2023 held high hopes for the entire crypto industry following the bloodbath witnessed in 2022. The bear market ruled most of 2022, and the collapse of prominent firms like Terra and FTX gained mainstream attention, raising doubts about the industry’s long-term future.

The first quarter of 2023 is already over. And Coingecko’s industry report captures six key moments from the quarter. The report features an in-depth analysis of Bitcoin and Ethereum, the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. Also a comparison of the performance of centralized and decentralized exchanges. Let’s discover the highlights of this report.

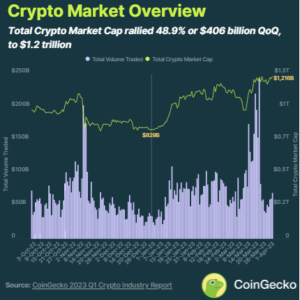

The Crypto Market Had a Solid Start, Rallying 48.9% To $1.2 Trillion

As per the report, the crypto market had an impressive market cap of $1.2 trillion at the end of the first quarter of 2023. This represents an increase of 48.9%, or $406 billion, in value terms over its performance in 2022, when it rounded the year at $829 billion.

The average daily trade volume also increased, climbing 30% QoQ from -33% in the fourth quarter of 2022 to a total of $77 billion in the first quarter of 2023.

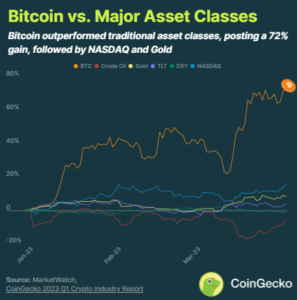

Bitcoin Outpaced Conventional Asset Groups, With a Gain of 72.4%

Surprisingly, bitcoin was the asset with the best performance in Q1 2023. It had gains of 72.4% QoQ, followed by the NASDAQ index (15.7%) and gold (8.4%).

All significant asset classes, excluding crude oil, which decreased by -6.1%, finished the quarter in the green. This result was predictable because crude oil was one of just two assets to end 2022 on the upside.

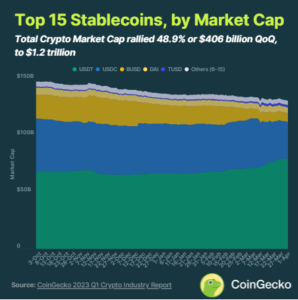

Stablecoins Lost $6.2 Billion or 4.5%. Usdc and Busd Had the Biggest Losses

Stablecoins didn’t have the best of experiences in Q1. Several events took place in the quarter that affected the asset class. First, Paxos stopped issuing BUSD. Also, the collapse of the Silvergate Bank affected Circle, the company behind USDC.

As per the report, the market cap of the top 15 stablecoins fell by 4.5% ($6.2 billion). USDC and BUSD had losses of 26.9% and 54.5%, respectively, wiping off gains from 2022.

The case was quite different for Tether’s USDT, the king of the stablecoin market. USDT boosted its position further by increasing its market cap by 20.5% ($13.6 billion).

The market also saw some reshuffling. True USD (TUSD), which surpassed FRAX, climbed into the top 5 stablecoins. Tron minted $750 million, increasing its market cap by 169.3%. In addition, Binance minted $130 million TUSD.

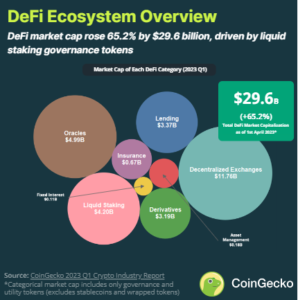

DeFi Ecosystem Increased 65.2% By $29.6 Billion, Boosted by a 210.9% Growth in the Liquid Staking Industry.

The DeFi world enjoyed some impressive numbers. The sector’s market increased by 65.2% in the first quarter of 2023, or $29.6 billion, primarily due to the performance of liquid staking governance tokens.

The market cap of liquid staking governance tokens increased by 210.9% in Q1 as a result of the news of Ethereum’s Shapella upgrade. Furthermore, decentralized exchange (DEX) governance tokens lost market share and have fallen by -5% since January. This is despite a 44.3% increase in market cap.

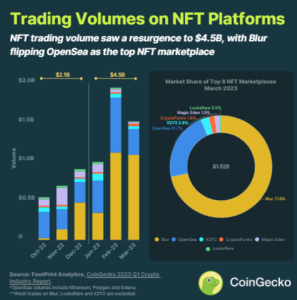

NFT Trading Volume Increased to $4.5 Billion, With Blur Overtaking Opensea as the Leading NFT Market.

In 2023-Q1, NFT trading volume surged noticeably, increasing 68% from $2.1 billion in 2022-Q4 to $4.5 billion. There was also a newcomer with impressive numbers. Blur, a new NFT platform introduced in October 2022, accounted for the lion’s share of trade volume in NFT.

It seized control over the top six NFT markets in just six months, unseating longtime market leader OpenSea. Blur increased its market share from 52.8% in December 2022 to 71.8% in March 2023. Interestingly, OpenSea’s market share decreased from 29.3% to 21.7% over the same period.

As per Coingecko’s industry report, Magic Eden suffered a 67.9% reduction in trade volume from $73.9 million in December 2022 to $23.6 million in March 2023. In addition, Solana’s ecosystem saw a massive decline in Q1.

Crypto spot trading volume increased 18.1% to $2.8 trillion in Q1, with DEXs exceeding CEXs in terms of quarterly growth.

The top 10 cryptocurrency exchanges saw spot trading volume reach $2.8 trillion in Q1 2023. This represents an 18.1% rise from the fourth quarter of 2022.

There was a global regulatory crackdown on CEXs in Q1, and DEXes were the biggest winners. DEXs enjoyed growth that was roughly twice as fast as CEXs. In Q1 2023, DEXs expanded by 33.4% compared to CEXs’ 16.9% growth. However, the ratio of CEX: DEX trading volume remained above 90%.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.