The crypto market is currently going through one of its worst moments in history. Since Luna’s crash in early May, there’s been a strong sense of fear over which project would go down next. Judging from recent reports, Magic Internet Money, or MIM, appears to be on a similar path as Luna.

MIM is a stablecoin soft-pegged to the U.S. dollar. DeFi lending platform Abracadabra.money mints the stablecoin. Abracadabra enables its users to convert interest-bearing cryptos into stablecoins. Word on the street is that the MIM stablecoin is the latest to de-peg amid the liquidity issues in the market.

Based on alleged insider information, Autism Capital, an investment firm, revealed that MIM’s slip was due to excessive loans caused by Terra’s collapse. In a long Twitter thread, the platform noted that MIM had accrued about $12 million in bad debt. However, MIM founder Daniele Sestagalli strongly denied such claims.

We have a scoop from one of our associate autists: MIM (Magic Internet Money) may be nearly insolvent. MIM is one of the larger stablecoins, with a market cap of ~$300M.

We can't believe that a project called Magic Internet Money has been acting irresponsibly either.

Details:

— Autism Capital 🧩 (@AutismCapital) June 17, 2022

Other Twitter users confirmed rumors of MIM’s impending collapse, with one user claiming that the entire crypto market could go further down the drain if MIM is unable to reclaim its peg. He wrote, ”we are still unsure whether they will be able to pay off debt and re-peg MIM stablecoin. If they are still unable to recover the peg. This will have ramifications to the entire crypto market which will bring bitcoin price and crypto down further from where it is now.”

Will the #MIM (magic internet money) stablecoin suffer the same fate as #UST? The recent Luna crisis caused many firms to lose pile of money in the market, causing debts to accumulate across the board. it is claimed that MIM Abracadabra had $12m in debt followed luna crash.

— Ian | The Trading Enthusiast (@jay20203019) June 18, 2022

What’s Happening With MIM?

The de-pegging of the MIM token began at about 7:40 p.m. ET on June 17, and the token’s price dropped to $0.926 in only three hours. At the time of writing, this stablecoin was trading at the $0.98 mark. Most experts believe that Terra’s collapse stole all the spotlight so that everyone had little time to access the damage it had caused to other platforms.

But Autism Capital shed light on an event that had escaped most eagle-eyed observers amid the dark Luna times. It wrote, “Last month during the Terra blowup, $12M of bad debt was created by Abracadabra (the protocol behind MIM) because liquidations couldn’t happen fast enough to cover the protocol’s MIM liabilities. This news was swept under the rug.”

Going further into the narrative, Autism Capital claimed that Abracadabra took down its analytics dashboard right away, claiming an upgrade. According to the report, the Abracadabra team alleged that the downtime of their analytics dashboard was purely coincidental.

Daniele Sestagalli, Abracadabra’s founder, however, dismissed claims of his platform being unable to pay the growing debt, resting concerns of insolvency in the process. He claimed that the “[Abracadabra] Treasury has more money than the debt and $CRV are valuable for the protocol.”

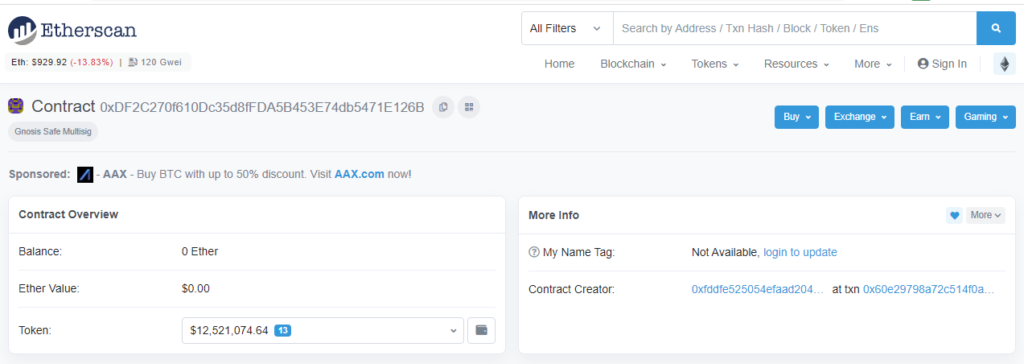

Daniele Sestagalli further strengthened the confidence of his investors by sharing the treasury’s address, which held $12 million in assets.

Instead of paying back the bad debt out of the MIM treasury the MIM core team decided to YOLO market buy $CRV instead.

The price of CRV has been plummeting and with the dashboard down there's no easy way of actually verifying how

much bad debt is in the protocol at this point.— Autism Capital 🧩 (@AutismCapital) June 17, 2022

More Details on the Debt

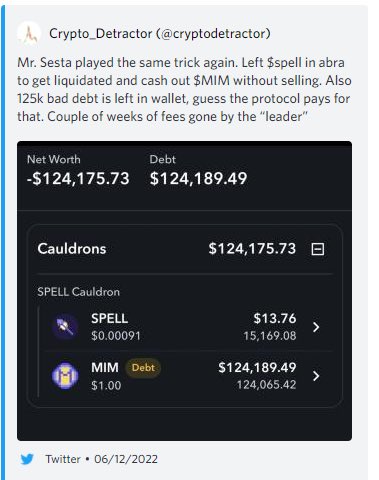

However, Autism Capital claimed that the bad debt occurred about five days ago. It wrote, “A couple days ago, the founder of MIM created even *more* bad debt by letting his SPELL position get liquidated.”

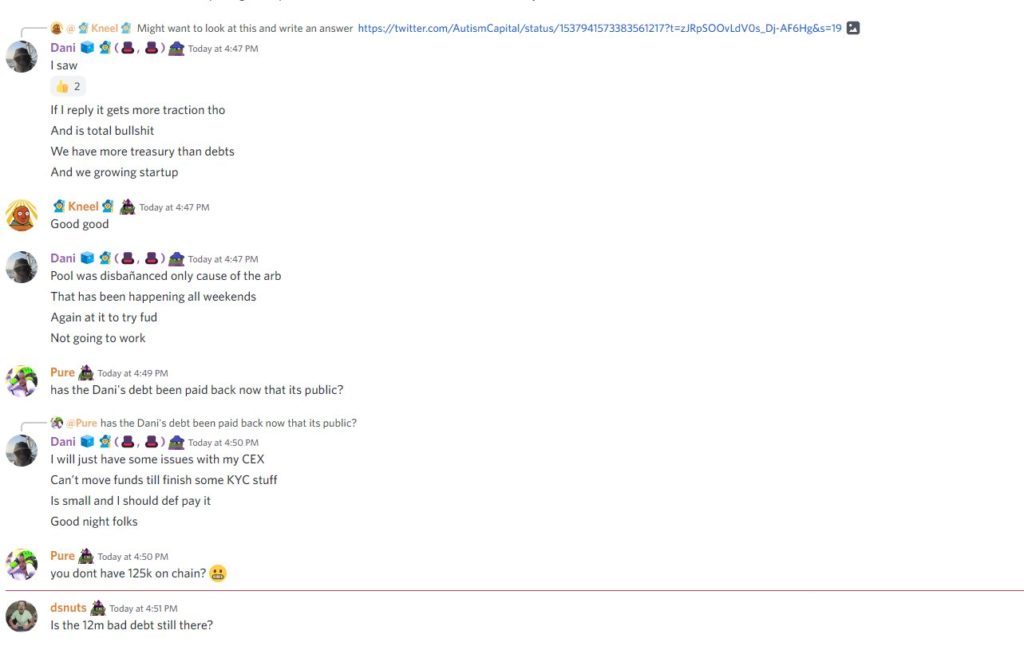

Autism Capital shared more proof, including a Discord screenshot of Daniele Sestagalli laughing off claims he won’t repay his bad debt.

Sharing its thoughts, Autism Capital wrote, “We’re concerned that the protocol could become insolvent, either through the MIM treasury continuing to dump in value or more bad debt created. At that point, the rational thing to do for any MIM holder is to dump it, as the last person holding the bag would get nothing back.”

A napkin example:

>5 guys

>Andy locks up 1000 ETH and borrows 100k MIM

>Ben locks up 100 BTC and borrows 100k MIM

>Carl locks up 100k USDC and borrows 80k MIM

>Sam locks up 1M SPELL and borrows 50k MIM, sells it for USDT to PlebTotal MIM = 330K

— Autism Capital 🧩 (@AutismCapital) June 17, 2022

Autism Capital also claimed that Wonderland recently took out $50 million and moved it to USDC. Autism Capital further pointed out that Sifu, who also co-founded QuadrigaCX, runs Wonderland. The tweet claimed that Wonderland and Abracadabra were previously linked. However, despite reports that both platforms have split, Sifu allegedly has a strong presence in the Abracadabra Discord.

Further Discord screenshots showed Daniele Sestagalli claiming issues with his CEX limiting him from paying his debt, which he referred to as “small.”

In Conclusion

Finally, we strongly advise investors to keep track of market movements and conduct their own research before making investment decisions while the possibility of insolvency continues to threaten the Abracadabra protocol.

⬆️Win $6,699 worth of bonuses in our exclusive MEXC & Altcoin Buzz Giveaway! Find out more here.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.