The recent UST (now known as USTC – Terra Classic USD) debacle has raised grave concerns over the future of decentralized stablecoins. According to CoinGecko, the market cap of UST reached as high as $18 billion, but now it is at $0.29 billion.

Luna (now known as LUNC – Luna Classic), the token that had an inverse burning and minting relationship with UST, also collapsed. This resulted in a huge market crash. Some announced the death of decentralized stablecoins. Therefore, in this article, you will discover why aUSD is a very good stablecoin alternative.

Table of Contents

Alternatives to UST

So, what are our other alternatives? We already have centralized stablecoins like USDT, BUSD, and USDC. These coins are backed by fiat and are pegged 1:1 with the dollar.

- USDT: It has concerns regarding regulations and has a lack of transparency regarding its asset backing.

- BUSD and USDC: They are relatively safer and are transparent about their holdings.

However, as all of these coins are managed by centralized parties, they can be easily blacklisted and locked, added, or removed from circulation. This is not good for De-Fi, where code is the king. The network should run without manual intervention. As stablecoins are at the core of De-Fi (Lending, Borrowing) that’s too much risk to have. So, we need decentralized stablecoins. This was the reason UST became popular.

What are our other alternatives? The closest alternative is DAI. The Maker DAO Platform mints DAI. It is backed by digital assets and is decentralized. However, it is fundamentally different from UST. UST is an algorithmic stablecoin with no backing of physical or digital assets. People predicted that DAI would become the top decentralized stablecoin. However, it had a problem, it was built on Ethereum and Ethereum was not scaling.

Is aUSD a good alternative?

This brings forth a unique opportunity to build a stablecoin that will fill this gap. A stablecoin that is not algorithmic, but asset-backed, highly collateralized, and has high adoption. The technology is moving towards modular blockchains where the computation layer is different from the application layer.

$aUSD is the decentralized stablecoin of @Polkadot powered by @AcalaNetwork.

BUT what is it, why is it exciting and how is it different from other stablecoins?

These 7 quick facts will give you a complete understanding 🧵..

— Robinson Burkey (@RobinsonBurkey) May 24, 2022

As the computation layer, it is shared among multiple blockchains, where interoperability is built at a protocol level. We need a common stablecoin solution for such interoperable blockchains and aUSD is trying to solve that in the Polkadot ecosystem. It is trying to become the decentralized stablecoin of Polkadot and Kusama.

Multiple collaterals back up aUSD. The Acala (Karura in Kusama) team in Polkadot developed the product. Acala is a decentralized finance protocol, built on Polkadot. It is scalable and EVM Compatible.

In addition, some of the features of aUSD include

- Backed by DOT, KSM, ACA, KAR, BTC, and ETH (Currently ACA, LDOT, LCDOT, and DOT are available)

- 1 aUSD is equal to 1 USD

- Decentralized and censorship-resistant

- On-chain liquidations with a guaranteed oracle price feed.

- No need for bridges. Transfer aUSD between any parachain on Polkadot or Kusama.

aUSD is Backed by the $250M Ecosystem Fund

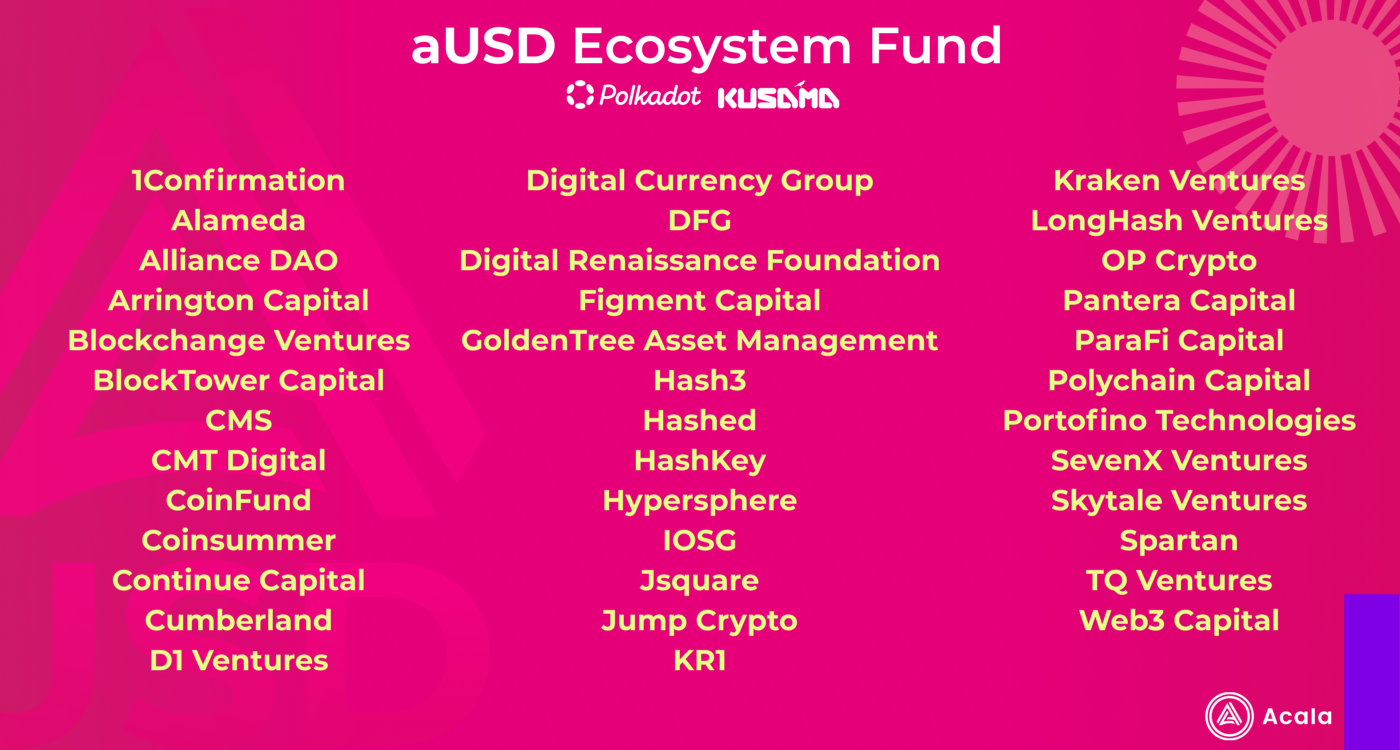

So, what about adoption? Recently Acala along with a consortium of 9 Polkadot parachains and several Venture Funds launched a $250 million aUSD ecosystem fund. Therefore, the goal is to identify and fund pre-seed or seed-stage startups that are building projects with a strong stablecoin utility.

Also, the fund will look out for utilities like DEXs, DAOs, asset management, money markets, payments, etc. The maximum funding will be $50,000 per project. The fund will also connect the projects to other Venture Capitals for further rounds.

Source: Acala Medium

aUSD is Backed by Polkadot’s Partners

On the other hand, some of the Top Polkadot parachains are already a part of the aUSD ecosystem fund. They include Acala, Moonbeam, Astar Network, Efinity, HydraDX, Manta, Centrifuge, OriginTrail, Parallel, and Zeitgeist.

In addition, after the launch of the ecosystem fund, a lot of projects have integrated aUSD. Some of these projects include Imbue Network, Mangata X, and Satori. Check out Acala’s latest ecosystem update to find out why aUSD is moving in the right direction.

Conclusion

Decentralized stablecoins are an absolute necessity to transfer value in a Blockchain. However, there is a cost of experimentation, as experienced in the UST saga. We now need a secure and well-designed stablecoin.

Moreover, backed heavily by collaterals, being a part of a promising Blockchain, and also having support from some of the key players in the ecosystem, aUSD is in a key position for future adoption. With gradual adoption, aUSD will become popular and thus, might succeed.

Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Finally, find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.