Anchor Protocol accepted proposal ID 20. Title: Dynamic Anchor Earn Rate. The Anchor forum discussed the proposal at length, and voting just ended a few days ago. The result is that Anchor will stop offering its 19.5% yield. Instead, a more realistic semi-dynamic yield will take its place.

We have been covering Anchor Protocol on a regular basis during the last few weeks. Anchor, the DeFi money machine. However, we also discussed if Anchor can keep offering the 19.5% rate. We concluded that they can’t. We just covered that you can now use sAVAX as collateral on Anchor too. A potential boost for their lending side of the business. So they have a lot going on as you can see. Nonetheless, this vote doesn’t come as a complete surprise. Let’s have a look at what happened and how this will play out for their yield.

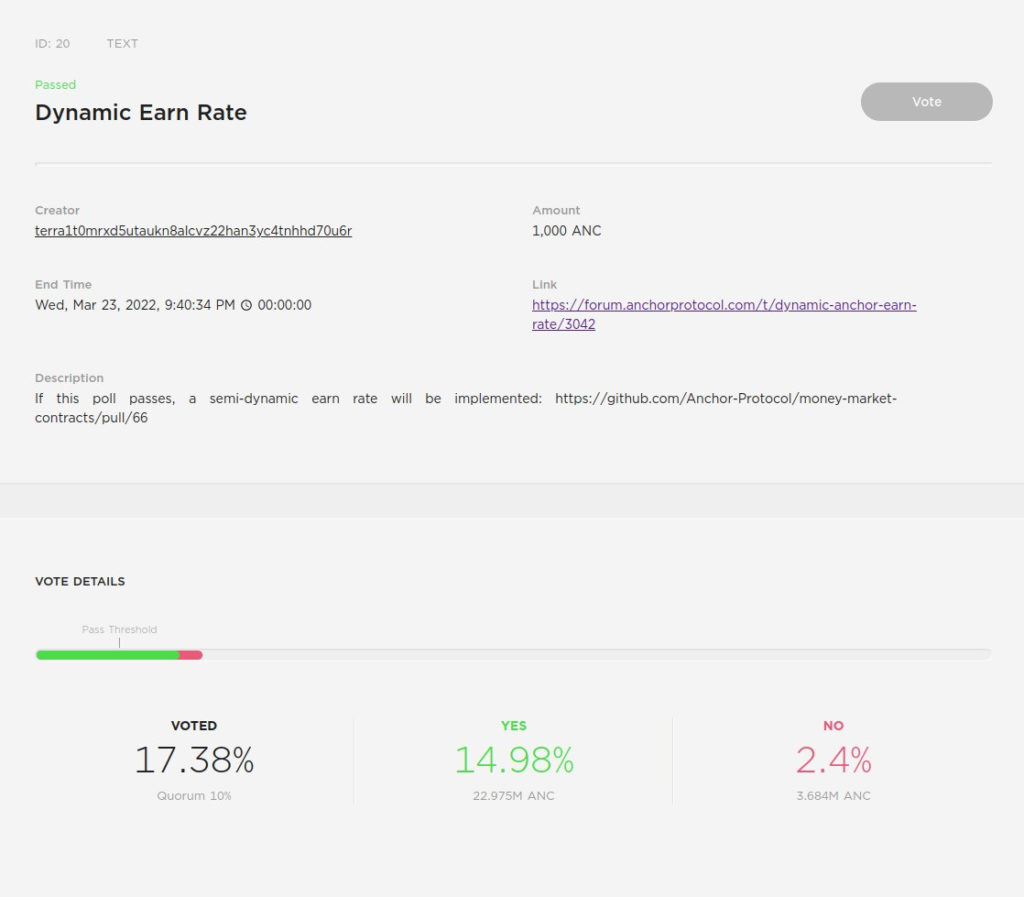

Governance proposal 20 for Anchor Protocol has passed.

What does this mean for Anchor?

-Rate will drop 1.5% per month until the yield reserve starts to increase

-If the yield reserve goes to zero (without a new top-up) there will be a switch to market rates

— Route 2 FI (@Route2FI) March 24, 2022

The Result of the Dynamic Anchor Earn Rate Vote

Early March 2022 a new discussion started on the Anchor Forum. The topic was the Dynamic Anchor Earn Rate. It was a lively discussion with many participants. However, this discussion also resulted in a proposal, as reported by NSSB. If the majority votes in favor of the proposal, the proposal passes. On the other hand, if the majority votes against it, that’s the end of the proposal right there and then.

The proposal included some major changes for the Dynamic Anchor Earn Rate. To clarify, the proposal will see a semi-dynamic Anchor yield rate. As a result, the Anchor rate drops each month by 1.5%. That is until the yield reserve starts increasing again. In the event the yield reserve reaches zero, market rates come into effect.

Furthermore, the proposal also includes some more dynamics. For example, if the yield reserve increases by 5%, the earn rate goes up by 1.5%. On the other hand, if the yield reserve goes down to 5%, the earn rate now drops once again by 1.5%.

Voting result

A surprising outcome of this vote is the low turnout. There was a lively and heated discussion, before voting on Anchor’s Forum. However, once the voting ended, only 17.38% of eligible voters participated.

Source: Anchor Forum

Nonetheless, this change is a more realistic approach. It still offers the highest possible yield rates. Expectations range between 5% to 15%, with double digits being very likely. Such a market rate depends on a few factors. For instance, the growth rate for UST will have an impact. Currently, this would mean 20% – 1.5% = 18.5%. However, this will decrease each month by 1.5%.

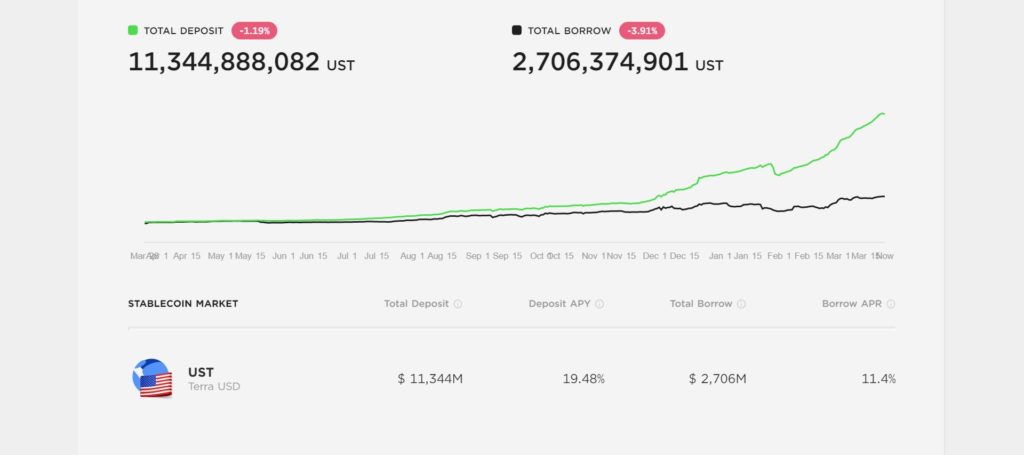

One big problem Anchor faces is that too many people lend their money. On the other hand, there aren’t enough borrowers. As the picture below shows, the balance is off.

Source: Anchor app dashboard

Conclusion

The high-yield rates at Anchor Protocol come to an end. Maybe a little faster than expected. However, we already concluded that the 19.5% yield is not sustainable. This approved proposal offers a semi-dynamic yield rate. As a result, we will see much more realistic yield rates. In turn, this allows the protocol to continue, and still offer competitive yield rates.

Also, join us on Telegram to receive free trading signals.

Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.