Kava is a cross-chain DeFi platform that offers an integrated ecosystem of stablecoin minting. It collateralized loan service on various crypto assets, including $BTCB, $BUSD, $XRPB, $BNB, $KAVA, and $HARD. The platform is built on Kava Chain, which is built on the Cosmos SDK. Kava offers a decentralized and censorship-resistant blockchain.

KAVA Protocol is open-sourced, fully audited, and secured that guarantees safety to user funds in the long run. The KAVA platform allows users to connect with the Trust wallet and Ledger.

Also, users can transfer BEP-2 and KAVA tokens into the KAVA chain. Therefore, KAVA is a DeFi platform that operates with the most prominent financial institutions like Binance, Huobi, Kraken, OKEX, etc.

Source: KAVA

KAVA’s Technology

Kava is designed using the Cosmos SDK that offers a modular blockchain development framework system. Kava Protocol operates with a Tendermint-based Proof-of-Stake (PoS) consensus mechanism, which gives Byzantine Fault Tolerance, instant finality, and security.

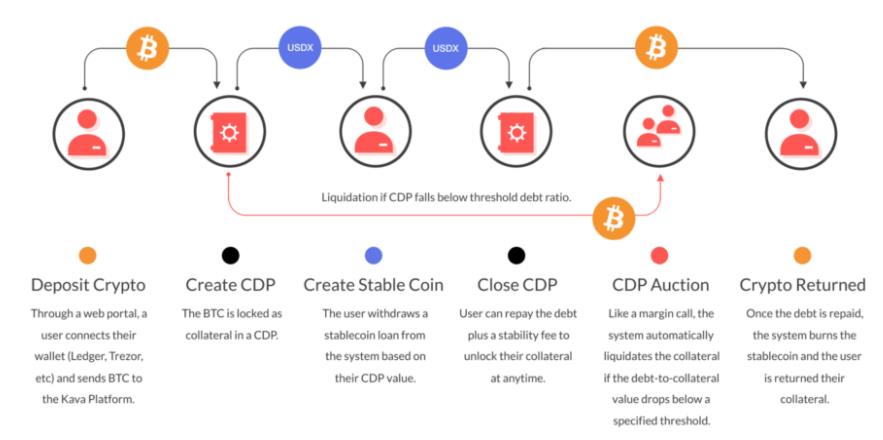

The CDP module is the basic building block for loans that helps in implementing collateralized debt positions. This is the heart of the Kava Protocol, and it depends upon the Auction and Price feed module. It also works with the Incentive module that determines the incentive rewards to USDX borrowers. To avoid liquidation, CDP must maintain a collateralization ratio of more than 1.5.

Source: Binance

Also, the auction module is responsible for maintaining the system’s stability, and it comprises several types of auctions that depend upon different economic conditions. This helps to maintain USDX’s 1:1 peg with the U.S. dollar. The Price feed module is responsible for feeding market prices from Chainlink oracles.

On the other hand, the BEP-3 module acts as a secure bridge between Kava and Binance Chain that supports cross-chain transfers. Finally, the Incentive module keeps track of the CDP creation and issues weekly rewards to USDX borrowers.

The KAVA Ecosystem (Before Rebranding)

The Kava Ecosystem has divided its platform into three main modules:

1. Kava Protocol

This is the stablecoin Minting protocol of Kava. Also, $KAVA is the native token of the Kava blockchain, which is involved in the platform’s security, governance, and mechanical functions.

Therefore, users can deposit their crypto assets as collateral and mint Kava’s stablecoin, $USDX. This stablecoin is used as collateral and is minted when a user opens a Kava CDP. In other words, users deposit some assets as collateral and mint or create new stablecoins.

For example, on Kava, users can stake $BNB, $BTCB, $BUSD, $XRPB, $KAVA, $HARD as collateral to mint USDX. The collateral is locked into the system, and it will be unlocked when the lender repays the loan along with interest accrued during that period.

Anyone in the world can gain access to the Kava ecosystem by buying KAVA on any of the major centralized exchanges and transferring their funds to the Kava Platform

Learn more: https://t.co/9IubsiW3fg pic.twitter.com/vCggxpg6El

— Kava (@KAVA_CHAIN) October 10, 2021

2. Hard Protocol

Hard Protocol is an application that runs on Kava Chain. It aims to add an autonomous money market protocol into the KAVA protocol. Also, the $HARD token is an asset on the Kava Chain. Users receive it as a reward for supplying and borrowing assets on the Hard app.

There are three primary activities:

- Supply – safely supply your digital assets on HARD and earn interest.

- Borrow – You can use your digital assets as collateral to borrow others.

- Earn – Suppliers and borrowers make HARD the governance token of the application.

3. Swap

Cross-chain Autonomous Market Making (AMM) Protocol that allows users to swap supported tokens

The SWP/USDX pool is one of the most active pools on Kava Swap

Providing liquidity is one of the best ways to take advantage of Kava Swap's increasing trading volume.

Get access to +200% APY now: https://t.co/4KURSl2YVU pic.twitter.com/570333TH2Y

— Kava Swap (@Kava_Swap) October 9, 2021

KAVA in Numbers

When writing this article, the platform records the following volume in terms of transaction processing, On-Chain asset lock, and community base.

Source: KAVA

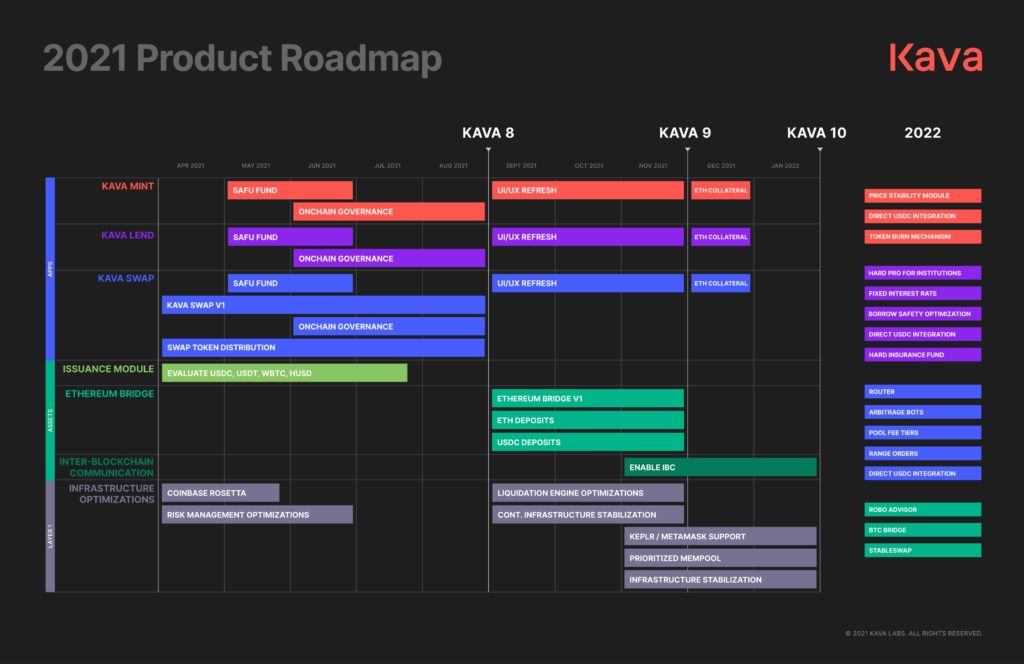

KAVA RoadMap

KAVA has successfully engraved a massive milestone in 2020. A few of them are:

- Launch of Kava Lending, world’s first cross-chain lending platform that allows to mint USDX stablecoin loan by providing BNB as collateral

- Mainnet upgrade to support HARD Protocol, the world’s first cross-chain money market

- Cross-chain transaction between Kava and Binance Chain that supports BTC, XRP, BNB, and BUSD

- Major integrations with partners like Trust wallet, Chainlink, PlasmaPay, OKChain, etc

On the other hand, the project has planned its roadmap for 2021. Major upcoming releases of 2021 will include cross-chain bridges, Kava API (Financial Service Integrations plugin for app developers and financial institutions), etc.

KAVA Tokenomics

The platform’s native token, $KAVA, is a BEP-2 token with a Market Cap of USD 570,851,323 and a Total Value Locked (TVL) of USD 308,509,708 with a Market Cap / TVL Ratio of 1.85.

Also, it has a circulating supply of 91,443,180.00 $KAVA and a total supply of 147,181,069 $KAVA.

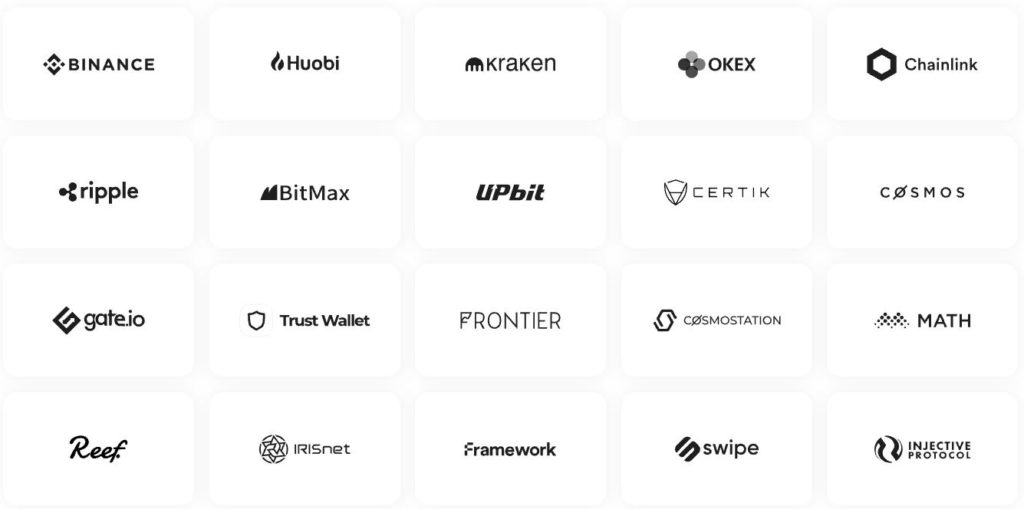

Partners

KAVA has collaborated with some of the major platforms of the blockchain industries, and a few of them are Binance, OKEx, Ripple, Cosmos, and Tendermint, etc.

Source: KAVA

In the next part of this article series about Kava protocol, we will explore the product rebranding that the platform has done recently.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Kava. Copyright Altcoin Buzz Pte Ltd.