Avalanche supports smart contracts on their platform. They are fast and cheap, so it attracts both developers and users. The protocol is in the top 20 for market cap ranking. They also have a lively DeFi ecosystem. AVAX is their native token and powers the platform.

So, let’s have a look at what Avalanche has to offer in DeFi protocols.

Sub-second transaction finality is paramount to the success of DeFi dApps.

Slow transaction finality means that value is at risk.

This is why DeFi innovation is happening on Avalanche. #AvalancheStandsApart pic.twitter.com/LqO5fskV0z

— Avalanche 🔺 (@avalancheavax) December 1, 2022

Benqi

Benqi focuses on two DeFi aspects – a) liquid staking and b) lending and borrowing. They also claim to have cracked the blockchain trilemma. That means that it can deliver a decentralized, secure, and scalable platform.

In TVL (total value locked), it takes second spot on Avalanche, behind Aave. According to DeFiLlama, its TVL is $232 million. But, like all DeFi protocols, it is quite down from its ATH. The platform reached this in early December 2021 with $1.81 billion. Around May in 2022 is when most protocols lost their TVL. But let’s have a look at the two main protocols on Benqi.

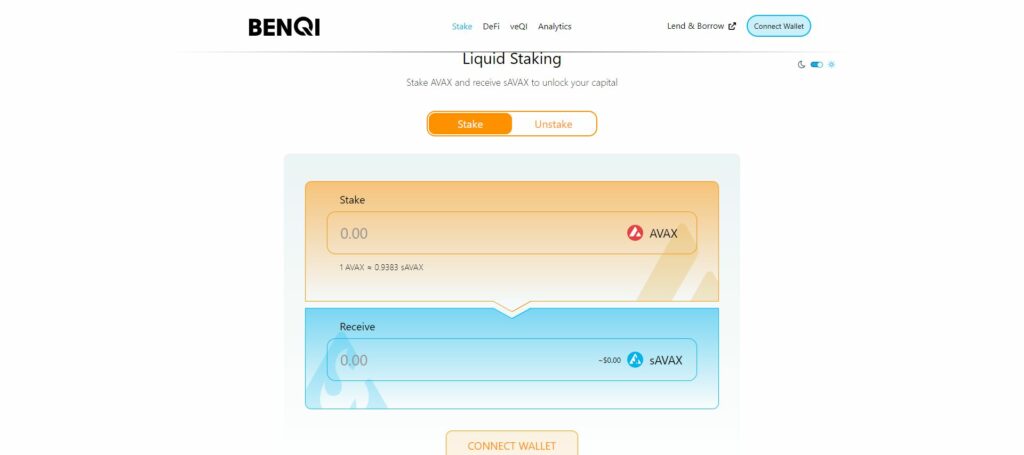

Benqi Liquid Staking (BLS) — This tokenizes your staked AVAX. You can use this liquid staking asset, sAVAX, by swapping it or using it as collateral. You can also sell it and get liquid again. However, the owner of the liquid staking token owns the staked AVAX.

BENQI Liquidity Market (BLM) — This allows you to lend and borrow with your digital assets. You can also earn interest with this. You can either provide liquidity and earn yield, or you borrow, and you need to over collateralize.

Below is a picture of the liquid staking UI on Benqi.

Source: Benqi staking

GMX

GMX is a decentralized perpetual exchange. This means that you can trade with leverage. GMX allows leverage up to 50x. But be careful when trading with leverage. The profits may seem tempting. However, your losses can be as big as your potential profit.

Nonetheless, GMX seems to be flying. DeFiLlama shows its TVL at $78.2 million on Avalanche. The platform’s Avalanche launch was in January 2022. Also, it has another $451 million of TVL on Arbitrum. But look at its GMX token. It’s up 50% over the last year! How many tokens can say that today?

So, trading perpetuals means that you don’t buy or sell any tokens. So, instead, you deposit collateral. This allows you to take long or short positions. Your profits in shorts come in USDC. A profit in longs comes at the pair’s other token.

In other words, leverage means that you borrow funds. With these funds, you try to make more funds. Your profit can be a multiplier of up to 50x. But so can be your loss. Because we’re in DeFi, there’s no registration. You only need a compatible wallet.

GMX offers reduced liquidation risk. This is when the exchange forcibly closes your leveraged position. Before you start trading with leverage, get more trading experience. The associated risks are high when trading with leverage.

Weekly Rewards Info 🔹

$3,156,367.41 collected in the past 7 days

$2,619,296.49 (ARB), $451,156.59 (AVAX), $85,914.33 (GMX-ETH)

To buy and stake $GMX / $GLP: https://t.co/HnDqM1Kd37 pic.twitter.com/MrL6x4B2b7

— GMX 🫐 (@GMX_IO) February 8, 2023

Yield Yak

Yield Yak is an auto-compounding platform. It’s also a yield aggregator. It will help you to optimize your profits. The platform offers auto-compounding farms. This is in contrast with many other farms where you need to compound yourself. Each time you compound your yield, it will cost you gas fees. It’s also time-consuming.

So, Yield Yak does all this for you. They do this by pooling assets and sharing the costs of compounding. In other words, your yield compounds more often, with lower gas fee costs. DeFiLlama tells us that their TVL is $33 million. Yield Yak currently offers 99 different farms. Furthermore, users stake 80% of their native YAK token.

Currently, it offers one boosted pool with GMX with a 22.1% APY. There are also plenty of other pools, with lower yield. Yield Yak also offers some interesting DeFi tools. For example:

- Best price search. This compares prices and comes up with the best option.

- Price slippage. The platform takes gas costs and price slippage into account. This results in the best execution route available.

- Once click execution. The platform detects the best possible route, with all the required steps. You only need to click one button to execute this.

So, to sum up, Yield Yak offers a swap, pools, earn options by staking, liquid staking, and boosts. It completes this with good DeFi tools.

The picture below shows their most popular pools.

Conclusion

Avalanche offers interesting DeFi options. So, we look at their top three DeFi protocols. This includes Benqi, GMX, and Yield Yak. It proves that there is much more going on than Aave or Trader Joe on Avalanche.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.