Binance Smart Chain-powered decentralized exchange PancakeSwap is continuing to eat the competition for breakfast as volumes and collateral surges.

As Ethereum network fees start to head north again, more DeFi users are turning to cheaper and faster alternatives, and PancakeSwap is their top choice at the moment.

Pancake Pummeling the Competition

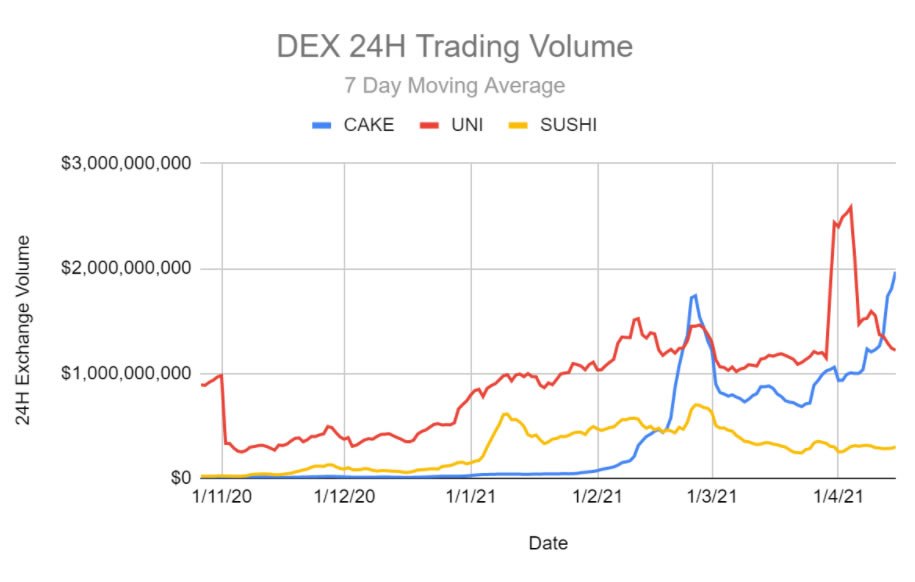

According to a report by derivatives exchange Deribit, PancakeSwap’s average 24-hour volume surpassed Uniswap by over $1 billion and SushiSwap by $2 billion over the past week.

PancakeSwap has enjoyed this momentum at the expense of its rivals purely because it is not based on Ethereum. New users can access DeFi without spending huge amounts on transaction fees.

“This is due to PancakeSwap targeting both retail users who have been priced out of Ethereum as well as native DeFi users who want to trade/invest/arbitrage with lower fees.”

According to a seven-day moving average of 24-hour trading volumes, PancakeSwap is now ahead of both Uniswap and SushiSwap.

Image source: Deribit

The report added that the ratio of daily transaction volume to the number of users is comparatively lower than that of Ethereum-based AMMs.

“This supports the observation that BSC users skew towards retail who, on average, make smaller-sized trades.”

Findings also revealed that the majority of BSC transactions are under $10,000 in size. It added that there were more transactions under $1 than there were greater than $50,000 across all PancakeSwap pools.

The number of total users and new users is growing. The retention factor has already confirmed that this is not an anomaly or a novelty associated with a new product. The DEX is holding on to its customer base.

The report concluded that PancakeSwap’s growth has been impressive. However, the report noted that PancakeSwap is ultimately bound to Binance and its blockchain. And the success of Binance and its blockchain depends on managing tradeoffs between throughput and decentralization.

The DEX has already had its first issue with centralization when a governance vote was hijacked by a single whale on April 19 who voted against it – and all of the other participants who wanted it passed.

CAKE Cranks Higher

The DEX’s native token is showing no signs of slowing down in terms of price action. CAKE hit an all-time high of $27.57 on April 12, according to CoinGecko.

At the time of publication, PancakeSwap was reporting $2.9 billion in liquidity whereas Uniswap and SushiSwap had $7.48 billion and $3.9 billion, respectively.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.