CoinGecko released their 2022 annual crypto industry report. There’s a lot of interesting information contained in there. So, we’re about to give you the highlights of this report. We’ll partly follow Zhong Yang Chan’s presentation on this. He is CoinGecko’s Head of Research.

Without further ado, let’s dig into the CoinGecko 2022 annual crypto industry report.

Market Landscape – Market Overview

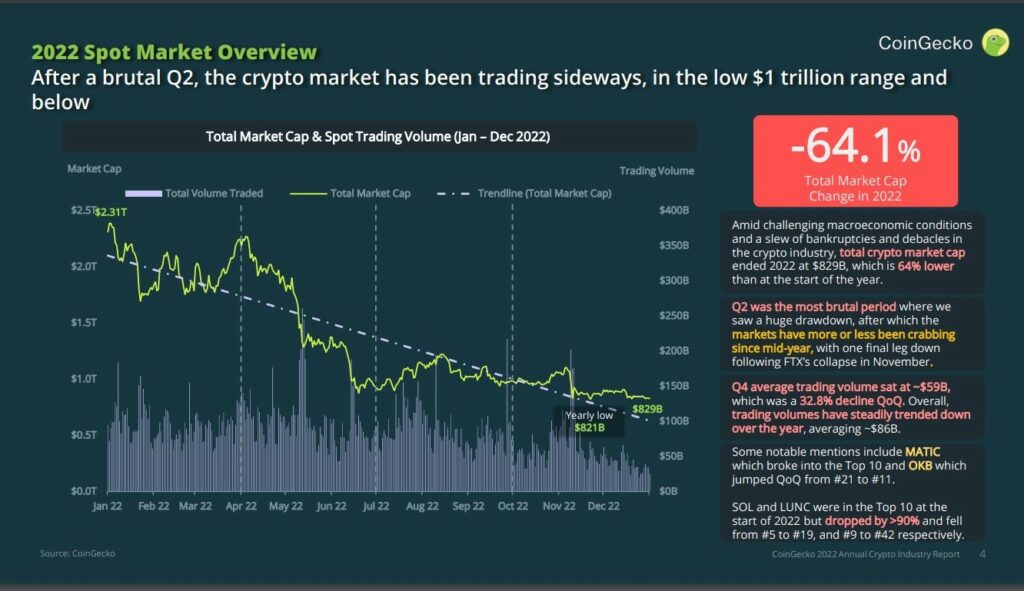

If we look at the market landscape, a few things catch our attention:

- The total market cap change is -64.1% compared to 2021.

- We see the year ending with sideways trading around the low $1 trillion mark.

- The biggest hit was when the Terra/Luna crash happened in April. This bottomed out in July.

- In November, we saw another drop from the FTX collapse. This was not as big as the impact that Terra had on the market.

#CoinGecko 2022 Annual Crypto Industry Report 📊

2022 was a tumultuous year for #crypto – NFTs and DeFi are among the hardest hit sectors, while stablecoins had a mixed performance.

Here are 8 key highlights you shouldn't miss 👇 pic.twitter.com/w4n4BoSq7x

— CoinGecko (@coingecko) January 17, 2023

- Matic made it into the top 10 and the OKB token jumped from #21 to #11. OKB is the OKX exchange token.

- SOL and LUNA were in the top 10, but dropped to #19 and #41. In January 2023, we saw a comeback from SOL into the top 10 again.

- In 2022 that the number of BTC and ETH wallet addresses grew. BTC wallet addresses remained active and stable.

- In bugs and exploits, we saw a loss of $2.8 billion. That’s from 180 exploits. However, from just 5 bridge hacks, bad actors took 65% of all stolen funds. Below is the overview for the 2022 chart in market cap.

Source: CoinGecko 2022 Annual Crypto Industry report

Stablecoins

So, let’s move on to stablecoins. The top stablecoins cement and expand their dominance. USDT, USDC, and BUSD offer safe havens in this bear market for investors. Still, stablecoins lost 17% over last year in market cap, or $27.3 billion. Where USDT lost 16% or $12 billion, USDC and BNB gained $2 billion each.

Most of the losses came during the Terra/Luna collapse and their UST stable coin crash. In this list, DAI and FRAX lost a lot of market cap. DAI 43% and FRAX 44%. See the picture below for an overview of stablecoins in 2022.

FTX

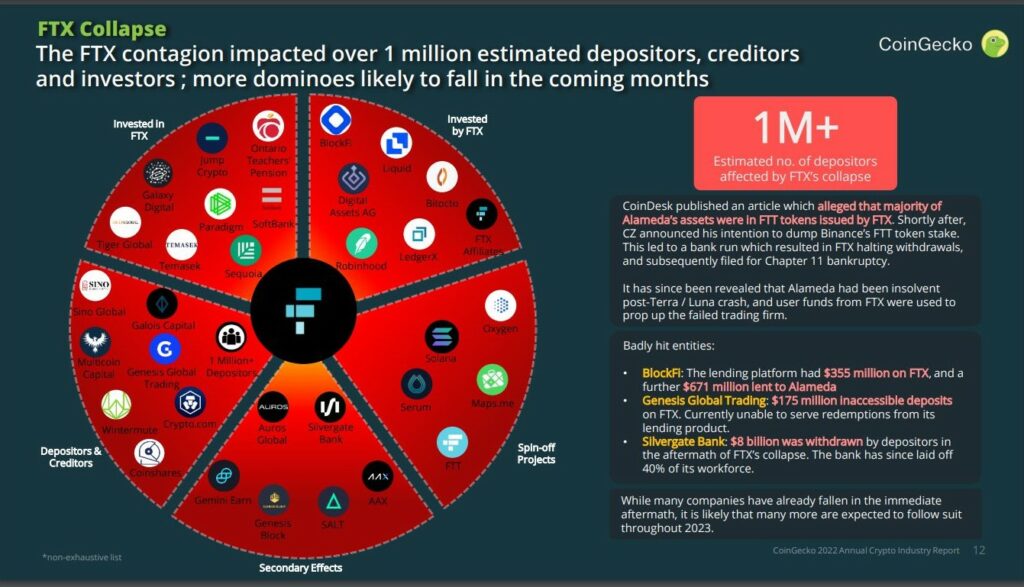

The last stop in this section is for FTX. This affected no less than 1 million depositors, creditors, and investors. We expect more dominoes to tumble in the coming months. For instance, the current Chapter 11 filing by Genesis.

But, FTX can turn the world even more upside down. The WSJ announced on 20th of January that FTX could open its doors again. That’s in the same league as seeing the bankrupt 3 Arrows Capital owners looking for funds, so they can start an exchange.

Bitcoin

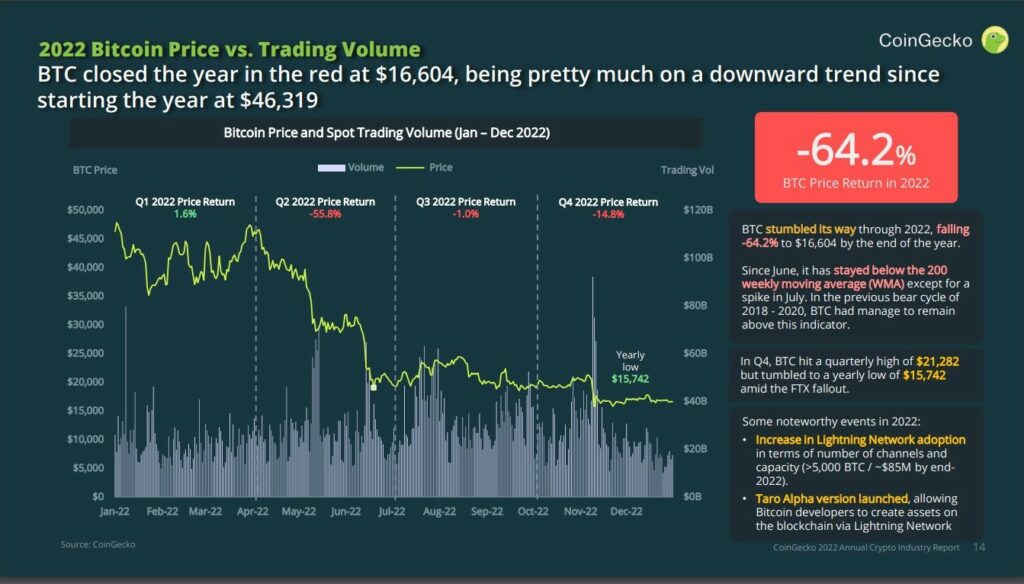

Over 2022, Bitcoin was down 64.4%. However, most major assets ended the year in the red. For instance, gold, or treasuries. Only crude oil and the USD saw green numbers in 2022. The Federal Reserve saved the US Dollar by raising interest rates.

Of all the measured assets by CoinGecko, Bitcoin fared worse. Bitcoin started the year at $46,319 but ended at $16,608. On the other hand, Bitcoin is still the undisputed market leader by market cap. As we know, in January 2023, Bitcoin made a slight recovery and hovers currently around the $21,000 mark.

We also see an increase in the mining hash rate by 54.5%. This is despite the current bear market. The hash rate is how we measure the required computational power on a blockchain network.

Ethereum

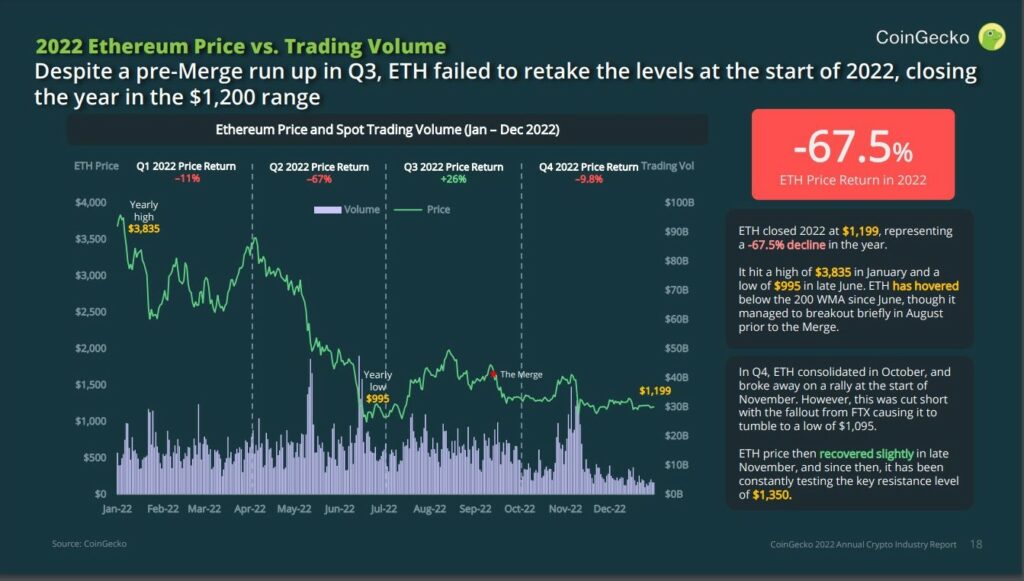

Ethereum saw an interesting year. The highlight was the Merge. This is when Ethereum changed from Proof-of Work to Poof-of-Stake consensus. As a result, Ethereum now uses 99% less energy.

It also saw an increase in staking ETH. At the end of the year, holders staked a total of 15,800 ETH. On the other hand, Ethereum also lost market cap, 67.5%. It started the year at $3,835 but slumped in June to a $995 low. ETH ended the year at $1.203. Late in 2022, ETH became deflationary. A token burn mechanism on fees came in play after the Merge. This started to show its effects around November 2022. Below is the 2022 chart for Ethereum by market cap.

Conclusion

This is the first part of two articles about the CoinGecko 2022 Annual Industry Report. Part 2 should be up soon, so please keep an eye out for it. In Part 2 we will cover DeFi, NFTs, and exchanges.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.