Wrapped stSOL tokens on Terra, also known as bSOL, are now accepted on Anchor Protocol. This means that interested persons will now be able to borrow the Terra USD ($UST) stablecoin with bSOL tokens as collateral.

The introduction of bSOL on Anchor Protocol will also help to increase the protocol’s collateral base. This, in turn, will furthermore facilitate more use cases for bSOL and better awareness and adoption of Anchor Protocol.

This article covers a step-by-step process on how to borrow the Terra USD ($UST) stablecoin on Anchor with bSOL as collateral. It is also important to note that borrowing UST with bSOL will attract an estimated 60% LTV.

1/ It’s the moment you @solana bulls have been waiting for…$bSOL is coming to Anchor as a new collateral type! 🎉 Upon execution, users will be able to borrow $UST against their $bSOL up to 60% LTV.

— Anchor Protocol (@anchor_protocol) May 6, 2022

Before we move on, let’s find out more about Anchor Protocol.

What You Should Know About Anchor Protocol

Anchor Protocol is a Terra-based decentralized saving protocol. It is also known for its huge APYs and fast withdrawals. The protocol brings together borrowers and lenders, providing them with a reliable platform to either lend or borrow funds.

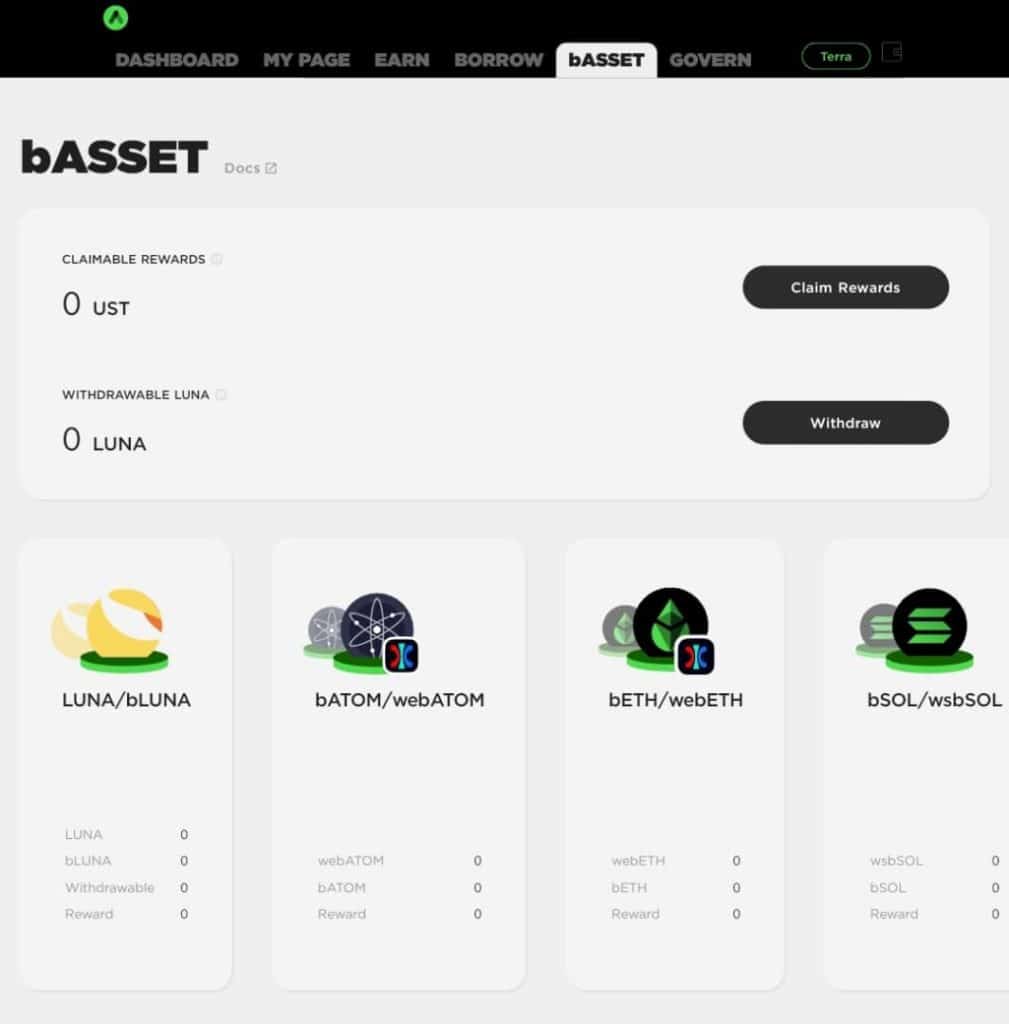

Anchor Protocol is also made up of two main participants, namely:

- Lenders – They earn low-volatile yields on their stablecoin deposits, also known as Anchor Terra (aTerra) tokens.

- Borrowers – They stake crypto assets (also known as Bonded assets or bAssets) as collateral to borrow stablecoin loans.

About bSOL

bSOL, simply put, is wrapped stSOL tokens on Terra. The token is also now an acceptable collateral on Anchor Protocol. This means that Anchor users will be able to borrow the Terra USD (UST) stablecoin with bSOL as collateral.

This is a major move for the entire Solana (SOL) ecosystem. As it will mean more use cases and better awareness for its SOL tokens.

How to Acquire bSOL Tokens

Notably, bSOL is a wrapped version of stSOL on both the Solana and Terra blockchains. This means that interested persons will be able to wrap or exchange stSOL tokens to bSOL tokens and vice versa. Once stSOL is wrapped to bSOL, all its staking rewards will be accrued in UST.

Also, depositing bSOL as collateral on Anchor will result in the accumulation of aUST as staking rewards. Other bAssets on Anchor include bLUNA, bATOM, and bETH.

The Steps to Getting bSOL Include:

- Interested persons will need to first stake Solana (SOL) tokens with Lido. Stakers, in return, will get stSOL.

- Next is to wrap the stSOL token on Solana to get bSOL. The bSOL can then be offered as collateral on Anchor Protocol.

How to Introduce bSOL as Collateral on Anchor

To do this, interested persons will also need to:

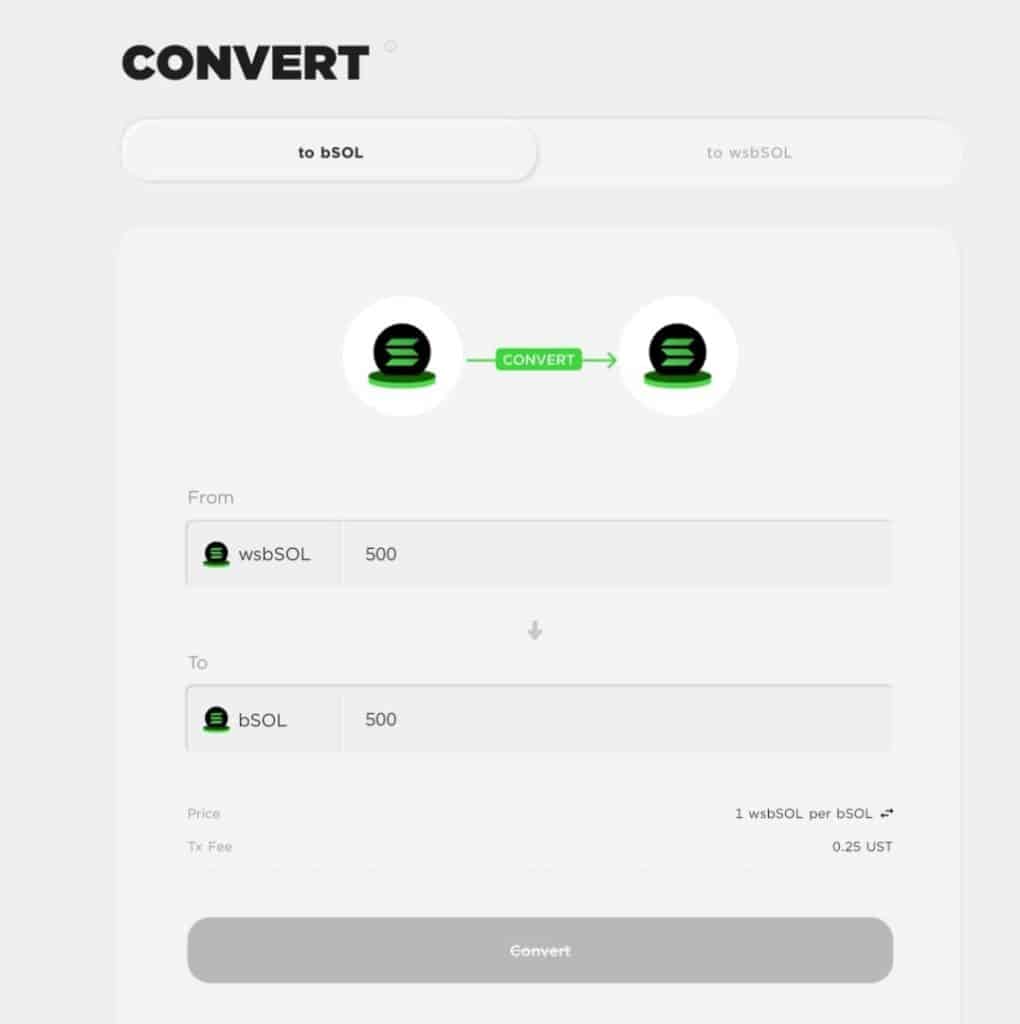

- Send bSOL through Wormhole to become wsbSOL (Wormhole-wrapped bSOL).

- Next is to convert the wsbSOL back to bSOL on Anchor.

Source – Anchor Protocol

- Then, deposit bSOL as collateral to be able to borrow the Terra USD (UST) algorithmic stablecoin.

- Lastly, is to pay, borrow, or receive ANC tokens as a reward. Notably, the ANC token serves as incentives or liquidity mining rewards for borrowers on Anchor.

In conclusion, introducing bSOL will help bring more TVL to Anchor Protocol. While also facilitating leveraged Solana staking and better decentralization on Solana (SOL). Both Solana and Anchor will also enjoy better awareness and adoption.

⬆️Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ACCESS PRO membership (worth $99). MEXC supports U.S. Traders in all trading pairs and services.

To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.