MakerDao had hit a major low and there were concerns with the DeFi behemoth’s future. How has MakerDao responded to the situation? Altcoin Buzz takes a closer look.

March 12: The Event – Under-collateralized debt of $4.5M

On March 12, Ethereum experienced a loss of over 30% of its market price within 24 hours. Such a radical drop put the MakerDao ecosystem to a harsh test.

According to MakerDao, a Maker Oracle was not capable of matching the speed of the price crash. Also, there was no report of a bug or a hack being the cause. As a direct result, the Maker Vaults didn’t receive the most recent price and remained over-collateralized.

Meanwhile, the scenario allowed some users to win auctions and gain ETH with zero DAI bids. This created a $4.5M DAI surplus in the market.

March 14: Immediate Fix – Maker Debt Auctions announced to meet the deficit

To recapitalize the system and make up for the $4.5M deficit, MakerDao had the option of putting up auctions for its Governance token, Maker (MKR). It would be minted and sold as per the below methodology:

- The protocol offers a keeper (the bidder) a lot of 250 MKR for a total of 50,000 Dai, translating to a price of 200 Dai/MKR.

- A second keeper bids 50,000 Dai but only requires 230 MKR, translating to a price of 217 Dai/MKR.

- The bid prices increase through the keepers’ willingness to take slightly less MKR in exchange for 50,000 Dai.

March 15: Long Term Fix Proposal: Risk Parameters, Governance Security Module and Liquidation Freeze Module adjustments proposed

There was an acknowledgment that the Maker Protocol needed more safeguards to strengthen itself in light of a system-wide Dai shortage. It should also be able to protect itself in case of another potential ETH price crash in a volatile market scenario. Proposed protocol alterations included:

- Lowering of Dai Stability Fee from 4% to 0.5%

- Raising Dai Savings Rate Spread to 0.5%. Note: This will set the Dai Savings Rate to 0%

- Bringing down SCD debt ceiling to 5M to 20M range

- Reducing Governance Security Module delay from the existing 24 hours to only 4 hours

- Activation of Liquidation Freeze Module

Voting was then announced.

March 16: Improve liquidity – Proposal for Collateral Onboarding of USDC

MakerDao proposed introducing the USDC stablecoin as a collateral citing the following reasons:

- Increase Dai liquidity, especially for keepers participating in both FLIP and FLOP auctions.

- Increase Dai liquidity to ensure that the Dai peg moves closer towards $1.

March 16-March 30: Series of Adjustment Polls

From March 16 to March 30, there has been a series of polls in the Maker Voting Platform. Votes started on 16th, 23rd, and 30th March. The voting was mainly on the below points:

- Migration Contract Debt Ceiling Adjustment

- Dai Savings Rate Spread Adjustment

- Dai Stability Fee Adjustment

- Sai Stability Fee Adjustment

- USDC Stability Fee Adjustment

Some major Votes and their results:

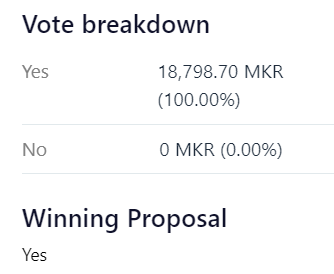

- Unblock the remaining Debt Auctions – March 23, 2020

100% of the voters were in favor of the proposal.

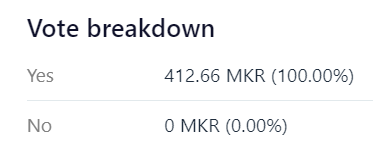

- Migration Contract Adjustment – March 30, 2020: To lower Sai to Dai migration debt ceiling to 0

100% voted for the proposal.

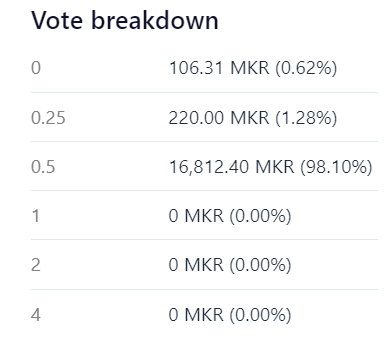

- Dai Savings Rate Spread Adjustment – March 30, 2020: for a Dai Savings Rate Spread within a range of 0% to 4%

The Dai Savings Rate Spread was voted for 0.5%.

- Dai Stability Fee Adjustment – March 30, 2020: for a Dai Stability Fee within a range of 0% to 4.5%

The Dai Stability Fee Adjustment was decided to be 0.5%.

- Sai Stability Fee Adjustment – March 30, 2020: for a Sai Stability Fee within a range of 3.5% to 11.5%

The Sai Stability Fee adjusted to 8%.

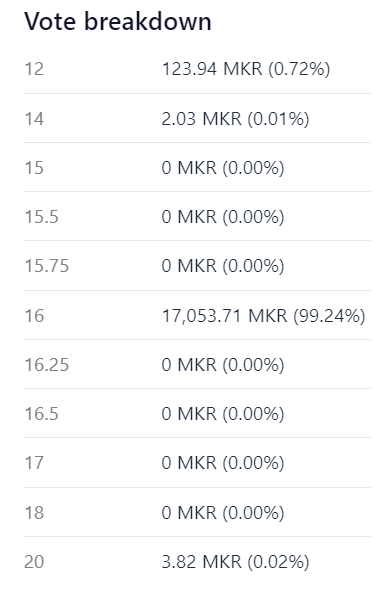

- USDC Stability Fee Adjustment – March 30, 2020: for a USDC Stability Fee within a range of 12% to 20%

The USDC Stability fee adjusted to 16%.

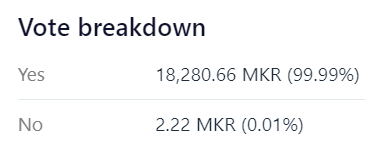

- Single Collateral Dai System shutdown on April 24th, 2020

Yes, good old SAI is shutting down. Below is the result, with an almost unanimous vote in favor of the motion.

March 25: MKR Token Control to Governance

The Maker Foundation completed the transfer of MKR token from it to the Maker governance community. MKR holders now control 100% of the MKR token contracts. As a result, decentralized governance would now be the only avenue for changing MKR token authorizations.

Conclusion

Whatever happened on March 12 had put MakerDao in a bad light. However, the learnings are immense for both MakerDao and the entire DeFi ecosystem as a whole. Also, in spite of all the existing drawbacks, the purpose of being a 2-coin protocol somewhat makes sense.

The immediate proposals will make the platform more robust. Moreover, it will be prepared to handle difficult situations in the future. We believe that the Maker Protocol will emerge as stronger than ever and continue to be the No.1 DeFi platform for a long time.