The shift of governance from a small group of founding partners to the stakeholders of a particular project. That is what DeFi governance is.

The ConsenSys Q3 Web Report exposes some of several key DeFi governance processes incorporated in top DeFi protocols like Synthetix, Aave, Uniswap, etc.

Before we go into the details of the reports, it is important to note that governance is currently the driving force for change in most of the DeFi protocols available today. Token holders now have a huge role to play in determining the future of projects in which they have invested. They can now:

- vote on proposals

- endorse how funds should be allocated

- and more.

DeFi governance will also make it possible for token holders to be more attuned with changes taking place in the protocol. This is because they will have timely access to information about changes and updates to the protocols.

The ConsenSys 2021 Q3 report assessed the DeFi governance activities of top protocols like Synthetix, Aave, AirSwap, Uniswap, and Compound.

1. Synthetix (SNX)

According to the reports, Synthetix protocol had the most active governance in the entire DeFi space. With several updates and changes made to the framework used in minting synthetic assets every week. Some of the governance decisions made also affected core areas of Synthetix like issuing fees, etc.

Below is a list of Synthetix top DeFi governance On-chain Proposals that took place in Q3 include;

- SIP -155 – Deprecating SynthetixDAO

- Next was the SCCP -136 which resulted in the increase of L2 inflationary rewards to 50,000.

- There was also Proposal SIP-120 – Atomic Exchange Function

- Then SCCP-137 Proposal which reduced L2 Target C-Ratio To 750%.

- SIP-184 Proposal introduced Dynamic Exchange Fees

- SIP-133 increased volume partner rewards to 10,000 SNX p/month

- SIP-170 helped with Inflation Diversion for L2 Incentives

- And lastly, the On-Chain Proposal SIP-168 – Governance Participation Program

2. AAVE

According to ConsenSys Q3 report, DeFi lending protocol Aave had some of the biggest proposal changes in Q3 2021. Proposals that brought about changes in liquidation bonuses, resulted in the extension of liquidity incentives, etc.

Some of these On-Chain Proposals include

- AIP 33 – resulted in the addition of FEI to Aave V2

- AIP 35 – brought about the adjustment of interest rates to compensate for the over-estimation of APYs.

- The On-Chain Proposal AIP 37 – Liquidity Mining Distribution updates.

Other important proposals include; On-Chain Proposal AIP 36, AIP 31, AIP 32,etc.

3. Airswap

AirSwap is a unique protocol, compensating its token holders both for voting and for creating proposals. The protocol launched two important proposals in Q3 namely;

- Snapshot Proposal AIP 46 – Fee Allocations proposal, and

- Snapshot Proposal – Contributor Circle Funding

4. Uniswap (UNI)

Unlike Synthetix, Uniswap did not have a very active DeFi governance process in Q3 2021. This, however, could be as a result of the fact that each vote requires a minimum of 40 million UNI token as support for it to be considered. Also, to submit a proposal, a user needs to have at least 2.5 million UNI tokens. The only Uniswap proposal passed in Q3 of 2021 is the upgrade of the Governance Contract to Compound’s Governor Bravo contract.

5. Compound

Like Synthetix, Compound had a very active governance process. Some of its major proposals resulted in the temporary disablement of COMP rewards, the distribution of DAI tokens to those affected by the DAI liquidation crash of November 2020, etc.

Some of Compound’s On-chain Proposal for Q3 include;

- On-Chain Proposal 59 – To distribute DAI to users affected in the 2020 DAI incident

- On-Chain Proposal 60 – Addresses whitelist for submitting proposals

- The On-Chain Proposal 62 – Divide COMP rewards distribution and bug fixes

- Lastly, On-Chain Proposal 63 – Temporarily disables COMP rewards

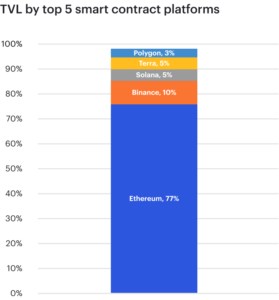

ETH DeFi Dominance

Despite its massive scalability issues, Ethereum is still at the helm of affairs in the DeFi space. The Ethereum blockchain currently houses an estimated 77% of all the total value locked (TVL) in the DeFi space. According to the ConsenSys report, major contenders still remain both Binance and Solana, each with 10% or less than 10% of the TVL in the DeFi space.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.