When using DeFi, you will, eventually, stumble over this word; Impermanent Loss (IL). Many DeFi protocols give you Impermanent Loss protection or ILP.

What is Impermanent Loss, and how do protocols manage to protect you from it? So, let’s have a look and find out.

A lot has been happening with the protocols that provide Impermanent loss protection (ILP) to their users.

We explain how they pay for user's losses?👇

— Magik Invest ✨ (@magikinvestxyz) July 4, 2022

What Is Impermanent Loss?

Impermanent Loss can happen when you put crypto assets in a liquidity pool. Once the price of the tokens changes, you could have impermanent losses. However, it’s a loss on paper. If you manage to sell your tokens at the same price they were, once you deposited them, there’s no IL. When you suffer from IL, it shows that you would have been better off just hodling your coins. We wrote an extensive explanation on impermanent loss.

So, there are a few DeFi protocols that offer IL protection. Magik Invest, co-founded by Shiv Sakhuja, wrote a Twitter thread about these protections. Let’s have a look at who they are and how they manage to do this.

Bancor

Bancor (BNT) is a protocol where you can trade and stake tokens. You provide a single token as liquidity in a pool. Bancor adds an equal amount of BNT. Now, both you and Bancor receive an LP token. Once you provide liquidity, you receive 100% ILP. They offer a few more appealing features.

- Auto-compounding rewards

- Impermanent Loss protection

- Dual token reward

- Unlimited single-sided staking

- Low gas fees

But how can they afford to do this?

- When trading in their pools, Bancor receives a part of the trading fees. That reward is in BNT and non-BNT tokens.

- LPs pay 15% of the yield earned on their assets.

Bancor does the ILP payouts using the ILP treasury in tokens that you as an LP deposited. If the treasury can’t cover the full ILP amount, you receive an equal amount of BNT to complete the balance.

However, on June 20, 2022, Bancor suspended its ILP. The reason given is; Due to hostile market conditions.

Due to hostile market conditions, Bancor’s Impermanent Loss Protection is temporarily paused. IL protection will be reactivated on the protocol as the market stabilizes.

More info: https://t.co/pHrdO4sTFd

We're hosting a community AMA in 15 minutes: https://t.co/xgh8UmfNoL

— Bancor (@Bancor) June 19, 2022

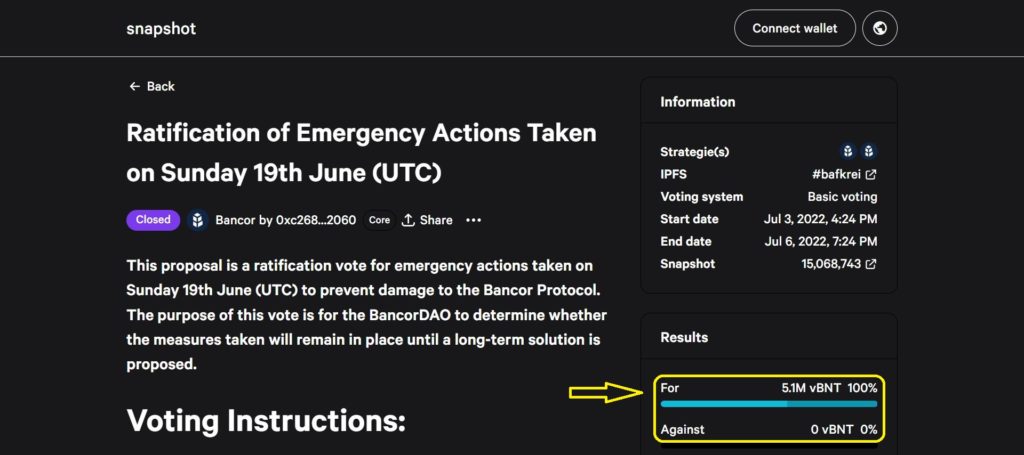

On July 4th, the protocol’s DAO started a vote about this decision, ending July 6th. Part of the Bancor users were not happy about this decision. They questioned how decentralized the protocol is.

3/

✅A vote FOR will result in the emergency measures being left in place until a long-term solution is presented.❌A vote AGAINST will result in the steps taken to protect the protocol being reversed, thus returning the system to its vulnerable state.

— Bancor (@Bancor) July 4, 2022

The result from this vote is in, and nobody voted against the proposal. This means that the emergency measures stay in place. At least until there is a long-term solution available.

Source: Bancor network

Elk Finance

They are a decentralized network for cross-chain liquidity. In other words, trustless and secure transfers across 19 chains. In a fast and safe way with low costs.

They offer ILP to their liquidity providers with their native ELK token. This is also a utility token. During the TGE or token generation event, they allocated 10 million ELK to an insurance fund. This insurance fund adds in each pool, each day, ELK tokens, equivalent to the value of the farm rewards. For example, if a farm has a 100 ELK reward, they receive 100 ELK from the fund to cover IL.

So, if the total daily claims exceed the assigned ILP, they use a simple calculation. The % of liquidity provided / total allotment. Furthermore, for all LPs, there is a linear vesting schedule of 40 days. This entitles you to 2.5% ILP per day. However, if you hold the native NFT, the Moose NFT, this can get boosted to 5%. You need to hold the Moose NFT on the chain where you provide liquidity.

Rekt by @Bancor?

Check @elk_finance $elk

They have real ILP protection with max cap on farms. $ELK token has max supply.

There isn't a way to print it over and over like $BNT or $LUNAC…. $LUNA pic.twitter.com/1yidjf5kul

— C_R_Y_P_T_O (@blininho) June 27, 2022

THORSwap

THORSwap is a multichain DEX aggregator. It’s part of the THORChain ecosystem. We wrote quite a few articles about them, including THORWallet. They enable cross-chain asset swapping natively.

They pay LPs out in the native RUNE token, and that’s how they use the ILP. Rune is the intermediate token between all token pairs. Each LP pair has RUNE as the other token in the pair.

The TVL locked in all pools has 3 x that amount available in RUNE. As per system requirements. Furthermore, node operators also need to buy RUNE. Their requirement is worth 2X the liquidity in pools on that chain. The LPs add the remainder.

You, as an LP, can provide your liquidity as a single token or multiple. As explained before, for instance, RUNE + asset. Now, from the day you provide liquidity, you get 1% ILP. So, after 30 days, you have 30% ILP.

Source: THORSwap

Conclusion

We saw some interesting and innovative ways that protocols use ILP. This helps, of course, with attracting new investors to a protocol. However, before you join such a protocol, do your own research. So, make sure you understand how a protocol can cover the ILP. Follow the money in the protocol! That will help you better with avoiding a situation as Bancor finds itself right now.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.