The most focus on India’s new tax laws was on the 30% capital gains tax. However, it’s the 1% TDS law that gives the Indian crypto community sleepless nights. TDS means ‘tax deducted at source’. It’s likely to have a much bigger impact on the Indian crypto space.

So, why is it that this Indian TDS tax has a bigger impact? 1% is a lot less than 30%, right? Let’s have a look at the Indian tax laws and explain how they work.

The 30% Capital Gains Tax

This is the ‘big’ one. The news of the 30% capital gain tax on crypto transactions went all over the world. There are a lot more details involved, though. For instance, a loss on one asset can’t be offset against a profit on another asset. So, as this sample implies, traders pay this tax on losses and profits. Even with an overall loss during a tax year, the 30% tax is due. However, there seem to be some holes in the reasoning.

This is not only for crypto, this is for all speculative income. For example, if I take horse racing, that also attracts 30% tax. There is already a 30% tax on any speculative transaction. So we have decided to tax crypto at the same rate: Finance Secretary TV Somanathan

— ANI (@ANI) February 2, 2022

The above statement seems to make sense if it wasn’t for one thing. Businesses, mutual funds, and stocks losses can be offset. Not so much with crypto losses, though. This is a big difference in interpretation.

The 1% Indian TDS Tax

Now, a totally different ball game is the 1% TDS tax. This means that traders must pay a 1% tax on every transaction. For example, buying an NFT may include 3 transactions.

- Buy crypto.

- Send crypto to a wallet.

- Buy NFT.

According to this law, each step is paying a 1% tax fee. All these costs add up. It’s time to make a list of pros and cons.

Pros of the TDS Tax Law

It wasn’t at all easy to find pros for this law. Nonetheless, here we go.

- The law now recognizes digital tradable assets.

- There is more clarity for the industry on the crypto legal status.

- Crypto has a more regulated operating space.

That the crypto space can use regulation, is a strong and good argument. On the other hand, it can happen that lawmakers don’t fully understand crypto. As a result, laws slow down crypto development, rather than promoting it.

Cons of the Indian TDS Tax Law

As you can expect, there were a lot more cons found against this law. Here’s a list of some comments made against this law.

- The laws don’t clearly define crypto.

- It slows down the overall growth of the crypto industry.

- Reduces mass adaption of crypto.

- The outflow of capital to foreign exchanges.

- Not the same treatment as other investment-related industries.

- Investors and firms are hesitating to invest.

- There is no clear process to comply.

- A logistical nightmare for exchanges to comply.

- Day trading, arbitrage trading, margin trading become unfeasible. As a result, this has a serious effect on order books and volume.

- Markets become illiquid and inefficient.

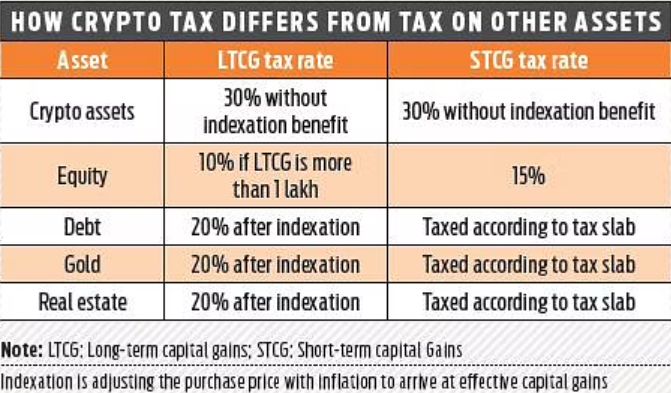

Here is a comparison of how crypto taxes is different depending on the asset in India:

Source: The New Indian Express

To sum up, there is a high burden to comply. It is a very harsh tax, compared to similar capital gains taxes in India. The Indian government compared the TDS to a tax on equities. However, this tax is only 0.1% instead of 1%. In general, this will have a drastic effect on crypto trading in India.

Join us on Telegram to receive free trading signals.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join now starting from $99 per month.