Beyond a doubt, the bear market has left crypto investors and speculators in a state of panic. New crypto enthusiasts are left asking questions like: How can I profit or even make money in a bear market? Am I safe if I simply HODL? Or will an ideal scenario be the dollar cost average (DCA) or buy the dip in order to construct my stacks over the long run?

There are ways to survive during this crypto bear market, but it will take a little bit of analysis and creativity. However, it is doable. In this article, we will look at a simple strategy that crypto enthusiasts can adopt in the current crypto winter.

How to get Profits in the Bear Market?

Although there are several ways to beat the bear market and even make some profit, a simple and sustainable strategy is to HODL your crypto asset and earn passive income from it, preferably via a low-risk farm.

The tricky part about HODLing during a bear market is knowing what to HODL. From previous crypto winters, we do know that some crypto tokens will eventually cease to exist. Therefore, the cryptocurrencies to invest in are those with the best fundamentals and real use cases that solve a critical need. These are the cryptocurrencies that have a high probability of surviving a bear market.

What is Yield Farming?

Yield farming is the process cryptocurrency holders adopt to maximize their returns through decentralized finance (DeFi) protocols. Yield farmers generate passive income by lending or borrowing their tokens on a DeFi protocol and earning cryptocurrency for their service. Hence, since the development of “yield farming”, crypto investors or holders don’t need to keep their crypto assets idle.

Yield Farming 101 – a simple primer on yield farming. APR vs. APY.#DeFi #Web3 #YieldFarming #blockchain#CosmosEcosystem pic.twitter.com/jqCSFjfGmc

— Alani Kuye | 🛰 🏁 🫱🏻🫲🏿 🈯 🧨 (@AlaniKuye) December 24, 2022

DeFi protocols that provide yield farms run on different blockchains. If we were to discuss most of them, we would have a near-inexhaustible list. In this article, we will look into the options available when participating in a low-risk yield farm within the BNB Chain (formerly the BSC and Binance Chain).

Low-Risk Farms in Pancakeswap

There are several decentralized finance protocols built on the BNB Chain, but according to DeFiLlama, Pancakeswap is the leading DeFi platform, with approximately 55% of the Total Value Locked (TVL) on the BNB Chain, or approximately $2.2 billion.

Now that we know the best DeFi platform to utilize, you have to know the safest cryptocurrency to HODL. As mentioned earlier, cryptocurrencies with real-world use cases will most likely weather the storm. These cryptocurrencies can easily be identified by their large market capitalization (market cap).

Cryptocurrencies that meet these criteria in the BNB chain are $USDT, $USDC, $BNB, $BUSD, and $CAKE. It is important to note that farming in Pancakeswap will enable you to earn $CAKE over time.

The available low-risk farms on Pancakeswap are:

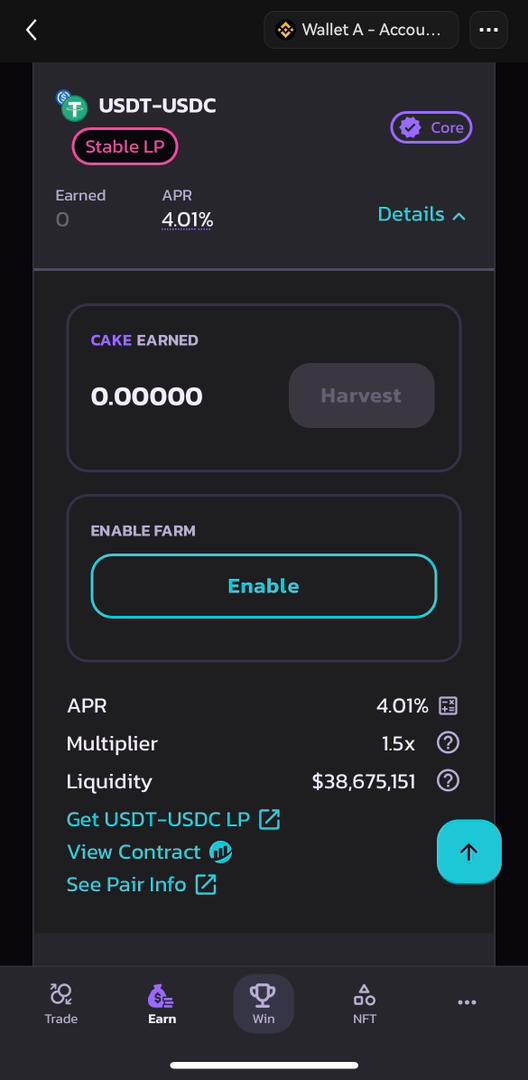

- USDT-USDC: In order for users to participate in this farm, they’ll have to deposit USDT-USDC LP tokens into the farm. At the current time of writing, this farm will generate 4.01% of what a user deposits annually.

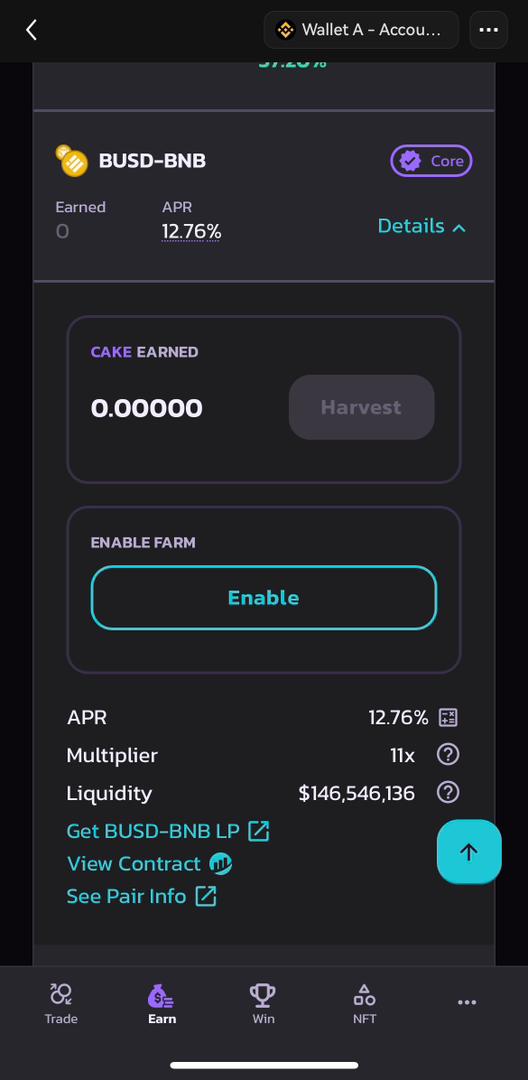

2. BUSD-BNB: In order for users to participate in this farm, they’ll have to deposit BUSD-BNB LP tokens into the farm. At the current time of writing, this farm will generate 12.76% of what a user deposits annually.

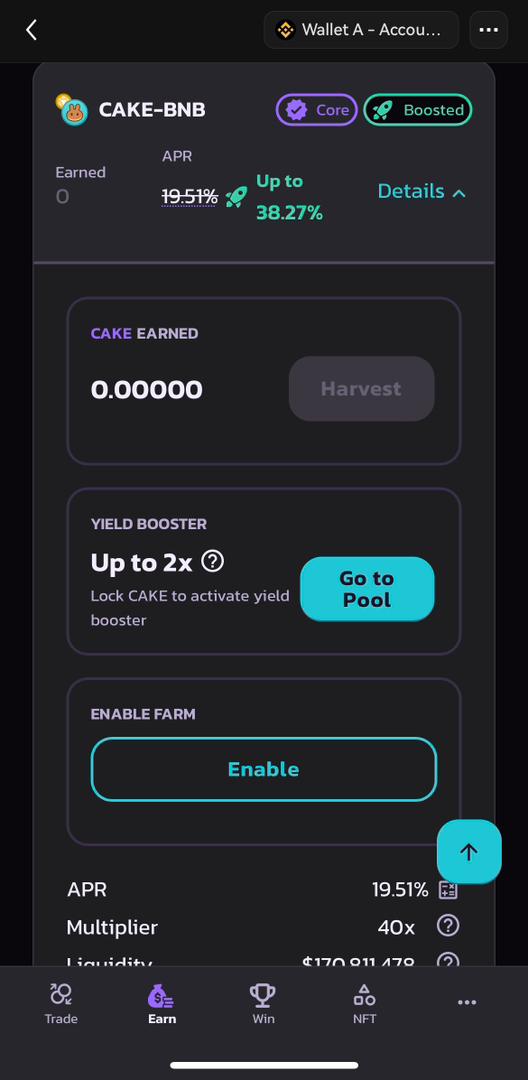

3. CAKE-BNB: In order for users to participate in this farm, they’ll have to deposit CAKE-BNB LP tokens into the farm. At the current time of writing, this farm will generate 19.51% of what a user deposits annually.

That’s it. Be sure to do your own research before investing.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Great article, thanks! The short video by the twitter post was fantastic!