DeFi protocols went on the back burner during the recent crypto winter. However, after the FTX disaster, interest in DeFi picked up again. Many crypto users found their way to DEXes. DeFi allows you to stay in control of your assets.

So, let’s have a look at three popular DeFi protocols on Cardano.

What is Decentralised Finance today?

Decentralized Exchanges (DEX) & AMMs

Lending & Credit

Stablecoins

Oracles & Prediction Markets

Asset fractionalization (NFTs)

Margin trading & leverage

Balancing Systems#Cardano #SmartContracts #DeFi pic.twitter.com/lLRtNbRreU— Cardano Community (@Cardano) June 3, 2021

1) Indigo Protocol

Indigo Protocol issues decentralized synthetic assets on Cardano. In other words, they tokenize real-world assets. These synthetics are “iAssets” in the form of iAsset tokens. Furthermore, you can fractionally own one of these iAssets. This means that anybody, in any part of the world, has 365-days, 24/7 access to them.

You can mint iAssets after you place a collateral. This can be in stablecoins or other iAssets. They use over-collateralization for this, up to 150-200% of the real-world asset’s value. Once you mint an iAsset, you can start trading them or short them. Indigo uses oracles to sync the price of the synthetic asset with the real-world asset price.

It’s also possible to provide liquidity to a pool. You deposit an iAsset with stablecoins that match the iAssets’ value. Now you earn rewards in the form of INDY, Indigo’s native token. You can also stake INDY and get rewards in INDY. If you own INDY, you can take part in the protocol’s governance. Below is a video that explains Indigo Protocol.

2) Optim Finance

Optim Finance uses vaults. These are pools that, with coded smart contracts, allocate and reallocate funds. This way they get the most return out of the available yield options. The vaults use whitelisted Cardano DeFi protocols for this. Each vault uses different yield earning strategies.

Community members and finance strategists develop the strategies. In turn, devs code these strategies into smart contracts. Each vault can have one or more strategies. They use oracles for assigning off-chain computed allocation of funds.

Once you provide liquidity to a vault, you receive an oVault token. This represents your share in a vault and the yield you earned. They are native Cardano tokens, so you can trade them on the open market. Currently, there are five different vaults, for example:

- Single Asset Vaults — You can use only one asset, for instance, ADA.

- DEX LP Vaults — Liquidity positions on DEXes. They maximize yields.

- LenderOps — Yield through optimized, whitelisted lending.

- KeeperOps — Arbitrage and similar options.

- StakerOps — Optimized staking yields with farming options. You set your own parameters.

Vaults can be time-locked for long-term investors for up to a year or longer. Their governance token is OTM. You can stake it and receive more OTM tokens and voting rights. Here’s more information on Optim Finance. The following video also gives a good insight on this protocol.

3) Aada Finance

Aada Finance is a crypto lending and borrowing protocol. Loans can be over- or under-collateralized. You can deposit liquidity into lending pools. You earn yield on loans taken from the pool.

After depositing liquidity into a pool, you receive an NFT. This NFT represents your deposit. You can trade this on the open market. In the meantime, the funds remain locked away in the pool and collect interest. The holder of the NFT-bond owns the provided liquidity and its yield.

Borrowers also receive an NFT-bond. It represents their collateral and their loan. The pools have dynamic interest rates for borrowers. They base the rates on how much they use a pool. Pools with little traffic have low rates. So, this should attract borrowers. On the other hand, busy pools have higher rates.

Aada also offers flash loans. You borrow any amount of available assets. Flash loans don’t need collateral. However, you need to return the liquidity within the same time frame of writing a new block.

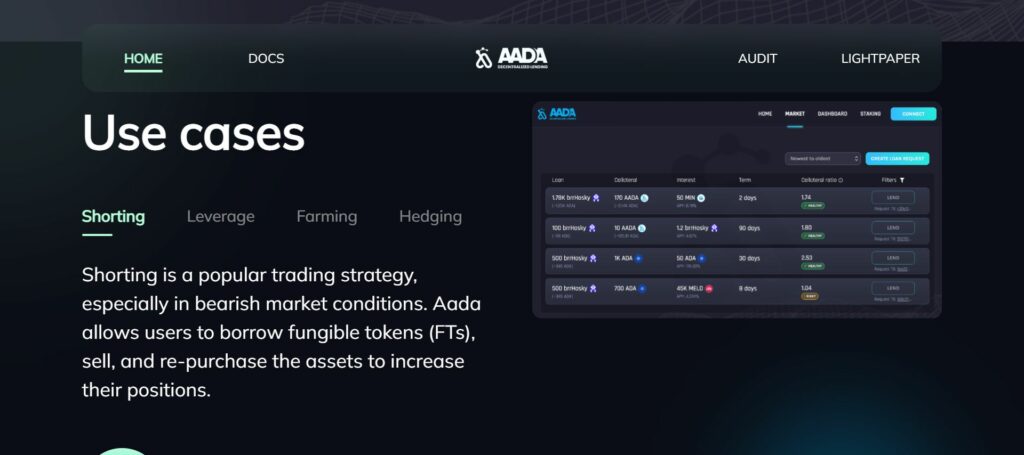

Their native token is AADA. It’s used for governance and to pay rewards for providing liquidity. You can stake AADA, which allows you to take part in governance. The picture below shows some Aada Finance use cases.

Conclusion

We showed you three popular DeFi protocols on the Cardano blockchain. All three have different use cases, and it shows the diversity of the Cardano DeFi space.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.