Cryptocurrencies have gained huge popularity in 2021! We have seen new all-time highs, a huge inflow of cash into the ecosystem, China banning crypto, and other governments adopting cryptocurrencies. However, since November 2021, the market has taken a downturn. There is FUD (Fear, Uncertainty, and Doubt) among the investors. Many projects have dipped below 50%. It is a concern? A recent report titled “The 2021 Geography of Cryptocurrency Report” can throw some light on the situation.

About the Chainalysis Report

Chainalysis is a respected cryptocurrency research firm well known for providing various analytics solutions to governments, exchanges, financial institutions, and others. The report tracks three major matrices:

- On-chain cryptocurrency value received, weighted by purchasing power parity (PPP) per capita.

- On-chain retail value received, weighted by PPP per capita.

- Peer-to-peer (P2P) exchange trade volume, weighted by PPP per capita and number of internet users.

Eastern Asia

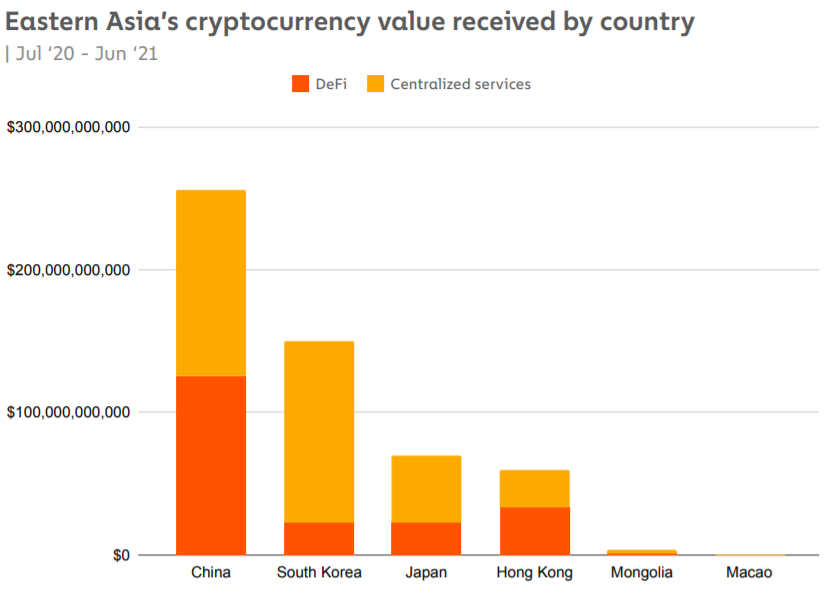

The report covers crypto adoption in 154 countries. We will cover Eastern Asia (China, South Korea, Japan, Hong Kong, Mongolia, and Macao) to understand how the China crypto ban has affected the ecosystem.

- 14% – Compared to the rest of the world, Eastern Asia contributes to 14% of global cryptocurrency value received.

- 27% – Out of this, the domestic market contributes to 27% of volume source. The remaining 73% comes from foreign sources.

The Impact of China

The positives:

China remains the biggest player in the Eastern Asia market.

- $256 billion in cryptocurrency transacted in June 2020 – July 2021.

- 49% of the volume went to DeFi protocols.

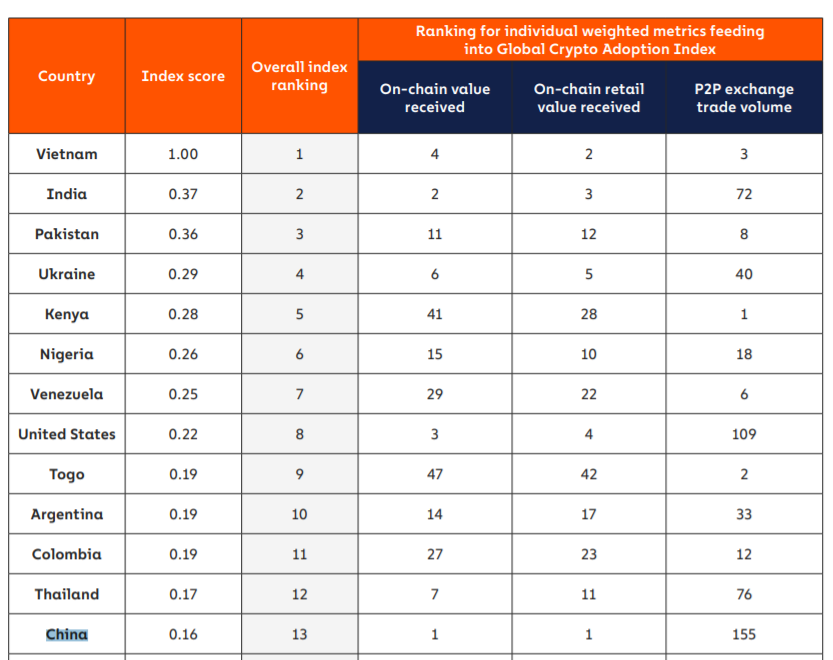

Let’s compare this with China’s overall index ranking. China ranks 13th. China was in 4th position.

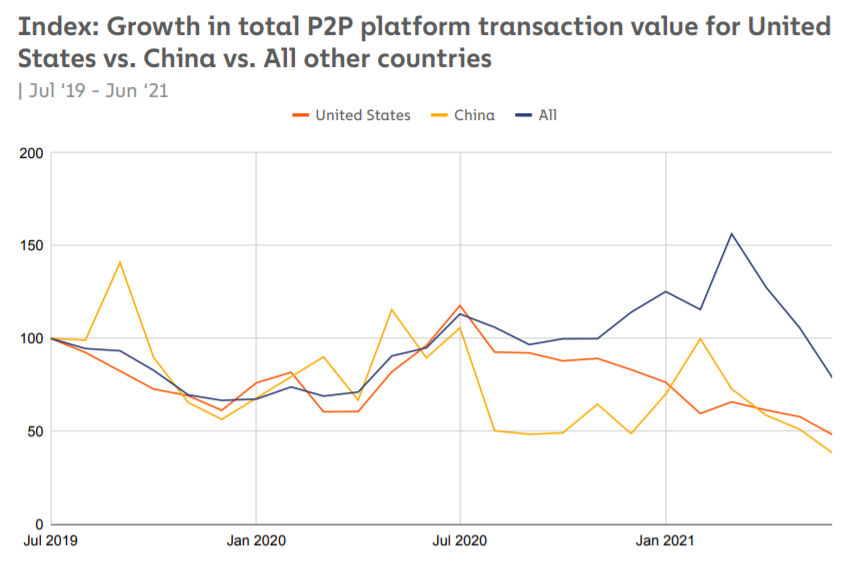

The trading volume in P2P platforms decreased drastically. This is the opposite trend compared to the rest of the world.

What is interesting is that, even with a decline in transaction volume, China still ranks 13th in the overall index and 50% of the people are using decentralized finance. Is it creating an alternate money market? It might be very much possible.

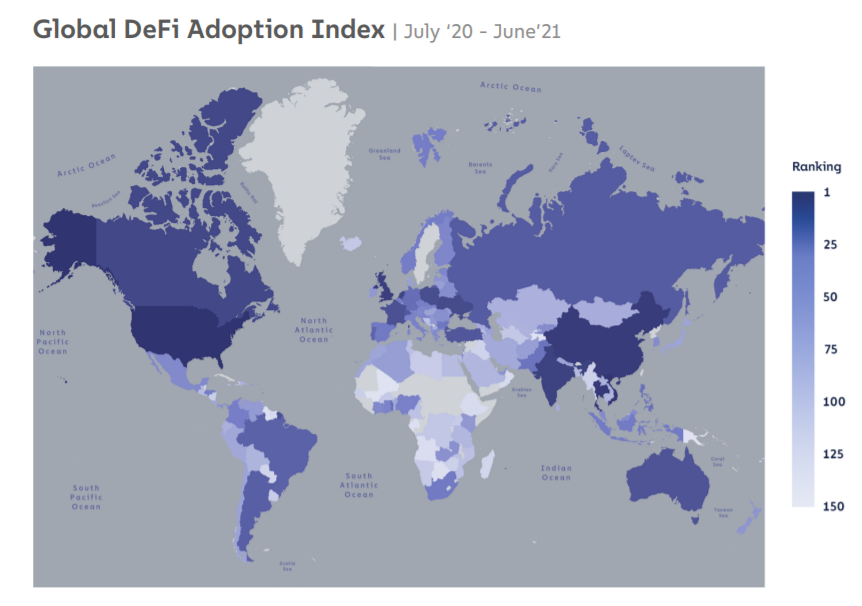

The Global Defi Adoption Index qualifies the statement. China ranked 4th in DeFi adoption.

So what about Digital Yen? The Digital Yen (currently under development) is more focused on reducing the dependence on the USD. To fight one enemy, China might have just created another.

The negatives

- Cryptocurrency adoption in China has slowed down. The global crypto adoption rate is increasing by 2300% in Q3 2019 and over 889% in 2021. China’s adoption growth rate is only 452% compared to the previous year.

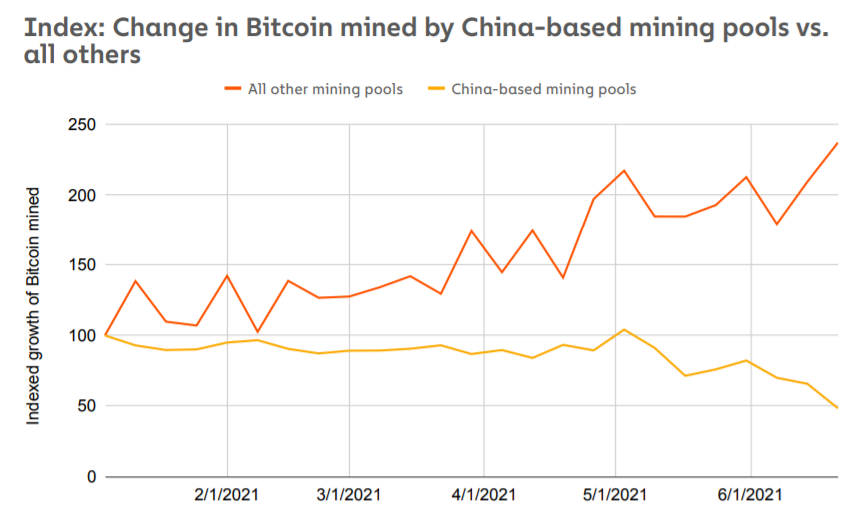

- China’s contribution to Bitcoin mining has also decreased. China contributed to 65% of Bitcoin’s global hashrate. This number has drastically declined by 50% after the mining ban.

On the flip side, this might be a good sign for the overall Bitcoin ecosystem.

Conclusion

Blockchain is mostly decentralized. No central entity can control it. A central ban can not pull down the network. This is proven by the global hashrate data that has remained steady even after the China Bitcoin mining ban.

As the network remains steady, people will want to participate and that will slowly create a parallel economy. While solving the problem of the U.S. Dollar on China’s economy, it should not create another problem for itself. This situation might just backfire.

Source: Geography of Cryptocurrency

Also, Join us on Telegram to receive free trading signals.

Finally, For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.