Isn’t it exhausting and inefficient to manually check for the best crypto trading prices on different Centralized and Decentralized exchanges and then carry out the trades? That is where price Aggregators fit in. They work just like Expedia works for your travel bookings. They are getting you the best deals always.

However, CeFi and DeFi run in parallel universes. For example, DeFi has aggregators like 1inch and Paraswap, and there are eToro and Crypto.com for CeFi exchanges like Binance. It’s always been one or the other. Until OpenOcean entered the space, the first DeFi CeFi crypto aggregator.

Therefore, we think it’s a project with lots of potential because it seems to be providing maximum returns and swap rates, outperforming most of the DEX aggregators. In this article, you will discover everything about this excellent decentralized platform.

What is OpenOcean?

OpenOcean is a financial app in the crypto economy that can appeal in decentralized and centralized worlds because it offers DeFi and CeFi options. Some are calling it CeDeFi. So, why limit yourself only to DEX or centralized exchange pricing when you can get the best of both worlds?

The enormous increase in DeFi and financial apps means exchanges and AMMs (automated market makers) are constantly looking for liquidity and great pricing for themselves and their customers. And that’s what aggregators like OpenOcean do.

As part of launching the new Atlantic upgrade, OpenOcean tested more than 4500 swaps to see how its system did compare to other DEX aggregators. And what they found out was that 69% of the time, OpenOcean beat 1inch on price and speed. For anyone, trader, AMM, or individual, 69% is a big difference and an excellent reason to give OpenOcean a try.

🚀#OpenOcean Atlantic Version just launched on @ethereum

Through this update, it delivers traders the BEST RETURNS!

Traders can take full advantage of improved algorithm for more efficient order routing, heavily reduced gas fees and minimal slippage👊https://t.co/NbZFZAQ59W

— OpenOcean – A leading Web3 DEX Aggregator (@OpenOceanGlobal) November 1, 2021

And with over $66 billion in liquidity, 1.2 million trades, and 350,000 customers, the public likes what OpenOcean offers.

OpenOcean Tokenomics

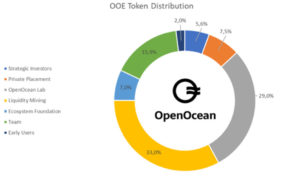

With an initial supply of 78,989,286, OpenOcean’s ERC-20/BEP-2 token,$OOE, has a market cap of USD 91.8 million. It’s available to buy and sell on Kucoin. Therefore, the token has three uses:

- Governance-make proposals and vote on suggestions to improve OpenOcean

- Trading & Services-OOE helps keep gas and trading fees down, especially for cross-chain transactions

- Collateral-OOE can be used for margin trading or as collateral for margin lending

On the other hand, there is a total fixed supply of 1 billion $OOE, and there is a fixed schedule for releasing new tokens into the market. All 1 billion will be issued within five years with a plan:

Source: OpenOcean Whitepaper

OpenOcean Ecosystem and Roadmap

OpenOcean Atlantic runs across aggregated blockchains like Binance Smart Chain, Avalanche, Polygon, among others. Also, there is support for OKExChain, Tron, Ontology, and Heco. Also, they will support Ethereum.

Therefore, an ecosystem foundation is designed to make future integrations of blockchains, trading partners, and complimentary services easier. The ecosystem foundation currently holds ~10 million $OOE.

On the other hand, according to the roadmap, goals during this stage entering Q4 2021 include:

- Adding more public blockchain networks like Solana. They currently support ten different blockchains.

- Support aggregator activities across chains and perform cross-chain swaps seamlessly for customers.

- Add more spot products.

- DeFi yield products to aggregator services.

- CeFi derivative products like USDT and Coin based futures contracts.

What's your favorite #BSCGems💛?#OpenOcean got you covered to add custom tokens found on @coingecko !

♾Trade them on https://t.co/b4ffEL98RM across all 10 networks in one place at best price. #DeFi #cryptocurrency pic.twitter.com/5XtIGYEDqt

— OpenOcean – A leading Web3 DEX Aggregator (@OpenOceanGlobal) November 8, 2021

Competitors & Potential Risks

On the CeFi, centralized exchange side of things. Aggregators like Cryptoradar, eToro, Binance, and CEX.io are direct competitors for OpenOcean. On the DeFi side of things, 1inch, Paraswap, and Matcha.

On the other hand, you need to be aware of a couple of risks aside from the general risks involved with trading crypto, trying to arbitrage, or using derivative products.

Between management, early and strategic investors, advisors, and the development team, 58% of the coins are already committed to others. That means there is not a ton of liquidity in the market, and those holders can sell at any time after their lockup periods end.

TOP 15 AVALANCHE DAPPS BY VOLUME 7D

Top 4 positions remain the same this week while top 5 is replaced by a new factor @stabilize_fi. Let's see others. #AvaxholicInsights #Avalanche #AVAX #dApp $JOE $AAVE $PNG $MIM $SET $LYD $ELK $OOE $TEDDY $YTS pic.twitter.com/wQ8OHmjP38

— Avaxholic 🔺 (@avaxholic) November 7, 2021

The release of 1 billion tokens in five years is one of the fastest rates we’ve seen from a cryptocurrency that could add downward pressure to prices.

Finally, the price of $OOE has been between $0.26 and $1.01. For most of the last six weeks, $OOE has ranged from $0.60 to $0.75. In the intermediate-term, the chart shows the range getting tighter, which can manipulate the $OOE token.

Also, join us on Telegram to receive free trading signals.

Above all, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by OpenOcean. Copyright Altcoin Buzz Pte Ltd.