In Part 1, we will focus on developing our understanding of Security Tokens. Why are security tokens important? What does the current security token ecosystem look like?

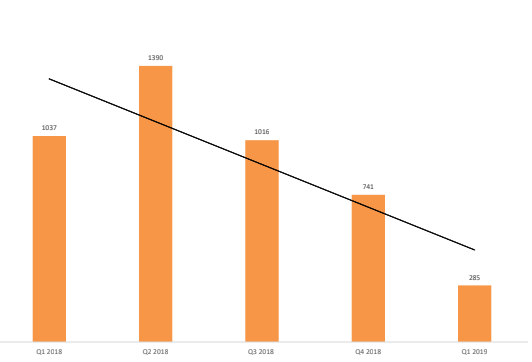

According to research by Inwara, from Q2 2018 to Q1 2019 the number of ICOs has fallen by a staggering 79%.

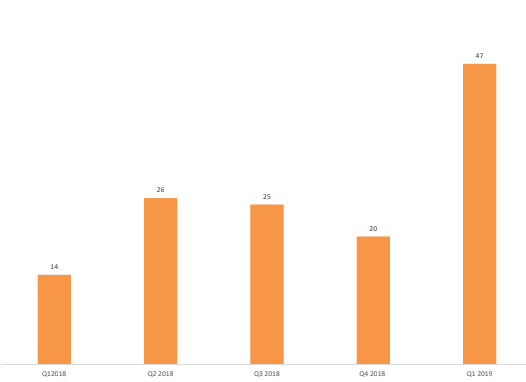

On the other hand, the number of STOs has risen meteorically in 2019. The growth of QoQ was over 130% in Q1 2019. Security Tokens seem to become more and more popular.

What are Security Tokens?

ICOs all share the same problem. Factually, there’s no relationship between the token’s value and the company’s current state. Enter Security Tokens. In the traditional world, securities represent:

- An ownership position in a publicly-traded corporation (stock),

- A creditor relationship with a governmental body (bond),

- Rights to ownership (option).

A security token is a tokenized, digital form of these traditional securities. A security token doesn’t need to have a utility.

The Howey Test

In 1946, two Florida-based corporate defendants sold real estate contracts for land with citrus groves. Then, they decided to lease the land via a service contract back to the defendants. The latter would then harvest, pool, and market the citrus. However, this was deemed illegal by the U.S. Securities and Exchange Commission (SEC). This famous case, known as SEC vs W. J. Howey Co. laid down the foundation for the famous Howey Test. The SEC uses it to determine whether a certain transaction is an investment contract. The Howey test contains the following criteria:

- It is an investment of money

- The investment is in a common enterprise (A common enterprise is a horizontal enterprise where the investors pool in their money and assets to invest in a project.)

- There is an expectation of profit from the work of the promoters or the third party.

- The profit is solely on the efforts of others

Moreover, if a crypto token passes the Howey test, then the SEC (or another regulatory body) qualifies it as a security token. As a result, they’re subject to federal securities and regulations.

How did the SEC enter the crypto scene?

The DAO made them to. It was a digital decentralized autonomous organization. It was also a form of investor-directed venture capital fund. In May 2016, The DAO raised $150m during a crowdfunded Token Sale. However, in June 2016, hackers stole $50m from the DAO fund. This heist gravely affected the price of ETH: it dropped by 50%. The SEC became immediately interested.

In July 2017, the SEC concluded that the DAO tokens (sold on the Ethereum blockchain) were securities. This constituted a violation of U.S. securities laws. To add, in order to ensure the proper functioning of crypto projects, they needed a regulation.

Advantages of Security Tokens

Regulation makes it easier for an organization to function in a certain geographic region. Security tokens hold accountability. But it does not stop there. It has several other advantages.

- Improving Traditional Finance: Smart contracts will reduce the complexity, costs, and paperwork of traditional finance.

- Speeding up Processes: By removing middlemen, securities allow for faster execution time.

- Exposure to Free Market: Investment transactions are extremely localized. The exposure to the free market helps increase asset valuation. For example, an investor in the Netherlands could easily buy equity in a real estate in New York with a few clicks of the mouse.

- Lack of Institution Manipulation: Because the number of middlemen decreases drastically, the chances of corruption and manipulation by financial institutions decrease drastically.

- Automated compliance: As security tokens are programmable, compliance can be baked right into the token.

- Easier Liquidation: Secondary trading on security tokens is made simple through licensed security token trading platforms. As a result, it will be extremely easy for investors to liquidate security tokens.

- 24/7 Trading: Security tokens allow for 24/7 markets, which eliminates the huge inefficiencies of daily market closures.

- Asset Interoperability: This means that we can hold ownership claims to a commercial building, early-stage equity, corporate bonds, a single-family residence, and a decentralized network on the same platform.

- Voting and Governance Rights: In the future voting rights and governance on decentralized security token networks may become an effective method of incentivizing ownership and introducing financially based price stability.

The Security Token Ecosystem

A security token issuer needs to work with multiple entities including legal, custodians, brokers, etc.

The various players in the Security Token ecosystem include:

- Security Token Issuance Platforms

- Security Token Exchanges

- Broker-Dealer

- Compliance Service providers

- Legal Service Providers

- Custody Service Providers

Admittedly, all these different players are equally important. At the same time, the major technical innovation is happening with the Security Token Issuance Platforms and Security Token Exchanges. In Part 2 of this series, we will handpick Top 5 Security Tokens.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

You should be looking into TOP Security Token Issuance Platforms offering equity! After all, securities need a digital upgrade. Researching for 12 months in this space and Preflogic is the only STO Issuance Platform offering equity ownership targeting the “little guy”. IMO – once in a lifetime opportunity.