Although the Bitcoin price continues to hang around the $9-10K range, other factors suggest an incoming bull run. Chain analytics shows that the dormant Bitcoin supply, profitable bitcoin supply, and the number of Bitcoin whales are all increasing. These statistics are important because they are approaching levels not seen since the bull run of 2017.

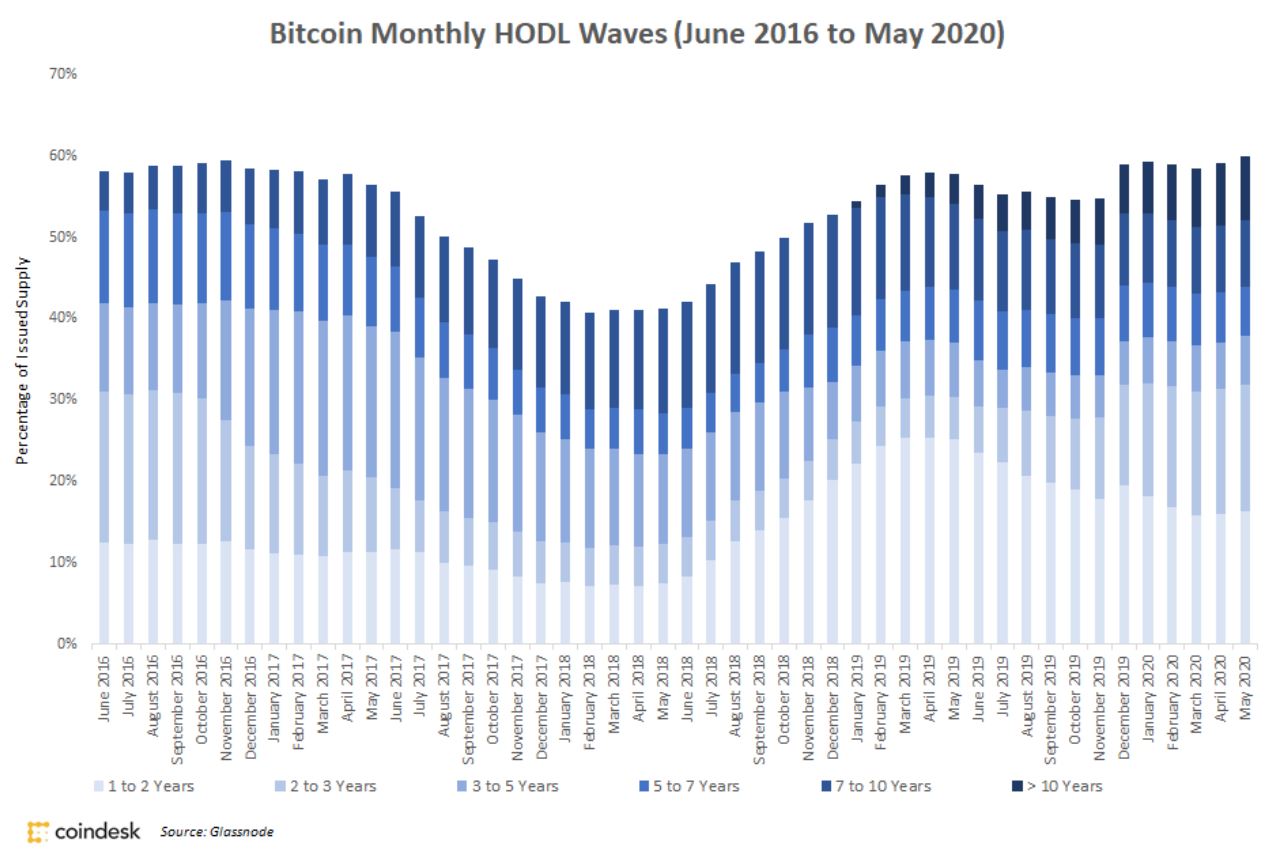

Dormant Bitcoin Supply Increasing

Over 60% of the current issued Bitcoin supply has not moved in at least a year. 30% has not moved in over 3 years, and 22% has not moved in over 5 years. This is the highest amount of inactive Bitcoin Supply since early 2017 when Bitcoin began its upward run towards $20K. Check out the “HODL Waves” chart below for a visualization of this.

Of course, some of these long term HODLs may not be intentional. It is estimated that around 2.5 to 4 million Bitcoin have been lost forever.

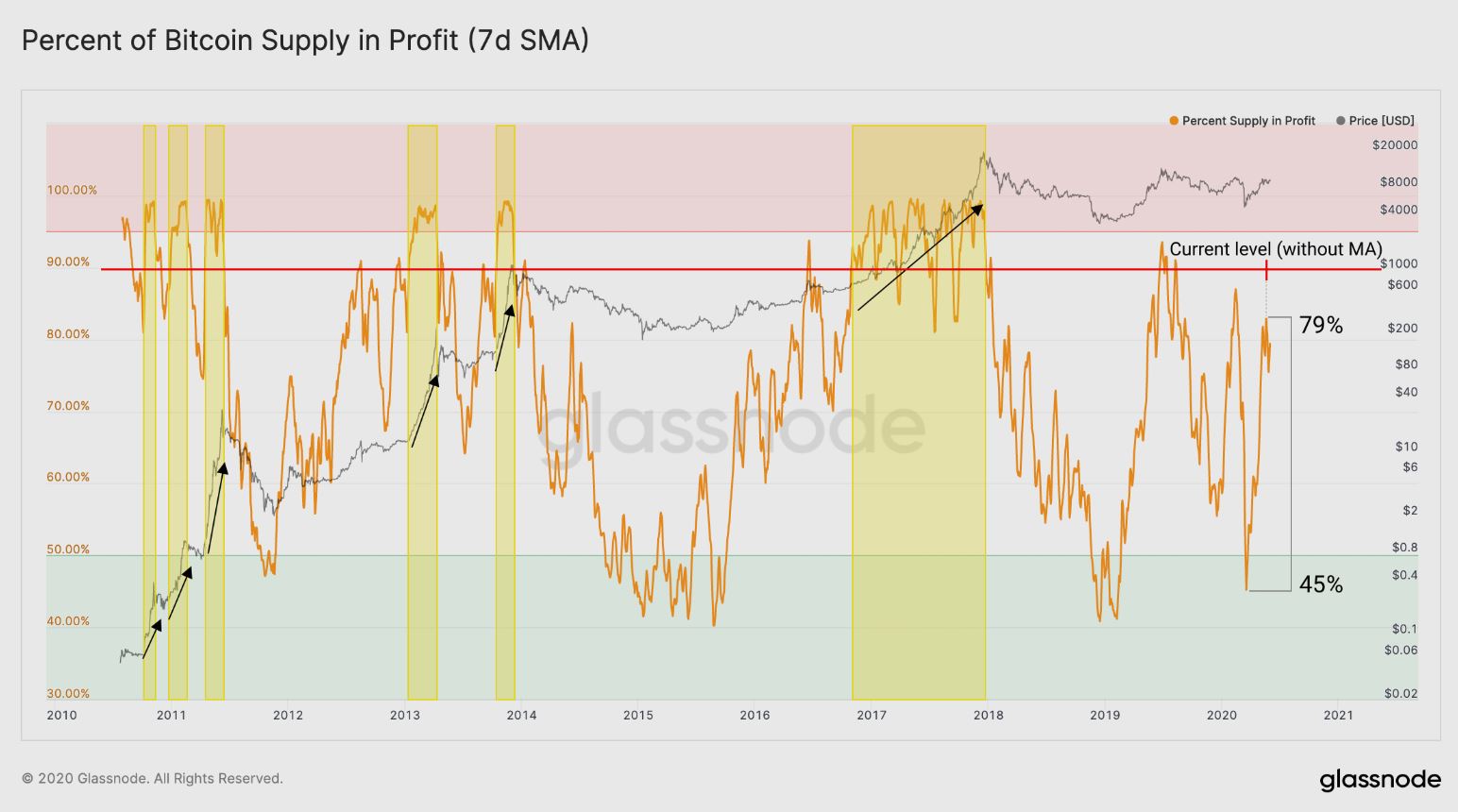

Profitable Bitcoin Supply Increasing

According to data provided by blockchain analytics firm Glassnode, about 87% of the Bitcoin supply is in profit. In Glassnode’s weekly insight update a few weeks ago, they wrote that levels of 90% and higher “clearly marked pronounced bull markets”.

Bitcoin Whale Population Increasing

If we define a Bitcoin “Whale” as an entity holding at least 1,000 BTC, then there are 1,882 whales today. This number has been growing since January 2019. The last time that these many whales were around was September 2017, which was right before Bitcoin’s parabolic move to $20k. The red line in the chart below shows the 1,882 whale line.

Despite the harsh economic impact from the COVID-19 pandemic, Bitcoin holders are proving resilient. If the statistics discussed above continue to rise, a bull run is very much possible.

Check out the article here to read more about why Bitcoin may win its battle with $10K.