Crypto.com has a new report with information on various crypto-related markets. This information relates to April 2022. In total, Crypto.com covers six different market segments.

It’s all about gains and losses during April 2022. Keep an eye out for our other articles that deal with the further sections of this Crypto.com Research Report. We are first going to have a look at the DeFi and Exchange sections and see what’s cooking there.

What’s Happening in DeFi During April 2022?

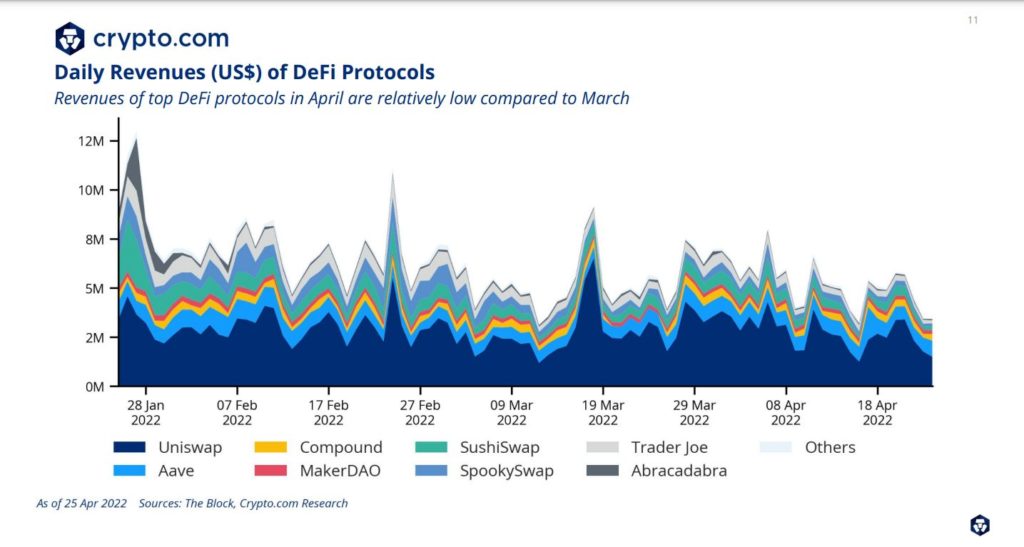

- DeFi Daily Revenue

The DeFi sector in the crypto space saw a bit of a slump during April 2022. The daily revenues went down when compared to March 2022. Uniswap is still the biggest player in the DeFi field for daily revenue. They actually gained $0.3 million at the end of April. They went from $3.83 million to $4.13 million, which is a nice 7.8% gain. Curve did even better, with a 51% increase. On the other hand, SushiSwap lost 29% and Balancer a stunning 66%.

The total DeFi market, however, lost $0.47 million. It went from $7.01 million to $6.54 million daily. Below you find the picture from the Crypto.com research report. For this article, we took figures straight from ‘The Block’ website. The reason is that they included all of April.

Source: Crypto.com research report

- DeFi token value

If we look at token value, we get a different perspective. For example, the OG, Bitcoin, lost 17% of its value in April. However, the DeFi sector lost a combined 34% in token value during April. RUNE handed in most with a 51% loss.

According to CoinGecko, the total market cap value went down from $141.4 billion to $112.9 billion. That’s almost 20%. On the other hand, TVL for DeFi went from $223 billion to $202 billion. This is almost 10%. That’s according to DeFi Llama.

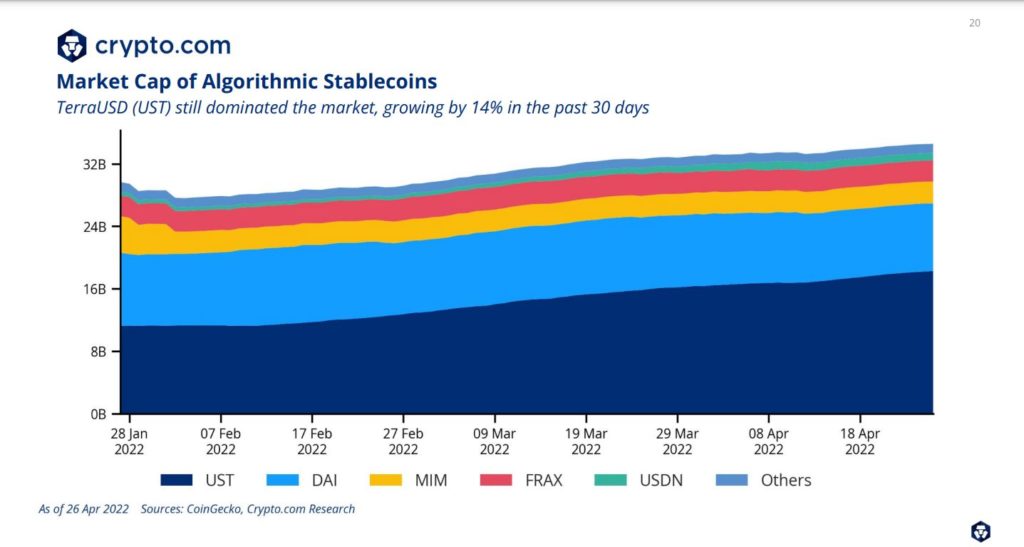

- Algorithmic Stablecoins

In contrast to DeFi tokens, the algorithmic stablecoins did well, the Crypto.com Research Report states. They gained in total market cap. That’s no big surprise since many traders swap tokens for stablecoins. Especially in current volatile market conditions. Stablecoins offer a less volatile environment.

TerraUSD (UST) is still the biggest algorithmic stablecoin. During April, UST gained an impressive 14%.

Source: The same Crypto.com research report

Exchanges

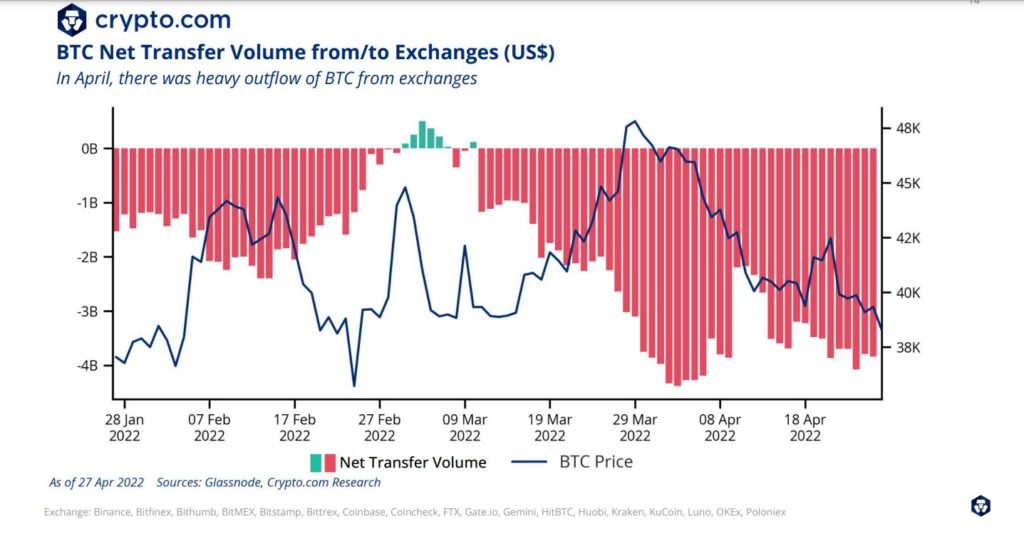

- Exchange Net Position Changes for BTC and ETH

The price of Bitcoin dropped from $48,000 to $40,000 in April. Still, outflow didn’t happen in April. To hodl seems the way to go. It also shows that investors have confidence in the market. Once a big sell out starts, it may show that investors lose their faith in BTC. All major exchanges took part in delivering these numbers.

Getting the net flow number of BTC is easy. You just take the exchange inflow and outflow. Use the following equation, and voilà, you have your net flow.

Inflow – Outflow = Net flow

Like in this case, a large outflow over a longer period of time, means that investors are positive. We consider this to be a bullish signal. Coins move from exchanges into long-term HODLing like cold storage.

Source: The same Crypto.com research report

For Ethereum, we see a similar development. Investors hodl, although the price of ETH went from $3,500 in early April to $3,000 in later April.

- Net Transfer Volume of BTC and ETH In and Out of Exchanges

The transfer volume is how much BTC or ETH moves between wallets. Or in these cases, exchanges. We saw already that both BTC and ETH dropped in price during April. Another thing they have in common is that more BTC and ETH left exchanges. This makes sense, since as we saw above, investors are hodling. This means that they move their BTC and ETH to their noncustodial wallets or cold storage options.

With the current drop in crypto prices, that doesn’t come as a surprise. In general, during bull markets, more BTC and ETH tends to move around.

Conclusion

This report shows that DeFi is having a bit of a drawback in early 2022. During April, revenue and token value dropped. On the other hand, algorithmic stablecoins increased in volume.

For exchanges, the trend is that investors hodl BTC and ETH. As a result, we also see that these two crypto assets are leaving exchanges. Thanks to crypto.com for this great and informative research report.

Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ACCESS PRO membership worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your ‘newly signed up MEXC UID’ and ‘Telegram ID’ on our Twitter @altcoinbuzzio)

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.