The Covid-19 pandemic saw a change in the financial behavior of customers in the US. As a result, financial relationships have transformed, creating a new landscape. This resulted in crypto holdings seeing a higher adaption rate throughout the US.

Many US citizens struggle to meet financial ends. This is one of the results of the Covid-19 pandemic. Also, payment habits have changed because of it. Yet, consumers show content with financial service providers. Crypto holdings, on the other hand, are on the increase.

Report: 24% Of Us Citizens Hold Crypto and 23% Have a Savings Account.

Nowadays, consumers use various financial services to make ends meet. According to the Morning Consult report, it covers this situation from various angles. The report looks at four main points.

- Consumer needs aren’t met by banks.

- The meager financial state of millennials.

- The expected boom of crypto in 2022.

- The role embedded finance plays.

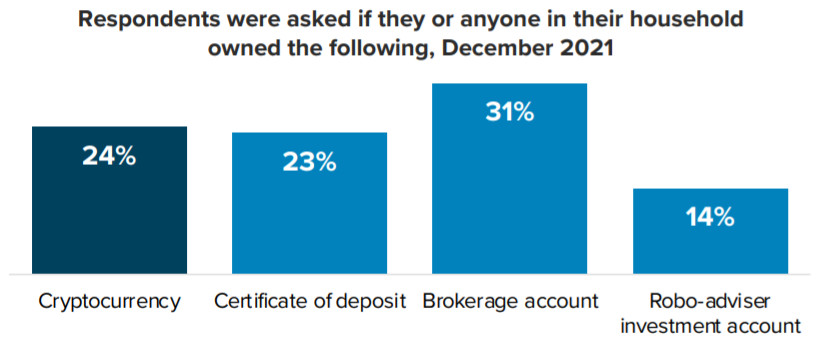

This report used monthly polls with 2200 to 4400 representative US adults. One of the interesting results in these polls concerns crypto holdings. For the first time, US citizens holding crypto, surpass saving account holders. This is for the first time in US history. 24% of US citizens hold crypto and 23% have a savings account.

JUST IN: For the first time the number of US citizens holding #crypto (24%) has surpassed the number of citizens with a savings account (23%).

— Watcher.Guru (@WatcherGuru) February 15, 2022

Why are American Citizens Using More Cryptos Than Banks Now?

Banks are not meeting certain needs that consumers have. Still, consumers trust their banks and are content with them. This indicates how easy it is for consumers to switch providers. They search for something better. Consumers’ trust is also still in favor of banks and credit unions. Digital banks and credit card companies lag just a bit in consumer trust.

Still, consumers didn’t change the number of financial providers. Most Americans just stick to using one bank. Yet, almost a third conducted business with more than one provider. This is typical for millennials and adults earning $100.000 per year or more. Using credit cards on the decline.

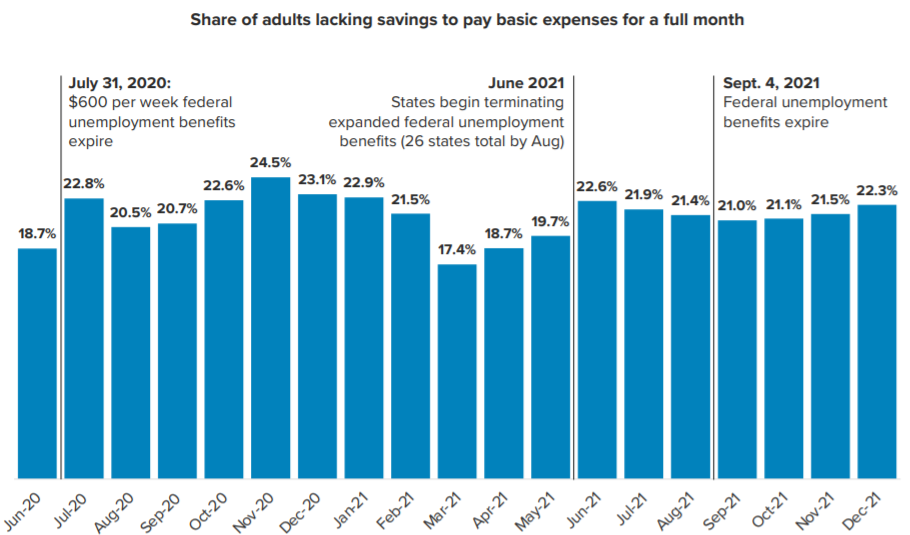

Continuous uncertainty over finances dented consumers’ confidence. Especially, the ability to be able to keep paying bills took a hit. Meanwhile, inflation keeps rearing its ugly head. The cost of important items like food, gas, and other staple goods keeps rising. Households in low- and middle-income brackets suffer most.

This results in less credit card use, but more BNPL (buy now, pay later) use. Millennials and Gen Z use more BNPL services. Gen X seems to be following suit. Overdraft is also on the rise. Also, other financial options are becoming popular. Payday loans or money orders experience user increase. All this to make it possible to pay the monthly bills.

Banks seem to be more disconnected from what their customers need. Because of this, these customers start to explore new options. In the following picture, you will see the % of US adults without savings.

Source: Morning Consult

What is the Millennial’s Financial State?

The financial state of millennials is not looking good. Some are better off than others, where their income is in general below the national average. Freedom of choice and financial security lack for this group. However, this is a worldwide phenomenon and not exclusive to the US.

In addition, millennials have serious concerns if their money or savings last. They also feel like they will never have things in their life that they want. Finances often controls their lives, and they are behind on finances.

On one side, millennial goals seem short-term. How can they better their current financial situation? This includes creating a buffer to cover emergencies by making and holding on budgets for monthly spending. On the other hand, they are also the group with long-term goals that buy houses, education for the children, or start-ups.

Did you know that over 33% of millennials use more than one bank? More than 25% of them use many digital banks. As the first generation, internet was a big part of their lives. They connect online in an effortless way with brands. Millennials like to use a variety of financial options. This includes owning cryptocurrencies.

Crypto Holdings and Adoption Is on the Rise

Crypto adoption in US adults has reached 24%, despite bank deposits standing at 23%. They are closing in on brokerage accounts at 33%.

Millennial males with high-income drive this development. Gen Z adults are also part of the increased adoption rate. As a result, these two groups will remain instrumental in the crypto growth.

Also, millennial households close in on 50% crypto ownership. On the other hand, baby boomers show the least interest, with just 6-8% ownership. No less than 70% of crypto owners are men which represents 48% of the population.

Moreover, Crypto owners with less than $50,000 income make up 39% and owners between $50,000 and $99,900 cover 36%. High-income represent 25%.

Note: Gen Z owns 13% of the crypto market. Millennials, a whopping 57%. Gen X covers 20%, and baby boomers just about touch 10%.

Also, cryptocurrency holders use a variety of financial providers. They are fond of crypto exchanges. In general, they have no problem opening accounts at various exchanges. Moreover, they also include traditional banking services. Compared to an average US adult, they are flexible in their choice of financial providers.

The crypto economy boomed in 2021. Therefore, the report expects the adoption of crypto to continue in 2022. This made crypto brands among the fastest-growing brands in 2021. Thus, it’s not only the general population that will embrace crypto in 2022. Crypto exchanges and related services will also profit.

Source: Morning Consult

Embedded Finance Plays an Important Role

Embedded payments are easy according to consumers. This makes them wonder why bank transactions are difficult.

An embedded finance transaction is when a consumer doesn’t notice them. Like automatic uber payment when exiting. Or buying things in “just walk out” stores. 40% of consumers have used Google Pay or Apple Pay. 25% sends payments through social media apps or BNPL options.

Money changes hands between a consumer and a non-financial entity. It is seamless for and invisible to a consumer. An interesting fact is that 33% of Americans have used embedded finance options. But only 10% have ever heard of it.

This threatens traditional financial institutions and also affects fintechs. They will need to think of different approaches to keep their customers. One way is to give customers more of what they need. This seems to be lacking.

Conclusion

Crypto holdings surpassed savings accounts for the first time in the US. As a result, consumers are looking for new financial options because the traditional financial services don’t meet their needs.

Finally, consumers have too many other options at hand. This report also indicates that the crypto popularity will keep surging in 2022. Traditional finance is about to lose their customers unless they adapt.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.