’s stance on Cryptocurrency Mining

Apple’s stance on Cryptocurrency Mining

Bitcoin Carbon Footprint

Beware of Cryptojacking

Disclaimer:

This article is the opinion of the author and every individual need to do their own research before investing in Bitcoin mining. Please follow the Rules and Regulations of your country related to Bitcoin mining.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Genesis Mining take your money then after a month or two will say your contract will be voided after 60 days. Say goodbye to it. Checkout TrustPilot & the forums. Try googling, “scam genesis mining” before becoming a victim.

In my opinion (also shared by others), the sun has set on the age of cloud mining. Lately, a new business model has started to take wings: MaaS (Mining as a Service). This means that the investors are the owners of the equipment (called ASICs), and services such as hosting, guarantee of the mining operations and their maintenance are ensured by the Bitcoin mining companies. I would like to encourage your readers to take a look on a company which have this business model: https://elevategroup.io/