You can compare Stacks to any layer 2 chain, but it’s built on Bitcoin. In contrast to Bitcoin, it can handle smart contracts and Dapps. They cover all kinds of different fields, For example, finance or NFTs, but also social or wallets.

So, we take a closer look at two top decentralized Dapps on Stacks. When using Stacks, you need a Bitcoin-compatible wallet. This video explains how to install and use such a wallet.

Now, let’s see which are these 2 decentralized applications on Stacks.

1) Arkadiko

Arkadiko Finance is a decentralized and non-custodial liquidity protocol. With your STX tokens as collateral, you can borrow the soft-pegged USDA stablecoin. You mint the USDA token and your STX goes into a vault. Now, your STX generates yield. This yield pays off your loan. Paying off your loan takes around three years. So, no need for monthly payments. In other words, it’s a self-repaying loan. It’s DeFi, so there are no middlemen.

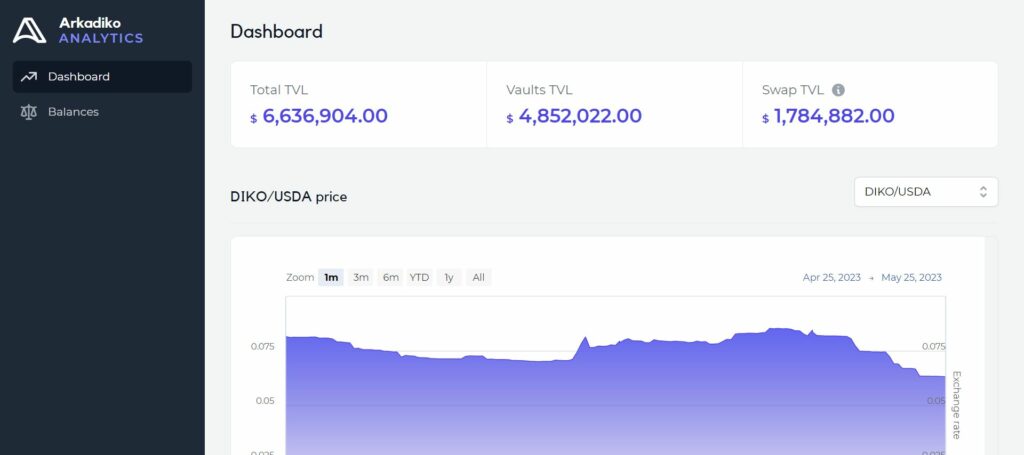

According to DeFiLlama, its current TVL is $1.492 million. That puts them in the second spot on Stacks, out of five protocols. Shortly after the protocol launched in 2021, its TVL hit $50 million. According to their own website, they also have $4.852 million TVL in their vaults. That’s besides their own calculated $1.784 million TVL. This is a deposit as liquidity for swapping. That brings their total TVL to $6.6 million. See the picture below.

Source: Arkadiko

Other features the platform offers are:

- Swap

- Liquidity pools

- Staking DIKO. (That’s the native governance token).

There have also been talks of adding Bitcoin and USDC as collateral. Furthermore, Arkadiko has had several audits. This raises their security levels. However, you want to make sure that you always have enough collateral. You can still get liquidated on Arkadiko. You can borrow USDA at a 25% Loan-To-Value setup. This is its roadmap:

Source: Twitter

Arkadiko is a DAO. This means that the users, or rather holders of DIKO, govern the platform.

2) CityCoins

CityCoins are closely linked to Stacks. Patrick Stanley launched the idea, and he designed Stacks’ Smart Contract Protocol. Not to mention that he built CityCoins on Stacks. Keep in mind, that CityCoins are privately owned. No government or other public organization is part of it. Still, associated cities profit from the coins.

From all miners’ revenue, 30% goes to the digital wallet of your preferred city. In other words, you can earn free crypto for your fave city. Here is a use case for Citycoins:

Source: Twitter.

To make this setup easy, there are various tokens. Each participating city has its own token. The first city to onboard was Miami. It has the MiamiCoin (MIA). That was back in August 2021. Do you still remember that? In November 2021, New York City followed suit. They have the NYCCoin. In 2022, there was talk of, among others, Austin, Texas joining CityCoins. However, the mayor has not yet endorsed the proposal. This is how it works:

- Any user can nominate a city.

- A vote follows the nomination.

- After a successful vote, your first step is to get the mayor on board.

- Once he agrees to have a CityCoin, users can deploy the new coin.

- As mentioned before, 30% of all revenue from a CityCoin goes to that cities digital wallet.

Mining CityCoins and Rewards

On a technical level, miners bid a number of STX tokens. So, the miner with the highest bid, in relation to the total bid, wins the bid. There’s a new block every ten minutes. Miners can bid on up to 30 blocks.

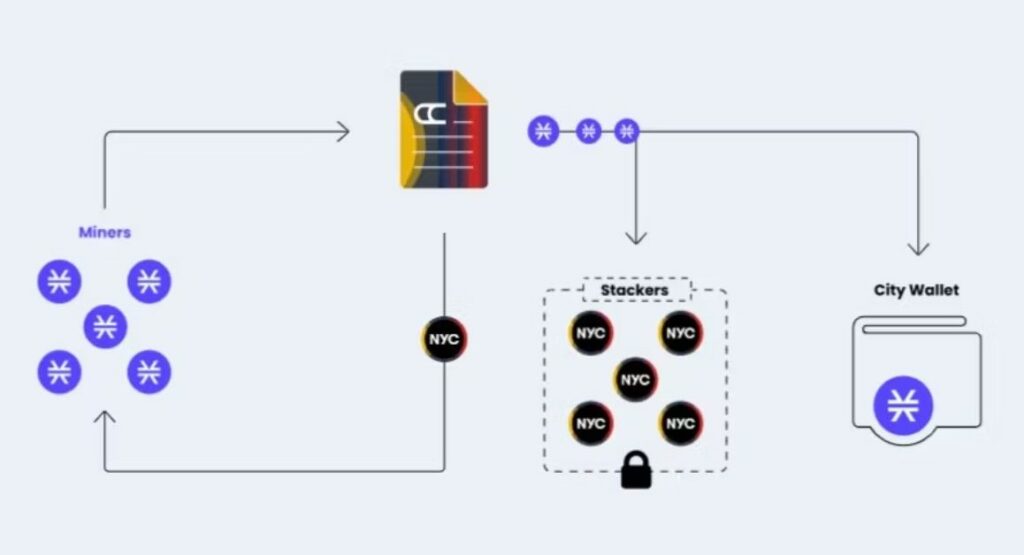

Now 30% goes to the city’s wallet and 70% goes to stackers. To clarify, the latter are the users of the platform. For example, you can stack 10,000 CityCoins. After the end of a stacking cycle, you get your CityCoins back and your share of STX rewards. Below is a picture that explains how the mining cycle works.

Source: Make use of

Conclusion

We looked at two Dapps on the Stacks protocol. This is a kind of layer 2 solution but for Bitcoin. We looked at Arkadiko and CityCoins.

The current price of the STX token is $0.6024. It has a market cap of $832 million. The max and total supply of STX tokens is 1.818 billion. Currently, 1.318 STX tokens already circulate.

The STX token is available on a few exchanges, including Bybit. Did you know that Bybit is giving out up to $30,000 in bonuses & together with a brand-new iPhone 14? Just click this link to find out more. If you already have a Bybit account, you can still join by clicking this link.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.