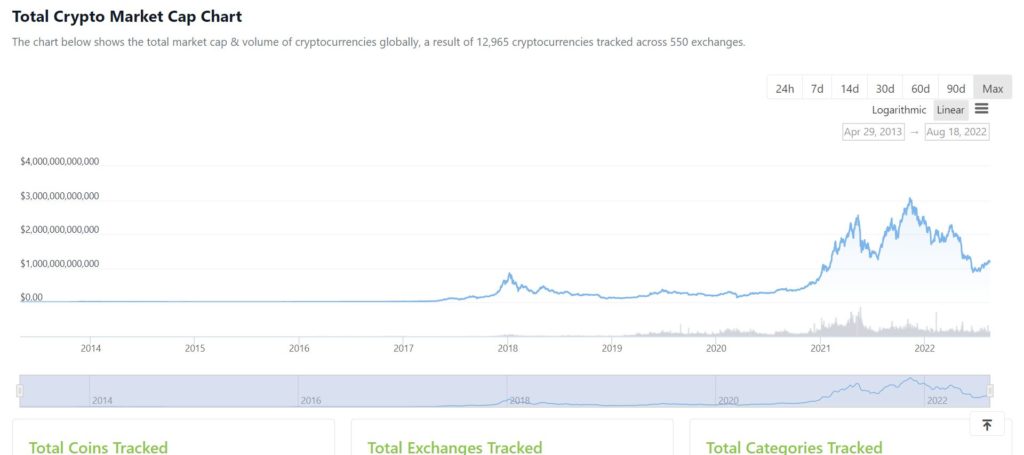

In October 2021, the crypto market cap was at an ATH. Almost $3 trillion at the time being. Currently, this is down to $1.16 trillion. However, only a month ago, it was well below that mark and stood at $800 million.

The crypto market was down by 70% at times. That is way more than the required 20% to determine a bear market. So, will this downturn in the crypto market affect the broader market?

The #crypto bear market marks a significant increase in the number of Google searches regarding 'crypto crash' and 'crypto correction'. Often, these terms are used interchangeably. But what is a #cryptocrash? And what is a #correction?

Check out our 🧵#cryptomarket

(1/7) pic.twitter.com/7DElkozL8h— IN4X Global (@IN4XGlobal) August 11, 2022

Two Topics

We take the Planet Money podcast from NPR as our basis. The July 6th podcast covered two episodes. One is if the current crypto crash can spread to TradFi. The other one is looking at minorities and the unbanked. There’s an emphasis on the black community with this episode. So, without further ado, let’s have a look.

Can the Current Crypto Crash Spread to TradFi?

With crypto investments, we can distinguish two groups. One is the collection of institutions, or the big players. On the other hand, we have retail investors, just like you and me.

One of the big crypto investors is Pantera Capital. They only invest in companies that are into Bitcoin or crypto. Their chief of staff, Emma Rose Bienvenu, thinks this is a great opportunity to buy. She also stated that crypto, or the underlying blockchain technology, didn’t fail. She points out macroeconomic reasons for the crash. Big investors like this can survive and even profit from market downturns like this.

Retail Investors

This in contrast to retail investors who on social media claimed to have lost thousands of dollars. The Fed states that, currently, 12% of US citizens held crypto last year. That’s around 31 million people. However, Jamie Cox said on the podcast that he thinks that the impact of this doesn’t affect the economy too much. He’s a managing partner at Harris Financial Group in Richmond, Virginia.

Although the crypto market cap of $1 trillion sounds like a lot, it isn’t that much at all. Apple or Amazon have twice that market cap as a single company. As a result, Cox doesn’t think the crypto crash will trickle into the broader economy.

The situation is also different compared to 2008. People borrowed money to buy real estate they couldn’t afford. Banks were happy to lend without asking any questions. The market went down and investors lost everything, and banks went into a nosedive. The worldwide economy almost collapsed. It’s different this time around. Neither retail nor big investors use crypto as collateral. It’s considered too risky and too volatile. It’s basically too uncertain. In other words, the corporate loan economy is not affected by the downturn crypto faces.

Source: CoinGecko

Institutional Investments

Still, there are institutions that start to invest in crypto. Think of Tesla or MicroStrategy. There are plenty of other companies that have small crypto investments. It’s not only these well-known names. At this time, the U.S. economy can still shield itself from the crypto space. However, things are moving fast as crypto is closing in on going mainstream.

As a result, we will see this leading to crypto regulation, Cox mentioned. Bienvenu of Pantera Capital also welcomes regulation. It helps in weeding out dishonest projects. But the overall sentiment is that the current crypto crash isn’t impacting TradFi or the broader economy.

The Black Community and Other Minorities in Crypto

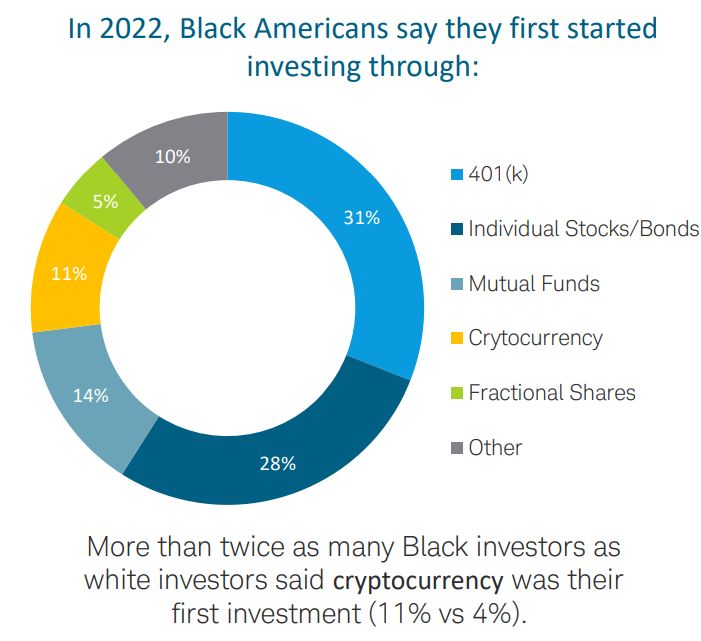

Here’s the result of a survey by Ariel Investments and Charles Schwab. 25% of black investors in America own crypto. On the other hand, for white investors, it’s only 15%.

Source: Ariel Investments

The podcast also talked to Terri Bradford. She works at the Federal Reserve Bank of Kansas City. At work, she studies payment systems. It surprised her to see such a high number of black investors in crypto. The reason for this all leads back to systemic racism. In general, black consumers don’t invest as much in stock markets or retirement funds. White investors tend do to this more. In general, black investors have less wealth to invest.

Lending discrimination was also rampant, aka redlining. As a result, many black people and minorities feel that the financial system doesn’t work for them. However, crypto is a way out of this. For example, the current wealth gap is at 6 to 1. That is the wealth for each person between white and black Americans. This gap also keeps growing.

Professor Tonya Evans

This brings Tonya Evans to the scene. She is a professor at Penn State Law. Her classes are about cryptocurrency and blockchain technology. Instead of warning people of the risk of getting into crypto, she’s the opposite. She warns people for missing out on crypto. She’s all about more consumer education and protection.

And so it begins!

My one-year law school leave of absence to focus on my interdisciplinary crypto, DeFi + economic justice research w my co-hire colleagues at the Penn State Institute for Computational & Data Sciences. @icds_psu #aprofslife #practicegreatness #advantageevans pic.twitter.com/dtQOR8t7KW

— Prof. Tonya M. Evans | #ForbesOver50 (@IPProfEvans) August 15, 2022

In 2014, a co-worker introduced Samson Williams to crypto. He is black and thought that crypto “could be a driver for racial equity.” However, even before the crash, his view changed.

Williams had a 180-degree turn around and sees crypto now as a Ponzi scheme. He’s still keen on blockchain technology. However, he no longer thinks that crypto investments will solve the racial wealth gap. As he puts it, “Bitcoin doesn’t address human rights, civil rights, voting rights.” He doubts that Bitcoin will help minorities. Mostly because of political reasons.

Conclusion

We showed you that the current crypto issues have no immediate effect on the broader market. This even though crypto is about to reach mainstream adoption. Things move fast so this can turn around quickly. There are plenty of positive signs. This is despite the current bear market conditions.

We also saw that, for minorities, crypto can be a way out. Williams likes to see Bitcoin take on a more active role on solving unemployment. On the other hand, he does still believe in blockchain technology. In contrast, Professor Evans sees crypto as a way out for minorities.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

⬆️ALTCOIN BUZZ – BINANCE – GET UP TO $800* ON SIGN UP

Sign up using the links below on Binance Exchange and get the following benefits

- $100 Sign-Up bonus*

- 20% Trading fee discount for life*

- FREE $200 worth of Altcoin Buzz Access PRO Membership*

- Plus $500 Unlockables*

Sign-Up Links –

For more details visit*

*Terms & Conditions Apply

Disclosure: Altcoin Buzz may receive a commission, at no extra cost to you, if you click through our links and make a purchase from one of our partners.