Staking is one of the best ways to earn high rewards in the crypto ecosystem and Yield Yak is one of them. This Avalanche-based DeFi farming tool is known for providing DeFi users with the opportunity to earn massive yields.

This article covers important details about how to invest $AVAX tokens and Yield Yak. Therefore, in this article, you will discover why Yield Yak is a very interesting option to earn massive rewards on your $AVAX tokens. Before we move on, let’s find out more about Yield Yak.

What is Yield Yak?

Yield Yak is a DeFi farming on Avalanche. It is community-driven and also boasts of one of the most efficient and cheapest autocompounder in the sector. This yield platform is also self-sustaining and requires little or no involvement from its team.

Note: Autocompound means that yields are automatically re-invested in the protocol. As a result, rewards are much bigger.

Yield Yak, however, has a few risks. Some of these risks include:

- Impermanent loss

- Its Pool 2, is known for rewarding farming with an asset already in the pool. For example, an AVAX/PNG pool will receive PNG tokens as rewards.

- Its underlying assets.

Moreover, $YAK is the native token of the Yield Yak ecosystem. It also has a fixed maximum supply of 10,000 $YAK tokens. This means that no additional $YAK will ever be created again. Interestingly, it is also possible to earn $AVAX tokens by staking $YAK. This is, however, possible for single-sided stakers who deposit their $YAK tokens in the YAK staking pool.

1/9

You might be wondering where is the best place for staking your $AVAX and get some nice returns. Let’s see some options using @yieldyak_ pic.twitter.com/wkhQhEWNOI— MauroG 🔺 (🐃,🧞♂️) (🔭, 🔺) (@MauroG_Crypto) April 24, 2022

On the other hand, Yield Yak is a safe option to earn rewards on your $AVAX tokens. However, stakers are expected to lock up their tokens for a minimum of 12 months (1 year). Staking your $AVAX on p-chain attracts an APR of between 9% and 10%. Now, you will learn about two very attractive staking strategies inside Yield Yak.

It’s important to say that what makes Yield Yak unique is that it picks certain staking protocols from different protocols and puts them all together in its platform with higher yields. Therefore, in these strategies, we will mention MoreMoney and Benqi Finance’s protocol.

Two Staking Strategies to Invest $AVAX in Yield Yak

1. Depositing and Borrowing Funds on MoreMoney

MoreMoney is a top DeFi borrowing and yield generating platform. This means that users can now deposit $AVAX on MoreMoney to borrow $MONEY, its native token. The deposited $AVAX tokens will earn interest of up to 9% APY. Also, by depositing $AVAX, users will have the opportunity to borrow funds up to 80% of their deposited $AVAX tokens.

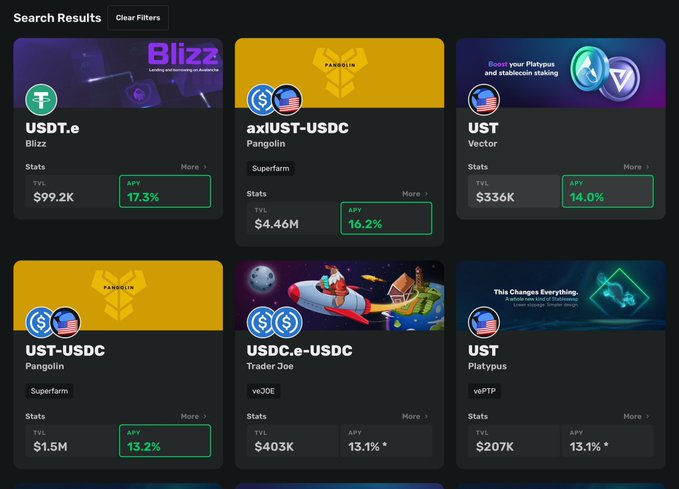

An easier way to do this is to swap your $MONEY tokens for “USDT.e”. Next is to deposit the USDT.e tokens. Interestingly, this strategy also offers up to 17.3% APY. Look at it in the picture below.

Source – Yield Yak

2. Yield Yak SA Leveraged Strategies

With this method, stakers will earn rewards as high as 12.4% APY. These strategies function on platforms like Aave, Benqi Finance, and BankerJoe. Also, these strategies involve lending and borrowing $AVAX tokens multiple times.

Note: This method has no risk of being liquidated.

a) Liquid Stake Half of Your $AVAX on Benqi Finance

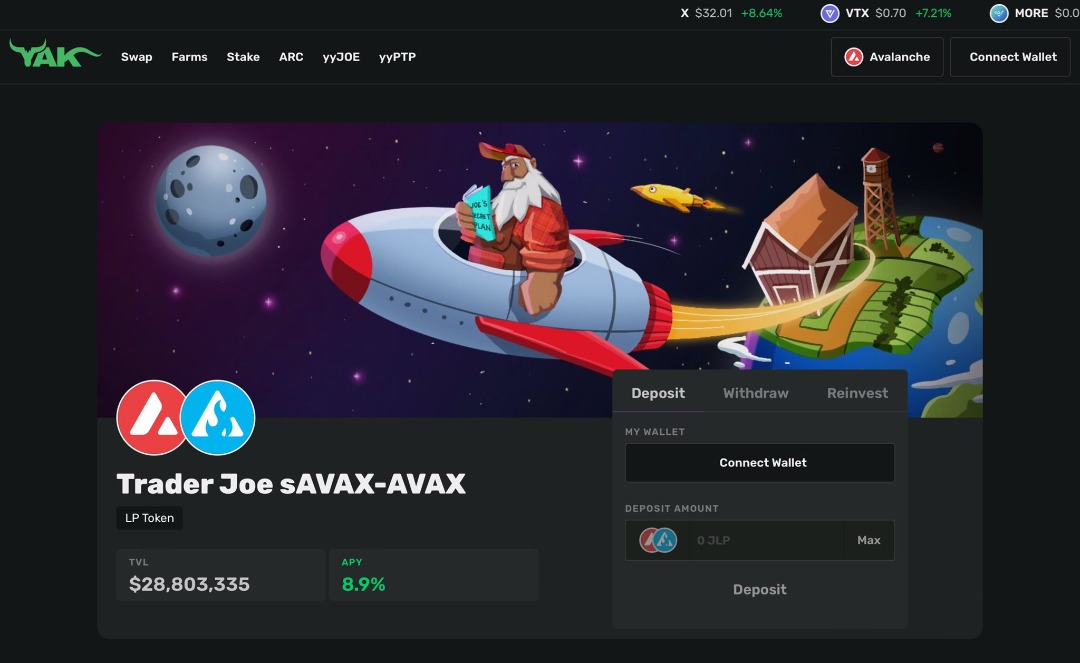

This is one of the most innovative ways to earn rewards on your AVAX tokens. For example, the sAVAX/AVAX liquidity pool on TraderJoe. Here, users will need to deposit sAVAX/AVAX LP tokens on Yield Yak to enjoy compounded rewards. So, instead of earning APY of just 7.2%, with Yield Yak auto-compounding, stakers will earn rewards as high as 12.44% APY.

Source – Yield Yak

The bad side to this staking method is that swapping your sAVAX tokens back to $AVAX tokens will attract a trading fee of about 0.3%.

b) Deposit $AVAX Token on Benqi Finance

By depositing $AVAX on Benqi, users can lend qiAVAX tokens on Yeti Finance. Notably, Yeti Finance is a portfolio borrowing protocol with 21x leverage and zero percent (0%) interest. On Yeti, users can borrow YUSD as high as 18.4%. They can also easily convert the YUSD to USDT.e, and also deposit it in this strategy. The issue with this method is that there is a high risk of liquidation.

Also, you can deposit your $AVAX on Yield Yak’s Aave strategy.

In conclusion, one of the best and safest ways to earn rewards on your $AVAX is by farming sAVAX/AVAX on Yield Yak.

AVAX Price Outlook

At the time of writing this article, the price of AVAX is currently trading at $68.84 with a market cap of $18,4 billion and a 24-hour trading volume of $530 million. The token price is also down by 1.7% in the last 24 hours.

⬆️Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ACCESS PRO membership (worth $99). MEXC supports the U.S. Traders in all trading pairs and services.

To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.