Yield Yak is an auto-compounding platform that optimizes users’ profit on liquidity mining programs by using yield farming rewards. The platform gathers data from Avalanche-based decentralized exchanges, such as Pangolin. It then allows its users to get better rates for their deals.

Yield Yak is multifaceted and community-driven. To encourage the growth of Yield Yak, the community combines rewards and offers new techniques and combinations. Yield Yak embraces a model that works independently of its core team.

Yield Yak farms can compound in a matter of minutes or hours. The incentives will be turned into deposit tokens on behalf of the pool’s users, giving them a mix of price and reward assets. Furthermore, the auto-compounding platform has one of the highest compounding APYs on Avalanche.

Yield Yak recently shared a tweet detailing an enticing pool to earn huge APY from a GMX position. It wrote, “ Call-out to a seriously under-rated position: GLP from our friends @GMX_IO. GLP is a basket of $AVAX $ETH $BTC & stables that earns fees from trading. Introducing a YY GLP vault which: Autocompounds rewards, Locks esGMX which in turn earns GMX rewards at a 1:1 ratio.”

👍 Call-out to a seriously under-rated position: GLP from our friends @GMX_IO.

GLP is a basket of $AVAX $ETH $BTC & stables that earns fees from trading.

Introducing a YY GLP vault which:

✅ Autocompounds rewards

✅ Locks esGMX which in turns earns GMX rewards at a 1:1 ratio. pic.twitter.com/LJVHl05eoA

— Yield Yak 🐃 🥛 (@yieldyak_) May 27, 2022

Now let’s look into this pool

What is GMX?

GMX is a decentralized exchange that allows for low swap costs and trades with no price influence. Trading on GMX is supported by a unique multi-asset pool that provides revenue for liquidity providers from leverage trading, market-making, and swap fees. Furthermore, GMX receives its token prices from Chainlink oracles, ensuring real-time and competitive prices 24 hours a day, 7 days a week. GMX is available on both Avalanche and Arbitrum. Its user base is currently on the increase, making it a strong competitor.

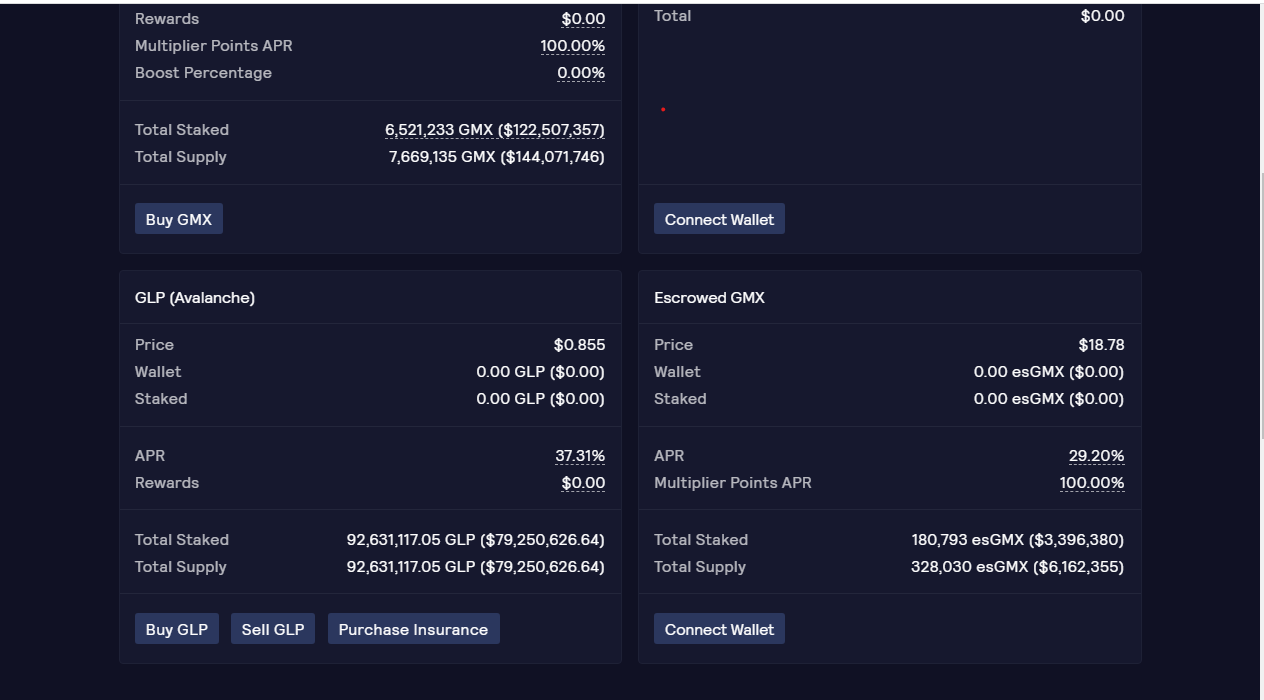

There are two native tokens on GMX: $GMX and $GLP. Each serves a unique function. The $GMX token is the GMXs utility and governance token. To put it another way, holding $GMX is equivalent to owning a portion of the platform. Also, staking the $GMX token gives users the right to vote. Stakers also receive 30% of the swap and leverage trading fees which are converted to AVAX.

The $GLP Token

GLP is the second native token on GMX. It is a basket of assets that are used in swaps and leveraged trading. A basket refers to a collection of cryptos managed as a single asset. This reduces the need for the holder to monitor each crypto individually. So, users can mint the GLP token with any index asset and burn it to redeem any index asset. GMX uses this method to provide liquidity for leveraged trades.

On Avalanche, GLP is composed of

- Avalanche (AVAX) –

- Ethereum (WETH) –

- Bitcoin (WBTC) –

- USD Coin (USDC.e) –

- USD Coin (USDC) –

- Magic Internet Money (MIM) –

On Avalanche, $GLP holders receive Escrowed $GMX (esGMX) rewards. Users can utilize these tokens in two ways:

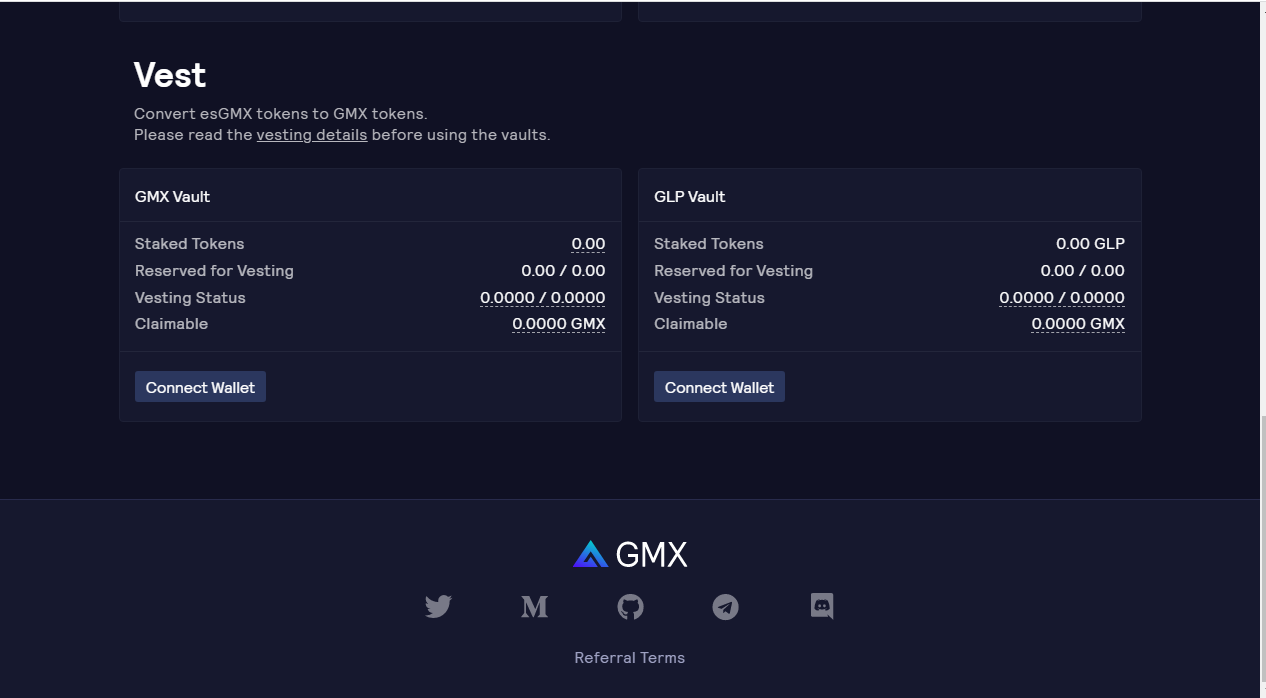

- Vest it to become a $GMX token within a one-year period: Vesting allows users to convert their $esGMX tokens into $GMX tokens. The average number of $GMX or $GLP tokens utilized to earn the $esGMX incentives will be reserved when vesting begins.

2. Stake it for more rewards; Users who staked their $esGMX tokens will receive a similar amount of $esGMX and $ETH / $AVAX rewards as a standard $GMX token would. Furthermore, the amount of $GMX or $GLP required to vest $esGMX is specific to each account and limited to the rewards obtained by that account.

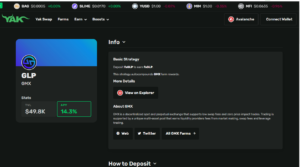

Yield Yak GLP Vault

Back to the main tweet, GLP on Yield Yak currently has an APY of 14.3% and a TVL of $49.8k. Using this vault auto-compounds GMX farm rewards. It would also lock esGMX which will earn GMX rewards at a 1:1 ratio. To deposit into this pool, all you have to do is

- Connect your wallet,

- Fund your wallet with fsGLP (This is available on Yak Swap)

- Deposit fsGLP on Yield Yak (Use the “Deposit” tab on My Account)

In conclusion, GMX is a solid protocol with fantastic offerings for users seeking to trade with multiple options for leverage. The $GLP token allows users to gain simultaneous exposure to a diverse range of both stablecoins and cryptocurrencies. Most experts believe that yields from $GMX and $GLP are more sustainable than regular stablecoin yields. This is because they come from fees paid by traders rather than some unsustainable medium.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.