Decentralized finance (DeFi) is changing people’s attitudes around money worldwide. Historically, banks have controlled the way we access money. However, DeFi platforms are now facing threats to banks’ monopoly.

In 2021, the DeFi ecosystem has seen a massive increase in volume, where more participants enter the market and more sophisticated financial instruments are developed. According to DeFillama, the DeFi TVL has grown more than 130% since January. Look at this chart:

Source: DeFillama

A Crypto Recap of 2021

1. Stablecoins

According to the stablecoin supply on Ethereum continues to diversify. USDC and BUSD continue to gain market share at the expense of USDT on Ethereum. This means that these two stablecoins are the leading smart contract technology for stablecoins.

Over the same period, BUSD has increased its market share, while DAI’s market share has stayed unchanged. Also, USDC is gaining in on USDT’s market share.

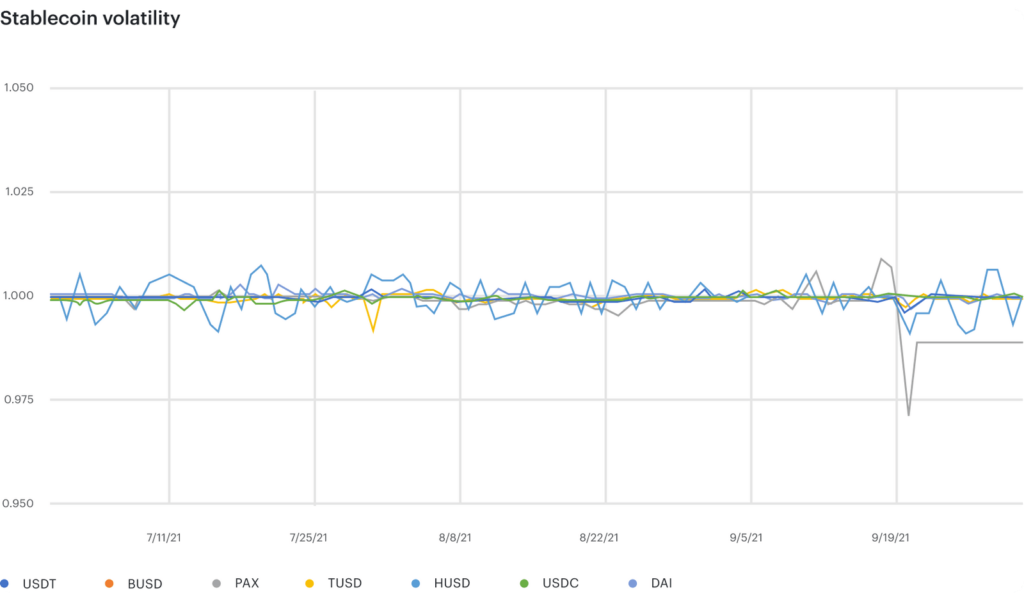

The graph of stablecoin peg performance below demonstrates that most USD-denominated stablecoins have held their peg close to parity with the US Dollar while experiencing relatively modest volatility. Look at this graph:

As you can see, DAI was more volatile than other stablecoins. All stablecoins had minimum and maximum values that were lower and higher than par.

2. Borrowing and Lending

Borrowing and lending in DeFi had a tremendous increase in outstanding loans in Q3. It hit an all-time high on September 6th, with about $24.7 billion. This spectacular recovery in Q3 followed a sharp drop-off in activity at the end of Q2, when the total outstanding debt was roughly $14.3 billion.

Source: DeFillama

Aave tops the DeFi lending protocols, with $14.7 billion in outstanding lending on the protocol. Surprisingly, the market anticipated Aave being the primary lending protocol. The AAVE token surpassed leading competitor Compound’s token. Furthermore, Aave has a thoroughly diluted market size of around $4.6 billion, while Compound has a fully light market cap of approximately $3.1 billion.

On the other hand, approximately 68.2% of outstanding loans are in DAI, compared to 21.9 percent in USDC. This demonstrates an increase in confidence in USDC.

What to expect in 2022?

This year represented a significant shift in Defi solutions in finance. Therefore, we have selected four things that we expect next year:

1. Decentralized Finance Will Be Adopted Rapidly

In 2021, blockchain was a hot topic because it is the technology that supports cryptocurrencies such as Bitcoin. However, its uses extend well beyond cryptography. In the coming year, we may expect a rise in interest in decentralized finance or DeFi.

2. Stablecoins will Continue to Grow

Stablecoins have become a fixture in crypto markets because they give a haven from fluctuating crypto assets. These coins are also a gateway to DeFi services where users can borrow, lend, and earn high-interest rates on their coins. Therefore, we expect stablecoins to expand in popularity in 2022.

3. Central Bank Digital Currencies Might Debut in 2022

Central bank digital currencies (CBDCs), which are digital versions of fiat currencies such as the US dollar, are another topic to watch in 2022. The jury is still out on whether CBDCs, is a step forward or a leap into even more governmental control over individuals’ lives. CBDCs are inevitable, but they will have to live with private money such as Bitcoin. There will be space for both private and central bank-issued money

4. Major Banks Will Begin Offering Crypto Asset Services

Coinbase’s most recent quarterly report shows that institutional trading activity now represents 72% of the overall market. These institutional traders are certainly current clients of the large banks, who are forced to transfer their business elsewhere.

They’d probably prefer to keep their crypto assets with a respectable financial institution to conduct all of their other banking. It is just a matter of time until sufficient legal clarity is provided to encourage large banks to join.

Also, for the more great info, join us on Telegram to receive free trading signals.

Above all, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.