THORChain is an altcoin gem that promotes interoperability. Currently, they are the only blockchain that can swap tokens without the need to wrap them. But there is more, you can earn yield with native assets, by depositing them. The current average liquidity APY is 27.37%. However, be aware that this rate fluctuates.

THORChain also just added LUNA. This adds a wide array of new opportunities for staking and LPs. So, this sounds great, right? However, how can you stake THOR, and how can you take part in liquidity pools? In this THORChain staking guide, we will show you step by step how to do this.

What Do You Need for Starters?

To get started with the THORChain staking guide, there are a few things that you need to organize. However, one thing that you don’t need is the RUNE token. In case you like to find out more about THORChain, check our deep-dive article. Here’s what you do need.

- Multichain wallet—There are a few options out there, but THORWallet is a great choice. Another option is the XDEFI wallet. They are both created by the THOR community. THORWallet is mobile-only. XDEFI also has a web extension. Trust Wallet or Keystore Ledger are other options. An added benefit with ThorWallet is you can go into its DEX directly from the wallet.

- The crypto you want to pair with RUNE in the liquidity pool.

Source: THORSwap app

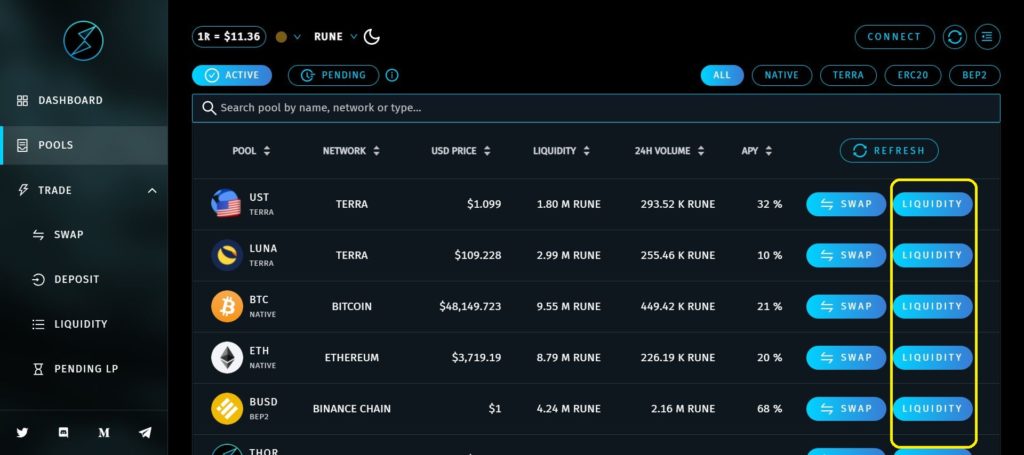

Now you are ready to join one of the pools at THORSwap. At the time of writing, there are 25 liquidity pools that you can choose from.

The above page lets you play around a bit with the settings. For instance, in the long yellow box, each tab gives a different sorting option when you click on it. For example, highest USD price to lowest or highest APY to lowest.

Start Swapping

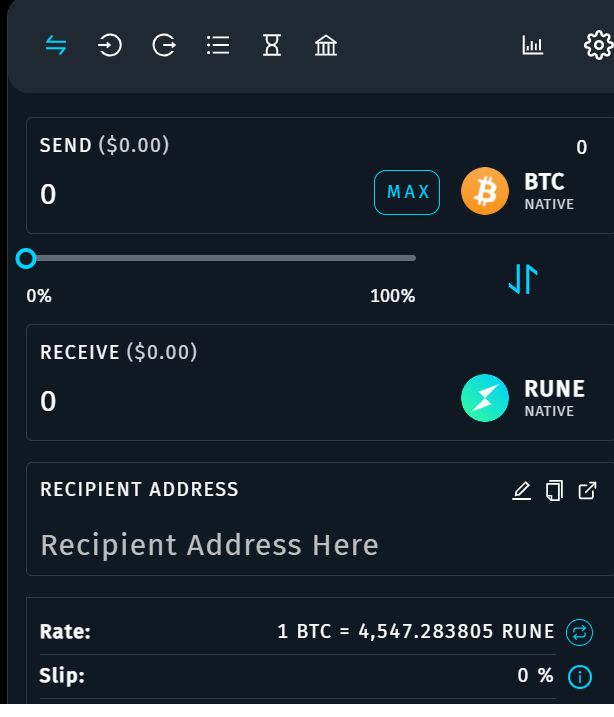

Now you’re ready to swap. You see on the right-hand side various swap buttons. Click ‘swap’ on your preferred pool. For our sample, we look at the BTC:RUNE pool, and you will get this image.

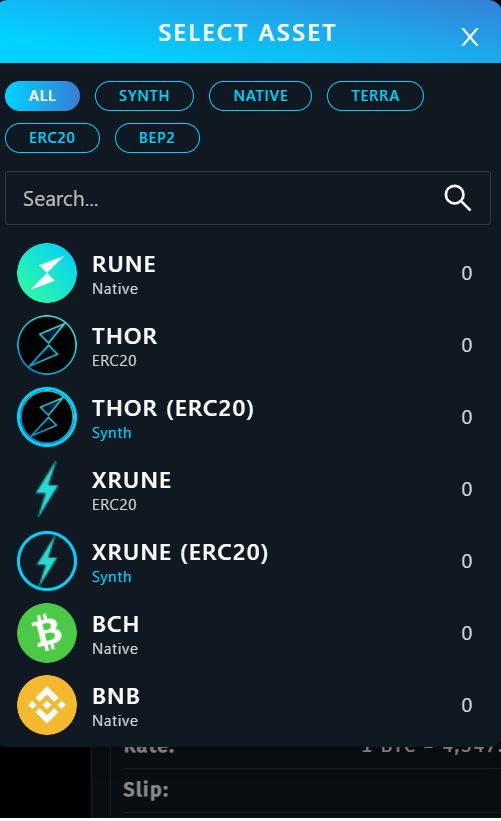

However, if you decide that you prefer to swap a different asset, click on RUNE and other assets will pop up. Just like the picture below. Some of these assets are ‘synths’. Don’t worry about that, they are legit, and you can use them to swap. In a nutshell, they are native assets on the Thor chain.

Just in case you decide to swap a synth asset, they have some benefits.

- Lower gas fees.

- Fast transaction time

- Cheaper swap fees

- Interest bearing

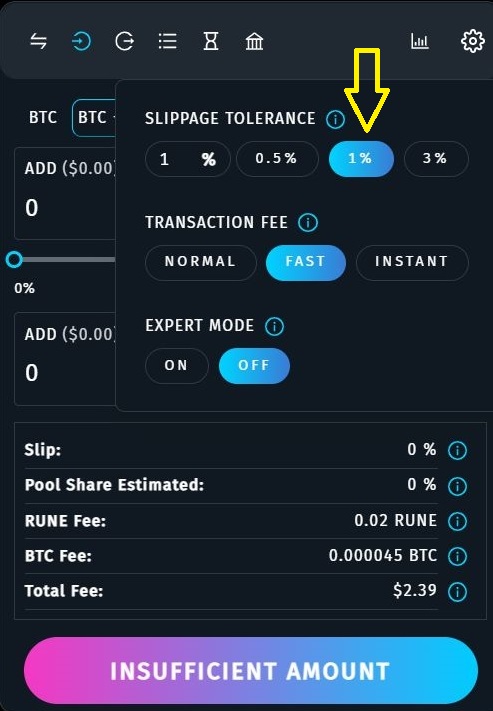

So, we are going to swap BTC for RUNE. There are no gas fees, only transaction fees in BTC. Any network fees, the protocol takes during the actual swap. However, you can adjust your slippage. There is a ‘slip’ button, upon clicking a pop-up appears. You can adjust slippage between buttons of 0.5%, 1%, and 3%. The 1% option is a good one unless you are swapping volatile assets. Now you are ready to join a liquidity pool.

Liquidity Pool

We are going to stake our assets in a liquidity pool. In return, we receive rewards from transaction fees, made by other users of the pool. Furthermore, the reward is proportional to the amount you stake. For example, you are in a 1,000 token pool with 100 tokens. This means that your share of the pool is 10%. If the exchange charges each trade a 0.3% fee, you receive 10% of that transaction fee.

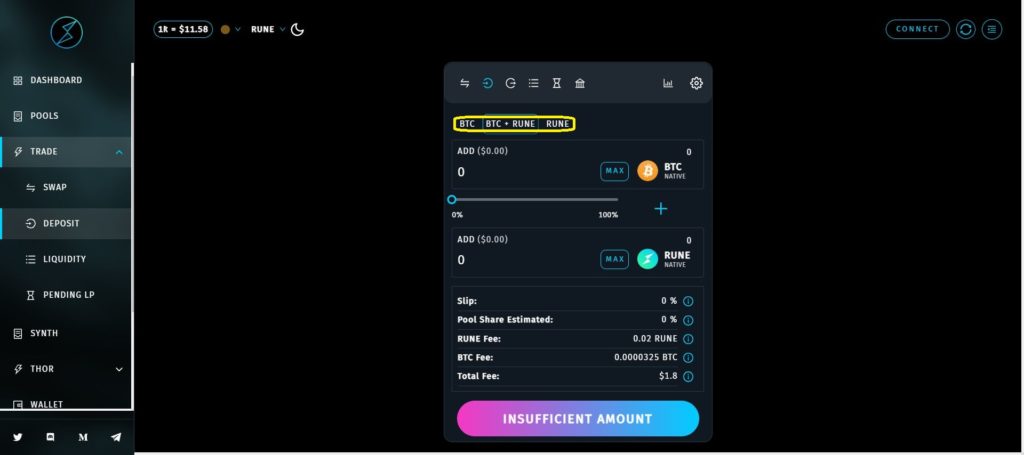

So, we are going to add liquidity and hit our preferred liquidity pool. We use the BTC and RUNE pool again. See the picture below, the yellow box. Note that not all pools are available, you will need to check each pool.

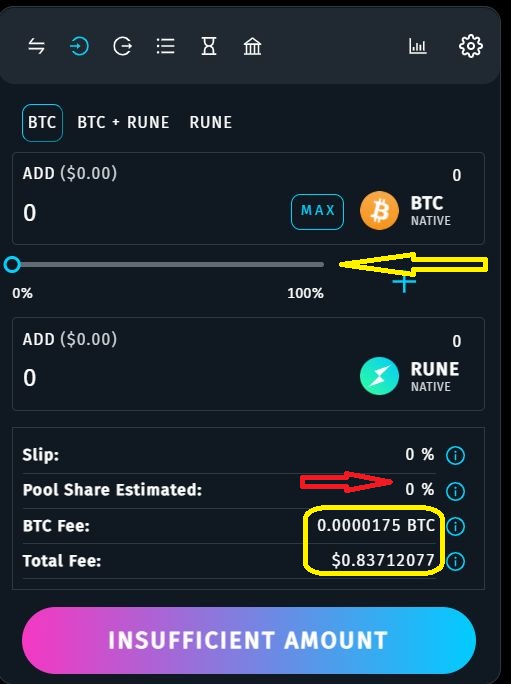

Now you can decide what you actually want to do. For instance, you can add just RUNE, or only BTC, or add both. See the options in the yellow box in the below picture.

Also, note the fees. You only pay fees for the asset you deposit. The gas fees list in the respective asset and in USD.

There is lots of information available on top of the box. You can set slippage under settings. For example, if you deposit a large amount. Try to keep this number low.

Now you are ready to add liquidity. You can use the slider in the picture below to state how much you want to add. The yellow arrow. The max amount is 100 million RUNE. The fee shows in the yellow box. The red arrow shows your share in the pool.

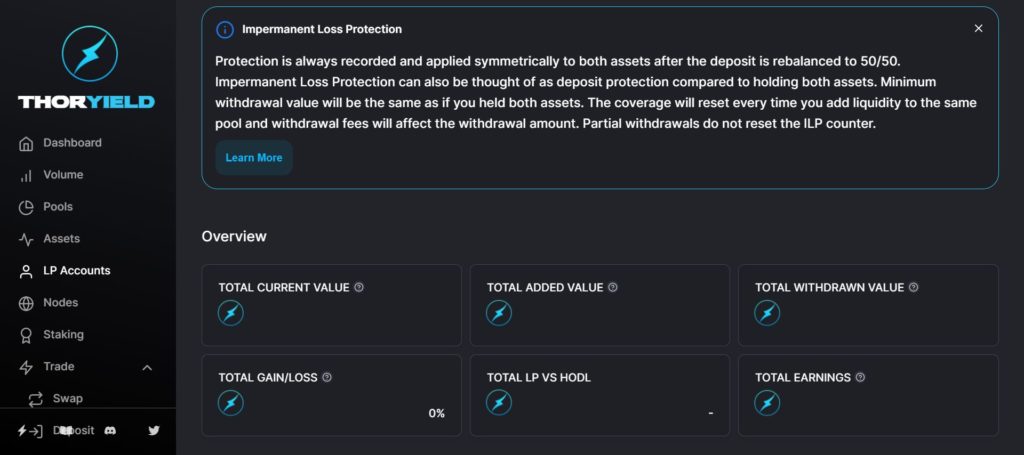

There are two different ways to see how you are doing in the pool. In THORYield, you can see an overview of the BTC pool.

Source: THORYield

You can also use the more personalized option in THORYield.

Withdrawal

When you want to withdraw, just take your share out. For a single asset, just withdraw that asset. If you added two assets, this can be asymmetrical. This means that not both amounts need to be of the same value. You can deposit 0.002 BTC and 5 RUNE. Now you take out whatever combination suits you best.

That’s it for staking and adding to liquidity pools. However, let’s have a word about the safety of the THORChain pools.

How Safe Are the THORChain Staking Pools?

In July 2021, THORCHain had the dubious honor of being the victim of three hacks in just one month.

In total, the hackers took $140,000, $7 million, and $11 million. These numbers vary, pending on which source you use. One hack was a white hat. It may not come as a surprise that the RUNE token slumped as a result. The argument concentrated mostly on the question of did the team rush the release of its updates.

On the other hand, in March 2022, the RUNE token is making a comeback. This raises the question of THORCHain is safe now.

After the hack, THORChain halted their Bifröst protocol. They reviewed and audited it. Many things have happened in the meantime. Among others, 21st March 2022 saw a hard fork to release the Chaosnet. Furthermore, at the same time, they carried out the Cosmos v0.45 upgrade.

In conclusion, it appears that all systems are go. However, there is never a guarantee. One can only hope that THORChain figured out what went wrong. It looks like they have. In addition, they have addressed the issues. Since July 2021, THORChain has seen no further hacks. However, we did write an article on how THORChain works. This may be helpful in this context.

Conclusion

THORChain staking or adding liquidity to THORChain pools on THORSwap is not difficult. This THORChain staking guide takes you step by step through the procedures to follow. We also pointed out the three hacks that occurred in July 2021. It appears that the team resolved the problems. However, having said that, there is never a guarantee. We most certainly can’t give such a guarantee, either. So, please do your own research before you invest. Moreover, don’t invest more than you can afford to lose.

You can learn more on the Altcoin Buzz Youtube Channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join now starting from $99 per month.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by THORWallet. Copyright Altcoin Buzz Pte Ltd.