A month ago, no one would have thought that Terra, a little-known blockchain, would have ended the year as the platform with the second-largest LTV in the DeFi sector. This has represented a 200% increment in $LUNA, Terra’s native token. But, what caused this take-off?

According to DeFillama, Terra has 13 DeFi protocols with a spectacular growth of 43% in the last seven days. However, 30 days ago, Terra had $ 9.1 billion in TVL, which represents a 220% growth. This article will discover how this could happen and how to get involved in the most critical Terra DeFi protocols now.

Terra Ecosystem Overview

Terra had 13 DeFi protocols with an accumulated TVL of $20.4 billion when writing this article. Also, only two protocols, Lido and Mirror, operate in other blockchains, reflecting that this blockchain is just starting its path for significant adoption.

Source: DeFillama

On the other hand, Anchor has accumulated 43% of the total Terra TVL, growing 39% of its TVL in the last seven days. To give you a clear idea of how strong are Terra DeFi protocols now, let’s make a simple comparison of how much TVL, on average, has every protocol in the first four blockchains. Of course, these are theoretical numbers:

- Ethereum: $0.42 billion / each protocol. We have to consider that Ethereum has 369 DeFi protocols.

- Terra: $1.57 billion / each protocol.

- BSC: $0.72 billion / each protocol. BSC has 232 DeFi protocols.

- Solana: $0.3 billion / each protocol. Solana has 41 Defi protocols.

But, how has Terra absorbed so much liquidity in just 13 protocols, gaining ground on such well-known blockchains as BSC (Binance Smart Chain) and Solana? Here is the answer.

1. Very High DeFi-Yields

In this article, we will show you some examples of how profitable Terra protocols can be:

- Anchor: Nowadays, if you deposit and borrow your UST tokens, you will have a 19.4% and 18.8% APY, respectively. Just take a look at AVEE’s numbers and compare them yourself: AVEE (In Matic) deposit and borrowing rates for USDC tokens are 3.4% and 3.9% APY, respectively.

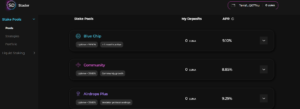

- Stader: This Terra platform maximizes staking returns via a smart compound protocol that gives 25% higher returns. Nowadays, Stader has three liquidity pools with a 9% APR.

Source: Stader

2. Protocols with High Value

Terra has 13 very high-valued protocols that attract a massive amount of liquidity because it gives access to anyone in the world to use them without any requirement and in a secure way. We can sum up this as true decentralization. Therefore, in this section, we will show the best 2 DeFi platforms that we think represent Terra properly:

- Anchor, which has $8.9 billion in TVL and has 43.4% of Terra’s TVL, is an open-source platform where users can quickly adapt its API to any other platform that shows people’s money balances. Also, this decentralized protocol works as a lending/borrowing platform with no minimum deposit amounts and requirements. Anyone in the world can access it.

- Lido: This protocol lets users can inject liquidity for staked assets without the need of locking them. For now, it’s the first Terra dApp of this type that also works in Ethereum and Solana too. Nowadays, Lido offers an 8% APR for users who stake $LUNA. One of the secrets of this platform’s success is that you can use your staked tokens across all Terra DeFi platforms.

As you can see, Terra protocols give people the power to have 100% control of their assets securely and efficiently. In DeFi, if you give freedom, profitable and easy tools to use, the results are practically guaranteed.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.