DeFi has grown in popularity since 2020. Each year, the number of users increased. The combined TVL of all DeFi protocols also increased. One of the big motors behind this DeFi popularity is yield farming. It is a great way to earn passive income.

So, what is yield farming? And where can you do it? Is it safe and does it have risks? Many questions to answer here! Let’s have a look at what yield farming is.

Source: Pexels, Karolina Grabowska

What Is Yield Farming?

Yield farming is locking your cryptocurrency and receiving rewards for it. You use DeFi to get the most out of your investment. In other words, maximizing your returns. Because it all happens on DeFi platforms, there are no third parties involved. In yield farming, there are a couple of options available on how to take part.

- Staking your crypto on a PoS chain — In return, you receive a reward or interest. In the meantime, you help to secure the specific network. Generally, this is not part of DeFi. You can, however, also stake your coins in DeFi protocols.

- Liquidity provider — You join a liquidity pool on a DEX. For this, you will need two different coins, but each for the same value. You pay a small fee to the DEX. This, in turn, the DEX pays to the liquidity providers. Sometimes this is in new LP tokens. However, there are also platforms that offer single-sided staking. This means that you only need to lock one token to start earning a yield.

- Lending your crypto to a DEX — The DEX uses a smart contract for this. The yield is in the form of the interest that the borrowers pay you directly for the loans taken out.

- Borrowing crypto on a DEX — A farmer can use one token as collateral. In return, he receives a loan for the other token. Now, with the borrowed coin, you can farm more yield again. This results in double yield earnings. First, from the collateral, which you get to keep. Secondly, from the borrowed tokens, that you farmed again.

Stablecoins and Strategies

For most pools, they use a stablecoin. These peg to the USD. However, using stablecoins is not a requirement. Popular stablecoins used on DeFi platforms are DAI, BUSD, USDT, and USDC.

Now, this becomes really interesting, if you, as an LP, receive pool tokens. It can be that a platform mints these. For instance, Compound does this. For the DAI that you deposit, you receive cDAI (Compound DAI). In case you deposit another coin, this will be cCoin. For instance, Ethereum becomes cETH.

At this moment, it can become complex since the platforms start to add layers. For example, you can add the cDAI to another protocol. This protocol mints a new token that represents your cDAI. And this can go on and on. At times, it can be challenging to keep track of all this. On the other hand, it is a great example of how the DeFi lego blocks works. However, if one of the lego blocks malfunctions, the whole chain can collapse.

How to Calculate the Yield?

Calculating the yield in yield farming happens in two different ways. One is the APR or annual percentage rate. On the other hand, there is APY or annual percentage yield. The difference between the two is that with APY, you add compounded yield. Compounding is that you add rewards to your main investment. So, you generate a larger return.

However, it is important to understand that these numbers are subject to change. They are nothing else but projections and estimates. The reason they can change rather quickly is that DeFi is a fast-changing environment. Because yields change all the time, farmers are searching all the time for better options. Hence, they move their capital around a lot.

Farmers may also be secretive about their strategy. The reason is fairly simple. Since you share the rewards in a pool, fewer people mean higher rewards. Once more people start to join, the rewards water down.

In general, you receive yield in three different ways.

- As a percentage of the transaction fees.

- From the interest of lenders.

- In the form of governance tokens.

Something to point out about APR and APY is that they originate from TradFi. Hence, they talk about annual yield. In DeFi, it makes much more sense to look at daily or weekly yields. In other words, DeFi should come up with its own way of calculating yield.

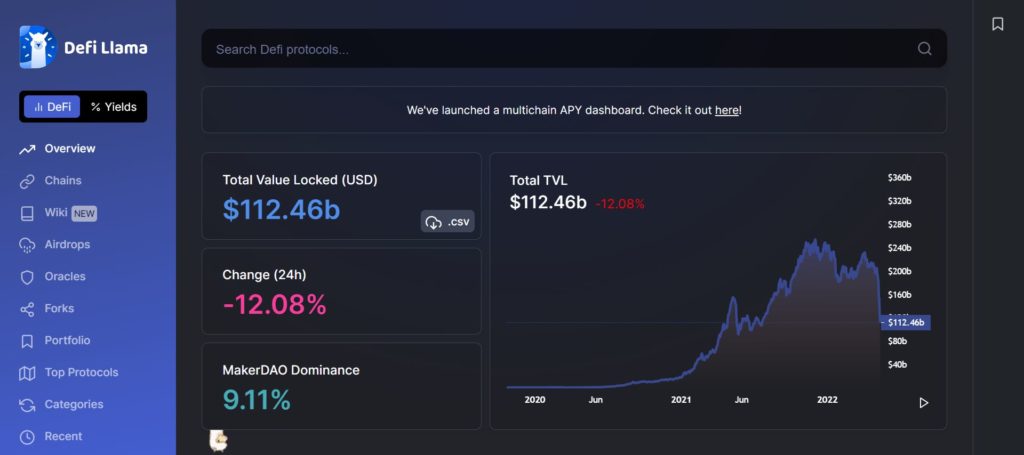

What Is TVL?

The term TVL stands for Total Value Locked. This means how much money all traders locked in a DeFi platform for lending or other services. Among others, it tells you about the health of the entire DeFi farming market. On the other hand, it also shows a good way to see how much market share a platform has.

DeFi Llama and DeFi Pulse are two good places to track TVL. They show many details about complete chains or individual platforms.

Source: DeFi Llama

Conclusion

Here we are, at the end of the first part of what yield farming is about. We gave an in-depth explanation about this. Furthermore, we showed you about the role that stablecoins play in yield farming. On top of that, we looked into how complex strategies can become.

By now you also know the difference between APR and APY and what TVL is.

In part 2, we will look at some risks of yield farming and discuss some well-known yield farming platforms. See you there.

⬆️Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ACCESS PRO membership worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your ‘newly signed up MEXC UID’ and ‘Telegram ID’ on our Twitter @altcoinbuzzio)

⬆️Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.