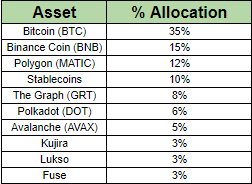

It’s monthly portfolio update time again. And this time I am adding a super revolutionary coin to my portfolio. Its price is already up 230% in last 30 days. But it is still under $1, has a monster release in about 20 days and the Bitcoin’s Ordinal hype is working all in favour of it.

Curious to know if I can beat the market with this portfolio? Let’s find out!

General Update P&L

I know I must have said this last month too. But what a difference a month makes. First of all, we added Moonbeam. So now we have 10 holdings plus stablecoins. Until today. Because today we are using our last $500 in stablecoins to add another position. One of our favorite Layer 2’s.

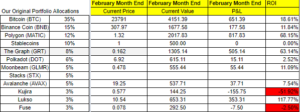

More about that coming in a second. After a big comeback in January, our portfolio rocked February. We almost doubled our ROI from 12.6% as of January to 24.5% today. We went from 4 losing positions to only 2. And those two, smaller caps Kujira and Fuse improved their positions in the last month. Their losses are smaller than before. So we are sticking with them.

How many coins in our Master Portfolio are in your portfolio? Let us know in the comments below.

Benchmarks

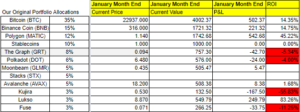

So how did our two benchmarks Bitcoin and Ethereum do this last month? In January, this is how the returns looked:

- Bitcoin 14.35%

- Ethereum 18.74%

- Our Portfolio 12.62%

So we came back nicely from an ugly November and December. But we were still trailing the market. Not anymore, my friend. Here are our February returns:

- Bitcoin 18.61%

- Ethereum 19.33% (Notice both are higher than January so they made money too)

- Our Portfolio 24.5%

BOOM! So who allowed us to beat the market? Almost everyone. We now have 8 profitable positions. But let’s start with the biggest month-to-month changes. The hugest, most monstrous gain in the last month was almost $600. Our position went from -42 to +$505. WOW! And who did that? The Graph. Like all cryptos, The Graph could go back to unprofitable next month. But I expected this position to be profitable sometime.

More About Beanchmarks

Why? Because we bought quality at a good price. More than that, The Graph is still the leader in its sector of organizing blockchain data. Buying leaders while they lead is a winning strategy. The next biggest monthly change was Polygon up just under $300 for the month. They’ve been on fire and they are capturing everyone’s attention with the deals they are making.

And now their zero-knowledge-based EVM is coming out at the end of March. They just seem to be doing everything right. Here’s a sum of our other winning positions. Lukso is up the highest by % at 117%. Then we have Polygon and The Graph at 68% and 63% respectively. Then Bitcoin at 18.6% and a respectable 11% from both BNB and Moonbeam.

🥁 It’s time to add another chain to the MIPs program!

The next chain to begin integration on The Graph Network will be announced tomorrow.

Any guesses which chain it will be? Make your guess by tagging the chain below⬇️ pic.twitter.com/cHh0DeUPXq

— The Graph (@graphprotocol) March 6, 2023

This is our portfolio management at work. When you diversify positions, as we have with our 10, you can increase returns AND reduce risk at the same time. And we think we are doing exactly that. We are up 6% from 24.5% against 18.6% with lower risk than just holding Bitcoin alone. Our goal is to beat Bitcoin and have a lower risk than Bitcoin only.

Narratives & New Coin Addition

Narratives matter a lot in crypto. What’s the trending story? Right now, one of them is Layer 2 solutions. Coinbase just announced its Base Layer 2. Bitcoin’s Layer 2 with Stacks, Rootstock, and Ordinals has been busy. And ETH Layer 2’s are always active from the Polygon zk update to increasing transactions on most L2 solutions. So who did we pick?

We are happy to announce that we will be adding Stacks to our portfolio. We still have $500 in stablecoins and we are using it to buy Stacks. Now we have no cash on the sidelines and we are fully invested.

This means we can no longer add a position without selling something. With our current portfolio management rules in place, none of our positions is huge enough on a % basis for us to take profits to sell. When they are big enough we will hold in stables or buy something else with the profits.

Why Stacks?

With a few good Layer 2 choices out there, this is a fair question. We are adding Stacks because it’s the most exciting thing to happen to Bitcoin in a while. It’s already been building DeFi for Bitcoin and the Bitcoin Name Service. But now with Ordinals, NFTs are on Bitcoin and only use up 1 satoshi of block space while doing so. By the way, we have a video on Ordinals coming up soon, at the time of writing this article. So, stay tuned for that in our youtube channel.

Welcome to #Stacks 💜 👇

⭐ A #Bitcoin layer for smart contracts

⭐ Enabling smart contracts and decentralized applications to trustlessly use $BTC as an asset

⭐ Settling transactions on the #Bitcoin blockchain

⭐ Unlocking #Bitcoin Decentralized Finance, NFTs, BNS, and more pic.twitter.com/VoHnypE1dx— stacks.btc (@Stacks) February 21, 2023

But Stacks is more than just the recent hype. It and Rootstock are the only 2 main operating Layer 2 solutions for Bitcoin if you don’t include the Lightning Network in that. Other than the .btc Name Service, just a few of the great apps on Stacks include:

- Registrar by Paradigma: It lets you register decentralized domain names and IDs without needing to use IPFS like Ethereum does. All secured by Bitcoin.

- Sigle: A Web3 journaling and blogging app so you can’t be censored for what you write.

- USDA: The first USD stablecoin in the Bitcoin ecosystem. Minted with Stacks and secured by Bitcoin.

- Zest Protocol: Bitcoin loans for institutions. Where DeFi and TradFi are meeting in Bitcoin, and more.

So you can see Stacks is building an extensive ecosystem that most of us don’t know much about. And that’s what I like about the Ordinals news and hype. Yes, it’s hyped right now. But there’s a new awareness for Stacks and Bitcoin Layer 2’s. An awareness we SHOULD have had all along. But now we are playing catch-up to all the amazing things happening over on Bitcoin.

We bought our $500 worth at 76 cents so that means we have 657 $STX in our portfolio now.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.