Almost a year back, Bloomberg published a warning note for traditional payment processors like Visa and PayPal. Essentially, it shared the viewpoint of MoffettNathanson analyst Lisa Ellis. She believes that cryptocurrencies pose an “existential threat” to Visa, PayPal and the like. And it seems Visa is not at all taking the threat lightly.

In a recent tweet, Cuy Sheffield, Head of Cryptocurrency at Visa, invited crypto wallets to its Fintech Fast Track program. With this association, the wallets would be able to issue Visa cards to their cryptocurrency users.

Any crypto wallets interested in issuing Visa cards please apply to our Fintech Fast Track program here

https://t.co/K6owCBrgqx https://t.co/0XYaft18Nk— Cuy Sheffield (@cuysheffield) February 21, 2020

There is no doubt that cryptocurrencies directly compete with payment processors like Visa. In spite of this Visa is ceaselessly partnering with crypto fintech organizations. Additionally, it is offering its services too. This shows how effective their technology’s capabilities are.

Unlike JPMorgan, Visa is not directly venturing into the crypto space. But it is strengthening its presence at the intersection of fiat payments and cryptocurrency. And promises to deliver value to the cryptocurrency fintech ecosystem.

Why does Visa have a ‘Head of Crypto’?

For many years Visa has been facing this toxic question. Will cryptocurrency render Visa obsolete?

But the more possible scenario is that the cryptocurrency ecosystem might commodify players like Visa. As per analyst Lisa Ellis, there is another risk. Visa might lose ground in cross-border and business-to-business payments to cryptocurrencies.

In June 2019, Visa started embracing crypto openly. The payment processor giant started building an in-house crypto team. In the same month, they moved Cuy Sheffield to the chair of crypto-head. And this is when a serious crypto roadmap fabrication started.

A clever engagement

Visa’s Crypto Head seems to have devised a very clever strategy. With kind of services, it is offering to crypto fintech’s, it still maintains its stance as a middleman. Effectively, Visa has been able to maintain its neutrality towards crypto. And that is going to prove very advantageous for it in the longer run.

Uncovering the services Visa is offering to crypto companies and wallets

Enabling Cryptocurrency buying with Visa

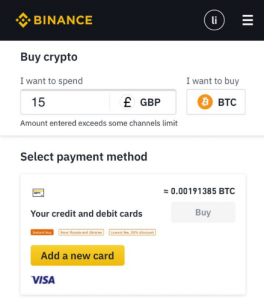

To bring cryptocurrency to masses, credit card buying support played a pivotal role. Through third-party integrations, platforms are integration Visa support. This allows cryptocurrency traders to cash in and cash out their digital assets. And this is being practiced by major exchanges like Binance, BitMart Exchange, KuCoin, Bithumb Global, CoinFlip and more.

In a recent update, Binance users can buy crypto with Visa on a mobile browser too. The same will be implemented in the Binance App very soon.

Source: Binance.com

Cryptocurrency Visa-branded Cards

Visa is making it possible for crypto users to freely walk into a grocery store. And then pay for their purchase with cryptocurrency.

Some of the leading Visa-branded Cards are:

1. BitPay

The platform offers its users a crypto-debit card. This is used to make payments to any merchant that accepts Visa. After loading the card from the BitPay Wallet with crypto assets, the user can shop with Visa merchants across the globe.

Source: Bitpay.com

2. Wirex

Wirex brings its users a next-generation multicurrency travel card. As a Visa card, it allows crypto users to spend their assets. And this is done at any point of sale without bothering about crypto-to-fiat conversions.

Source: wirexapp.com

It brings this ease to its users by partnering with Contis Financial Services Ltd which is a member of Visa.

3. Crypto.com

The Singapore based crypto platform, Crypto.com provides its user with Visa-powered payment cards. This makes crypto-spending easier for day-to-day transactions.

The cryptocurrency on Crypto.com can be converted into various fiat currencies including USD, SGD, AUD and more, by transferring them on to the MCO Visa Card. Furthermore, the users can pay for their purchase using these cards globally with an attractive cashback model in the form of MCO Rewards. Additionally, users can process ATM withdrawals and

LoungeKey™ Airport Lounge access also.

Source: Crypto.com

4. Tenx

Visa-supported merchants accept the Visa-branded TenX Card for both offline and online payments. These cards are used at ATMs to withdraw cash across the globe.

Source: tenx.tech

5. Cryptopay

Cryptopay issues both physical and virtual Visa-card. This is a contactless card and is used to spend crypto at any payment point that accepts Visa. The physical card is used to make ATM withdrawals too.

6. Coinbase

A Coinbase account balance powered Visa card allows users to spend crypto instantly. These cards are contactless and support both PIN transactions and ATM cash withdrawal. All the Visa-card payments can be tracked on the Coinbase Card App.

Source: coinbase.com

Previously, Coinbase was using Plaid Technologies for supporting fiat transactions. Recently Plaid was acquired by Visa for $5.3 Billion which is twice the recent valuation of the company.

7. Abra

Crypto wallet and exchange app Abra uses both Simplex and Plaid integrated. With Simplex it enables cryptocurrency buying using Visa cards. And Plaid integration increased the Abra wallet compatibility with thousands of banks.

Post Plaid acquisition by Visa, Abra wallet is effectively using Visa infrastructure only.

There are other crypto platforms also that use Plaid. Square Cash and RoundlyX use Plaid fintech support. And it seems Plaid was acquired not for its revenue but the fintech user base.

8. Blockcard

The company brings its users a virtual card backed by the cryptocurrency account balance. This card is accepted by Visa accepting merchants.

9. Spend

It provides cardholders leveled Visa-powered cards. An introductory card, an everyday Visa card, and an exclusive Visa card. These virtual or physical cards is used to make purchases and withdraw cash at ATMs.

Currently, Spend Visa cards are accepted at 40+ million locations across the globe.

10. Celsius Network

UK based crypto lending startup Celsius Network has also integrated a third party Visa supporter. With this, it has launched in-app crypto purchases using Visa cards.

11. Socios

The sports fan token project Socios recently announced the launch of its fiat-crypto prepaid debit card. According to Socios CEO Alexandre Dreyfus, the firm might engage with Visa for fiat onramp.

Implications of this big move!

A digital wallet is the core of any cryptocurrency start-up. Visa’s Fintech Fast Track Program brings a quick and easy way for crypto start-ups to onboard with Visa.

There is another pronounced advantage too. The provisions offered by the Visa Digital wallets are in line with what a crypto-digital wallet seeks to establish. The program is ideal for:

- A startup in an emerging market seeking to leapfrog a physical card program

- Looking for a way to enable digital payments and remittances both domestically and across borders

- In need of a high-usage payments platform to extend your customer relationships

- Serving customers who don’t have access to traditional brick and mortar banks

And this is a trump card for both Visa and crypto-startups. Firstly, it will dramatically increase Visa’s participation in the crypto industry but not at the cost of its neutrality.

Secondly, the crypto-startups will be able to quickly introduce Visa-branded cards into the market. And this could prove to be the tipping point for mass adoption.

Go ahead and share your point of view about this strategic step by Visa in our comments section.

Use my referral link https://platinum.crypto.com/r/vb4s1ut5lw to sign up for Crypto.com and we both get $50 USD 🙂