The DeFi market has grown from a budding sector of the crypto industry in 2020 to a dominant part of the market. DeFi brought alongside it a couple of financial benefits such as lending and borrowing apps, staking pools, savings applications, improved transparency, etc.

However, DeFi protocols all provide different solutions to the market. That’s why Synthetix Network is one of the DeFi platforms that have gained attention over the past couple of months due to its structure and offering. Synthetix aims to introduce that toolbox into the decentralized, permissionless, and global crypto market.

What is Synthetix Network?

Synthetix is a decentralized finance (DeFi) platform built on the Ethereum blockchain. It allows users to trade synthetic assets, or “synths.” These are tokens that copy the value of real-world assets like fiat currencies, commodities, and cryptocurrencies. A decentralized autonomous organization (DAO) powers the Synthetix network.

What is insane 125% Supply APY for $SNX in @SonneFinance!

I suppose I should move some SNX from native @Synthetix_io staking here for a week at least.

It is easy, as both Sonne and Synthetix operate in Ethereum L2 @OptimismFND network. pic.twitter.com/JKKLPLe4lR

— Liss Stern (@LissStern) January 12, 2023

Synthetix utilizes smart contracts to automate the issuance, trading, and management of synths. The platform aims to provide a decentralized and trustless way for users to gain exposure to a wide range of assets without the need for intermediaries.

Who Created Synthetix Network?

The Synthetix Limited company, which Kain Warwick founded created Synthetix network. Kain Warwick is an Australian entrepreneur and blockchain expert. He has been involved in the crypto industry since its early days.

Warwick first proposed the concept of the Synthetix network in a whitepaper published in 2017. And the platform was launched in 2018. Warwick started Synthetix as a stablecoin project called Havven and later rebranded.

Synthetix is built on Ethereum. It creates synthetic dollar assets sUSD through the mortgage platform token (SNX, Synthetix Network Token), and then users can use sUSD to trade other synthetic assets, such as sBTC, sETH, sAUD, sBNB, etc.

— Walter DuBois (@WalterDuBois13) January 15, 2023

Why is Synthetix Network Unique?

Synthetix employs a multi-token structure based on a system of fees, inflation, staking and collateral. Furthermore, Synthetix uses two major tokens:

- SNX, the native token of the Synthetix Network.

- Synthetic assets or Synths.

The platform uses a DAO, similar to MakerDAO, which locks up ETH to create DAI. So, Synthetix locks up SNX to create sUSD (synthetic USD). The sUSD serves as debt while SNX serves as the collateral.

A very interesting feature of the Synthetix system also has the ability to obtain data such as the price of the Japanese Yen, and traditional stocks like Tesla. It uses Chainlink’s decentralized oracle system to get these details without needing a central party.

Synthetix’s goal is to allow users trade. So, holders of Synths have the option to either bet on an asset’s price going up or down by going long or short on it. Then, by staking SNX, holders can create new Synths, get rewards and observe their holdings increase.

On the other hand, the Synthetix network already has a growing ecosystem because a number of protocols already use it to power their projects. The projects include Curve, Lyra, Thales, Kwenta, ParaSwap, dHEDGE, Yearn, and Aelin.

As a synthetic asset project on the Ethereum network, Synthetix provides liquidity through the over collateralized debt pool, and uses smart contracts to directly realize transactions, thus avoiding the problems of slippage and insufficient liquidity. #DeFi

— Walter DuBois (@WalterDuBois13) January 15, 2023

Where to Trade SNX Tokens

Those who already have an Ethereum wallet and some crypto in it can trade SNX tokens on exchanges such as Uniwswap or Kyber. SNX is a prospective token that supports a platform with a broad range of use cases. However, investing in it should be an option you consider after doing your own research.

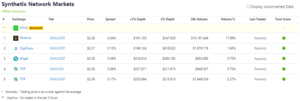

In case you are looking for centralized exchanges to trade SNX, here is a list:

Source: Coingecko

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.