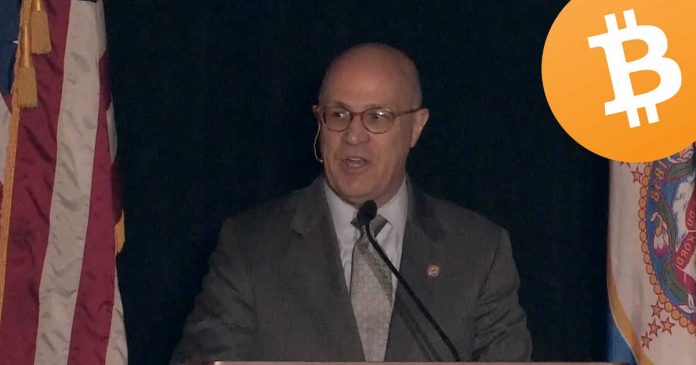

At Eurofi, in Bucharest, Romania, CFTC Chairman Christopher Giancarlo spoke about the CFTC’s approach to crypto assets like Bitcoin. “We have resisted calls to use our legal powers to suppress the development of crypto-assets and the underlying technologies that support them.”

On April 4th, CFTC Chairman Christopher Giancarlo gave his last speech at Eurofi in Bucharest, Romania. He covered many topics throughout his speech but most importantly, he covered crypto assets and their approach to them. He explicitly stated that the CFTC has resisted calls to “suppress the development of crypto assets” and that allowing products like Bitcoin futures have helped in determining the appropriate value of Bitcoin.

“And consider the CFTC’s approach to the development of new derivatives products on crypto-assets like Bitcoin. We have resisted calls to use our legal powers to suppress the development of crypto-assets and the underlying technologies that support them. Instead, we have favored close monitoring of market developments while not hindering the introduction of new products like bitcoin futures, which have proven invaluable in letting market forces determine the appropriate value of the bitcoin.” – Christopher Giancarlo

He went on to talk about his beliefs that instead of setting up regulatory barriers between Europe and the US, we should be removing those barriers that make the world less global. In addition, he believes both markets need to be “the best regulated” while “balancing market oversight, health, and vitality.”

The Chairman values quality when it comes to regulation and oversight, not quantity. By having the best cooperative supervision, it should in turn help grow both markets.

“They should be neither the least, nor the most, prescriptively regulated – but the best regulated for the unique characteristics of our marketplaces, balancing market oversight, health and vitality. This goal will not be achieved by setting up regulatory barriers and separating ourselves from our foreign counterparts, but by removing the barriers that stand in the way of global market participants choosing the best markets for their needs. Thus, our common approach to regulation should not be based on a crude measure of the quantity of regulation, but the quality of regulation and oversight. In this respect, regulatory and supervisory cooperation should lead to greater access to each other’s markets.” – Christopher Giancarlo

It is important to note that this is the Chairman’s last speech as he will be stepping down as Chairman this April. Having said that, he felt it was important enough to recommend to both the US and Europe not to overregulate the crypto markets and by removing regulatory barriers, it will help both markets grow. Cooperation is key.

“Moreover, it is a future in which our markets actively support each other with knowledge, skill and capital flowing freely between them, making both stronger and more vibrant, under the thoughtful oversight of European and U.S. regulators working cooperatively with one another. I see a bright and prosperous future, one of courage, confidence and commonality.” – Christopher Giancarlo