Over the last couple of years, everyone has had to search for new ways to earn some extra bucks. Especially with the pandemic, the need to have a more stable source of income became more serious. Many people lost their jobs due to economic downtime, but thanks to crypto, people found an even more lucrative way of earning money.

The crypto world is vast. And for a beginner who wants to dive into the money-making part of things, it could be somewhat overwhelming to know the different ways to earn. Let’s discover what staking has for us.

Staking, DeFi’s Winning Horse

Trading is the most popular way of earning that comes to most people’s minds. However, there are other ways to cash in on the crypto space, such as staking.

Staking is the process of locking up digital tokens for a set period to contribute to a network’s security and performance. In exchange for staking your tokens, you will be able to earn interest. Therefore, thanks to decentralized finance (DeFi), people can stake their tokens and earn passively from them.

Staking isn’t possible with every cryptocurrency. Only cryptocurrencies that use the proof-of-stake model support staking. The proof-of-stake model is gaining popularity amongst blockchains. Before now, many cryptos used the proof-of-work model to add blocks to their blockchain.

However, this model isn’t error-proof and necessitates a lot of computing power. But proof-of-stake requires far less effort. This makes it more scalable and capable of handling larger volumes of transactions.

Staking Stablecoins

Stablecoins are usually considered a strong asset to own since they are pegged to a native currency such as the dollar. But not many people know the enormous potential that stablecoins wield. Stablecoins are gaining traction as a feasible choice for those who want to invest in cryptocurrency without subjecting their assets to the associated risks of cryptocurrencies.

Furthermore, staking stablecoins provides a good source of passive income. While stablecoins are not completely risk-free, they provide greater financial and legal security than any other type of crypto asset.

Some Staking Options Worth Considering

The Twitter handle, Rune Ranger, shared an intriguing way to earn huge APY from your stablecoins. However, this is not a piece of financial advice. As always, we encourage you to do your research.

38% apy for $BUSD

39% apy for $USDCIf you're looking for stables yield and okay with 50% $RUNE price exposure, these are both great options for liquidity providers

— $RUNE Ranger 🔨 (@TheRuneRanger) May 17, 2022

According to Rune Ranger, people who supply liquidity in either BUSD or USDC on ThorSwap and do not mind a 50% $RUNE price exposure, can go for this pool. Exposure here refers to the risk inherent in an investment. So let’s take a look at them.

BUSD

At the time of writing this article, liquidity providers who supply BUSD on the ThorSwap liquidity pool stand a will earn up to 36% APY. The pool has total liquidity of $27.86M and a 24-hour volume of $12.36M. Providing liquidity to this pool could be worth a try.

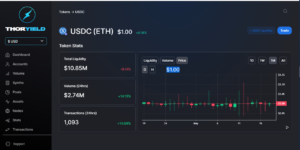

USDC

The USDC-Rune pool has one of the highest APYs in Thorswap. Liquidity providers will currently receive an APY of 34%. The pool has a total liquidity of $10.85M and a 24-hour volume of 2.74M. The APY for these pools generally comes from trading fees and emissions.

Note: Most of the yield comes from the trading fees and some protocol emission-based incentives.

Finally, in another article, we’ll give a stablecoin staking guide on this topic.

Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ACCESS PRO membership worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(Therefore, to get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your ‘newly signed up MEXC UID’ and ‘Telegram ID’ on our Twitter @altcoinbuzzio)

Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.