Messari, a crypto-focused media organization, recently released a report by the name of State of Avalanche Q1 2022. The media platform analyzed Avalanche’s performance in the first quarter of the year. Messari later hosted an analyst call featuring Ava Labs’ John Nahas, Luigi DeMeo, Ed Chang, and Nick Mussallem to discuss Avalanche’s experiences in Q1 and shed light on Q2.

Avalanche had a remarkable experience in 2021. The scalable blockchain network rose from a relatively obscure platform into a notable blockchain space in 2021. Within Q3 and Q4 of 2021, Avalanche’s community witnessed remarkable growth. The platform also onboarded several DeFi projects.

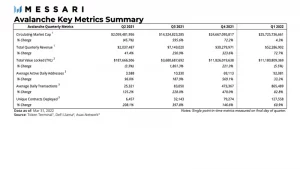

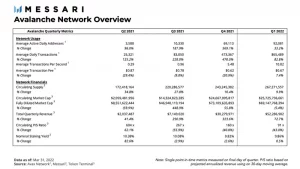

Avalanche continued its fine run of form in 2022. Despite the slow pace of the market at the beginning of the year, Avalanche was among the few blockchain platforms to experience growth. During Q1, Avalanche had more than 600,000 followers. Furthermore, Avalanche’s quarterly revenue exceeded that of Q4 2021, showing the platform’s growth in a few months.

According to Messari, Avalanche had about 127,558 unique contracts deployed in Q1 2022. This is a significant 60.9% rise from the 79,274 unique contracts deployed in Q4 2021. Here are more details about Avalanche’s growth in Q1.

Avalanche’s Q1 Was Miles Ahead of 2021

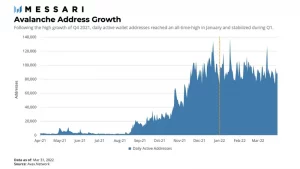

Avalanche experienced rapid growth in the fourth quarter of 2021. Factors such as the Ethereum–Avalanche bridge and multiple exchange listings triggered growth in 2021. Furthermore, high-profile partnerships and the Avalanche Rush liquidity program were part of Avalanche’s growth in 2021 Q4. Going into the new year, there were questions about Avalanche’s ability to sustain its growth in 2022. The platform exceeded expectations during Q1 2022.

Avalanche witnessed positive growth when compared to the previous quarter. Although the market cap remained relatively flat (-5.4 percent), the blockchain platform saw sustained increases in usage. Revenue generation was also on the rise. There was a shift toward a more satisfactory valuation in Q1. In addition, during Q1, average daily transactions nearly doubled at +82.8 %. Furthermore, total revenue increased by 72.7%.

Additionally, daily active addresses reached an all-time high of 140,000 in January. In the first week of January, Avalanche’s active users eclipsed the figures for October 2021. Daily active addresses peaked at 92,000 during Q1.

Also, Avalanche’s average daily transactions increased from 473,000 in the previous quarter to 865,000 in Q1. The launch of several DeFi projects further triggered the daily transactions on Avalanche. GameFi projects and NFT projects on Avalanche accounted for the bulk of Avalanche’s daily transactions.

What Triggered Avalanche’s Growth in Q1?

Avalanche’s growth in Q1 was triggered by several factors, such as:

- The continued deployment of Avalanche Rush, as well as the Blizzard ecosystem fund.

- The development of the Ethereum Virtual Machine (EVM) subnet.

- The introduction of the Culture Catalyst fund and the Multiverse subnet incentive program.

- Multiple strategic partnerships.

- The rise of DeFi projects.

DeFi projects played a huge role in Avalanche’s massive climb in Q1. The ongoing Avalanche Rush program introduced last year played a significant role in stepping up DeFi projects on Avalanche. Furthermore, the $200 million Blizzard ecosystem fund was another factor. During Q1, popular DEX Pangolin and Terra entered the Rush program and teamed up to bring TerraUSD (UST) to the Avalanche ecosystem.

By the end of the first quarter, 60 protocols had amassed $1 million TVL. This was a significant increase from 29 the previous quarter. Also, as the first quarter came to a close, 60 protocols remained above the $1 million TVL mark.

What Lies Ahead in Q2?

Avalanche’s current roadmap does not prescribe protocol developments. But Q2 is expected to field a series of activities for the scalable blockchain platform. Avalanche Rush will continue to trigger DeFi growth in Q2. Furthermore, the Blizzard fund will aid in overall ecosystem expansion. Additionally, Culture Catalyst will attract more developers and talents to the network. Q2 will feature continued platform upgrades.

The Multiverse initiative will be a focal point in Q2 to drive subnet development. During the analyst call, the Ava Labs team confirmed that Avalanche would pay huge attention to subnets in Q2. The director of Avalanche Foundation, Emin Gün Sirer, believes that subnets are the next big thing on the blockchain.

A subnet’s goal is to divide a large network into a collection of smaller, interconnected networks in order to reduce traffic on the Avalanche blockchain. This eliminates the need for traffic to travel through unnecessary routes. It ultimately increases network speed. You can watch the recap of the analyst call here.

⬆️ Also, get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ALTCOIN BUZZ ACCESS PRO membership (worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️ In addition, find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

⬆️ Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.