In DeFi, you may have heard of the lego-blocks and stacking. That’s how the developers build. All kinds of different DeFi features fit together. You can build with them just like lego-blocks. Stack them together like money-lego. An important part of DeFi are tokens.

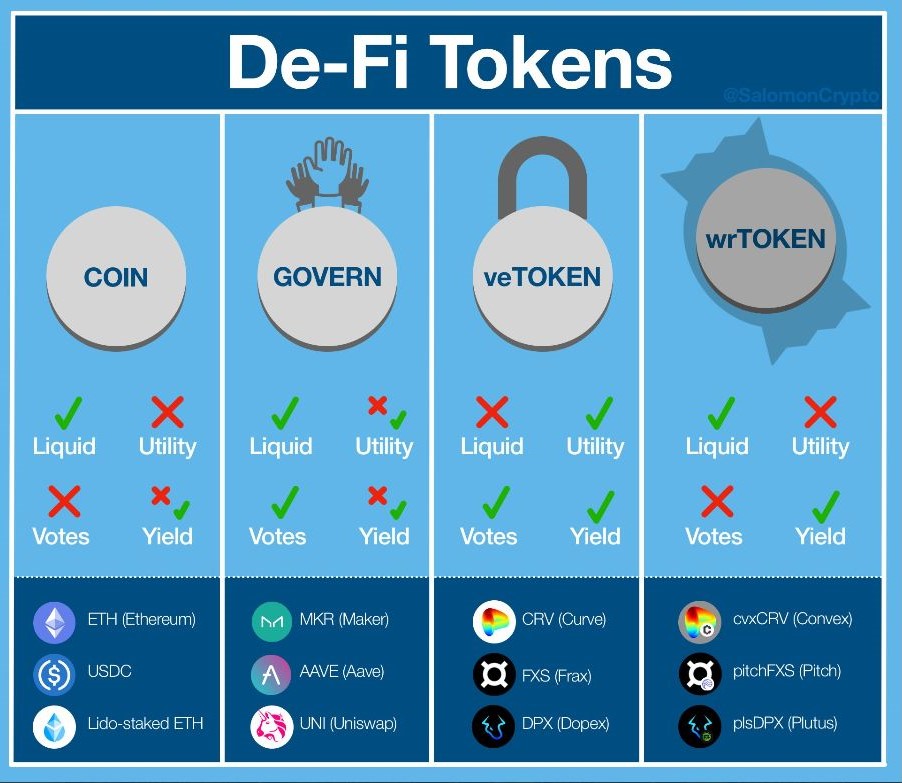

There are a variety of DeFi tokens out there. We are going to have a look at four types of these DeFi tokens. So, let’s dig in.

(1/19) De-Fi 101: Tokens

From $ETH to wrapped-ve-token, your guide to the money-legos that builders are using to create the future financial system pic.twitter.com/VDfuxLSYqV

— Haym Salomon (@SalomonCrypto) July 2, 2022

How Do Coins and Tokens Fit Into DeFi?

At the beginning of DeFi, there was Ethereum. That kick-started blockchain computing in this field. Haym Salomon on Twitter wrote a thread about this topic. Haym played a role in the American Revolution. However, in those days they apparently didn’t have Twitter yet, so we assume this name is a pseudonym. Now, we quickly bypass everything else in DeFi and concentrate on two things; AMMs and lending/borrowing platforms.

To make things simple, and according to Haym, also at a very high level, they do the same four things.

- Accept user deposits

- Deploy those assets to generate (real) yield

- Return those fees to the depositors

- Take a fee for the service

According to Haym, DeFi refers to two different protocols.

- Those that generate yield.

- And those that manipulate other protocols directly/automatically on-chain.

As a result, this is how we created programmable money. By using this network of protocols on one side. On the other side, by carefully constructing money legos. It’s the tokens that are the center of this system. They look after the organization, coordination, and execution.

Over time, networks became more sophisticated. However, as true DeFi, they also became more complicated. So, the tokens needed more capability and nuance. Let’s take a look at four different types of tokens.

Source: Twitter

1. Coins

Coins are at the foundation of DeFi. They have real value and work in generating yield. Their value comes from outside DeFi. Furthermore, they provide utility and are liquid. For example, ETH or stablecoins like USDC. They can also be programmable assets, like stETH.

2. Governance Token

Once protocols came of age and became big enough, they started to issue tokens. Before they could do that, they needed enough TVL and participants. The first set of these tokens was straightforward. They represented your part of the protocol. At least, that’s the idea. However, it’s doubtful how much impact they had on a DAO or paying dividends. So, we look at this from both sides.

The Investor—It’s not looking good here. According to Haym; “the benefits of governance are questionable at best. Completely worthless most of the time.”

In other words, although the D in DAO means it’s decentralized, most often they aren’t. Token distribution concentrates around just a few people. They own most of the tokens. As a result, they also control most of the decision-making process. In a nutshell, these few controlled the governance.

(8/19) On the investor side, the benefits of governance are questionable at best and completely worthless most of the time.

We can talk about the idea of DAOs, but the reality is that the concentration of most tokens renders a lot of it theater.

— Haym Salomon (@SalomonCrypto) July 2, 2022

There’s also the issue that some protocols paid a fee to token holders, like SushiSwap. On the other hand, others don’t do this, like Uniswap. This resulted in governance tokens not being an influential factor if a protocol would grow or not. Or that any potential growth would benefit token holders.

The Protocol—These tokens leave the protocols at the mercy of the market. There are two issues at play here.

- Their capital is in the hands of traders’ impulses.

- Voting attacks can happen by whales with deep pockets.

So, we needed something new and better.

3. ve-Tokens

These Vote Escrow (ve) tokens aim at long-term benefits for both the holders or investors and the protocol. The investors make a long-term investment. In return, they gain long-term control. They get rewarded with relevant governance and rewards. For example, an investor buys and locks tokens for a longer period. In return, he receives voting power. Especially with influence on token distribution. Now, the protocol rewards him with yield. However, the benefits may dwindle over time, and you may need to lock the tokens anew.

Locking the tokens makes sure that voters see the whole procedure and result through. Because they locked their tokens for a long period, it’s in their interest to stay focused on two things. Protocol long-term health and sustainability.

But, what is long term? DeFi hasn’t even been around for that long, less than 4 years. So, it’s mainly other protocols that have an interest in a long-term healthy DeFi ecosystem.

4. Wrapped Tokens

Occasionally, it’s easier for a protocol to use another protocol. Rather than building more functionality. At some stage, this may even lead to bundling and locking an essential amount of ve-Tokens.

It can also come to a point that this protocol is only interested in the voting rights and not so much in the yield. With a token, they can put the yield back into the market, like Convex Finance.

With wrapped tokens, it’s possible to unbundle ve-tokens. Now the protocol can distribute them to a variety of users. Yield requires a long-term lock. However, with a wrapper, you can trade it at will. In contrast, if you want yield but no voting rights, there’s a liquid version available.

Conclusion

DeFi has grown and become more complicated. However, to get the most out of all features, it required a variety of tokens. These tokens cater to different needs.

In this article, we showed the four types you should know. This can help you decide which you want to add to your portfolio.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.