Decentralized Finance (DeFi) is a game-changer in the blockchain industry. It’s part of a larger wave of innovation. The goal is to provide liquid and interoperable financial services. And do so without the need for a centralized middleman.

The decentralized nature of this technology (the De in DeFi) provides many advantages such as:

- Lower entry barriers to financial markets

- More competitive financial products

- Increased transparency

Blockchain technology allows these benefits. Decentralized finance gives us these benefits with cryptocurrencies.

With DeFi, we bypass central authority. DeFi provides peer-to-peer services for

- banking

- lending

- mortgages

- and other financial services.

In other words, the main goal is to create an ecosytem that does 3 things:

- it’s open-source

- it’s transparent

- and it’s permissionless.

That ecosystem needs to be devoid of any central authority. Users can do some cool things. One thing they can do is keep custody of their assets. Another is to execute peer-to-peer transactions fast. Users can also create decentralized applications (dApps).

Traditional finance is expensive. It has lots of regulations, with consistent & high fees. While traditional finance is more familiar to us, DeFi provides much higher degrees of transaction autonomy. There is no need for approval to execute transactions. You also get greater transparency of transactions and lower fees. Over time, people trust more in the technology itself as opposed to intermediaries such as banks.

How Does DeFi work?

Banks play an important role in traditional Finance. They are transaction guarantors in today’s financial world. In fact, banks have too much power over your money. What’s worse is billions of individuals around the world can’t even access a bank account.

DeFi bypasses intermediaries. They do so by using cryptocurrencies and smart contracts. A smart contract replaces the bank in DeFi transactions. To clarify, a smart contract is an automated enforceable agreement. There is no need for a middleman and everyone has access to it with an internet connection.

Source: Twitter.com

In traditional banking, the bank has a private ledger. For example, it records all the information about your transactions. And consequently, for us, the bank owns that private ledger.

DeFi has no owners. It stores financial transactions on a decentralized public ledger using computer code. The ledger is the same for everyone using DeFi applications and platforms. This ledger keeps track of all transactions.

Decentralized blockchain platforms and applications are immutable. Because of that, a third party cannot change or erase ownership records. In addition, transaction verification and data storage are both secure.

Smart contracts can do more than just send and receive crypto. In fact, smart contracts are self-executing contracts. They are blockchain-based programs that execute only when we complete the terms. We call these programs Decentralized apps or dapps.

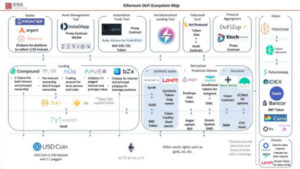

Decentralized finance applications

DeFi includes dozens of different financial applications already. In addition, more are on the way in the next few years. After all, the only limit to what DeFi could achieve is the quality of the smart contracts.

Some of the most important DeFi applications are:

- Payments

Making payments and other banking services is one of DeFi’s primary applications. Payments will allow individuals to transfer cryptocurrency anywhere. The transfer is without any third party and it’s secure, most importantly. Above all, DeFi allows for faster payments and processes. - Decentralized Exchanges (DEX)

Decentralized Exchanges (DEX) allow users to swap tokens for other assets. Again, no need for a third party to act as a custodian. They are able to conduct peer-to-peer transactions and keep track of their funds, for instance. - Borrowing, lending, saving

You can use Smart contracts to borrow and lend cryptocurrencies. Once again, no middleman required. In this way, we remove many of the risks associated with traditional lending. DeFi savings accounts are the same as ordinary savings accounts. The exception, above all, is much higher interest rates. - Liquidity mining

You’ll provide liquidity to other platform users. It allows users to complete their transactions. You’ll get a return on your investment. - Yield Farming

Yield farming is a form of staking or lending crypto assets. It can generate large returns payable in cryptocurrency.

Conclusion

Decentralized finance is big already. And it could get huge. DeFi benefits all sectors that need secure financial infrastructure. Many businesses could adopt DeFi in the future.

DeFi is a once-in-a-generation financial opportunity. Yet, the industry is still new. There are unscrupulous companies out there. They will try to take advantage of new investors due to their lack of technical knowledge.

But that should not stop you from checking out DeFi. In fact, its many benefits far outweigh the risks.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.